China Gold Demand Voracious, Chinese Yuan Gold Standard?

Commodities / Gold and Silver 2011 Mar 03, 2011 - 08:42 AM GMTBy: GoldCore

Gold and silver have recovered somewhat from slight falls in Asia overnight and are now higher against the British pound and Swiss franc which are weaker this morning. With geopolitical instability looking set to escalate and the real possibility of a military confrontation in the Mediterranean, any sell off in the precious metals will likely be tentative.

Gold and silver have recovered somewhat from slight falls in Asia overnight and are now higher against the British pound and Swiss franc which are weaker this morning. With geopolitical instability looking set to escalate and the real possibility of a military confrontation in the Mediterranean, any sell off in the precious metals will likely be tentative.

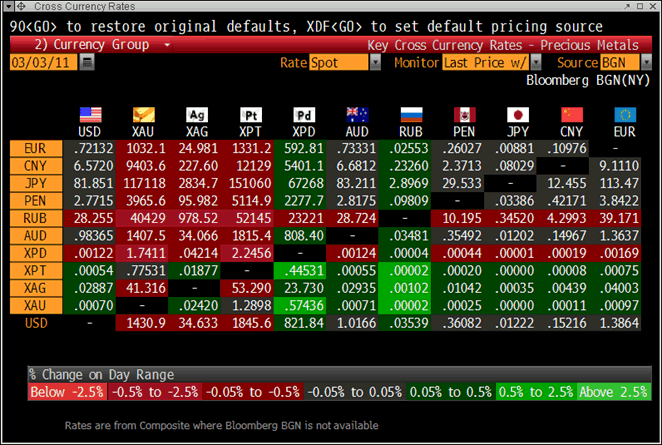

Cross Currency and Precious Metal Table

$1,500/oz for gold and $40/oz for silver remain viable short term targets and any price dip should be seen as a buying opportunity. Bullion dealers, including GoldCore, are experiencing only tentative buying and indeed some selling; buying of bullion is nowhere near the levels seen during the Bear Stearns, Lehman Brothers or more recent Eurozone sovereign debt crises.

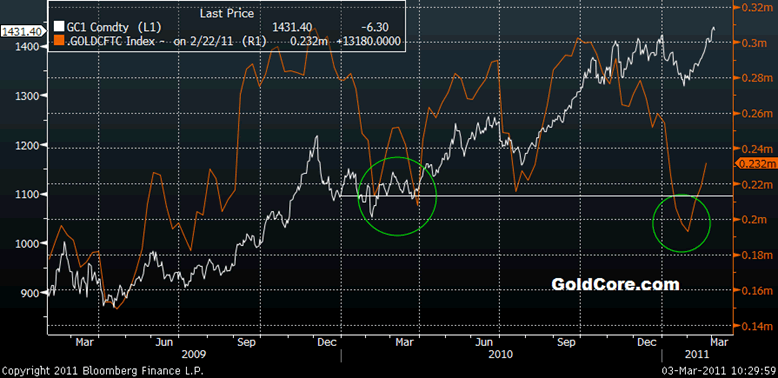

Total Known Gold ETF Holdings

The lack of animal spirits in the gold and silver bullion markets is also seen in the decline of the gold ETF holdings (see chart above) and the Commitment of Traders open interest (see below). Neither show any signs of speculative fever whatsoever.

This would suggest that the recent record prices are due to short covering on the COMEX (possibly by Wall Street banks with concentrated short positions as alleged by the Gold Anti-Trust Action Committee or GATA and being investigated by the CFTC) and buying of bullion in the Middle East and Asia, particularly in China.

While all the focus is on the geopolitical risk in the Mediterranean, the not insignificant risks posed by the European sovereign crisis, the possibility of a US municipal and sovereign debt crisis and continuing currency debasement internationally are the prime drivers of gold today.

Quantitative easing, debt monetisation and competitive currency devaluations have not gone away and are leading to deepening inflation which will likely result in much higher prices in 2011 and 2012.

Enter the Chinese Gold Dragon

Overnight, UBS confirmed in a Bloomberg article that China alone imported a massive 200 metric tonnes of gold in just the first two months of 2011. This gold is being bought by China’s 1.3 billion people in order to protect against surging inflation (see news).

The FT last week quoted a senior executive of the world’s largest bank by market capitalisation Industrial and Commercial Bank of China Ltd. (ICBC) about the “voracious” appetite for gold in China. ICBC bank has in some two months opened gold savings accounts for more than 1 million savers with more than 12 tons of gold stored on their behalf.

Shopping malls in China are experiencing massive buying of gold jewellery and ingots as shoppers buy gold as a store of wealth in order to protect against surging food and energy inflation. Statistics from Beijing Caibai, Beijing’s largest jewellry store, show sales of gold bars and jewellry have totaled an incredible 4 billion yuan or about $600 million US dollars so far this year, a 70-percent increase year-on-year (see news).

