Best of Time For Gold and Silver, Worst of Times For U.S. Dollar

Commodities / Gold and Silver 2011 Apr 01, 2011 - 02:56 PM GMTBy: Jeb_Handwerger

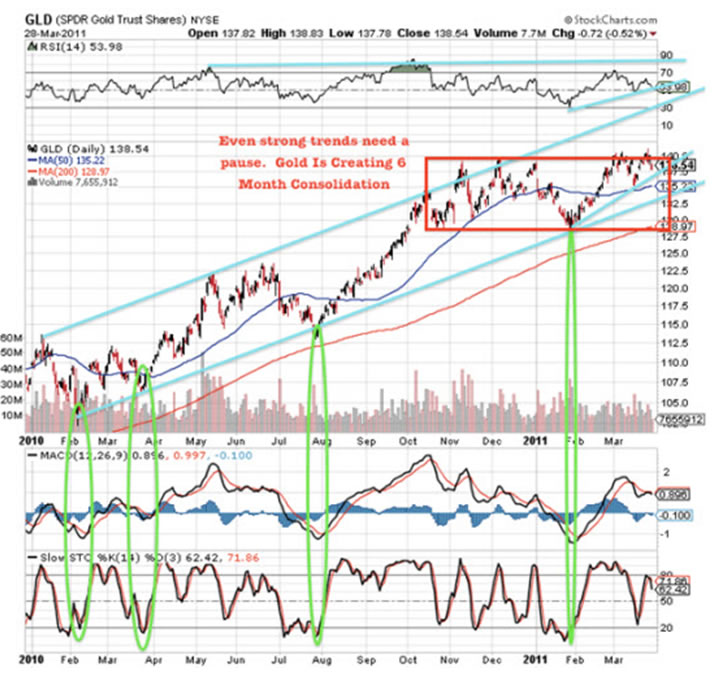

It is the best of times for equities and precious metals and the worst of times for the U.S. dollar. It is prudent to focus on the sectors with long secular uptrends as these patterns tend to last longer than expected and produce the greatest returns. Gold (GLD) and Silver (SLV) are in a decade long uptrend as geopolitical uncertainty and rising debt levels have caused many investors to seek the safe haven shelter of real money. In July 2010, as the European Crisis was the prominent topic of worry, gold reversed higher and made a major move on central bank plans to ease.

This continued through October and November, when the precious metal trade was very overbought. For the past six months, gold has consolidated as the dollar took a respite before hitting new lows. A breakout in precious metals and continued weakness in the US dollar to all time lows could radically impact our investments. In late January, my buy signal was activated when gold reached its 2-year trend support. During this time we saw precious metals reach very oversold levels. Even the strongest trends need time to pause. For six months gold bears have put up resistance. But it may end soon and this breakout may be powerful. Gold may follow

Now we have a six month rectangle where gold has vacillated between the $1300 to $1450 area. The battle is raging between buyers and sellers. Gold bears are not allowing it to break above the $1450 area yet and we may see a further shakeout before the next major high volume breakout, as there are a lot of shorts. I would add on pullbacks, especially as odds are on the bulls' side for a major breakout. These long pauses in the uptrend usually result in major moves to the upside rather than bearish tops which usually end in parabolic moves. Don’t fight the odds, don’t fight an uptrend, and look for a breakout above $1450 which will bring us closer to my late January target of $1600.

Many Fed members are trying to support the gold bears by talking about exit strategies as the US dollar reaches record lows. These news items with central bankers should be bullish for the dollar, yet it is having difficulty sustaining any counter trend rallies. Most moves up in the dollar have been short lived and new record lows are being breached. Investors are realizing the record deficits and obligations will force the central bank to keep interest rates low and devalue the US dollar, so they can pay back their debts with a devalued currency.

I will continually monitor whether or not this breakout from the box in gold is authentic. Volume needs to come in and we should see gold's ability to hold new highs. I firmly believe that precious metals will continue their uptrend and the shorts will have to be stopped out once we significantly break through resistance. It is normal to see short term profit taking at new record highs. Most box patterns like this are continuation patterns, meaning that this consolidation will only be a pause. If gold closes 3% higher than $1440 we could see a major short covering for precious metal bears. The US dollar is having a series of declining highs (Bearish), while gold makes higher lows (Bullish).

Grab your free 30-day trial of my Members-Only Premium Stock Analysis Service NOW at:

http://goldstocktrades.com/premium-service-trial

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.