Central Banks Favour Gold and AAA Rated Government Debt

Commodities / Gold and Silver 2011 Apr 13, 2011 - 11:54 AM GMTBy: GoldCore

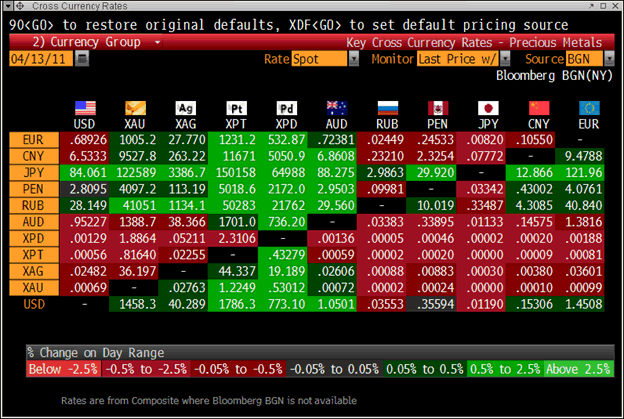

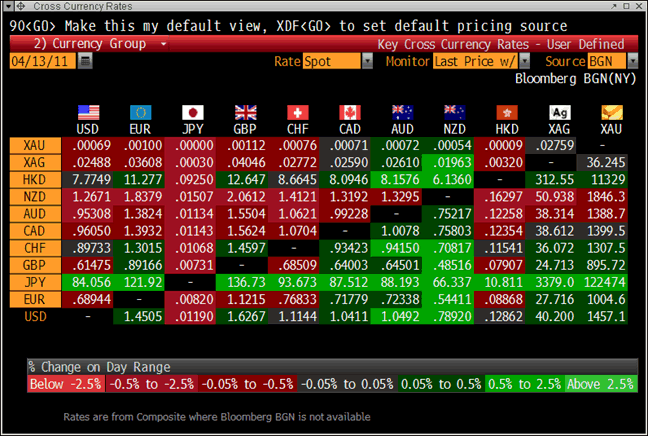

Stocks are higher in Europe after gains in Asia despite losses on Wall Street yesterday. Gold and silver are showing tentative gains after 1% declines yesterday. Gold is particularly strong in yen terms as the yen has weakened against all 16 of its major peers (see cross currency tables). China’s yuan climbed to a 17-year high versus the dollar but is lower against the precious metals.

Stocks are higher in Europe after gains in Asia despite losses on Wall Street yesterday. Gold and silver are showing tentative gains after 1% declines yesterday. Gold is particularly strong in yen terms as the yen has weakened against all 16 of its major peers (see cross currency tables). China’s yuan climbed to a 17-year high versus the dollar but is lower against the precious metals.

Cross Currency Rates at 1200 GMT

Treasuries have fallen as the US prepares to sell $21 billion of 10-year notes today, the second of three auctions this week. Ten- year yields rose three basis points and the yield on the five-year Treasury note rose three basis points.

Commodities have advanced with cocoa and coffee making gains and oil making tentative gains.

Gold Higher as IMF Warns Regarding US Massive Budget Deficit of 10.8% of GDP

With America set to have the largest budget deficit of any of the developed economies, a whopping budget deficit of 10.8pc of GDP this year alone, gold and silver’s medium term prospects remain positive.

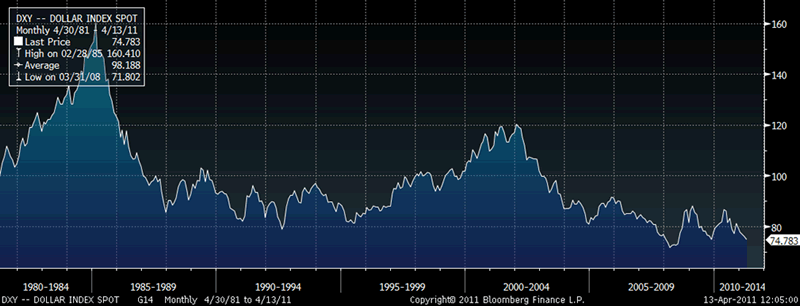

US Dollar Index - 31 Year (Monthly)

The IMF has warned that the US lacks credibility regarding its debt and must implement stringent austerity measures.

