Crude Oil, Gold Rise Whilst Silver Surges to Record on MENA Contagion

Commodities / Gold and Silver 2011 Mar 07, 2011 - 08:22 AM GMTBy: GoldCore

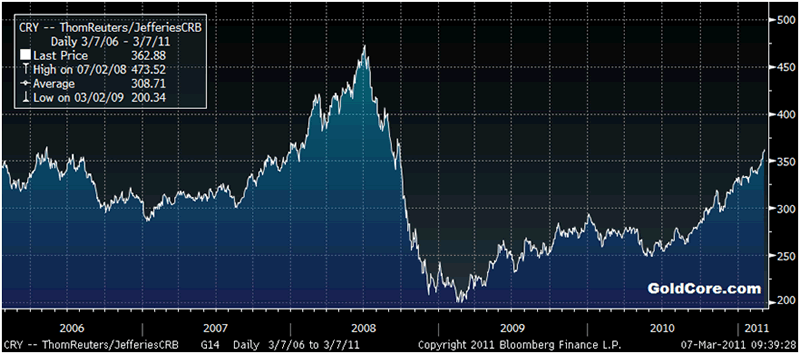

Concerns about Libya, Saudi Arabia and the Middle East and North Africa continue to dominate markets. There are growing concerns of contagion and oil supply disruptions from the region. Oil and gold have risen and silver for immediate delivery surged another 2.3% after climbing to $36.5375/oz, the highest price since February 14, 1980 when silver reached a its nominal high $50.35/oz.

Concerns about Libya, Saudi Arabia and the Middle East and North Africa continue to dominate markets. There are growing concerns of contagion and oil supply disruptions from the region. Oil and gold have risen and silver for immediate delivery surged another 2.3% after climbing to $36.5375/oz, the highest price since February 14, 1980 when silver reached a its nominal high $50.35/oz.

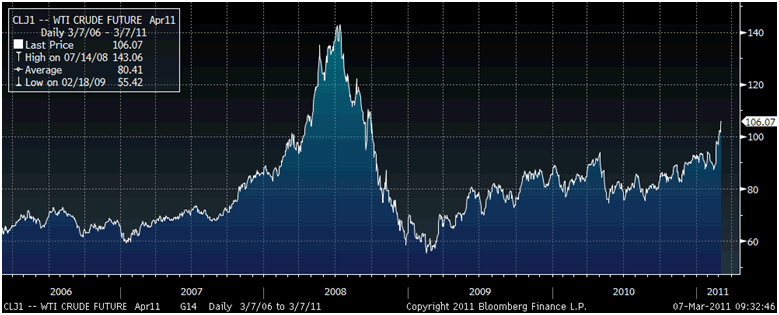

WTI Crude Oil – 5 Year (Daily)

Oil (WTI) rose 6.7% last week and contributed to silver rising 6.94% and gold rising by 1.33%. These gains have been added to again this morning. Growing concerns that surging oil prices will lead to further inflation and snuff out the already tentative global recovery will lead to continuing safe haven demand which will support the precious metals on dips.

WTI Crude Oil – 5 Year (Daily)

Currency debasement on a scale never seen before in modern history continues in the US and other countries. This is leading to a real risk of stagflation and possible even hyperinflation if sane monetary policies are not returned to soon.

The fiat currency experiment of the last 40 years (since Nixon came off the Gold Standard in 1971) grows more precarious by the day. Ironically, Alan Greenspan, the central banker most responsible for the cheap money policies and asset bubbles of the last 20 years, has again warned about the euro and dollar being “faulty” fiat currencies.

Greenspan again said how gold is the ultimate form of payment and currency (see interview and transcript of interview in News).

WTI Crude Oil – 5 Year (Daily)

"What the price of gold is saying is essentially that there are elements within the marketplace which feel very uncomfortable with respect to what's going on generally," the former Federal Reserve chairman said. "It's not an accident that you're finding that central banks are going in to buy gold."

Greenspan emphasized that he isn't calling for a return to the gold standard. That's just not doable, he said. "I do think that to get a sense of the stability of the system, watching the price of gold is not too bad."

