ECB Stuck in Sovereign Debt Garbage, Germany Sets High Price for Bailout Changes on Greence and Ireland

Interest-Rates / Global Debt Crisis Mar 11, 2011 - 05:09 AM GMTBy: Mike_Shedlock

Leaders of 17 eurozone countries meet on Friday in Brussels to discuss the sovereign debt crisis and the stabilization pact, but don't expect much of anything to come from it. Instead, expect to see a lot of bickering interspersed with agreements to agree on non-critical issues.

Leaders of 17 eurozone countries meet on Friday in Brussels to discuss the sovereign debt crisis and the stabilization pact, but don't expect much of anything to come from it. Instead, expect to see a lot of bickering interspersed with agreements to agree on non-critical issues.

Please consider Germany Sets Steep Price to Shore Up Euro Zone

Faced with financial turmoil that has resisted every emergency fix the European Union has adopted, European leaders are considering a radical step: giving up some of their independence to set domestic economic policies and cutting back many of the wage and welfare benefits that have defined the region’s politics for decades. In return, the European Union would provide funds to shore up the weakest member states, including Portugal, Greece and Spain.

The proposals, originally pressed by the newly assertive German chancellor, will be debated Friday in what is expected to be a contentious session of the leaders of the 17 countries that use the euro.

Germany is calling for several measures: raising retirement ages to reduce the burden on pension funds, ending the linking of wages to increases in the cost of living, committing to debt reduction and submitting to a level of budget scrutiny that was until recently considered anathema — and is still viewed by many as a step too far.

But a comprehensive deal will be difficult to reach. The proposals under debate now have already been watered down from a more robust program of integration and monitoring first put forward by Germany, and will be subject to further negotiation before a full European Union summit meeting on March 24-25, two days before an important German state election.

Among the measures it is pressing is an agreement to raise retirement ages closer to Germany’s, where access to government pensions begins at age 67, well above the European average. Germany would also like others to stop pegging wage increases automatically to inflation. That is a necessary step if wages are to shrink in absolute terms, which some economists argue is necessary if bitter medicine to inject some competitiveness into the economies of Europe’s southern tier.

The Germans would also force private bondholders who bought the high-yielding debt of the most troubled euro-zone countries to bear part of the burden if countries defaulted or needed to restructure their debt — and not be protected by taxpayers.

The most important is a “permanent regime” — the so-called European Stability Mechanism, which will replace the temporary bailout fund called the European Financial Stability Facility, set up during the Greek crisis last May. That fund ends in June 2013, and the Germans want a permanent fund of perhaps 500 billion euros ($695 billion) to show the markets that the euro zone is prepared for future problems.

But that fund must also show Germans that private investors will not be bailed out by taxpayers, that no country will assume the debts of another and that there will be collateral offered and penalties for bad behavior.

German officials contend that commitments remaining in the pact are important, that retirement ages and benefit systems should be adjusted to fiscal and demographic realities and that each country must find a way to make debt limits binding, as Berlin has done.

Mrs. Merkel is insisting that all three levels represent a package, and that there will be no increase even in the temporary bailout fund unless there is a deal on the pact.With sovereign debt spreads and yields exploding to record highs in Greece, Portugal, Ireland and Spain, how much longer the ECB and EU can get away with its fairy tale fantasy of no sovereign debt haircuts remains to be seen, but the market has expressed its opinion loud and clear already.

ECB Stuck in Sovereign Garbage, Looks for German Bailout

German central bank president Axel Weber did not want the ECB buying sovereign debt. ECB president Jean-Claude Trichet went ahead anyway. Now the European Central Bank Wants to Unload PIIGS Bonds and expects the EU Rescue Fund to bail out the central bank.

Spiegel Online International reports European Central Bank Wants to Unload PIIGS Bonds

During the crisis, the European Central Bank began buying up bonds from debt-ridden countries like Greece. Now the bank wants to transfer responsibility for those securities to the EU's euro rescue fund. Meanwhile, the parliamentary group of German Chancellor Angela Merkel's conservatives have issued a resolution opposing such bond purchases.

At the peak of the debt crisis in Europe, the European Central Bank committed a break with tradition that many at the time considered to be a cardinal sin. The bank began buying up massive amounts of sovereign bonds from euro-zone countries that faced the risk of insolvency and which were having trouble selling their bonds on the public market.

