Stock Market Fear Levels and the VIX...

Stock-Markets / Stock Markets 2011 Feb 25, 2011 - 09:31 AM GMTBy: Marty_Chenard

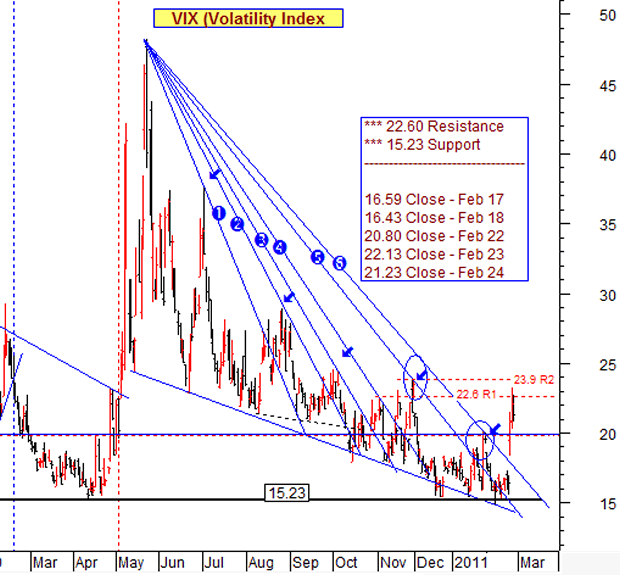

The VIX (Volatility Index) spiked up when the Libyan revolt started to unfold.

Today, there is talk of a possible Libyan massacre today which would be a real negative should that occur because it could end up meaning U.S. intervention.

The other possible negative event that needs to be watched is the Saudi "Day of Rage" that some are trying to initiate for March 11th. If this happens or develops the appearance that it will happen, then the markets are likely to react very badly.

For Today: So, the market needs to know that these possible dangers have subsided for the VIX to go back down to below 20. Below 20 would reflect a lessening concern about Libya and Saudi Arabia, but 17 and below will be what is needed for the market to regain the confidence it lost this week.

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.