U.S. New Home Sales Plunge, Gains From First-Time Home Buyer Program Nearly Erased

Housing-Market / US Housing Mar 23, 2011 - 07:44 PM GMTBy: Asha_Bangalore

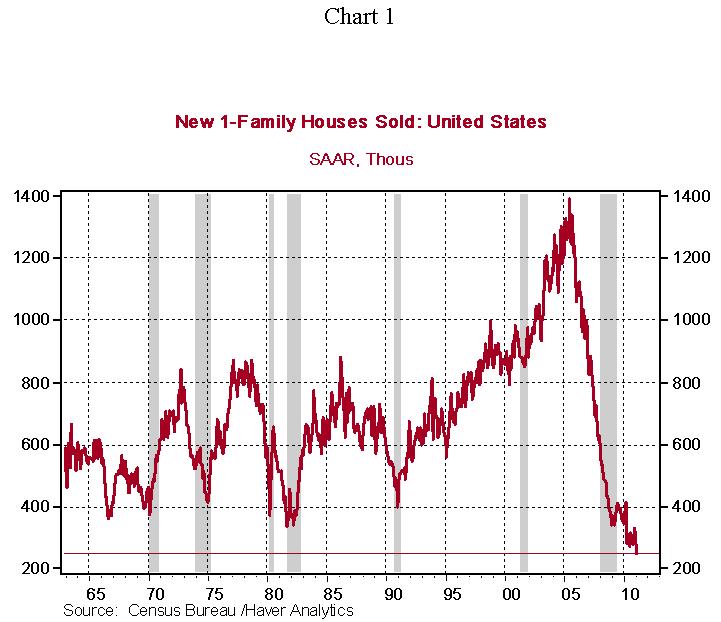

Sales of new single-family homes fell 16.9% to an annual rate of 250,000 in February, a new historical low for home sales. Sales of new single family homes have plunged 82% since the peak in July 2005 (1.389 million homes, see Chart 1). Sales of new single-family homes declined in all four regions of the nation, with the Northeast recording the largest drop (-57%).

Sales of new single-family homes fell 16.9% to an annual rate of 250,000 in February, a new historical low for home sales. Sales of new single family homes have plunged 82% since the peak in July 2005 (1.389 million homes, see Chart 1). Sales of new single-family homes declined in all four regions of the nation, with the Northeast recording the largest drop (-57%).

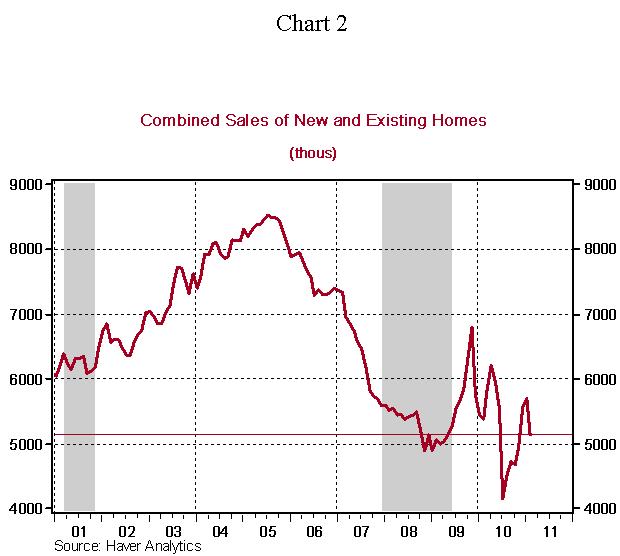

Combined sales of new and existing single-family homes stand at 5.130 million in February, close to the reading posted in May 2009 (5.127 million units). This suggests that the gains in home sales from the first-time homebuyer program, originally put in place in early-2009 and extended to April 2010, has been nearly erased (see Chart 2).

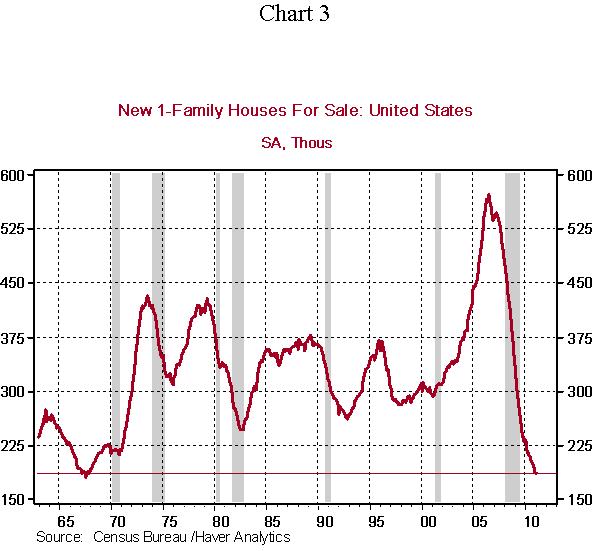

The number of new single-family homes for sale (186,000) is close to the record low of 181,000 set in August 1967 (see Chart 3). The availability of foreclosed homes at attractive prices has left the new home building industry in a tight spot.

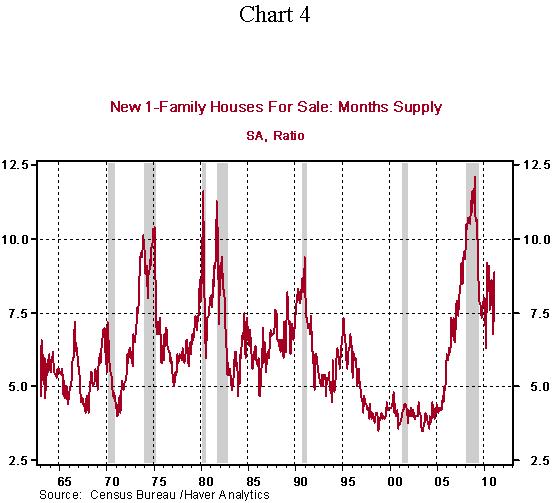

The inventory of unsold new single-family homes rose to an 8.9-month supply during February from 7.4-months in the prior month. The inventory of unsold homes has ranged between 7.4-9.2 months' supply since May 2010.

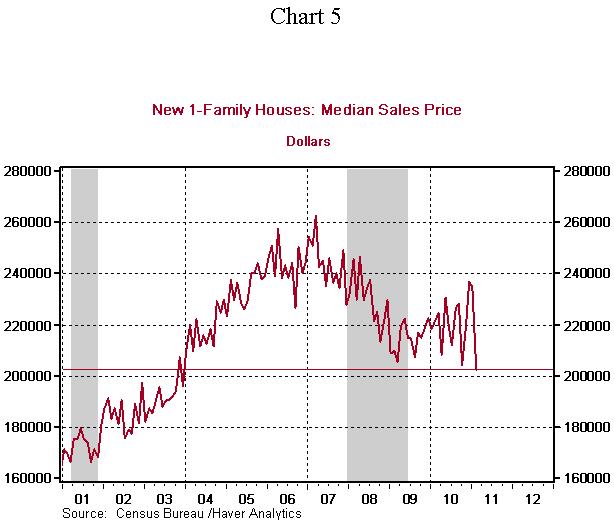

The supply-demand imbalance has driven the median price of a new single-family home to $202,100, the lowest since December 2003. As we have noted on several occasions, robust gains in employment are necessary to turnaround the housing market.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.