This is one of the primary factors which strongly suggests that, contrary to the consensus, a double dip recession looks increasingly likely in the US This would be negative for the dollar and US treasuries and lead to higher gold and silver prices due to safe haven buying.

Central banks are questioning the dollar and the euro as reserve currencies due to the massive liabilities and debt levels confronting the US and the eurozone (see News below). This is set to lead to central banks continuing to be net buyers of gold for the foreseeable future.

Gold

Gold is trading at $1,459.82/oz, €1,006.63/oz and £895.97/oz.

Silver

Silver is trading at $40.42/oz, €27.87/oz and £24.80/oz.

Platinum Group Metals

Platinum is trading at $1,781.00/oz, palladium at $769/oz and rhodium at $2,350/oz.

News

(Reuters) - Central Banks turn Net Gold Buyers, Cut Euro Zone Debt: Survey

Central banks turned net buyers of gold last year and cut exposure to debt issued by euro zone members Greece, Ireland and Portugal, an annual survey of the world's reserve managers showed.

A quarter of managers polled said they had upped their exposure to 'non-traditional' reserve currencies such as the Australian and Canadian dollars in the last two years and a majority said debt issued by the euro zone rescue fund, the EFSF, had the makings of a sound reserve asset.

"Traditionally, government bonds have been termed 'risk-free' assets but the euro zone situation has made some of us change our understanding of that," said one of the 39 reserve managers that responded to the poll conducted by Central Banking Publications over the winter of 2010-2011.

Concerns over sovereign default fueled demand for gold, turning central banks into net buyers in 2010 after 20 continuous years of selling the metal.

"Gold's quality as a store of value and fears over reserve currencies are the main reasons that central banks turned net buyers of bullion in 2010," wrote survey author Nick Carver.

The survey's respondents, who manage central bank reserves worth $3.5 trillion in total or 35 percent of total world reserves, identified gold as a "safe" reserve asset at a time when rising sovereign debt levels and super-loose monetary policy from the world's major central banks sapped confidence in more traditional reserve currencies.

"Both the euro zone and the U.S. are confronted by large deficits with simultaneously modest growth, which has influenced the value of their currencies and raised questions about debt sustainability," said one respondent.

Gold, investment grade corporate bonds and AAA-rated bonds were the three assets that reserve managers saw as more attractive than the year before.

Over 70 percent of the managers surveyed said central banks were likely to remain net buyers of gold given the level of uncertainty about sovereign debt.

CREDIBLE ALTERNATIVES

The survey also found 69 percent of respondents had not changed their reserve management strategies as a result of the Federal Reserve's expansion of its bond purchase program.

Instead, the second round of quantitative easing had prompted a tactical reaction with some central banks shortening the duration of the U.S. debt they held.

U.S. Treasuries remained the safest liquid asset "in the absence of a credible alternative", said a reserve manager from the Middle East.

There was, however, growing interest among reserve managers in non-traditional reserve currencies.

Over a 20 percent of respondents said they held more than 5 percent of their reserves in currencies such as the Australian dollar, the Swedish crown and the Singapore dollar.

(Wall Street Journal) -- Indian Investors Switch to Silver From Gold

NEW DELHI -- Higher returns are tempting many small Indian investors to buy silver and sell some of their gold jewelry as the price of the white metal has more than doubled over the past year, traders said.

Spot silver prices rose to an all-time high of 60,125 rupees ($1364) a kilogram Friday in India's main bullion hub, Mumbai, from 28,535 rupees on April 12 last year, driven by firm global cues as concerns over unrest in the Middle East and North Africa have improved its safe-haven appeal. Gold prices too rose, but at a much slower pace of about 21% to 21,500 rupees per 10 grams.