Calls are being led by ECB President Jean-Claude Trichet of France, who wants to free the bank of the burden, the sources said. The ECB is seeking to transfer a package of bonds valuing a total of €77 billion ($107.5 billion), but so far the member states have expressed little enthusiasm for the idea.

Senior members of parliament in Merkel's CDU, its Bavarian sister party the Christian Social Union (CSU) and the business-friendly Free Democratic Party (FDP), are already warning the chancellor not to take their message lightly. "We have made it clear that we reject any form of a buying program for state bonds -- there is no room for interpretation," said Michael Meister, deputy chairman of the joint CDU and CSU party group in parliament.

Initially, firmer language had been planned in the resolution, with a call for an explicit ban on such bond purchases. But after Merkel intervened and went to the chairman of the parliamentary group, Volker Kauder, the language was watered down. Instead of a blanket ban, the parliamentary group states only that it "expects" such a ban to be implemented.

The CDU's Meister, however, cautioned that the implementation of any deal would still require the approval of both Germany's federal parliament, the Bundestag, as well as the Bundesrat, the upper legislative chamber that represents the states and also has the right of co-determination on many important issues. Merkel's coalition government does not currently hold a majority in the Bundesrat. "The federal government would be well advised not to disappoint us too much," he said.

Michael Fuchs, likewise a deputy chair of the conservatives' parliamentary group, has also expressed his opposition to such bond-buying programs. He warned that Greece cannot become the model for how European countries can "inexpensively dispose of part of their debt."

Meanwhile, FDP finance expert Hermann Otto Solms has said he is also "strictly opposed to allowing the rescue fund to provide loans to indebted nations to buy back their state bonds." He said it was questionable whether such actions could be reconciled with Germany's constitution. "What is being proposed here is nothing other than a transfer union through the back door," Solms claimed.Trichet's Self-Imposed Problem

My opinion, not that it matters, is easy to explain: Trichet foolishly bought the bonds, he can sell them if he no longer wants them. By the way, precisely what good did it do to buy them?

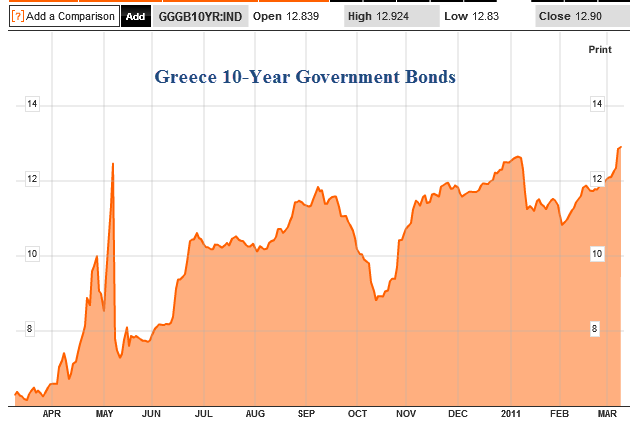

Before you answer, recall the goal was to reduce sovereign debt yields. Here are a few charts I created last evening.

Greek 10-Year Bonds

Irish 10-Year Bonds

Portuguese 10-Year Bonds

Spanish 10-Year Bonds

Anger in Greece, Ireland

I keep waiting for Ireland to tell the EU and ECB where to go. With anger rising in Irish citizens, hopefully we will see some action. The Telegraph reports EU paralysis drives fresh bond rout

Portugal edged closer to the brink yesterday, having to pay almost 6pc to raise two-year debt. The yield on 10-year bonds briefly surged to 7.8pc after the Chinese rating agency Dagong downgraded the country's debt to BBB+.

"These levels of interest rates are not sustainable over time," said Carlos Costa Pina, secretary of the Portuguese Treasury, blaming the latest upset on the lack of a coherent EU debt strategy rather any failing by Portugal to deliver on austerity.

Mr Costa Pina rebuffed calls by leading economists in Portugal for an EU-IMF bail-out rather than drawing out the agony. "It is not justified. Portugal doesn't need external help, it needs urgent measures by the EU to restore market confidence."

