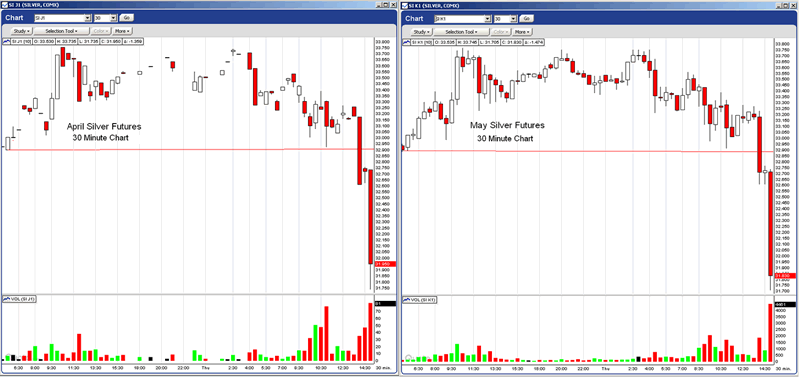

Silver Market Hit Hard With Bear Raid

Commodities / Gold and Silver 2011 Feb 27, 2011 - 07:19 AM GMTBy: Jesse

Friday I said: "Today was the option expiration on the Comex, and those options which are 'in the money' and have not been settled for cash are now converted to March futures positions.

Depending on the size and distribution of those conversions we may see some 'action' in the front month because they are sometimes notoriously weak hands and will receive at least one 'gut check.'"

And a gut check to run the stops was very obviously delivered in the afternoon trading session at the Comex and across the monthly contracts.

This is remniscent of the 'Dr. Evil' strategy that got Citi warned and fined in Europe a few years ago. Memories of Citi's Eurobond Manipulation At the time one of the defenses offered by an ex-pat trader was 'in the US everybody does it.' Has JPM taken up the trading strategy that Citi once made infamous? And why would banks be trading for themselves in markets with players they help to finance, and with public money?

Large players can come into a relatively small market and drive the price by selling in size, running the stop loss orders which they often can 'see' through probing orders and positional advantage, and essentially bomb the market, manipulating the price in the short term to their advantage. The profit is made through derivative and correlated bets that depend on the price of the metal, index, or bond such as shorts on mining stocks, currencies, bonds, etc.

This is why the 'uptick rule' in stocks served a purpose, and why regulators are in place to keep an eye on big players with deep pockets and a far reach. In a properly regulated market the CFTC would immediatly pull the trading records for today and track the big sellers, and inquire as to the reasons for their sudden selling in a quiet market.

It *could* have been a hedge fund margin call. It could even have been a margin call provoked by a bank tightening credit lines with one hand while playing the market with their other hand. There were rumours being spread all week keying in on the day after expiration. I do not have any inside information, no special knowledge, only the advantage of experience and a watchful eye on the markets.

And so there it all is. I was ready for it. I may or may not make money from it, but at least I had flattened my positions as I had said earlier this week and did not lose from it. But it sickens me to the heart nonetheless, to see a once great government fallen so low.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.