This demand is only the demand from Chinese investors and savers. It does not include purchases by the less than transparent People’s Bank of China who are almost certainly continuing to diversify their massive nearing $3 trillion currency reserves into gold bullion in order to protect themselves from their massive dollar ($1.6 trillion dollars of US debt alone, according to the Treasury Department) and other currency exposure.

Chinese Yuan Gold Standard

China is clearly trying to position the yuan or renminbi as the alternative global reserve currency. The Chinese likely realise that they will need to surpass the Federal Reserve’s official, but unaudited, gold holding of 8,133.5 tonnes. China is the sixth largest holder of gold reserves in the world today and officially has reserves of 1054.1 tonnes which is less than half those of even Euro debtor nations France and Italy who are believed to have 2,435.4 and 2,451.8 tonnes respectively.

China’s ambitions to rival and even supplant the dollar were seen overnight with news that China is to allow all exporters and importers to settle their cross-border trades in the yuan this year. The People’s Bank of China said that it was “part of plans to grow the currency's international role” and “would respond to overseas demand for the yuan to be used as a reserve currency.”

Russia is also attempting to position the Russian ruble as a global reserve currency (see news).

World Bank President Robert Zoellick recently mooted the possibility of a return to some form of gold standard. It seems extremely likely that senior and influential Chinese policy makers, bankers and government officials may be having similar thoughts.

Gold Bubble?

The lack of knowledge of the vast majority of people about gold and the very important developments in the gold markets with significant macroeconomic, monetary and geopolitical ramifications is hardly indicative of a bubble.

Nor is the instinctual aversion and bias against gold by some today. Indeed, the negativity displayed against gold by a minority (normally vested interests offering other investment or saving products) in recent years and continuing today may be partly due to some feeling unwise due to their failure to predict gold’s rise and return as a global currency.

The significant and continuing price appreciation of something they don't own, they don't understand and did not advise people to diversify into has some looking somewhat imprudent.

Gold

Gold is trading at $1,428.10/oz, €1,030.45/oz and £877.86/oz.

Silver

Silver is trading at $34.49/oz, €24.89/oz and £21.20/oz.

Platinum Group Metals

Platinum is trading at $1,841.25/oz, palladium at $815.00/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- Gold Is Heading for $2,000 in 12 Months, Deutsche Bank Says

Gold is heading for $2,000 an ounce in the next 12 months, Deutsche Bank AG said in a report. Silver may average $50 an ounce next year, Deutsche Bank analyst Daniel Brebner said in the report e-mailed today.

(Bloomberg) -- Russia Depository Bought 3.4 Tons of Gold in 2011, Interfax Says

Russia’s Gokhran state depository bought 3.4 metric tons of gold from producers last year, more than the 2.5 tons previously reported, Interfax reported, citing unidentified sources in the organization.

The state precious-metals and gems depository purchased 5 tons of gold in 2009, according to Interfax. Russian banks last year bought 148.8 tons of gold from producers, led by OAO Sberbank, Nomos Bank and OAO Sberbank, the news service reported.

(Russia-Media.RU) –Russia’s currency- and gold reserves up 4.8 billion USD during last week

The External and Public Relations Department of the Bank of Russia informed on Thursday that the country’s international currency and gold reserves are up 4.8 billion USD or 1.0 percent during last week to a volume of 492.2 billion USD per 25 February 2011.

Since 1 January 2011 the reserves are up 12.8 billion USD.

The reserves have been on 478.7 billion at 1 January 2008, 427,1 billion 1 January 2009, 440,6 billion USD January 2010 and 479.4 billion USD at 1 Januar 2011. They reached their highest volume with 598,1 billion USD before the conflict with Georgia about South-Ossetia in the beginning of August 2008.

(Bloomberg) -- World Food Prices Rose to a Record in February, UN Says

World food prices rose to a record in February, the United Nations said. Its FAO Food Price Index averaged 236 points, the group said in a notice on its website today.

(Bloomberg) -- Commodity Index Extends Rally to 29-Month High on Cotton, Sugar

The Thomson Reuters/CRB Index of 19 commodities rose to a 29-month high, led by gains in cotton, sugar, silver and crude oil. The index advanced 0.6 percent to 357.32 at 9:33 a.m. in New York, after touching 357.67, the highest since Sept. 29, 2008.

(DPA) -- Swiss central bank reports loss of 20.7 billion dollars in 2010

The Swiss National Bank (SNB) reported Thursday a consolidated loss of 19.17 billion Swiss francs (20.7 billion dollars) last year, largely due to the appreciating value of the Swiss currency.

