Silver Rises to New Nominal 30-Year High of $34.44/oz; Italian Banks Want Protection of Gold Reserves

Commodities / Gold and Silver 2011 Mar 01, 2011 - 08:41 AM GMTBy: GoldCore

Silver has risen another 1.4% today to a high of $34.44/oz and above the 31-year interday high of $34.33/oz reached last Tuesday (February 22nd). Silver is higher in all currencies this morning, especially the Japanese yen. The news that Saudi Arabia may be sending tanks to crush anti-government protests in Bahrain saw buying of silver, gold and oil.

Silver has risen another 1.4% today to a high of $34.44/oz and above the 31-year interday high of $34.33/oz reached last Tuesday (February 22nd). Silver is higher in all currencies this morning, especially the Japanese yen. The news that Saudi Arabia may be sending tanks to crush anti-government protests in Bahrain saw buying of silver, gold and oil.

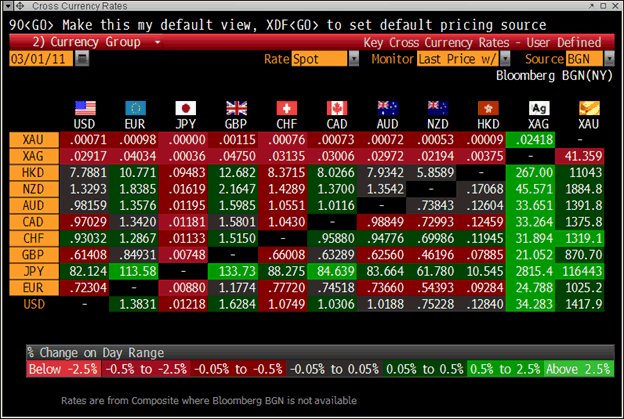

Cross Currency Table

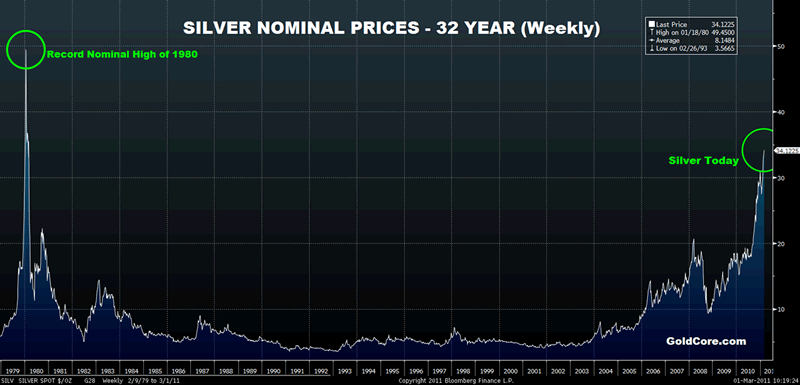

Silver rose another 2% yesterday and reached a new 30-year record high close, but remains more than 30% below its March 1980 record nominal high, when silver reached a record high of $50.35/oz (see long term chart below).

Gold is also higher in all currencies as oil prices remain near recent highs on geopolitical concerns. Both gold and silver would be expected to see a period of consolidation after the sharp gains seen in February. However, the strong fundamentals may lead to further upward pressure on prices.

Silver remains in backwardation going out as far as the December 2014 contract which is trading at $33.03/oz while spot (for immediate delivery) is at $34.25/oz.

The majority of the media continues to completely ignore the developments in the gold market and, especially, in the silver market. Tech stocks and speculation regarding banks, Twitter, Facebook and other individual companies remain far more fashionable and the primary focus of the mainstream media (not to mention Charlie Sheen and Lady Gaga).

Nominal Silver Prices – 1979 to Today (Weekly)

The backwardation and news regarding delays and difficulty of securing silver bullion in volume including the Royal Canadian Mint having difficulty sourcing physical bullion from bullion banks suggest that silver could soon break out and move sharply higher.

