February Sees Gold up 6% and Silver up 19% on Inflation and Escalating Geopolitical Risk

Commodities / Gold and Silver 2011 Feb 28, 2011 - 06:54 AM GMTBy: GoldCore

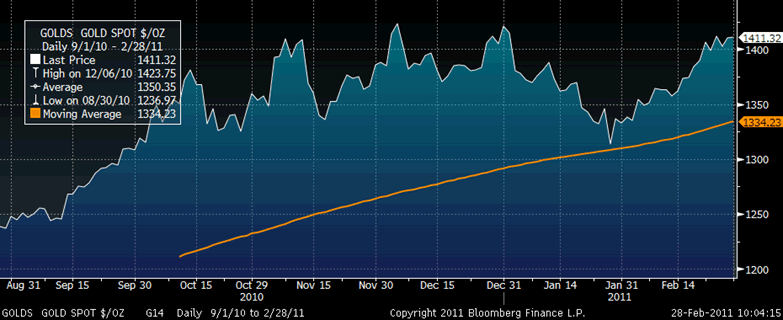

The paper-driven sell off in the gold market seen in January has been trumped by continuing robust physical demand in January and February. This has resulted in gold rising nearly 6% in February and silver’s strong industrial and investment demand leading to a 19% rise to new nominal 30-year highs.

The paper-driven sell off in the gold market seen in January has been trumped by continuing robust physical demand in January and February. This has resulted in gold rising nearly 6% in February and silver’s strong industrial and investment demand leading to a 19% rise to new nominal 30-year highs.

Gold in USD – 6-Month (Daily) and 150-Day Moving Average

Political, and more importantly socioeconomic, revolutions in the Middle East and North Africa are leading to a degree of geopolitical instability and risk not seen in many years. This is leading to concerns about oil supplies from the region and hence the 14% jump in US crude oil just last week and deepening inflation concerns.

Hopes that the feudal Saudi regime will contain the situation by increasing production and exporting more oil are misplaced as the Saudis are already producing oil at maximum capacity and indeed are likely to have been overstating their oil reserves for some years, possibly considerably.

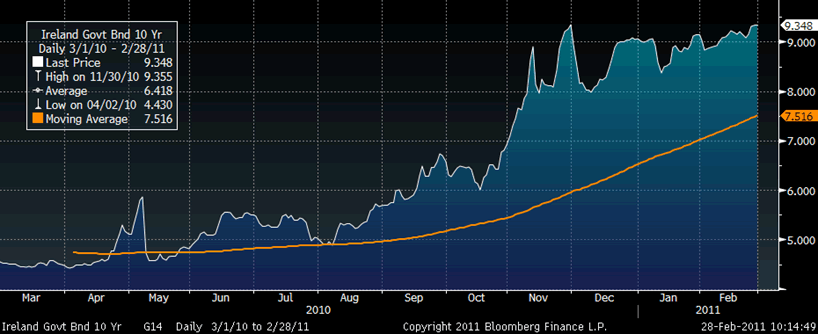

Ireland Government Bonds 10-Year – 1 Year (Daily)

With all eyes on the Middle East and North Africa, there has been less focus on the continuing European sovereign debt crisis. However, the crisis continues and recent days and weeks have seen government bonds in Greece and Ireland again come under pressure.

The yield on Greek bonds (10-year) have risen to over 11.6% in recent days and the yield on Ireland’s 10-year reached a new record high of 9.40% this morning after the Irish electorate “liquidated” the Fianna Fail/Green government over the weekend. While the new government is likely to be a centrist Fine Gael and Labour one, there has been a swing to the left with Sinn Fein, the Workers Party and many left leaning independents elected.

The majority of Irish people are seeking that the massive debts of the Irish and European banking systems, incurred against them, be restructured or defaulted. Therefore, the new government will be under pressure to negotiate a fairer, more equitable settlement with the European Commission and the ECB with possible ramifications for the many European banks who lent irresponsibly to Irish banks.

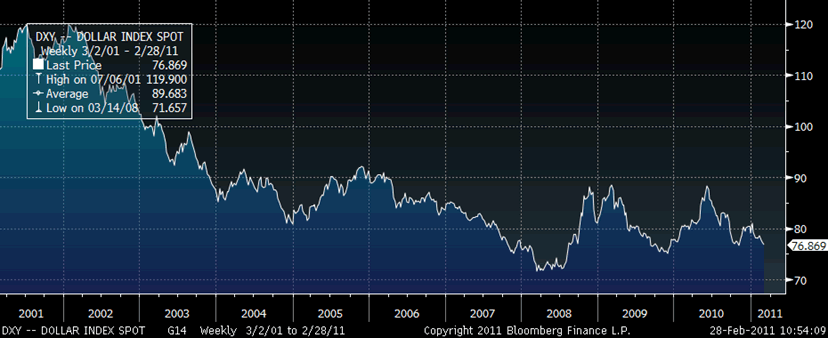

US Dollar Index – 10-Year (Weekly)

Political and economic instability in Europe is set to continue and while the Irish used the ballot box, citizens in some EU countries may not be as peaceful or passive. While the euro has bounced against the beleaguered US dollar recently (the dollar looks very vulnerable to breaking down technically (see chart above), gold above EUR 1,000/oz (€1,020/oz this morning) is a sign that the euro’s troubles are far from over and further euro weakness in the coming months will see gold rise above the EUR 1,072/oz high seen at the end of 2010 (December 28th).

