FOMC Meeting 15th March: Fed More Bullish, Japan U.S. Trade Facts

Economics / US Economy Mar 16, 2011 - 02:20 AM GMTBy: Asha_Bangalore

The Fed left the federal funds rate unchanged at 0%-0.25%, as expected and indicated it would continue its quantitative easing program of $600 billion. There were no dissents at the meeting, despite disagreements among members about the quantitative easing program that is underway, as revealed in the minutes of the January meeting and subsequent speeches of Fed Presidents.

The Fed left the federal funds rate unchanged at 0%-0.25%, as expected and indicated it would continue its quantitative easing program of $600 billion. There were no dissents at the meeting, despite disagreements among members about the quantitative easing program that is underway, as revealed in the minutes of the January meeting and subsequent speeches of Fed Presidents.

The Fed's latest assessment of the U.S. economy is more bullish compared with its view published in January. With the regard to the overall economy, the Fed indicated that the "economic recovery is on a firmer footing." In January, the Fed noted that the "economic recovery is continuing." Labor market conditions are now described as "improving gradually" vs. the view at the prior meeting when the recovery was viewed "insufficient to bring about a significant improvement in labor market conditions."

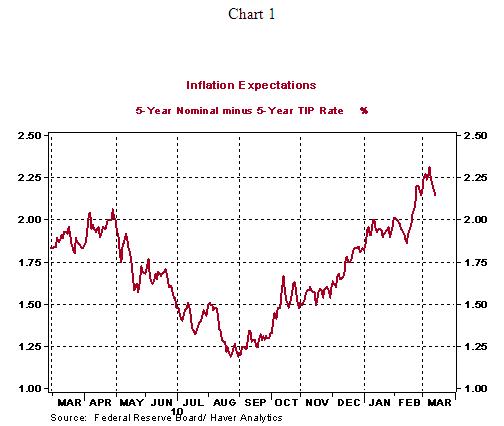

Higher energy and commodity prices were seen as problematic but the Fed views these effects as "transitory" and it is following closely the "evolution of inflation and inflation expectations." In this context, the Fed also stressed that "inflation expectations have remained stable and measures of underlying inflation have been subdued." Inflation expectations (see Chart 1) have reversed the sharp increase following the crisis in North Africa and the Middle East in the past four trading days; inflation expectations, as measured by the difference between the nominal 5-year Treasury note yield and 5-year inflation protected security, was 217 basis points as of March 14, down from 231 basis points on March 8 (see Chart 1).

U.S. Merchandise Trade with Japan - Facts

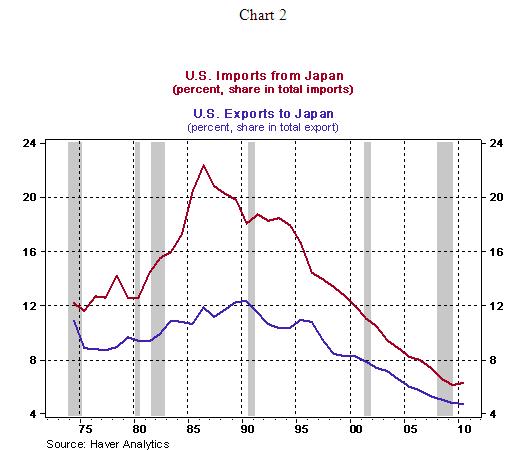

Japan has been the destination of 4.7% of U.S. exports of goods in 2010, roughly $60.5 billion. During 2006-2010, major exports of the U.S to Japan were aircraft (7%-9%), industrial machines (3%-5%), medical equipment (4%-5%), corn (3%-6%), and plastic materials (2%-3%), with most other categories making up less than 1% each of total exports to Japan. In the short-term, these categories of exports could suffer a setback. Rebuilding of the destroyed region, including new power plants, could generate demand for a wide variety of goods and services and make a positive contribution to business activity in the United States.

Imports of goods from Japan accounted for 6.3% of all imports of the United States and amounted to $123.0 billion in 2010. In the past five years, 25%-30% of imports from Japan was made up of cars and ranked at the top among different categories of imports from Japan. Parts and accessories came in second at 6.4%-7.2% of imports during 2006-2010. Industrial machinery (3.8%-6.0%), semiconductor and related devices (2.3%-2.9%), electric apparatus and parts (2.8%-3.2%), engines and engine parts (2.4%-2.7%), telecommunication equipment (2.0%-2.1%), and parts of civilian aircraft (1.1%-2.1%) are the other major imports from Japan. In the short-run, disruptions in the production of these products could translate into bottlenecks if they are inputs for production in the United States.

In a longer time frame, substitutes for these products from other sources should emerge. If imports, such as cars, are final products, higher prices of Japanese cars are conceivable if there is inadequate inventory. Alternatively, domestic car production could experience an increase as preference could shift to domestic cars. In sum, it is too early to make a definitive call on the precise impact on the U.S. economy.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.