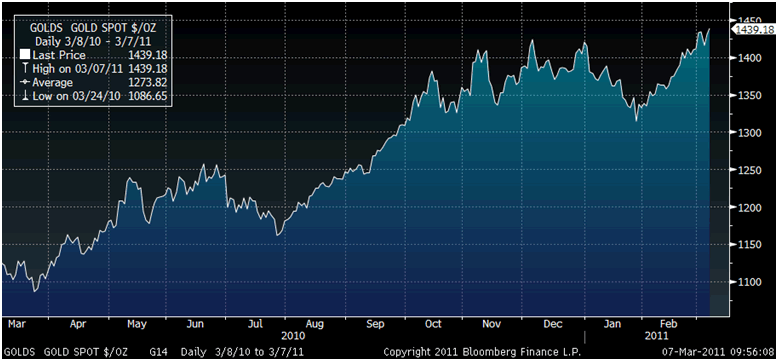

Gold

Gold is trading at $1,442.40/oz, €1,028.60/oz and £884.75/oz.

Silver

Silver is trading at $36.64/oz, €26.12/oz and £22.47/oz.

Platinum Group Metals

Platinum is trading at $1,832.18/oz, palladium at $811.00/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- Barnes Tells CNBC Sees Silver Prices Extremely High Over 3-5 Yrs

Peter Barnes, chief executive officer of Silver Wheaton Corp., told CNBC that he sees silver prices going to $50 in two to three years, and will be “extremely high” over the next three to five years and possibly longer.

(Bloomberg) -- Spot Silver Extends Gain, Rising as Much as 2% to $36.3125/OZ

Silver for immediate delivery extended gains, rising as much as two percent to $36.3125 an ounce in Singapore today. That was the highest level since February, 1980.

(Bloomberg) -- S&P GSCI Commodities Index Extends Gains, Led by Cotton, Silver

The Standard & Poor’s GSCI Spot Index of commodities rose to as high as 728.58, the highest level since August 2008. Cotton, silver and crude oil led the gains.

(Bloomberg) -- Gold Nears Record on Mideast Violence; Silver at 31-Year Peak

Gold climbed, approaching a record,as violence intensified in the Middle East and oil continued to gain, driving demand for precious metals as a hedge against inflation. Silver reached a 31-year peak.

Immediate-delivery bullion gained 0.5 percent to $1,437.85 an ounce at 2:07 p.m. Singapore time. The metal climbed to an all-time high of $1,440.32 on March 2. April-delivery futures in New York strengthened 0.7 percent to $1,437.90. Oil surged to the highest level in 29 months.

“Rising oil prices and escalating clashes in Libya and tensions in other key Middle Eastern countries continued to support safe-haven buying for precious metals,” Mark Pervan, an analyst at ANZ Banking Group Ltd., wrote in a report today.

Concern about rising inflation and currency debasement drove gold prices up 30 percent last year for a 10th annual gain. Asian nations from China to Indonesia raised interest rates this year to curb rising consumer prices. Increasing food and commodity prices have contributed to unrest that started in Tunisia in January and spread to Egypt, Bahrain, Iran and Yemen.

Fighting between Libyan rebels and troops loyal to Muammar Qaddafi intensified as the opposition advanced west from the oil hub of Ras Lanuf toward the leader’s hometown of Sirte. Some websites call for a nationwide “Day of Rage” in Saudi Arabia on March 11 and March 20.

“A civil war could be the unfortunate outcome and normal oil production from Libya may not be restored in the short term,” said Ong Yi Ling, Singapore-based analyst with Phillip Futures Pte. “Besides Libya, investors may also watch the situation in Saudi Arabia closely. Should the turmoil spread to the world’s largest oil exporters, we could witness spikes in oil and gold prices.”

Rising Inflation

Fifteen of 17 traders, investors and analysts surveyed by Bloomberg, or 88 percent, said the metal will rise this week. Two predicted lower prices.

Hedge-fund managers and other large speculators increased their net-long positions in New York gold futures in the week ended March 1, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 197,253 contracts on the Comex division of the New York Mercantile Exchange, the Washington- based commission said in its Commitments of Traders report. Net- long positions rose by 16,829 contracts, or 9 percent, from a week earlier.

Gold futures in India, the world’s biggest bullion consumer, rose to a record today. Silver also reached an all-time high in the country.

India, China

Bullion for April-delivery gained as much as 0.6 percent to a record 21,232 rupees per 10 grams on the Multi Commodity Exchange of India Ltd. and traded at 21,192 rupees at 10:51 a.m. in Mumbai. Silver for May-delivery advanced as much as 1.8 percent to an all-time high of 54,378 rupees per kilogram and traded at 54,225 rupees in Mumbai.