The move by the popular Egyptian Front for Reclaiming the People’s Wealth to ban the export of gold in order to preserve the wealth of the impoverished Egyptian people is a prudent one. The move may be emulated in other countries in the coming months leading to a further decline in scrap supply from emerging markets.

Conversely, mooted proposals by the Vietnamese Central Bank to ban “gold bullion trading” (see news below) are somewhat bizarre. If true this would be a very important development as the Vietnamese are some of the largest buyers of gold bullion in the world. It is unclear whether the proposed ban is simply to prevent “trading” or speculative short term buying and selling, or actually a move to ban the buying of gold bullion ingots and jewellery by Vietnamese households. If it is the latter, it will be unworkable as buying will simply move to the black market or Vietnamese will buy from overseas from bullion dealers.

Gold

Gold is trading at $1,410.50/oz, €1,020.11/oz and £868.59/oz.

Silver

Silver is trading at $33.43/oz, €24.18/oz and £20.59/oz.

Platinum Group Metals

Platinum is trading at $1,803.50/oz, palladium at $787.00/oz and rhodium at $2,350/oz.

News

(Al-Masry Al-Youm) -- Egypt bans exporting gold in effort to curb illegal wealth transfers

The Minister of Trade and Industry Samir Sayyad banned the export of gold in all its forms from Sunday evening.

The minister said in a press statement that the ban will remain in effect from 27 February to 30 June, explaining that it comes during a time of “exceptional circumstances” and is necessary “to preserve the wealth of the country until the current situation stabilizes.”

Since the start of the 25 January uprising, fears have risen that individuals suspected of corruption or wanted for investigation have been smuggling money abroad in the form of gold.

Mohamed Mahsoub, secretary-general of the popular Egyptian Front for Reclaiming the People’s Wealth, said early last week that the group has documents in its possession proving that certain former officials had transferred large amounts of money to foreign banks, where they had also deposited quantities of gold and platinum ingots.

He also said that one former Egyptian official had transferred some US$620 million from Barclay's bank in England to UBS bank in Switzerland and that the Egyptian Attorney General had asked Egypt's foreign ministry to monitor foreign bank accounts belonging to ousted president Hosni Mubarak and his immediate family.

Egypt's Illicit Gains Authority previously requested that the relevant legal bodies investigate wealth accumulated by former government ministers, National Democratic Party officials, and former chief editors of state-run newspapers.

(Al-Masry Al-Youm) -- Former Egypt officials transferred Gold and Platinum Bars to Western Banks

Mohamed Mahsoub, secretary-general of the popular "Egyptian Front for Reclaiming the People’s Wealth," said the group had documents in its possession proving that certain former Egyptian officials had transferred large amounts of money to foreign banks, where they had also deposited large numbers of gold and platinum ingots.

“We plan to submit these documents to the attorney-general and the prime minister,” Mahsoub said.

He also said that one former Egyptian official had transferred some US$620 million from Barclay's Bank in England to UBS Bank in Switzerland.

(Bloomberg) -- Bullish Gold Bets Rebound in February as Mideast Tensions Mount

Hedge funds boosted their bullish bets on gold to the highest since December, when the precious metal was headed to a record price, as tensions in the Middle East spurred investor demand for a haven.

Managed-money funds held net-long positions, or wagers on rising prices, totaling 182,739 futures and options contracts on the Comex as of Feb. 22, up 14 percent from a week earlier, U.S. Commodity Futures Trading Commission data showed last week. Holdings rose for a third straight week and are the highest since Dec. 7, the day gold reached a record $1,432.50 an ounce.

The price has rallied for five straight weeks as pro- democracy uprisings spread from the Middle East to North Africa. Gold is rebounding after a plunge in January that was the biggest in more than a year. Before then, the precious metal had rallied every year for the past decade.

“Gold has found support and buyers have been coming in in the past few weeks,” said Frank Lesh, a trader at FuturePath Trading LLC in Chicago. “All the factors driving the price of gold higher are still there -- political instability, currency volatility and inflation. People are following through with their intentions after the dip in January.”

Gold has climbed 5.6 percent this month, after a 6.1 percent decline in January prompted by an investor shift into equities. Prices are up 27 percent in the past year.

Managed-money positions include hedge funds, commodity- trading advisers and commodity pools. Analysts and investors follow changes in speculator positions because such transactions may reflect an expectation of a shift in prices.

(Bloomberg) -- Rising Gold Output Keeps Australia in No. 2 Spot, Surbiton Says

Australia kept its position as the world’s second-largest producer of gold with a 17 percent increase in output of the precious metal last year, a research group said.

Production rose 38 metric tons to 266 tons in 2010 from a year earlier, Sandra Close, a director of Melbourne-based Surbiton Associates Pty, said in an e-mailed statement.

