Beyond The Stock Market VIX Volatility Index

Stock-Markets / Volatility Apr 21, 2011 - 02:32 AM GMTBy: Tony_Pallotta

I have traded options for a number of years and fully understand the "greeks" as should any active options trader. When you understand options you realize how valuable of a tool they are for investing, managing risk and understanding market sentiment. They are not as risky as many think. Before I share a rather important chart, I think it is important to go over a few option basics to fully appreciate what the data is telling you.

I have traded options for a number of years and fully understand the "greeks" as should any active options trader. When you understand options you realize how valuable of a tool they are for investing, managing risk and understanding market sentiment. They are not as risky as many think. Before I share a rather important chart, I think it is important to go over a few option basics to fully appreciate what the data is telling you.

Implied volatility (IV) is one of the most important elements of how an option is priced. The simplest analogy is that of supply and demand. When traders are buying a specific option they drive the IV higher. When they are selling they drive it lower. The technical answer is based on a theoretical pricing model like black scholes, IV is the value needed to equate to a given price.

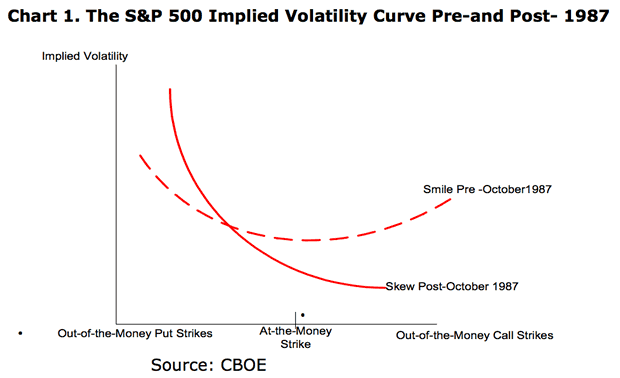

Ahead of company earnings for example, investors buy puts or calls causing the IV to rise. Once earnings are over, IV falls and so does the price of the options. Stay with me here and I promise to keep it as simple as possible. IV varies across time and strike price and is not linear, in fact if you graphed the IV for various strike prices you would see a "smile." This smile though is not uniform and in fact shifted more towards puts and less towards calls.

The chart below shows such an "IV smile" both pre 87 crash and post. Notice how volatility is higher for puts (left side of the curve) and lower for calls (right side). The more fearful investors are the more they buy puts and less they buy calls. The result puts generally have a higher IV than calls.

The VIX is the widely used measure of fear in the market as it measures implied volatility on the S&P 500. The lower the number the less fear, the higher the more fear. The CBOE though realized that the VIX does not capture the true picture of fear and or complacency in the market. Since the 1987 crash, investors have realized there is a risk of another crash and buy further out of the money options. In 1990 the CBOE created the CBOE Skew index which specifically measures these tail risks and how investors are pricing them in.

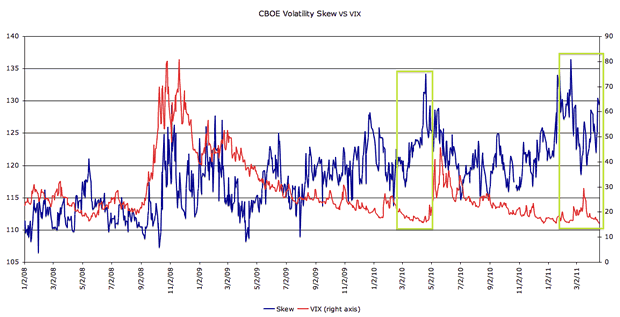

That's the class, now the chart. Below is a chart of the Skew Index VS the VIX from January 2008 to present.

Notice how since the March 2009, the Skew Index has actually risen while the VIX has fallen. The VIX has really given a false sense of security.

More importantly notice the two green boxes. The first is the flash crash of 2010. Notice how the VIX makes new lows while the Skew index makes new highs. Then once the market place reacts to falling asset prices, the VIX rises while the Skew Index falls. Now look at the next green box. The same exact divergence is occurring. Last month's selloff is even reflected.

The VIX is flashing a bullish divergence right now with the daily MACD which combined with the above chart should send chills down anyone who is overly leveraged and long this market right now.

If all was well, why would professional traders be speculating in out of the money options versus retail traders who based on the current VIX level are very complacent and have little to no insurance on their longs.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.