Gold Over £900/oz as British Pound Falls Sharply

Commodities / Gold and Silver 2011 Apr 12, 2011 - 07:59 AM GMTBy: GoldCore

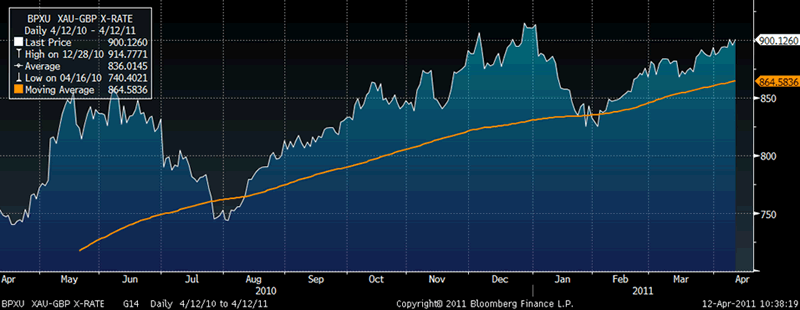

Gold is marginally lower in all currencies today, except sterling, after UK retail sales plunged the most on record in March due to deepening inflation. Consumer’s finances in the UK and internationally are being negatively impacted by food and energy inflation showing the UK’s vulnerability to a double dip recession and stagflation. Gold rose 0.5% in sterling over the £900/oz mark again.

Gold is marginally lower in all currencies today, except sterling, after UK retail sales plunged the most on record in March due to deepening inflation. Consumer’s finances in the UK and internationally are being negatively impacted by food and energy inflation showing the UK’s vulnerability to a double dip recession and stagflation. Gold rose 0.5% in sterling over the £900/oz mark again.

Silver has recovered somewhat from yesterday’s sell off and is nearly 1% up against major currencies and 1.5% higher against the pound. Yesterday’s selling was likely primarily due to speculators taking profits and locking in recent gains.

Japan's Nikkei fell and equities in Asia and Europe have come under pressure on the gradual realisation and admission that the impact of the March 11 earthquake may be far more severe than assumed and as Japan put its nuclear crisis on par with Chernobyl.

A nuclear catastrophe does not bode well for an already fragile global economic recovery.

Gold and particularly silver are vulnerable to a short term sell off. The fundamentals remain very sound but correction and consolidation may be necessary in both markets. Most participants are again expecting sharp pullbacks and some brave souls continue to assert gold and silver are “bubbles” about to burst. They are likely to again be disappointed as markets have a habit of doing the opposite of what the herd expects.

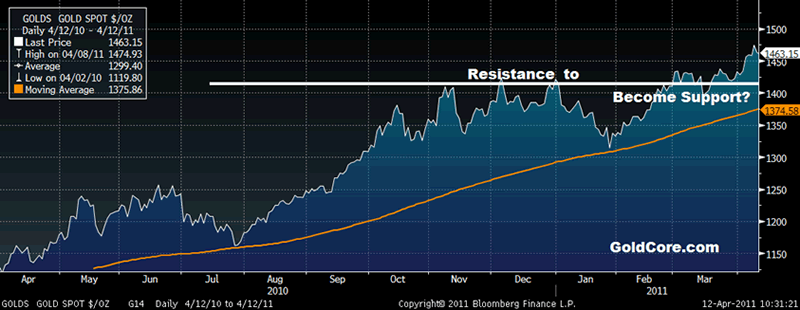

In gold, should a correction materialises previous resistance just above $1,400/oz and the 100-day moving average at $1,375/oz (see chart above) are likely to provide strong support. Resistance is at the recent nominal high at $1,475/oz.

The record nominal sterling high of £915/oz looks set to be challenged as sterling comes under pressure due to soaring inflation and record low interest rates.

Households in the UK are seeing their spending power eroded at the fastest rate in more than 60 years as food and energy costs soar and the faltering recovery restrains wage increases. Concerns about the tentative economic recovery as well as the government’s VAT increase and the deepest spending cuts since World War II are undermining consumer confidence.