The moves in silver have been greeted with the usual silence by mainstream financial media with little or no coverage or fanfare about the record highs. Indeed, only those who peruse the specialist press and make it their business to inform themselves about silver, would even be aware of the record highs.

CNBC ran a piece on silver yesterday which was unusually bullish and suggested (as we have done since 2004) that in time silver could reach its inflation adjusted high in 1980 of over $130/oz.

The Financial Times reports on the front page of their Company and Markets section (see news below) that Italian banks are seeking to use gold in order to strengthen their balance sheets ahead of coming stress tests. They wish to mark-to-market the considerable gold reserves of the Bank of Italy (Italian central bank), of which they are shareholders, in order to transform their core capital ratios.

As of December 2010, the Bank of Italy had gold reserves of 2451.8 metric tonnes (68.6% of their foreign exchange reserves) which makes them the fourth largest sovereign owner of gold in the world – after the US Federal Reserve, the German Bundesbank and the International Monetary Fund (IMF).

“Senior bankers say taking into account the surge in gold prices the Bank of Italy could have a mark-to-market value of about €30 billion.”

The move would mark a further remonetisation of gold in the world financial and monetary systems and may be a prelude to similar actions (revaluation of gold reserves or possible devaluation of currencies versus gold reserves) being done by other central banks.

The Federal Reserve may be forced into such an action in order to protect the US dollar. The Federal Reserve’s financial position has deteriorated drastically in recent years and is being constantly diminished by quantitative easing and the electronic creation and printing of money to buy mortgage backed, Treasury and other securities.

The Fed's asset holdings in the week ended February 23rd, climbed to $2.537 trillion and have expanded almost US$225 billion in just the last 16 weeks.

This is currency debasement on a scale never before seen in history and will have ramifications for bond markets, interest rates, the dollar and all fiat currencies.

Gold

Gold is trading at $1,419.68/oz, €1,028.16/oz and £873.06/oz.

Silver

Silver is trading at $34.44/oz, €24.88/oz and £21.12/oz.

Platinum Group Metals

Platinum is trading at $1,816.50/oz, palladium at $805.00/oz and rhodium at $2,350/oz.

News

(Reuters) - Daily gold transfers rise in January - LBMA

Gold ounces transferred between accounts held by bullion clearers rose 7.1 percent to a daily average of 19.2 million ounces in January from a month earlier, the London Bullion Market Association (LBMA) said on Monday.

The clearing statistics measure how much gold and silver are transferred on a net basis between the accounts held at the bullion clearers.

The average fixing dropped 2.5 percent, but value rose to a daily average of $26.1 billion. The number of transfers climbed 11.7 percent to a daily average of 2,034.

Measured year-on-year, gold statistics were mixed. Ounces transferred fell 3 percent, value rose 17.7 percent and the number of transfers increased by 13 percent.

Ounces transferred in silver rose 20.1 percent to a daily average of 119.7 million. The value of transfers rose 16.3 percent to a daily average of $3.4 billion, the highest figure since LBMA clearing statistic began in 1998.

The number of transfers rose 4.7 percent to a daily average of 597. Measured year-on-year, ounces transferred surged 69.9 percent and value leapt 171.4 percent. The number of transfers rose 100.4 percent.

(Reporting by Jan Harvey; editing by James Jukwey )

(Bloomberg) -- U.S. Mint Says Eagle Gold Coin Sales Increased 10% in February

Sales of American Eagle gold coins by the U.S. Mint were 92,500 ounces in February, 10 percent higher than a year earlier and 31 percent below January’s sales, data on its website show.

The mint sold 3.24 million ounces of silver coins last month, up 58 percent from a year earlier. That’s still 50 percent less than in January, the data show.