In China, Lion Fund Management Co., the first in the nation to invest in overseas gold-backed exchange-traded products, has been approved to as much as double the size of its fund raising, said a company executive today.

European Central Bank President Jean-Claude Trichet said last week that the ECB may raise interest rates next month to fight accelerating inflation pressures. Federal Reserve Chairman Ben S. Bernanke has signaled he will keep the Fed on course to finish $600 billion of Treasury purchases through June.

“Basically you have an environment where you have rising inflation and increasing liquidity,” Juerg Kiener, chief investment officer at Swiss Asia Capital Ltd. in Singapore, said in an interview with Bloomberg Television. “We have a very large physical position of gold and silver in the market.”

Cash silver increased as much as 2.3 percent to $36.4075 an ounce, the highest level since February 1980. Palladium added 0.8 percent to $818.50 an ounce and platinum for immediate delivery fell 0.2 percent to $1,839 an ounce.

(Bloomberg) -- Vietnam Stops Gold Bullion Trading and Production Licenses

Vietnam’s central bank said it is ceasing to issue licenses for gold bullion production and trading, without giving a specific timeframe, according to a statement on its website today.

The State Bank of Vietam will eventually eliminate deposits in gold at banks, it said.

Vietnam’s banks have about 112 trillion dong in gold deposits, according to the statement.

(Bloomberg) -- John Paulson Hedge Funds Gain in February as Gold Price Rallies

John Paulson, the hedge-fund manager who earned about $5 billion last year, posted gains last month in all his gold-denominated funds as the metal rebounded from its January lows, according to a report sent to investors.

The Paulson & Co. Gold Fund gained 13 percent in February, erasing most of the January losses and leaving the fund down 0.5 percent for the year, according to the report, a copy of which was obtained by Bloomberg News. The Advantage Plus Fund rose about 7 percent in the gold share class.

Gold gained the most last month since April as violence in Libya and other states in the Middle East spurred investor demand for precious metals. Paulson, 55, is betting inflation will accelerate and fuel demand for the metal in coming years. His investors can choose to have their stakes denominated in gold rather than dollars, meaning the value of their investment rises and falls with the price of the bullion.

Armel Leslie, a spokesman for Paulson, declined to comment on his February performance.

The dollar-denominated Advantage Plus Fund, which uses strategies designed to profit from corporate events such as takeovers and bankruptcies, rose 2.3 percent in February, according to the report.

Paulson’s dollar-denominated Advantage Fund gained 1.6 percent, while the gold-share class jumped 6.6 percent. The dollar-denominated Recovery Fund climbed 3.5 percent and the gold-share class rose 7.5 percent.

2010 Gains

Paulson benefited last year from his stake in the gold- share classes of his funds, whose gains were at least double those of the comparable, dollar-denominated shares after a 30 percent jump in the precious metal. His earnings in 2010 also included a portion of the 20 percent performance fee the firm collected on its gross profit of $8.4 billion.

The Gold Fund, which can buy derivatives and other gold- exposed investments, jumped about 35 percent in 2010.

The dollar-denominated Paulson Partners Fund, which invests in the shares of merging companies, was up 1.6 percent last month and rose 8.4 percent in the gold-share class. The dollar- denominated Partners Enhanced Fund increased 2.8 percent, while the gold-share class climbed 6.2 percent.

Paulson’s dollar-denominated Credit Opportunities Fund rose 1.9 percent last month and its gold-share jumped 5.6 percent.

(CNBC) -- CNBC EXCERPTS: DR. ALAN GREENSPAN, FORMER FEDERAL RESERVE CHAIRMAN, ON CNBC'S "SQUAWK BOX" TODAY

Following are excerpts from the unofficial transcript of a CNBC interview with Former Federal Reserve Chairman Dr. Alan Greenspan today on CNBC's "Squawk Box." All references must be sourced to CNBC.

GREENSPAN ON OIL:

"One thing that economists have been bedeviled by over the years is that the correlation between oil prices on a global basis, and global economic activity is far more precise than any evidence we have that it should be, in short, as a leading indicator, global oil prices are a very useful statistic, the only problem is we don't know fully where all the channels are."