"Ordinary investors are buying silver as if there is no tomorrow," Suresh Hundia, president emeritus of the Bombay Bullion Association, told Dow Jones Newswires. "Many people are selling their gold and buying silver because gold has not given them as good a return."

According to him, Mumbai alone is recording daily silver purchases of 400-500 kilograms.

Typically, most Indians prefer buying gold rather than silver for investment. The change in trend may hit gold demand to some extent this year in the world's largest consumer where 700-800 tons of the yellow metal is bought annually.

Mr. Hundia said the higher demand hasn't driven up silver imports.

"Most of the supplies are coming from recycled silver from wholesalers, who want to make a quick buck," he said, adding that monthly imports of silver were more or less static at around 30-50 tons.

The investment demand for the white metal is so high that there is a shortage of silver in the key western Indian bullion hub of Ahmedabad, said Girish Choksi, a bullion dealer based in the city.

At the same time, demand for gold is steady to lower.

Demand for gold in southern states such as Tamil Nadu and Kerala has crashed in the past 10-15 days due to a combination of high prices as well as ongoing state elections, which have made it difficult for people to carry cash for purchases because of law and order problems, said Krishna Kumar Nathani, managing director of Indiabullion.com.

"Elections have overshadowed gold demand for marriages... That demand will now come around June," he said.

Mr. Nathani said he expected a 10%-15% price correction in silver in May-June, but investors shouldn't panic because returns will still outshine that from gold over a period of a year or so.

"It has already beaten gold in the past one year and it will continue to do so because the scope for price growth is still more in silver."

(Bloomberg) -- Fresnillo Silver Output Falls on Lower Grades, Gold Advances

Fresnillo Plc, the world’s largest primary silver producer, said first-quarter output of the metal fell 4.3 percent as ore grades declined.

Fresnillo produced 9.08 million ounces of silver, compared with 9.49 million ounces a year earlier, the Mexico City-based company said in a statement today. That excludes 1.01 million ounces from the Silverstream agreement, an accord between Fresnillo and Mexico’s Industrias Penoles SAB.

The company reported “slightly” lower ore grades at its Fresnillo mine in Mexico. “We are currently taking measures to increase the volume of ore processed to compensate the lower ore grade,” it said.

Gold production rose 13 percent to a record 96,407 ounces in the quarter following a capacity expansion and improved recovery at the Soledad-Dipolos project, Fresnillo said.

(Bloomberg) -- Fresnillo’s Gold Output Climbs to Record During First Quarter

Fresnillo Plc said gold production rose 13.3 percent to a record 96,407 ounces during the three months to March 31.

(Bloomberg) -- Silver Options Bears Boost Bets on Metal’s Drop for Second Day

Trading of bearish options on a silver exchange-traded fund jumped to almost triple the four- week average, boosted by a single trade for a second day, as futures on the metal snapped a seven-day winning streak.

More than a third of all volume for puts to sell the iShares Silver Trust ETF was concentrated in a single trade of 100,000 contracts in a strategy known as a butterfly, according to OptionsHawk.com, a Boston-based provider of options-market analytics. The trade profits most if the fund falls 8 percent to $36 before May options expire.

The fund fell 0.2 percent to $39.12 at 1:33 p.m. in New York and is down from yesterday’s intraday record of $40.33.

Silver futures for May delivery fell 59.2 cents, or 1.5 percent, to $40.02 an ounce on the Comex.

(Washington Post) -- Rio Tinto to Provide Gold, Silver, Copper for Medals At 2012 London Olympics

LONDON — The gold, silver and copper that will be used in the 4,700 medals at the 2012 London Olympics will be provided by international mining company Rio Tinto.

By signing up as a tier-three backer of the games, Rio Tinto’s sponsorship will be worth about $16 million.

Rio Tinto has supplied the metals for Olympic gold, silver and bronze medals once before — at the 2002 Salt Lake City Games.

The metals for the London medals will come from the Kennecott Utah Copper mine in Salt Lake City and the Oyu Tolgoi site in Mongolia.

Rio Tinto chief executive Tom Albanese says the company is “excited to have the special job once again of digging the ore that will become treasured medals for the world’s elite athletes.”