(Financial Times) -- Italian banks go for gold in move to transform core capital ratios

Italian banks, which by a quirk of law are shareholders in the country’s central bank, are lobbying to have their stakes in the Bank of Italy marked-to-market on the back of surging gold prices in an attempt to ease regulatory pressure on them to raise capital in advance of this summer’s stress tests.

The move comes as Mario Draghi, Bank of Italy governor, over the weekend stepped up pressure on Italian banks, which are some of the lowest capitalised in Europe, to increase their core capital ratios or make clear to the market any plans to do so.

The Bank of Italy currently has a nominal value of just €156,000 ($215,000) divided into 300,000 shares which are distributed among Italy’s retail and savings banks according to their size.

Senior bankers say taking into account the surge in gold prices the Bank of Italy could have a mark-to-market value of about €30bn. Analysts estimate the Italian banking sector has combined recapitalisation needs of much the same amount to comply with new Basel III capital rules.

Any debate over the value of the Bank of Italy has met with opposition from the central bank concerned that it could harm governance. For the same reason, executives at Italy’s banks are not involved in the central bank’s decision-making process.

But several sources familiar with the talks say Italy’s banking lobby is gaining political traction amid opposition from its core shareholders, the local banking foundations, to capital increases as they fear a dilution of their stakes.

Italy’s government has also indicated there is a political will to reduce the need for Italian banks to access the capital markets.

After heavy lobbying from banks and foundations, the government last week forced through a motion, using a confidence vote, that will ease capital pressures on the banks by allowing them to book some deferred taxes as assets.

Monte dei Paschi di Siena and Banca Popolare di Milano, a regional lender, are the banks seen as most likely to have to tap the market as they have core tier one capital ratios of under 8 per cent and little room for assets sales. Both banks have denied any such plans. The capital structure of UniCredit, Italy’s largest bank by assets, is also in the spotlight as the future of its main shareholders – the Libyan Central Bank and Libyan Investment Authority – is unclear. Intesa Sanpaolo, Italy’s largest bank by retail network, has core capital of about 8 per cent, which could also be considered too low for a potentially systemically important bank.

Intesa Sanpaolo would be the biggest beneficiary of any capital revaluation with a 30 per cent stake in the central bank.

(Bloomberg) -- Silver may rise to $40 to $50 an ounce, said Sean Boyd, the chief executive officer of Agnico- Eagle Mines Ltd.

Boyd spoke today in a Bloomberg Television interview in Hollywood, Florida.

(Bloomberg) -- Silver in last two weeks cleared “resistance” at $31-$32 range; patterns “point to a full retracement” back to 1980 high when Hunt brothers tried to corner the market, says Bank of Amer. Merrill Lynch market analyst Mary Ann Bartels.

Silver futures would need to rise $8.58 or 26% to reach 1980 high from today’s $33.61

Silver set for breakout vs gold: Bartels

If silver relative to gold exceeds 1998 high “would confirm multi-decade base and set the stage for longer-term silver outperformance.

(Bloomberg) -- Following is a table of sales of gold and silver coins by the U.K.’s Royal Mint, as confirmed by a spokesman by phone today. The figures are in ounces.

20102009

Gold110,287118,374

Silver368,991388,129

(Bloomberg) -- Gold prices may average 8 percent more in 2011 at $1,320 an ounce because of investment demand driven by risks linked to global economic growth and fiscal stability, an Australian government agency said.

The price may peak this year before declining, in real terms, to average around $975 an ounce in 2013, and then increase to $1,064 in 2016, said the Australian Bureau of Agricultural and Resource Economics and Sciences. The appeal of the metal could weaken in the second half and in 2012 if the U.S. economy improves and the possibility of monetary tightening increases, it said.

“The assumption of world economic recovery over the next few years is expected to lead to a reduction in speculative investment demand,” Abares said in the report. “The appetite for higher risk assets such as shares and property is likely to increase.”