GREENSPAN ON MOMENTUM:

"My view is that when oil prices get up to this area and start to move up even higher, you do have to start to worry, but there is no question at this stage that the momentum of this economy, leaving out the oil price issue, leaving out the Euro problems that have emerged, and very specifically leaving out the budget problems, this economy is really beginning to pick up momentum."

GREENSPAN ON MOMENTUM:

"There is no question at this stage that the momentum of this economy, leaving out the oil price issue, leaving out the Euro problems that have emerged, and very specifically leaving out the budget problems, this economy is really beginning to pick up momentum."

GREENSPAN ON FORECAST:

"The fascinating issue for forecasters is how do you factor in all of the negatives because there are not sort of modest rises here, modest costs here, these are big stuff on both the debit and the credit side, and how its going to work is not all together clear-- but for the moment this economy is moving."

GREENSPAN ON CURRENCY:

"When you have two faulty currencies, and the euro and dollar are both faulty, but probably almost equally faulty, so that the exchange rate between the dollar and Euro is not really moving all that much."

GREENSPAN ON GOLD:

"What the price of gold is saying, is that there elements within the marketplace that feel very uncomfortable with respect to what is going on generally, and its not an accident that you're finding that central banks are going in to buy gold and one of the reasons is gold is historically one of the rare media of exchange that doesn't require any collateral or backing, counter signatures, gold is universally acceptable as a means of payment."

GREENSPAN ON THE GOLD STANDARD:

"I'm not saying we can or should go back on the gold standard, that would be extremely difficult, and it would require such cast changes that this society has made no indication that it wants to do that, but I do think to get a sense of the stability of the system, watching the price of gold is not too bad."

GREENSPAN ON OIL PRICE:

"When we talk about the price that will hit us, keep an eye on brent and not on WTI, that has got technical problems."

GREENSPAN ON FORECLOSURES:

"I am assuming, and this is an assumption, that the foreclosures will begin to slow down, they are beginning to slow down, but the problem that we've had is such a large proportion of sales are distressed sales, and clearly if you have a significant proportion in that category, the overall price level is going down."

GREENSPAN ON HOME PRICES:

"Ultimately what is the determinate, as far as I'm concerned, is basically whether or not the price, excluding distressed sales, is falling, because the other is a statistical problem, I'm not saying its not real, it is real, but it gives you a false signal, so I'm watching the less distressed sales, now I must admit those prices have edged down recently somewhat to my surprise. But not enough to create where I think the problem is."

GREENSPAN ON MORTGAGES:

"When subprime went underwater, they were very rapidly going into foreclosure because they couldn't basically live with it, but the vast majority of conventional conforming mortgages, even those which were underwater, are none the less capable of being financed by the people who live in the homes the proportion of conventional conforming homes that will be defaulted, is really very small."

GREENSPAN ON THE FED:

"At this point the Fed is in the position where it can contract its balance sheet very significantly and the issue is will they be able to do it in proper timing? They think they can."

GREENSPAN ON BERNANKE:

"These are judgments that you have to make, I know Bernanke very well, we worked together, Ben and I went over a number of crisises together, I know how he functions, I have considerable trust in his judgment."

GREENSPAN ON THE FUTURE:

"You're dealing with very difficult problems. The one thing we all pretend we can do but we can't, is forecast, the future out there isn't very bright."

GREENSPAN ON DODD/FRANK:

"I look at whole series of mandates in Dodd/Frank and I think some of them are internally contradictory, and we're going to find out if that is indeed the case when the regulators start to implement."

GREENSPAN ON CONSEQUENCES:

"What we're going to find is that the unexpected consequences of much of the new regulation that's going to come as a result of Dodd/Frank is going to have to reversed, and that's going to create very high degrees of uncertainty."

GREENSPAN ON TOO BIG TO FAIL:

"The purpose of a financial system is to move the scarce savings of a society into physically productive assets, we in the United States have been very affective in doing that, poor savings but very high rates of return. You start moving some of that scarce savings to propping up companies, it does not go into effective uses, and the result is output per hour slows down and standards of living slow down. So too big to fail is critically an issue with respect to standards of living, you have to have failures, JOE (HAVE WE SOLVED IT?) no we have not."

GREENSPAN ON SAUDI OIL:

"Saudi Arabia is, look- its got three and a half million barrels of standby crude capacity, nobody else has standby capacity, so Saudi is a whole game."

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.