Gold Targets $1500, Soaring Silver Hammers the Shorts

Commodities / Gold and Silver 2011 Apr 14, 2011 - 08:19 AM GMTBy: Bob_Kirtley

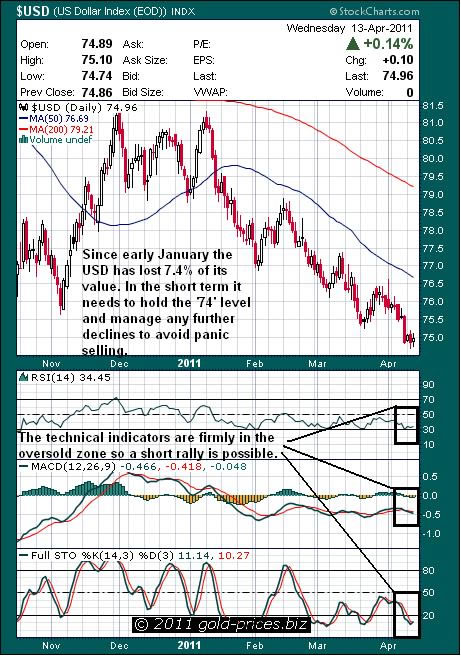

Since early January 2011 the USD has lost 7.4% of its value and needs to manage any further decline or stabilize at this point in order re-assure holders of this currency, that all is not lost. As we see it there will be short rallies on the way down but the ‘74′ level will soon be breached and then its down the ‘72′ level. The technical indicators are firmly in the oversold zone so a short rally is possible at this juncture, however, as the chart shows we have a had a number of rallies already this year that have amounted to nothing.

Since early January 2011 the USD has lost 7.4% of its value and needs to manage any further decline or stabilize at this point in order re-assure holders of this currency, that all is not lost. As we see it there will be short rallies on the way down but the ‘74′ level will soon be breached and then its down the ‘72′ level. The technical indicators are firmly in the oversold zone so a short rally is possible at this juncture, however, as the chart shows we have a had a number of rallies already this year that have amounted to nothing.

If ‘72′ fails then we are in for a very rough time as individual investors, states and countries, implement damage limitation strategies in order to protect whats left of their wealth. One of the stimulants for the dollar could be the European debt crises which is a long way from being out of the woods with Portugal lining up for help and Spain peering through curtains hoping that there will be something left for them.

As the Euro comes under pressure investors have to go somewhere and the dollar is regarded as the best of a bad bunch. The gold and silver markets are way too small to accommodate their needs, however, if and when they do transfer a small portion of their wealth into the precious metals sector, for safe keeping, then new price levels will become the stuff of dreams for the metals bulls.

It remains a puzzle to us as to why anyone would want to hold a paper contract that promises to exchange it for you with another paper contract. Maybe its the fear of the unknown or the fear of change that makes some of us behave like frightened rabbits when confronted by a cars headlights. The inability to assess a situation, recognize that there is a bull market in full flow and then take a position is astonishing to us, but, as my Dad use to say “You cannot talk sense to a twit” enough said.

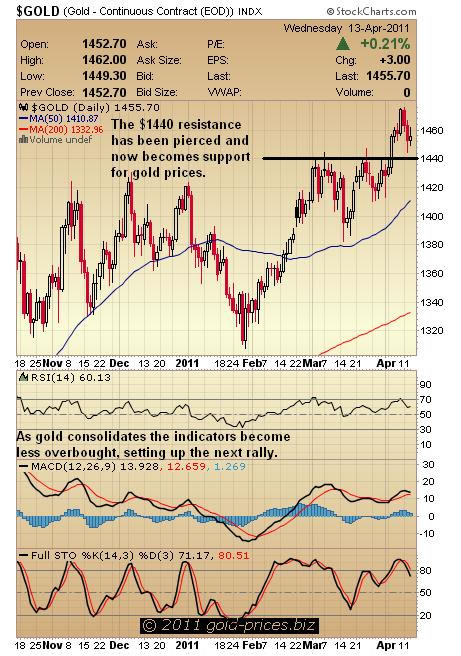

Gold Prices

The $1440/oz resistance level has been pierced and now becomes support for gold prices. As gold consolidates the technical indicators become less overbought, setting up the next rally. Gold is a class act and has its eye on the next hurdle which is $1500/oz, which in our humble opinion will fall shortly.

Silver Prices

A 30% increase in silver prices so far this year has rewarded the silver bugs and hammered the shorts. Both the 50dma and the 200dma are moving up in support, however, we would like to see the gap between the 200dma get a little closer to silver prices. A period of consolidation at or around the $40.00/oz would help, however, the demand for silver as an investment is growing along with the many industrial and medical uses for silver, pushing prices ever higher. As this demand continues to rise, silver prices will be forced to higher levels, in turn the shorts will have to cover sooner or later, so don’t be surprised if we have a record week with a stunning move to the high side in the very near future. Silver has been our favourite investment vehicle for some time now and our intention is to stay with it.

Our strategy remains the same in that physical gold and silver in your very own possession is the first step to take especially if you are new to this market. Secondly, investing in a short list of quality producers has generated handsome rewards, particularly in recent times when their value has been recognized. Finally a few well thought out options trades can add some spice with a boost to your returns on the back of the current volatility in these markets. Do remember to go gently with your investment choices and ensure that you are able to fight another day, no matter how good an ‘opportunity’ appeals to you. Otherwise keep building your position as this is the best game in town and today’s metals bugs will be handsomely rewarded in the future.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.