Crude Oil Unique Price Formation, Should You Buy Here?

Commodities / Crude Oil Feb 26, 2011 - 04:32 PM GMTBy: Jared_Levy

This has been a turbulent week on the geopolitical front, triggering waves in the stock market and sending the price of crude oil through the roof. While the stock market corrects itself (as we anticipated), the price of crude oil seems to be creeping ever higher, putting upward pressure on the price of fuel and energy. Worse still is the serious effect this could have on the economic recovery that everyone has been banking on.

This has been a turbulent week on the geopolitical front, triggering waves in the stock market and sending the price of crude oil through the roof. While the stock market corrects itself (as we anticipated), the price of crude oil seems to be creeping ever higher, putting upward pressure on the price of fuel and energy. Worse still is the serious effect this could have on the economic recovery that everyone has been banking on.

A couple of weeks ago I showed you a way you could partially hedge some of your fuel costs with the rise in crude oil prices. But higher gasoline prices at the pump are only part of the problem for most of us. A continued rise in crude oil will wreak havoc on the prices of many things that we need to live and work.

There are three questions I want to address today:

1.Are prices moving higher?

2.What the heck is the difference between Brent Crude and West Texas Crude?

3.How can you profit from a potential move in either?

Where Does Crude Oil Go From Here?

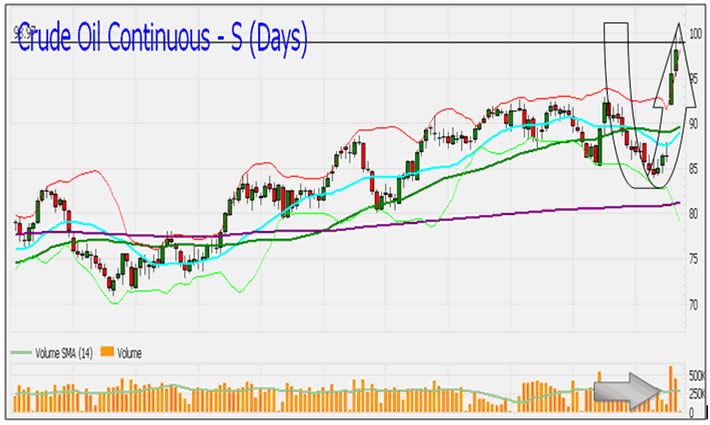

From a technical perspective, you have to be careful here if you are going long. The prices of West Texas Crude (and Brent crude) have almost gone parabolic. A "parabolic" move comes from the mathematical term "parabola," which describes even curvature from a point called the apex.

For us non-math folks who are simply looking at price charts, a parabolic move means the asset (in this case the price of oil) is exploding higher, on increasing volume and in much bigger percentage moves than usual. This is extremely abnormal. Buying anything after its price has "gone parabolic" increases the risk of a sharp pullback in the near term.

The chart formation looks like a bit like a steep parabola; take a look at the shape of the arrow!

The price of crude oil recently jumped from $84 to $100 in about four days; it broke its recent resistance of $92 and exploded on huge volume. A $16 rally in four days is extreme. I know this by looking at the average trading range (ATR), which tells me what the typical movements are. The normal WEEKLY price moves in crude oil are less than $5 -- a third of what we've seen in the past four days. Another factor is that volume is double its recent average.

As for the next move in oil, look for a pullback in the short term, maybe back to the $95 level (we saw a small reprieve yesterday), but with the long-term fundamental demand strong, geo-political unrest in the Middle East and the summer driving season upon us, bet on $120 oil in the next six to eight months.

Brent Versus West Texas

Now, when we talk about oil, we're mainly talking about West Texas Intermediate (WTI) oil. But there are other types out there, and there seems to be a great amount of confusion (and hype) concerning two specific types of oil: WTI and Brent crude. Let me try to clarify. Recently, Brent crude prices have been higher than WTI, but that is not always the case; there are many factors that can influence the price relationship between the two. Also keep in mind that that prices usually won't get too far apart, because of the ability to ship oil from one place to another to take advantage of prices.