The results compare with a profit of 9.96 billion francs in 2009. A profit of 2.6 billion francs was recorded by its so-called stability fund, which holds toxic assets from UBS AG, the Swiss bank that required a bailout in 2008.

But currency interventions were costly for the central bank, which has tried to prevent too quick a rise in the franc versus the dollar and the euro. Despite these market interventions, the franc has hit new highs against the major currencies.

Philipp Hildebrand, head of the SNB, has warned of deflationary risks from a strong franc to justify the interventions, which at times have been controversial in Switzerland.

The sharp rise in the price of gold resulted in valuation gains of 5.82 billion francs for the SNB, on unchanged gold holdings of 1,040 tonnes.

(Wall Street Journal) -- Bernanke Unfazed By Gold Standard, Currency History Queries

WASHINGTON -- Federal Reserve Chairman Ben Bernanke defended the central bank's effect on the dollar Tuesday, pushing back at the idea that policy makers should consider alternative proposals like the gold standard.

Bernanke, appearing before the Senate Banking Committee, was pressed by Sen. Jim DeMint, R-S.C., on the viability of a return to a gold-backed economy or the idea of the Treasury Department issuing bonds payable in gold.

Bernanke, who has studied the issue, said a return to the gold standard wouldn't work.

"It did deliver price stability over very long periods of time, but over shorter periods of time it caused wide swings in prices related to changes in demand or supply of gold. So I don't think it's a panacea," Bernanke told DeMint.

Additionally, Bernanke said there were a number of practical issues that would prevent the return of gold as the world standard. Namely, there's not enough gold in the world to effectively support the U.S. money supply.

"I don't think that a full-fledged gold standard would be practical at this point," Bernanke said, declining to opine on the gold-backed bond issue because he was not familiar with the idea.

Sen. Mark Kirk, R-Ill., also engaged Bernanke on the currency issue, questioning whether the Fed's $600 billion bond-purchase program is in effect monetizing the U.S. debt. Bernanke noted that the U.S couldn't have currency outstanding if there were no Treasury securities to back it up, and that even the most steady economic times the Fed engages in the buying and selling of U.S.-backed securities.

Kirk, however, noted that the United States did have currency not backed by federal debt at one time in its history: under the administration of President Andrew Jackson, the nation's seventh president.

Bernanke, appearing amused, was quick to respond.

"So this was before the Civil War. This was during the period where individual banks issued currency. We didn't have a national currency," Bernanke said.

Not to be outdone, Kirk asked whether it was possible for a country to have a currency without a trillion-dollar debt. Bernanke said that was the case.

(Bloomberg) -- Turkey Gold Imports 5.48 Tons in February, Exchange Data Show

Turkey’s gold imports reached 5.48 metric tons in February, the Istanbul Gold Exchange said in a report on its website.

The country imported no silver in February, the data show.

(Bloomberg) -- Gold Buying in China Jumps as Inflation Flares, Boosting Demand, UBS Says

Gold purchases in China, the world’s largest producer, climbed to 200 metric tons in the first two months of 2011 as faster inflation boosted consumer demand, according to UBS AG, which said the price may gain to $1,500.

“China is the big buyer,” Peter Hickson, global commodities strategist at Switzerland’s largest bank, said by phone yesterday, without giving a comparable figure for 2010. The estimate for the two-month period compares with full-year consumer demand from China of 579.5 tons for last year, according to the World Gold Council, a producer-funded group.

Bullion, which rallied 30 percent last year, surged to a record yesterday as uprisings in the Middle East, quickening inflation and currency debasement boosted global demand. China’s consumer prices rose 4.9 percent in January from a year earlier, exceeding policy makers’ 4 percent ceiling for a fourth month.

“Chinese interest is huge,” said Peter Tse, Hong Kong- based head of precious metals at Bank of Nova Scotia. “Demand for physical gold and imports has increased substantially” due to the Lunar New Year holiday, Tse said today, referring to the week-long break that began Feb. 2.

Immediate-delivery gold was at $1,429.05 an ounce at 5:08 p.m. in Singapore compared with yesterday’s peak of $1,434.93. Yuan-denominated bullion rose 0.5 percent to 303.58 yuan ($46.19) a gram in Shanghai, approaching the record 314 yuan, set Nov. 9.

‘Gold Is Attractive’

“Gold is attractive,” Hickson said. “The more the market becomes concerned about inflation or concerns about unrest in Africa, more and more people will look to gold.” The price may rise to $1,500 an ounce in the next six months, said Hong Kong- based Hickson, who’s worked for UBS since 1996.

Blackstone Group LP’s Byron Wien said in January that gold may rise to more than $1,600 this year “as investors across the world place more of their assets in something they consider ‘real’.” The price may reach $1,600 this year, Wayne Atwell, a managing director at Casimir Capital LP said the same month.