Gold climbed about 5.7 percent last month to $1,408.07 an ounce as of 4:38 p.m. Singapore time yesterday as riots in North Africa and the Middle East and the toppling of autocratic leaders in Egypt and Tunisia spurred demand for a haven. Bullion gained 30 percent last year as investors sought to preserve their wealth against currency debasement.

World mine production is forecast to increase 2 percent to 2,703 metric tons this year, the report said. Australian mine output may rise 14 percent to 274 tons in 2010-2011 as Newmont Mining Corp.’s $3 billion Boddington development in Western Australia ramps up, it said.

(Bloomberg) -- Gold is poised to advance to a record with the bull trend targeting $1,460 to $1,500, according to technical analysis by Barclays Capital.

“Gold is oscillating around the bull-flag trigger in the $1,410 area,” according to a report from analysts including Jordan Kotick and Phil Roberts. “We maintain our bullish view and expect a clear break over there to confirm gains through the all-time high at $1,432.”

Bullion for immediate delivery has advanced 6 percent this month as riots in North Africa and the Middle East and the toppling of autocratic leaders in Egypt and Tunisia spurred demand for a haven. Gold climbed 30 percent in 2010 and reached a record $1,431.25 an ounce on Dec. 7.

The metal faces resistance levels at $1,432, $1,465 and $1,500 an ounce and support at $1,370, $1,340 and $1,300, the report said.

In technical analysis, analysts study charts of trading patterns to try to predict changes in a security, commodity, currency or index.

(Financial Times) -- Vietnamese weigh impact of bar on gold trade

The desire among many Vietnamese to keep gold as a store of value is both a cause and a symptom of the fast-growing nation’s economic trouble.

Now the government has said it will ban the trading of gold bars in the “free market” as part of a package of measures designed to rein in soaring prices and tackle deep-seated economic imbalances. But it has befuddled investors and ordinary people alike.

Buffeted by persistent inflation and weakness in their currency, many Vietnamese prefer to save in gold and dollars. Their fondness for gold, which is often used to settle property deals and other large transactions, and dollars puts further downward pressure on their currency, the dong, in a negative feedback loop from which it is hard to escape.

Vietnam’s central bank said on Friday that in order to prevent speculation and market manipulation, the government would issue a decree in the second quarter of this year banning the free-market gold trade and thereby preventing cross-border smuggling. But, given the government’s tendency to issue decrees and circulars by the truckload, gold traders and economists say the real impact of this latest pronouncement will be determined by officials’ actions rather than words.

Cao Sy Kiem, a former central bank governor, told the Tuoi Tre newspaper that while the government needed to tackle the proliferation of gold and dollars in order to be able to make sound monetary policy, a “detailed road map” was needed to ensure the problems caused by unofficial gold trading were not made worse.

A gold trader on Ha Trung street in Hanoi, one of the most popular locations for the gold shops that double as black-market dong-dollar exchange houses, questioned how effective this latest move would be.

He said: “The government needs a clear definition of gold bars, or else gold shops will make whatever shape necessary to avoid the law.”

One economist said that, as transactions in gold and dollars were circumscribed by law, what was needed was serious enforcement and serious alternatives, not more decrees. Given much of the gold in Vietnam is held in people’s home safes, accurate statistics on the amount of the metal in the country are nigh on impossible to collate. Last year the central bank governor denied speculation that there was as much as 1,000 tons of gold in Vietnam, equivalent to 45 per cent of annual gross domestic product.

The onshore gold price, which trades at a premium to international prices, fell initially at the end of last week as news of the proposed trading ban broke. But it stabilised on Monday at 37.6m-37.7m Vietnam dong per tael, equivalent to 37.5 grammes or 1.21 troy ounces, according to Reuters.

Evidence, if it were needed, that it will take a lot more than another decree to coax the gold out of Vietnamese savers.

(Bloomberg) -- Silver for immediate delivery climbed as much as 1.4 percent to $34.3775 an ounce, the highest price since March 1980.

It traded at $34.3525 at 11:21 a.m. local time.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.