Crude Oil, Natural Gas and Geopolitics

Commodities / Crude Oil Feb 27, 2011 - 02:11 PM GMTBy: John_Hampson

Revolt in Libya and fear of the spread of revolt to Saudi Arabia and Algeria - all oil producers - helped push oil prices higher last week. Libya shut down what amounts to roughly 1% of the world's supply. Saudi Arabia responded by increasing supply and the IEA discussed releasing some of the emergency stockpiles. These emergency stockpiles amount to 1.6 billion barrels, or around 4 million barrels a day for a year. Given that Libya produces around 1.6m barrels a day and Algeria 1.3m barrels, the IEA could cover the eventuality of both losing all their supply for up to a year, which is clearly an outside scenario. But, if an uprising gathers pace in Saudi Arabia and disrupts its pumping of 10% of world supply, then the supply gap is unlikely to be filled. For now, this also represents an outside scenario, as the Saudi Government has taken proactive steps to placate its people.

Revolt in Libya and fear of the spread of revolt to Saudi Arabia and Algeria - all oil producers - helped push oil prices higher last week. Libya shut down what amounts to roughly 1% of the world's supply. Saudi Arabia responded by increasing supply and the IEA discussed releasing some of the emergency stockpiles. These emergency stockpiles amount to 1.6 billion barrels, or around 4 million barrels a day for a year. Given that Libya produces around 1.6m barrels a day and Algeria 1.3m barrels, the IEA could cover the eventuality of both losing all their supply for up to a year, which is clearly an outside scenario. But, if an uprising gathers pace in Saudi Arabia and disrupts its pumping of 10% of world supply, then the supply gap is unlikely to be filled. For now, this also represents an outside scenario, as the Saudi Government has taken proactive steps to placate its people.

So, some restriction in supply, some counter supply measures, some fear of further supply reductions, some assurance of further counter measures, and a lot of uncertainty as action in the Middle East and North Africa develops daily: is oil now a short or a long?

First, take a look at the US dollar. No flight to safety so far, as might be expected, instead money has flowed into precious metals and oil. A breakdown below support would likely be accompanied by a further push on crude and gold, due to historical inverse correlation.

Source: Chris Kimble

However, the US dollar Daily Sentiment Index stands in single digit percentage, typically a contrarian buy signal, and that support could be a springboard again for a rally. So let's see - wait for a dollar breakdown, or for a bounce to coincide with geopolitical quietening.

Let's now take a look at crude oil itself.

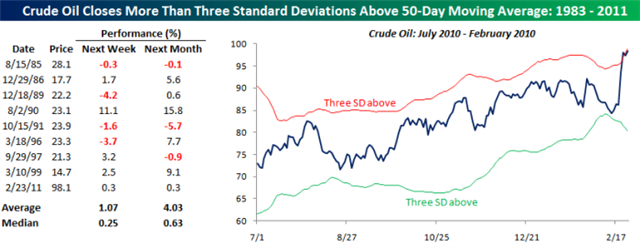

Source: Bespoke Investment

The above graphic suggests it is historically overbought. Furthermore, crude oil Daily Sentiment Index reached 97% last week. Given the dollar's very low DSI and crude's very high DSI, could we see them reverse?

Delving deeper on crude, stockpiles are currently above the historical range, so, revolutions aside, there isn't a demand-supply tightness yet.

Source: US EIA

Furthermore, crude oil appears to be overpriced in relation to natural gas, or natural gas underpriced:

Source: Bespoke Investment

However, the market for crude is international whereas Nymex natural gas is fairly local to the USA, US gas reserves are currently ample, and it is not easy to substitute one for the other. Nevertheless, relative historic cheapness is one supportive reason for a potential natural gas rally, but are there others?

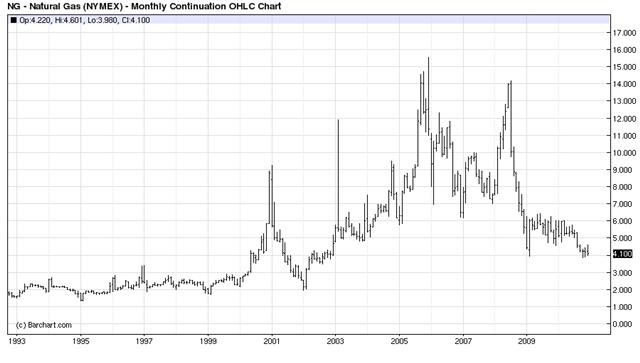

Here is the long term chart for natural gas, and we are close to the long term support line. In fact, it is as cheap as it was in 2000, the start of the secular commodities bull market, since which time most commodities have risen by a multiple.

Source: Futures Buzz

Turning to stockpiles, Gas has suffered from storage close to the top of the historical range in the last couple of years, putting downward pressure on prices. However, this has recently changed and we are now close to the bottom of the historic range, and could feasibly break below:

Source: US EIA

The above chart shows how cyclical and seasonal Gas is, and here is the same representation longer term:

Source: US EIA

Around March, Gas stockpiles tend to reach their annual low, with late winter weather providing the demand. This is reflected in positive seasonality for March:

Source: US Global Research / Frank Holmes

The latest US weather forecasts by Weather Services International and Browning-Garriss suggest below average temperatures from here into Spring, in part due to La Nina. Demand could therefore surprise to the upside.

In short, more wintery weather than normal creating higher demand, positive seasonality, stockpiles at the low end of the historic range, price close to long term support, and relative cheapness to other commodities, together make a good case for a potential natural gas rally during March (longer term, the EIA expects little change in the overall demand-supply situation so Gas prices could potentially continue to languish), and I see it as a short term long.

Oil also typically enjoys positive seasonality for March and over the next 6 months:

Source: US Global Research / Frank Holmes

Accelerating global economic recovery is supportive of prices rising again in this period. However, with crude oil we tread a fine line. James Hamilton found that 10 of the 11 post-war recessions were associated with an excessive increase in oil prices. Therefore, whether through continued geopolitical turmoil or tightening global demand-supply through growth, Governments will collectively try to deflate any excessive rises, and at $100 there is some nervousness.

So back to the question, is oil a short or a long here? For me, it is a long - although we can expect short term volatility. Technically overbought and by sentiment it may be, but global demand is currently back at all time highs and leading indicators for growth are positive and rising. Seasonality is positive for the next 6 months and geopolitical uncertainty should help fulfil this. After all, successful popular uprisings are just the first step. Elections come next, and history reveals that those elected do not often correspond to those leading the uprisings. Indications that Islamic political movements are stepping up to the opportunity may provide a continued market fear around oil supplies. I also want a defensive position against the possibility of a major spike should trouble escalate in other key producer countries in the region, and until the spread of uprisings peter out (or are stamped out) that remains a possibility.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation / Site launch 1st Feb 2011

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.