Stock Market Cycle Review, Don't Tell the Retail Investor, but..

Stock-Markets / Cycles Analysis Apr 04, 2011 - 04:59 AM GMTBy: readtheticker

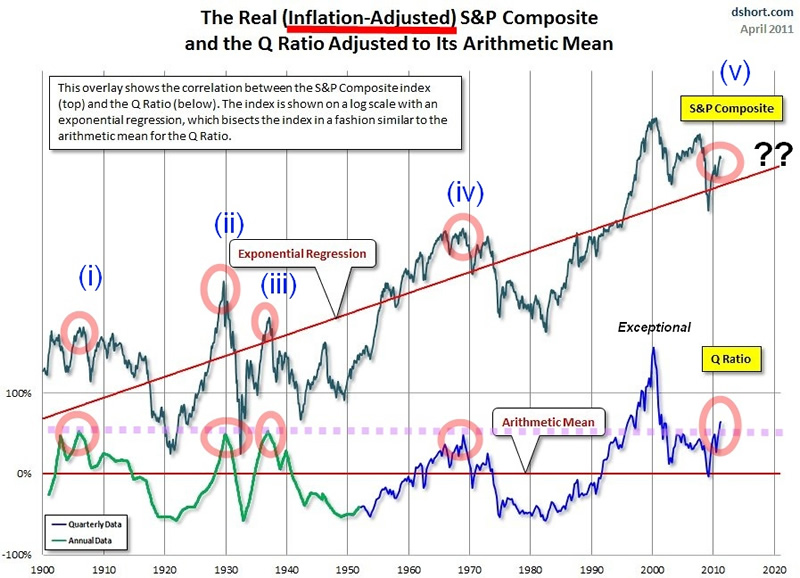

In Richard Wyckoff writings he suggest that the retail investor is always the last in, they tend to buy at the tops and sell at the bottoms. We dont tell them, just between you and me, we are closer to a top than a bottom. I recently saw dshort.com QRAtio market valuation of stocks and it also suggest that stocks are handsomely priced. Lets review some cycles to find if we concur.

In Richard Wyckoff writings he suggest that the retail investor is always the last in, they tend to buy at the tops and sell at the bottoms. We dont tell them, just between you and me, we are closer to a top than a bottom. I recently saw dshort.com QRAtio market valuation of stocks and it also suggest that stocks are handsomely priced. Lets review some cycles to find if we concur.

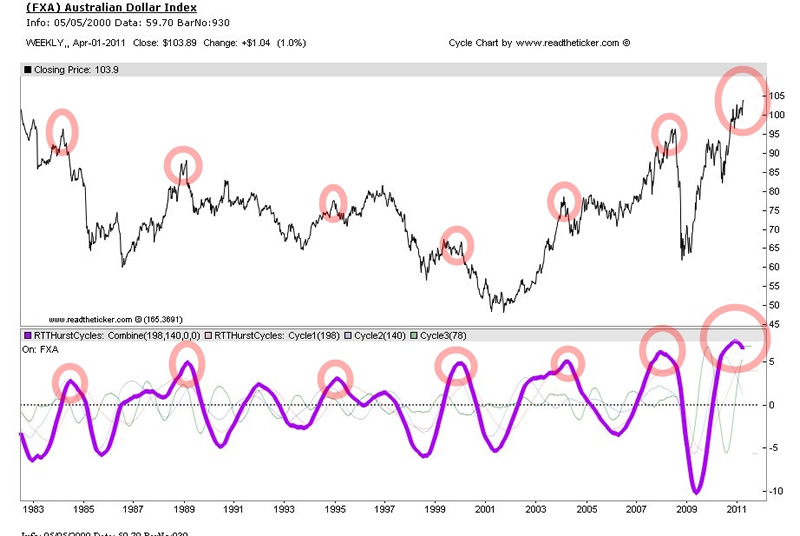

Please view the donuts in the charts.

First dshort.com QRatio.I have added the annotations: red circles, roman numerals, fat horizontal dotted line.

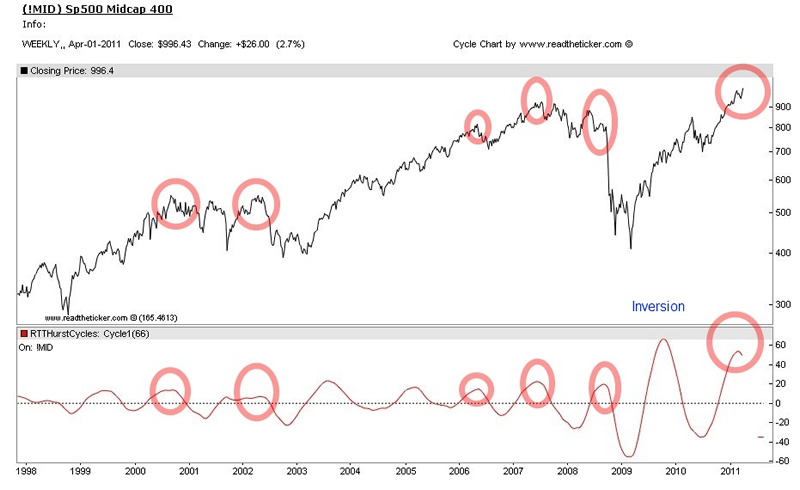

The SP500 is at a very interesting technical point. Like 2003 low to 2007 high, we are now at 100% off the lows.

