The Power Of Buying Stocks At The 50-Day

Companies / Company Chart Analysis Feb 25, 2011 - 03:18 PM GMTBy: David_Grandey

When the S&P 500 and the OTC Comp were both in nosebleed levels hugging trend channel resistance we talked about what happens to leading names when the markets pullback. We talked about the power of the 50-day average and sure enough that’s exactly what happened to them — they tagged the 50 day and POW ZOOM TO THE MOON ALICE.

When the S&P 500 and the OTC Comp were both in nosebleed levels hugging trend channel resistance we talked about what happens to leading names when the markets pullback. We talked about the power of the 50-day average and sure enough that’s exactly what happened to them — they tagged the 50 day and POW ZOOM TO THE MOON ALICE.

We featured CMG, NFLX, BIDU, FFIV, OPEN and SWKS to our paying subscribers all this week. One look at them now shows how the 50 day strikes again!

One such subscriber emailed us yesterday after he bought AAPL and CMG. We asked him what he was thinking when he did it and his response was:

Sometimes you just have to close your eyes and buy, I sat back and let them come to me as you instructed over the last few weeks and after seeing them getting hammered quite well I said look if I’m wrong there are some decent supports just below where I picked them off at and am willing to sit should they continue down.

Good response we must admit, especially the part about willing to sit if he’s wrong.

Let’s take a look at those names, we all know them.

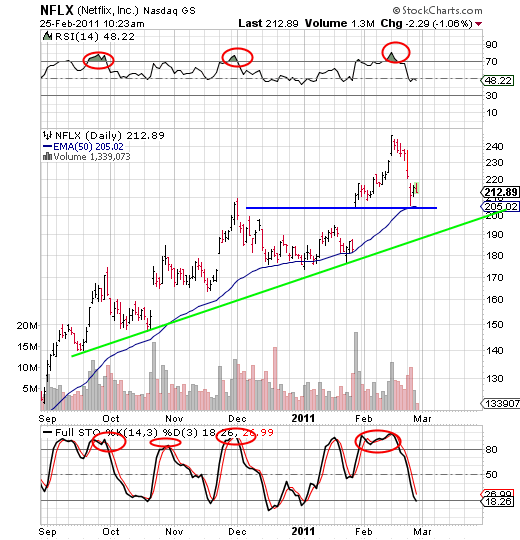

NFLX

Off the 50 day average level this issue has already put on 12 points through its highs.

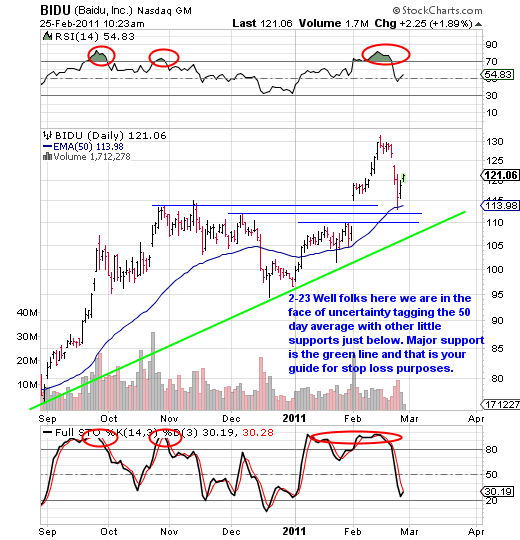

BIDU

Off the 50 day average level this issue has already put on 8 points through its highs.