There is no sign yet that Germany, Holland, and Finland will agree to expand the remit of the bail-out fund (EFSF), letting it buy the bonds of debtor states pre-emptively, or lend to these countries so that they can buy back their own debt in a "soft-restructuring".

If anything, the mood is hardening in Germany. The regional Länder have begun to demand a say over any EFSF deal. Hesse's justice minister Jörg-Uwe Hahn said he "categorically rejects" all moves to an EU 'Transferunion', debt pool, or fiscal fusion.

The Greek crisis is going to from bad to worse. Ten-year yields spiked to 12.78pc yesterday and unemployment jumped sharply to 14.8pc in December, a reminder that the social trauma of austerity has yet to hit.

Greece is undergoing the harshest fiscal squeeze ever tried by a modern Western economy, yet public debt will end above 150pc of GDP by 2013 even if it complies with EU-IMF terms. "We should default and return to the Drachma to punish foreign loan sharks who have bled us dry," said Avriani, a paper linked to the ruling PASOK party.

There was similar anger in Ireland yesterday where Socialist MP Joe Higgins denounced "the poisonous cocktail of austerity concocted by the witchdoctors in Brussels and in Frankfurt".

Premier Enda Kenny said Ireland was at "the darkest hour before the dawn." He has so far played down talk of a clash with Germany over the terms if Ireland's bail-out, but Irish politics may force him to default on senior bank debt if the EU refuses to yield.The Most Difficult Decisions Are Ahead

The Globalist explains Europe's Most Difficult Decisions Are Ahead

Chancellor Angela Merkel and I will never let the euro down, never," President Nicolas Sarkozy said at the World Economic Forum in Davos. "To those who want to bet against the euro, watch your money, because we are fully committed to defend the euro, in a structural way."

Now, both France and Germany must walk the talk. Still, the question remains: How?

Except for wartime and its immediate aftermaths, the public finances of most eurozone countries are in a worse state today than at any time since the Industrial Revolution.

In the United States, the 2010 midterm elections occurred in a single day. In Germany, a series of seven elections in the 16 federal states is a multi-month marathon, which will continue until September 2011.

The outcome of these elections will determine the composition of the Bundesrat, the country's upper legislative chamber. As a result, it will have a direct impact on Angela Merkel's ability to conduct policy — in Germany and in the euro area.

The current polls do not favor Merkel's Christian Democratic Union (CDU) and its coalition partner, the Free Democratic Party (FDP), whose support has already collapsed from almost 15% to less than 5% in barely two years.

As the government is increasingly divided about what to do next about the euro, coalition lawmakers are distancing themselves from the government. While Merkel’s former coalition partner, the social-democratic SDP, has signaled that it is more prepared to undertake the steps necessary to advance the cause of European economic integration, its voters — like those of Merkel’s CDU — might beg to differ.

During the past few weeks, Chancellor Merkel and President Sarkozy have advocated the so-called Pact for Competitiveness. The controversial plan essentially conditions the financial support of the large euro economies on structural reforms in troubled euro nations. The plan has backfired, due to the proposed harmonization of tax rates (which alienated Ireland), debt containment (which angered the deficit-countries) and the adjustment of retirement ages (which estranged most of the euro area).

Except for wartimes and immediate aftermaths, the public finances of most eurozone countries are in a worse state today than at any time since the Industrial Revolution.

The eurozone crisis also poses penetrating questions about the sustainability of the welfare model, which has been funded at the expense of the living standards of future generations.

Indeed, it is sobering to keep in mind that even if the global crisis had been averted, the average net debt for the G7 economies would have been 200% of GDP by the early 2030s and more than 440% by 2050, as estimated by the IMF.What cannot be paid back won't.

Thus, regardless of what Trichet, the ECB, or EU may want, Greece, Ireland, and Portugal are likely to default. The sooner that happens the better off Europe will be.

Thus, the one thing that makes the most sense is to restructure the debt and make senior bondholders pay the price. Unfortunately that is the one thing the ECB is foolishly attempting to prevent.

The ECB compounded its problems by unwisely purchasing sovereign debt hoping to stabilize yields. As a direct result it is stuck in PIIGS debt with yields exploding out of sight. This is the price of Hubris but don't expect central bankers to learn a damn thing from it.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.