West Texas Crude (WTI for short)

In North America, WTI is traded on the NYMEX under the ticker "CL." It is the most common measurement that we use HERE to track the price of crude oil. It is also considered "light, sweet crude" and is generally refined in and around the Americas. ALL the futures contracts for WTI oil are traded on the NYMEX and all are delivered and settled in Cushing, Okla. There are pipelines and storage tanks in and around Cushing that help distribute and store oil. When there is a glut in storage, prices generally go lower, when there is a big reduction in the amount of oil in storage, prices may go higher.

Brent Crude (Also called London Brent, Brent Blend, Brent petroleum and North Sea crude)

Brent crude blend prices actually account of two-thirds of the world's oil supply. Most of Brent crude oil comes from the North Sea, hence the name. Brent crude is traded on the ICE (IntercontinentalExchange) and on the NYMEX (Ticker "LO") as well. Brent oil fuels Europe and Asia and is delivered in several areas. Brent provides a pricing benchmark for most of Europe and Asia in the same way we use WTI.

Both WTI and Brent are priced in U.S. dollars

There are actually dozens of different types and blends of oil around the world. WTI and Brent prices are simply popular benchmarks for big oil companies and traders to use. Don't get too caught up in the struggle between the two. Right now, because of Middle East tensions heating up and Canada's oil sands sending supply to Cushing, Okla., the price of WTI is lower than Brent, but they are indeed highly correlated.

How Can You Profit?

The most efficient way to invest in the price of oil is to purchase futures contracts directly. Of course, there are things you need to know before doing so and you must have a futures account and understand the risks.

For those of you who are not ready to start your futures trading career just yet or can't decide if you should buy Brent or WTI, I have a solution. There is an ETF that contains the "pick and shovel" oil companies. These are the guys that get the oil out of the ground and sell it to refiners. If the price of oil (Brent or WTI) is on the rise, these companies are usually following right along. It's called the Oil Services HOLDRS (OIH:AMEX), and you can buy and sell it just like a stock with regular commissions.

Right now, the long-term prospects for oil look good and the Oil Services HOLDRS is a great alternative way for the average investor to participate. You can view the holdings and learn more here.

If I'm on target with my prediction for oil to hit $120 in the next six to eight months, I wouldn't be surprised to see the Oil Services HOLDRS knocking on $200's door. And for traders out there, the Oil Services HOLDRS does offer options.

Editor’s Note: This coming crisis could blow a 950% profit your way! The U.S. wants to use "green technology" to decrease our dependence on oil. But China has a 97% monopoly on a natural resource that is vital to green technology... and we're about to experience a serious shortage! Learn which companies could solve this crisis and hand you 950% gains in as few as 24 months in this exclusive investment report.

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source : http://www.taipanpublishinggroup.com/tpg/smart-investing-daily/smart-investing-022511.html

By Jared Levy

http://www.taipanpublishinggroup.com/

Jared Levy is Co-Editor of Smart Investing Daily, a free e-letter dedicated to guiding investors through the world of finance in order to make smart investing decisions. His passion is teaching the public how to successfully trade and invest while keeping risk low.

Jared has spent the past 15 years of his career in the finance and options industry, working as a retail money manager, a floor specialist for Fortune 1000 companies, and most recently a senior derivatives strategist. He was one of the Philadelphia Stock Exchange's youngest-ever members to become a market maker on three major U.S. exchanges.

He has been featured in several industry publications and won an Emmy for his daily video "Trader Cast." Jared serves as a CNBC Fast Money contributor and has appeared on Bloomberg, Fox Business, CNN Radio, Wall Street Journal radio and is regularly quoted by Reuters, The Wall Street Journal and Yahoo! Finance, among other publications.

Copyright © 2011, Taipan Publishing Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.