Protests partly linked to record food prices have erupted across North Africa and the Middle East this year, toppling leaders in Tunisia and Egypt and boosting oil prices. Libyan rebels braced for renewed clashes today with forces loyal to leader Muammar Qaddafi. Iranian protesters have clashed with security forces in Tehran, Al Arabiya reported.

Gold investment in China, the largest buyer of the precious metal after India, may gain 40 percent to 50 percent this year amid a lack of alternatives, Wang Lixin, China representative for the World Gold Council, said last month. He called that forecast a “conservative estimate.”

Bars and Coins

China’s investment demand in 2010 jumped 70 percent to 179.9 tons, surpassing Germany and the U.S., as buyers sought out bars and coins, the London-based industry group said. Consumption by the jewelry sector rose to a record 399.7 tons, it said. China imported more than 300 tons last year, People’s Bank of China Vice Governor Yi Gang said on Feb. 26 in Beijing.

China may be the “next big buyer” of gold, driven by institutional and retail demand, Credit Suisse Group AG analyst Tom Kendall said in Cape Town on Feb. 7. “If you’re sitting there in China with money in a deposit account, you’re losing between 1-2 percent a year through inflation,” Kendall said.

The boom in gold demand in China is driven by concern about inflation pressure and the poor performance of alternative investments, the producer-funded council has said. Premier Wen Jiabao pledged on Feb. 27 to boost food supplies to hold down costs, and to tackle surging property prices.

Spooked by Inflation

Jewelers at shopping malls across Beijing are witnessing a gold rush as residents spooked by inflation look to protect their money, the China Daily reported on Feb. 28

Statistics from Beijing Caibai, the city’s largest jewelry store, show sales of gold and other jewelry have totaled about 4 billion yuan so far this year, a 70 percent increase from a year ago, the report said.

China displaced South Africa as the world’s biggest gold producer in 2007. Imports through last October rose almost fivefold to 209 tons from the total shipped in the previous year, according to the Shanghai Gold Exchange. Mine output reached a record 340 tons last year, the China Gold Association has said.

The Industrial and Commercial Bank of China Ltd., the world’s biggest lender by market value, started physical-gold linked savings accounts in December with the World Gold Council. Account openings have surpassed 1 million, with more than 12 tons of gold stored on behalf of investors, it has said.

(China Radio International - CRI) - Malls Witnessing Gold Rush as Shoppers Fear Inflation

Jewellers at shopping malls across Beijing are witnessing a gold rush amid inflation fears.

Statistics from Beijing Caibai, the city's largest jewellry store, show sales of gold and other jewellry have totaled about 4 billion yuan or about $600 million US dollars so far this year, a 70-percent increase year-on-year.

Wang Chunli, general manager, said that hundreds of customers are lining up outside every day to buy gold accessories, such as necklaces and rings.

After seeing the enthusiasm for gold investment, insiders predict prices will continue to rise this year.

The price has already reached 338 yuan a gram at Caibai, according to data from cngold.org, a popular gold investment website.

A report released by the World Gold Council at the end of 2010 said China is the strongest market for gold investment and gold accessory purchase.

(Zero Hedge) -- As Silver Touches $34.90, US Mint Runs Out Of Bullion Blanks, Halts American Eagle Silver Coin Production

The scramble for non-dilutable currencies hits a frenzy as silver just touches on a fresh 31 year high of $34.90. To commemorate this historic event, the US Mint has halted American Eagle silver coins production, in addition to its ongoing halt of American Buffalo coins: "because of the continued demand for American Eagle Silver Bullion Coins, 2010-dated American Eagle Silver Uncirculated Coins will not be produced. The United States Mint will resume production of American Eagle Silver Uncirculated Coins once sufficient inventories of silver bullion blanks can be acquired to meet market demand for all three American Eagle Silver Coin products."

From the US Mint: Production of United States Mint American Eagle Silver Uncirculated Coins continues to be temporarily suspended because of unprecedented demand for American Eagle Silver Bullion Coins. Until recently, all available silver bullion blanks were being allocated to the American Eagle Silver Bullion Coin Program, as the United States Mint is required by Public Law 99-61 to produce these coins “in quantities sufficient to meet public demand . . . .”

Although the demand for precious metal coins remains high, the increase in supply of planchets—coupled with a lower demand for bullion orders in August and September—allowed the United States Mint to meet public demand and shift some capacity to produce numismatic versions of the American Eagle One Ounce Silver Proof Coin.

However, because of the continued demand for American Eagle Silver Bullion Coins, 2010-dated American Eagle Silver Uncirculated Coins will not be produced.

The United States Mint will resume production of American Eagle Silver Uncirculated Coins once sufficient inventories of silver bullion blanks can be acquired to meet market demand for all three American Eagle Silver Coin products.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.