They say the small and mid caps lead the broader index, take a look at the mid cap. Mid caps are also due for a roll over.

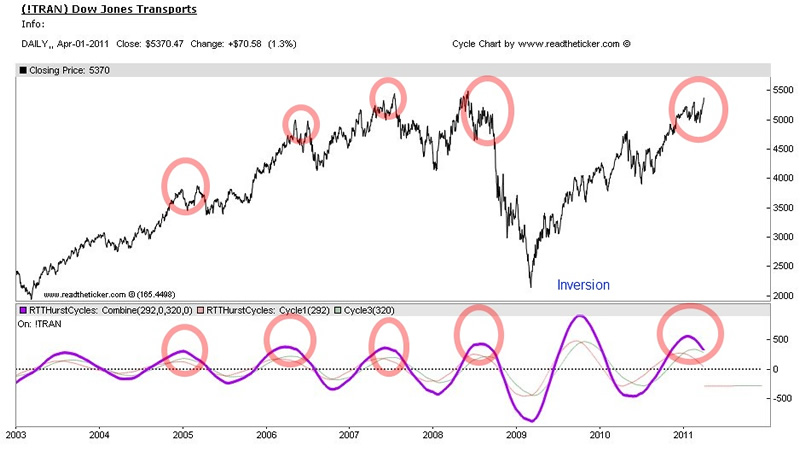

The more sensitive element of the 'Dow Theory' is the Dow Transport index. It too wants to roll over.

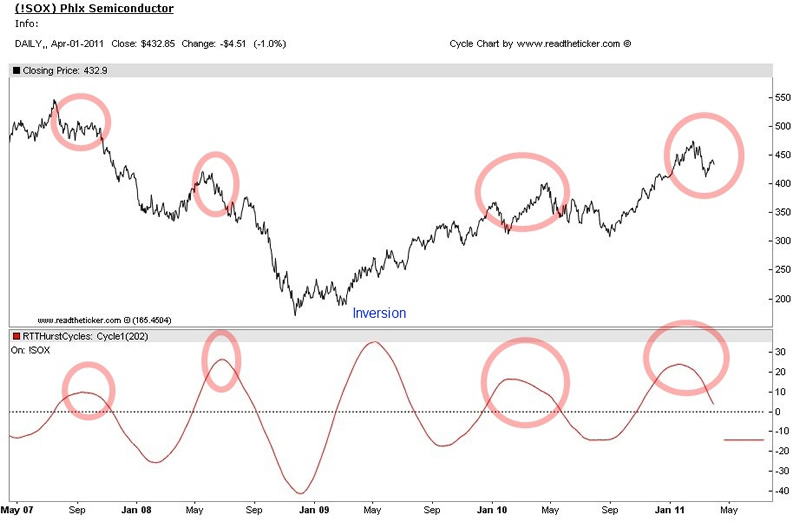

The important Semiconductor (SOX) index within the NASDAQ (technology stocks) has the roll over sickness. The SOX index is a leading index for the NASDAQ.

Are China and Emerging markets slowing down, if not, why does copper want to roll over.

And finally the cliché known as the 'risk on trade' has been well lead by the Australian dollar. What say yee, that too is looking like a top.

Nearly all cycles broke (inversion) coming off the 2009 lows on the back of massive stimuli from the central banks (quantitative easing, QE). Could a price inversion to the cycle happen again in the next few months? Sure, but!. We all know that QE2 ends in June 2011, Bill Gross of Pimco stated 'Who is going to be buying US bonds in June, we're not?'. This clearly states that there is more risk entering the market over the US summer. The central bank owns this market, when they take away the juice we shall see if this market has straw or stone foundations. The markets will need massive central bank injections to force price action within all the above market cycles to inverse. I just cant see it happening twice in a row. Zimbabwe economics will be given a holiday I feel.

We do concur with this statement from Marc Faber.

Source: Expect QE3, but not right away

.."regarding QE3 Marc Faber says :" for sure there will be QE3 but not right away , I think the FED believes that the economy is recovering and some sectors of the economy are actually doing quite well overseas we have strong growth in particular in emerging economies like here in Mexico the economy is doing very well at present time , so I think they will do QE3 , and my view is they will do QE3 , QE4 QE5 until QE26 until the whole system breaks down , and obviously the question is how fast they will do and to what extent the stock market has already expected this QE3 or the end of QE2 , as is QE2 is now fully discounted I do not think that the market will go up significantly , in fact I think that the FED would like to see stocks correcting somewhat and then have an excuse if stocks are down 20 percent that we need QE3 ..."

With dshort.com QRatio showing stocks are at high valuations, with many important cycles peaking, and the Fed (maybe) leaking to the market that rates will rise and/or no QE3, then we see selling in the stock market taking prices down 15 to 30 percent (assume Euro zone and Japan are benign) through June and July 2011. In the immediate term we expect to see consolidation as the big boys distribute stock float to the retail investor (this is includes mutual funds). Time to raise cash. Why, Pimco has !

Readtheticker

My website: www.readtheticker.com

My blog: http://www.readtheticker.com/Pages/Blog1.aspx

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2011 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.