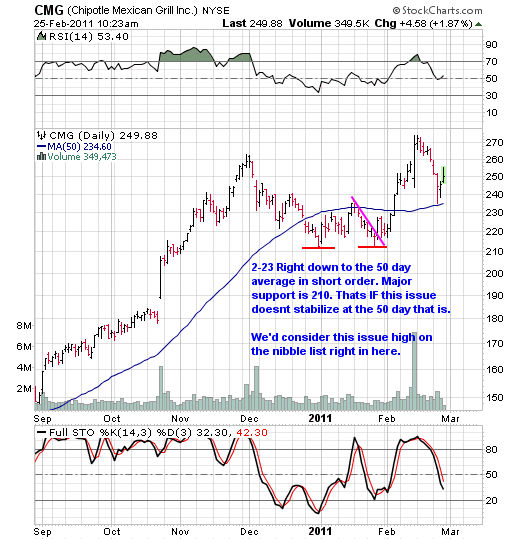

CMG

Off the 50 day average level this issue has already put on 20 points through its highs

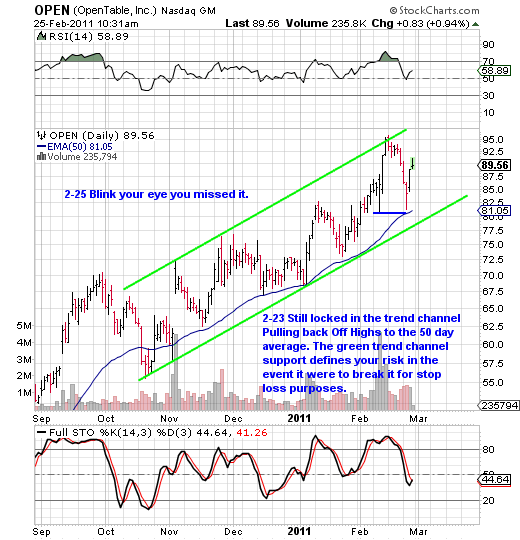

OPEN

Off the 50 day average level this issue has already put on 10 points through its highs.

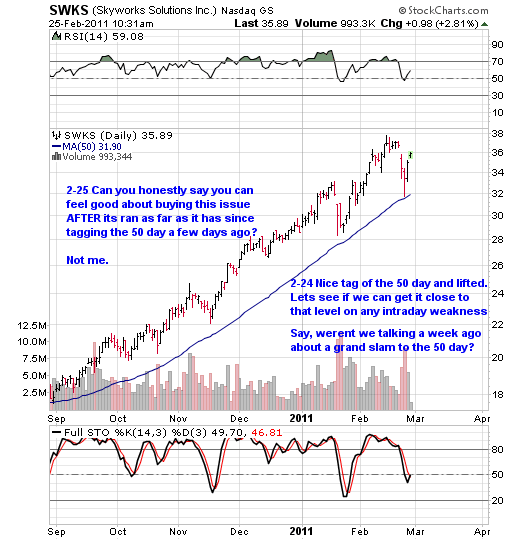

SWKS

Off the 50 day average level this issue has already put on 4 points through its highs.

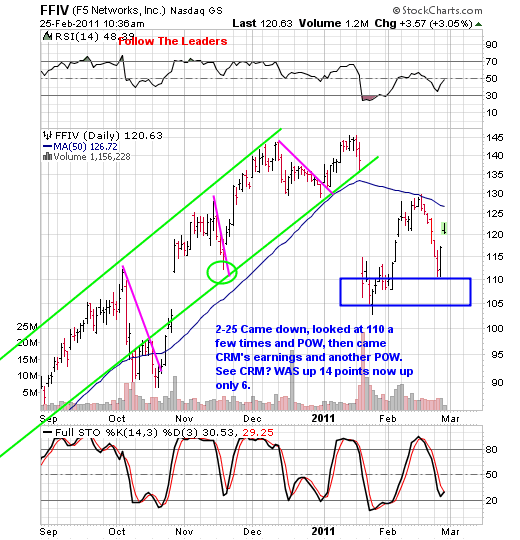

FFIV

Off the 110 level this issue has already put on 12.65 points through its highs.

These grand slams to the 50 day are common occurrences that happen time and time again.

To learn more, sign up for our free newsletter and receive our free report — “How To Outperform 90% Of Wall Street With Just $500 A Week.”

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2011 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.