Gold

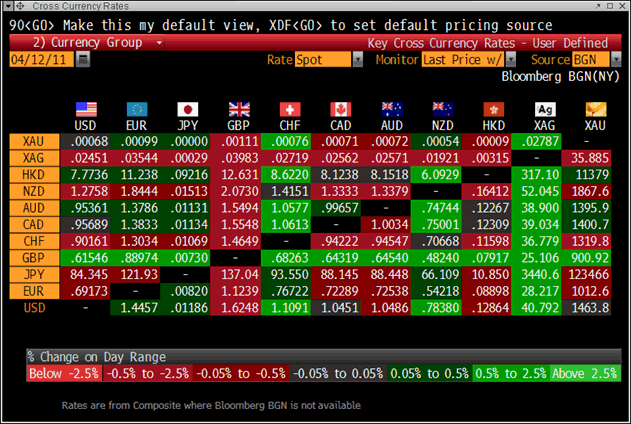

Gold is trading at $1,466.10/oz, €1,010.08/oz and £896.94/oz.

Silver

Silver is trading at $40.72/oz, €27.99/oz and £24.85/oz.

Platinum Group Metals

Platinum is trading at $1,775.50/oz, palladium at $774/oz and rhodium at $2,350/oz.

News

(Telegraph) -- Gold to Break $2,000/oz Barrier

The price of gold will reach $2,100 an ounce within three years.

The price of gold will reach $2,100 an ounce within three years and could rise to almost $5,000 by the end of the decade, according to a new report.

Rising demand for gold in China and India will drive the precious metal's continued bull run, analysts at Standard Chartered, the Asia-focused bank, predicted. They said low interest rates in America and a time lag before mines started supplying more gold would see the rally extend to at least 2014.

"Our base-case forecast is that prices rally to peak at an average of $2,107/oz in 2014, although our modelling suggests a possible ‘super-bull’ scenario of gold prices rallying up to $4,869/oz by 2020, should current relationships between Asian demand and gold persist," the analysts wrote.

The bank said there was a "powerful relationship" between income per head in Asian emerging markets and the gold price.

The report added: "We expect some headwinds for gold to come from higher US [interest] rates, but we find that the impact of higher rates is rather muted and we do not expect this to derail gold’s rally for now," they added. "More important, we believe, will be the impact of higher mine production. We expect a steady acceleration in mine-supply growth in the years ahead, which should overwhelm demand growth beyond 2014. Nevertheless, we expect an extended period of high gold prices."

In a previous report, the analysts had predicted that average income per head in China and India would reach 30pc of the US level by 2030. "Under this scenario, and assuming that the relationship between rising income levels and gold holds, gold prices could reach $4,869 by 2020," the report said.

"On this basis, the bull run for gold could still be in its infancy. This is based on the assumption that the current relationship between gold and incomes persists through to 2020, which is considered possible, but unlikely."

The report concluded: "The bull run in gold is likely to continue for some time, but prices should peak around 2014 as supply finally catches up with demand and US real rates turn positive."

(Bloomberg) -- Gold May Advance to $1,560, Commerzbank Says: Technical Analysis

Gold may rise to $1,560 an ounce by the end of the year, indicating a 7 percent gain, according to technical analysis by Commerzbank AG.

The $1,560 level is based on point and figure analysis, Commerzbank analyst Axel Rudolph said in a report on April 8.The attached chart shows gold may first climb to about $1,515, the 161.8 percent extension of the February 2010 to June 2010 gain, projected from the July low, one of the levels singled out in so-called Fibonacci analysis.

“Other point and figure targets are at $1,515 and $1,530, so the $1,515 zone seems important, together with the psychological $1,500 level,” Rudolph said by e-mail yesterday. A price of $1,500 may be achieved before three months, he wrote.

Gold climbed to a record $1,478.18 yesterday after gaining for 10 consecutive years on demand for a protection of wealth and an alternative to currencies. The metal for immediate delivery traded at $1,457.79 an ounce by 7:42 a.m. in London.

In technical analysis, investors and analysts study charts of trading patterns and prices to predict changes in a security, commodity, currency or index. Fibonacci analysis is based on the theory that prices tend to drop or climb by certain percentages after reaching a high or low. A point and figure chart gauges trends in prices without showing time or volume.

