Impending Crude Oil Correction By Mass Rollover

Commodities / Crude Oil Mar 04, 2011 - 02:36 AM GMTBy: Dian_L_Chu

Thanks to Muammr Gaddafi’s airstrikes near a Libyan oil terminal, and protests in Iran adding to the continuing chaos in Middle East and North Africa (MENA), on Wednesday, March 2, Brent oil settled at its highest level since August 2008 at $116.35 a barrel, while WTI futures on NYMEX also advanced to $102.33 per barrel.

Thanks to Muammr Gaddafi’s airstrikes near a Libyan oil terminal, and protests in Iran adding to the continuing chaos in Middle East and North Africa (MENA), on Wednesday, March 2, Brent oil settled at its highest level since August 2008 at $116.35 a barrel, while WTI futures on NYMEX also advanced to $102.33 per barrel.

Peace by Chavez?

Peace by Chavez?

However, crude oil retreated on Thursday, March 3 after Al Jazeera reported that Gadhafi had accepted a plan proposed by Venezuelan President Hugo Chavez for a multinational commission to mediate the conflict with rebel groups.

The International Energy Agency (IEA) said between 850,000 and 1 million barrels a day (bpd) of Libyan crude output has gone offline, and that the unrest in Libya had started to affect Europe's oil supplies. Indeed, since Europe is the largest importer of Libyan crude, the supply disruption there had Italian and French refiners rush to secure cargoes driving an 18-fold surge in oil-tanker rates in two weeks.

Saudi & Nigeria Stepping In

Then, Bloomberg reported that Saudi Arabian Oil Co. said the kingdom is “ready to supply incremental change in demand,” to cover any shortfall from Libya. Saudi Arabia pumped 8.43 million bpd of oil in February, according to Bloomberg.

Moreover, Nigeria, an alternative producer of Libyan crude grade and a favored oil supplier to U.S. refiners, said it will also increase daily crude exports of 14 main grades by 9.3% in April from this month.

Small Oil Disruption Risk

Crude market would react to the faintest geopolitical event as remote as North Korea shelling South Korea's Yeonpyeong Island. So far, the shortfall from Libya is not significant enough to cause a major supply disruption. However, the real oil supply risk is actually with Saudi Arabia, which accounts for about 12% of global oil production in 2009 and holds almost 25% of the world’s oil reserves. In a worst case scenario, the entire MENA oil supply could be at risk.

But from all indications, things most likely will not get out of control in Saudi as they did in Egypt and Libya for several reasons. The Saudi royal family maintains a tight control of the military force, and there’s not a significant opposition force. Furthermore, Saudi is in a much better economic state than Egypt, Libya, etc., and with a whole lot of petro dollars and resources to go around. And most importantly, the rest of world would hate to see any instability in Saudi Arabia.

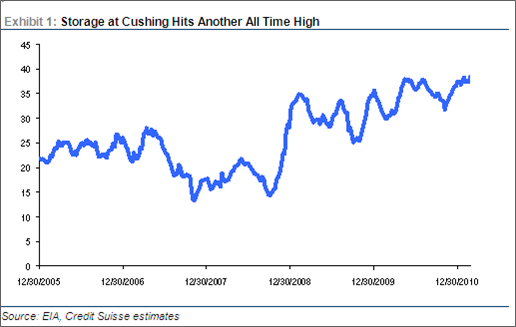

Cushing Inventory at All Time High.

Against this backdrop, the U.S. EIA reported the first draw in the U.S. crude inventories in six weeks. However, instead of demand-driven, the 364,000-barrel drawdown was primarily due to falling imports and higher refinery runs. And guess what? Crude inventory at Cushing, Oklahoma just rose 1.1 million barrels to hit a new all-time high of 38.6 million barrels (See Exhibit 1)

So basically, there’s not a real physical oil shortage, and crude prices primarily have been moving from fear and speculation depending on news and rumor coming out of MENA.

Now with crude prices bid up so much, traders are left with a dilemma - to be in the crude oil trade, players basically either have to take delivery, or rollover contracts and options comes expiration time. However, with storage at Cushing, Oklahoma pretty much at capacity, and price curve front month (April) loaded, it is doubtful that anybody would be in a position to take physical delivery.

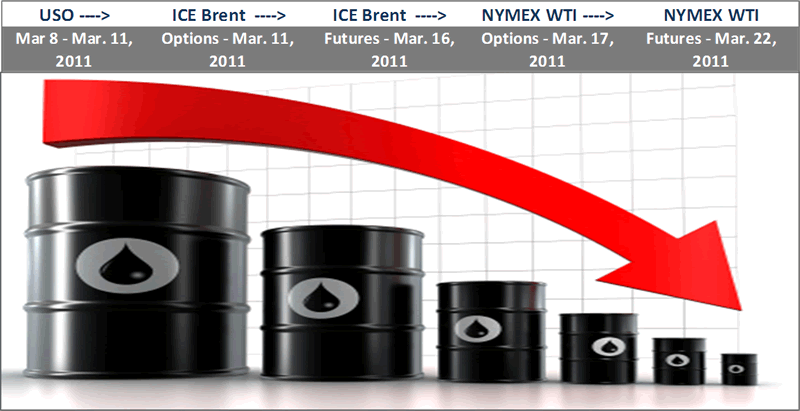

It's The Rollover That'll Get Crude

And don’t forget that the humongous United States Oil Fund (USO) is a futures-based ETF that has to rollover as scheduled (from Mar. 8 to Mar. 11). The USO effect, plus the record open interest almost exclusively long and heavy in April, suggest there will likely be a massive rollover starting with USO around March 8, then to all the other market players, when April contracts and options expire (See Chart). That will push down the April price for both Brent and WTI, regardless what’s going on in Libya and MENA.

From the current price and technical signals, WTI could easily correct down to $94 to $95, Brent could drop to $110 to $106 range. From a trading standpoint, short WTI at the beginning of the rollover, then cover when the trend starts to wane would be a good move in this March month.

Of course, there's always the possibility that both oil markers could drop like a rock before the rollover should Gaddafi decide to step down in the next few days.

Disclosure: No Positions

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://econforecast.blogspot.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.