Gold is trading near record highs as investors seek to protect their wealth against accelerating inflation and intensifying violence in the Middle East. Prices have risen for 10 straight years to reach a record $1,432.50 an ounce on Dec. 7 on the Comex in New York. Gold’s role as an inflation hedge will grow as consumer prices increase worldwide, Credit Suisse AG analyst Stefan Graber said Feb. 22.

China was No. 1 with reported production of 341 tons and the U.S. would rank No. 3 with an output of about 240 tons, Close said.

Australian output gained 12 percent to 70 tons in the fourth quarter, Surbiton said.

Newmont Mining Corp.’s Boddington mine, southeast of Perth, was Australia’s largest single producer during the quarter with 206,000 ounces. The Superpit, 550 kilometers (342 miles) east of Perth and a joint venture of Newmont and Barrick Gold Corp., remained Australia’s largest producer for the year with 788,000 ounces, Surbiton said.

(Bloomberg) -- Goldman ‘Neutral’ on Commodities in the Near Term on Unrest

Goldman Sachs Group Inc. is staying “neutral” on commodities in the near term as the unrest in the Middle East and Africa has raised concerns that global growth may slow.

The bank reiterated an “overweight” recommendation on commodities for the longer term, analysts including Jeffrey Currie wrote in a report. Goldman pared its 12-month forecast for returns on the S&P GSCI Enhanced Commodity Index to 14.3 percent, from 18.6 percent previously.

Commodities last week capped their best weekly performance in almost three months after crude oil jumped 14 percent on concern that the turmoil, which began in Egypt and has cut output in Libya, may spread to other parts of the Middle East. The Enhanced Commodity Index gained 3.9 percent last week, the most since the week to Dec. 3.

“Once the current civil unrests settle down and the contagion risks subside, we expect that higher confidence in global economic growth will once again pave the way for cyclical commodities performance to resume,” the analysts wrote in the Feb. 25 report.

(Bloomberg) -- Vietnam Dong Strengthens at Gold Shops as Reserves Set to Rise

Vietnam’s dong strengthened against the dollar at money changers on speculation foreign-exchange reserves will rise after Prime Minister Nguyen Tan Dung ordered state-owned companies not to “hoard” the greenback.

“Sentiment improved on the foreign-exchange market on expectations reserves will increase once companies sell their dollars to the state bank,” Marc Djandji, the Ho Chi Minh City- based head of research at Viet Capital Securities, wrote in a report today.

The dong advanced in the unofficial market, trading between 21,900 and 21,960 as of 3 p.m. at gold shops in Hanoi, compared with between 21,960 and 22,080 on Feb. 25, according to an information service run by state-owned Vietnam Posts & Telecommunications.

The official rate for the currency dropped 0.04 percent to 20,878, taking losses for the month to 6.6 percent, according to prices from banks compiled by Bloomberg.

“How can you hoard U.S. dollars when we are in this difficult situation?” Dung said at a meeting with ministries in Hanoi on Feb. 24.

The State Bank of Vietnam set the daily reference rate at 20,673, compared with 20,683 on Feb. 25, according to its website. The currency is allowed to trade up to 1 percent on either side of that rate.

The yield on the benchmark five-year bond fell four basis points to 11.55 percent, according to a daily fixing from banks compiled by Bloomberg. A basis point is 0.01 percentage point.

(Dow Jones)-- Vietnam Central Bank Proposes Banning Gold Bullion Trading – Report

Vietnam's central bank is proposing that the government issue regulations to ban the trade of gold bullion from the second quarter of this year, state media reported Monday, citing the State Bank of Vietnam.

"The State Bank of Vietnam in the second quarter will request the government issue a decree on management of gold trading, aiming to control imports and exports of gold and to ban the trading of gold bullion in the free market," the state-run Vietnam News Agency said.

"Trading of gold bullion is only seen in Vietnam but not in other countries," it said.

"It is bad for the economy because (the country) has to import gold, which causes trade deficits."

The elimination of gold bullion trading is "necessary and timely," as the government is rolling out measures to tame inflation and stabilize macroeconomic conditions, it said.

(Bloomberg) -- China Gold Imports Topped 300 Tons Last Year, PBOC’s Yi Says

China imported more than 300 metric tons of gold last year, People’s Bank of China Vice Governor Yi Gang said today in Beijing.

(Financial Times)-- Go for Gold: It is Far Ahead of Electronic Money

Mostly, when you buy insurance, you hope it won’t ever turn out to be necessary.

You pay annual premiums for your car insurance. But that doesn’t mean you secretly hope someone will knock you off the M25. You pay a fortune to insure your house. But that doesn’t mean you want it to be burnt to the ground during your summer holidays (mostly).

The same goes for gold. When I started buying it back in 2002 or so, I did so largely because the supply and demand balance seemed out of whack. But as the decade wore on, I began to see my holdings much more as an insurance – against pretty much all the things that have always gone wrong in the past and that will almost definitely do so at some point in the future. (For this and other important articles see the Commentary section on our website today).

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.