(Bloomberg) -- UBS Sees ‘Difficult Three Months’ Ahead for Metals, Miners

UBS AG said the next three months will be “difficult” for metals and mining companies, because of global slowdown, Middle East unrest, changes to U.S. interest rate policy and Japan’s earthquake.

The bank downgraded industrial metals, and expects a 5 percent decline “across the complex” in the second quarter, while gold climbs 5 percent, analyst Julien Garran wrote in a report today.

(Bloomberg) -- Gartman Adding to Gold in Sterling Terms

Newsletter writer Dennis Gartman adding to Friday’s gold position; had bought gold in GBP terms, says must add with gold trading upward through GBP900/oz.

Notes yr spreads for WTI, Brent both backwardated; Brent/WTI spread had gone “dramatically” in Brent’s favor; watching Qaddafi -- w/ Qaddafi “conciliatory,” Brent’s premium waning; Qaddafi “recalcitrance” may push spread back out, beyond $15/bbl.

NOTE: Friday Gartman said gold remained strong, with increasing monetary base, falling USD “gold has to move higher.”

(Bloomberg) – Bartels: Chances are Rising for NY Oil to Jump to $147/bbl

Oil’s potential to reach $147/bblis rising as crude “has started to trend above the 61.8% (Fibonacci) retracement level” of $103-$104/bbl, says Bank of America Merrill Lynch market analyst Mary Ann Bartels.

Says holding above 61.8% retracement “increases the potential” for oil to return to July 2008 high $147/bbl.

Says gold’s “breakout above $1450 supports the case for a rally to $1525 and $1575”, long term says may reach $2000-$2300/oz.

Says silver futures’s next resistance level $44-$45; says spot silver likely to reach $50/oz.

Says Investors Intelligence % of newsletter writer bears at 15.7% last week could be bearish sign for equities; says readings below 20% bears has been a “warning sign,” though sentiment is a poor timing indicator.

(Green Bay Press-Gazette) -- Steve Forbes predicts return to gold standard

Steve Forbes apparently no longer is interested in the White House.

The question just begged to be asked — would Forbes consider a third run for the presidency?

Although it didn't receive much mention during his lecture April 4 at Lakeland College in Howards Grove, Forbes willingly entertained the question afterward.

"There's an old saying that the third time's the trick," the audience member said rather encouragingly.

Forbes laughed along with the audience, and then put the matter to rest.

"Thank you for your compliment, but my role now is agitator," Forbes said.

Forbes, 63, president and CEO of Forbes Inc. and editor of Forbes magazine, shared economic philosophies that echoed his previous presidential campaigns when he delivered Lakeland College's 10th annual Charlotte and Walter Kohler Distinguished Business Lecture.

Forbes' presidential bids of 1996 and 2000 centered on a flat tax plan; ushering in a new system of Social Security for younger Americans, and allowing parental choice in the school system.

"It's highly unusual what we're experiencing today," Forbes said of our nation's current economic woes. "The norm for this country is for people to move ahead. When that doesn't happen, you have to look at what's standing in the way."

Forbes likened the economy to a stalled automobile — too little fuel and the engine stalls; too much and it floods — and said that the Federal Reserve's current monetary policy plays a fundamental role in the situation.

"The Fed has been on a bender since the early part of the last decade, printing too much money," Forbes said. "They're doing it again. ...Some people may benefit, short-term, but overall you don't get productive investment, (which) means more inflation at home, speculation in commodities, currencies."

Looking ahead

In one of several predictions he made during the lecture, Forbes said that within the "next five years, for the first time since the 1970s, the dollar will be re-linked to gold."

"We're going to have to do this," Forbes said. "Gold provides a stable value, as much as you can, in this imperfect world."

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Company Announcement: GoldCore Headquarters Change of Address

It is with great pleasure that I am writing to advise you that as of today, GoldCore have relocated to new headquarters - from 63 Fitzwilliam Square, Dublin 2, Ireland to 14 Fitzwilliam Square, Dublin 2, Ireland.

The move reflects the growing success of the business and the continuing expansion of our wealth management offering in Ireland and bullion services internationally.

Please note for your records our new address:

GoldCore, 14 Fitzwilliam Square, Dublin 2, Ireland.

Please not that phone numbers, fax numbers and emails remain the same:

T: +353 1 632 5010

F: +353 1 661 9664

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.