(Bloomberg) -- Gold Is Set to Rise as Industrial Metals Decline, UBS Says

Gold is poised to rise over the next few months as industrial metals drop on concern global growth may slow, UBS AG said.

Gold may climb 5 percent in the second quarter as industrial metals fall by the same amount, UBS analysts including London-based Julien Garran said in a report today. The bank lowered estimates for copper, aluminum and zinc prices in 2011 and raised its silver forecast by 21 percent.

UBS acted a day after the International Monetary Fund cut its projection for growth this year in the U.S., the world’s second-biggest copper consumer, citing higher oil prices and the pace of job gains. The IMF also lowered its projection for Japan’s expansion in 2011 and said weaker global growth will reduce demand for commodities and encourage destocking.

“We see a difficult three months looming for metals and mining,” the analysts said. “A combination of a global slowdown, Middle East tensions, Fed policy normalization and post-Japan quake disruption all threaten a tactical pullback from the current benign market.”

Precious metals are its top pick among commodities for the second quarter, UBS said, followed by thermal coal and other bulk raw materials, with industrial metals least preferred.

Copper, which touched $10,190 a metric ton on Feb. 15, has likely peaked for the year because of tighter monetary policy in China and in the West, the report shows.

Chinese Demand

Demand remains “lackluster” in China, the world’s biggest industrial-metals user, while further interest-rate increases to curb inflation may sap raw-materials demand, UBS said. The country’s central bank has raised rates four times since early October. China’s consumer price inflation reached 4.9 percent in February, above the government’s 4 percent target.

Commodities also may suffer as the Federal Reserve is likely to announce plans to end its second round of Treasury purchases, known as QE2, around the middle of the year, UBS said. The Fed last month stuck to plans to purchase $600 billion of bonds.

The IMF lowered its U.S. growth forecast to 2.8 percent from January’s 3 percent and reduced its forecast for Japan to 1.4 percent from 1.6 percent. Crude oil exceeded $113 a barrel in New York trading yesterday for a second session.

In Japan, power shortages in the aftermath of the March 11 earthquake will also constrain demand for industrial commodities, UBS said. In addition, it cited a “major disruption” to auto production.

Aluminum, Zinc

Copper will average $4.12 a pound this year, 2 percent below a prior estimate of $4.20, UBS said. The bank lowered its estimate for aluminum to $1.08 a pound from $1.12 and said zinc will average $1.09 a pound, down from $1.15. UBS expects silver to average $40 an ounce, compared with $33 previously.

Global thermal-coal demand may rise 2.3 percent this year to 736 million tons, even as about 5 million tons of demand might be lost because of the Japanese quake, UBS said. Rains have cut production in Indonesia, Australia and Colombia, while demand is climbing in China and India at respective annual rates of 17 percent and 10 percent, the report showed.

“As the world economy enters a soft patch and as the fiscal spotlight stretches to include the U.S., this will be a catalyst for higher gold prices,” UBS said. “Against this backdrop, gold should outperform other commodities.”

(Bloomberg) -- UBS Raises 2011 Silver Price Target by 21% to $40 An Ounce

UBS AG said it expects silver to average $40 an ounce in 2011, up 21 percent from a previous estimate of $33 an ounce.

"We're going to have to do this," Forbes said. "Gold provides a stable value, as much as you can, in this imperfect world."

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Company Announcement: GoldCore Headquarters Change of Address

It is with great pleasure that I am writing to advise you that as of today, GoldCore have relocated to new headquarters - from 63 Fitzwilliam Square, Dublin 2, Ireland to 14 Fitzwilliam Square, Dublin 2, Ireland.

The move reflects the growing success of the business and the continuing expansion of our wealth management offering in Ireland and bullion services internationally.

Please note for your records our new address:

GoldCore, 14 Fitzwilliam Square, Dublin 2, Ireland.

Please not that phone numbers, fax numbers and emails remain the same:

T: +353 1 632 5010

F: +353 1 661 9664

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.