Silver Crash 2006 vs Silver Today, Does it look Familiar?

Commodities /

Gold and Silver 2011

Apr 23, 2011 - 03:04 AM GMT

By: Submissions

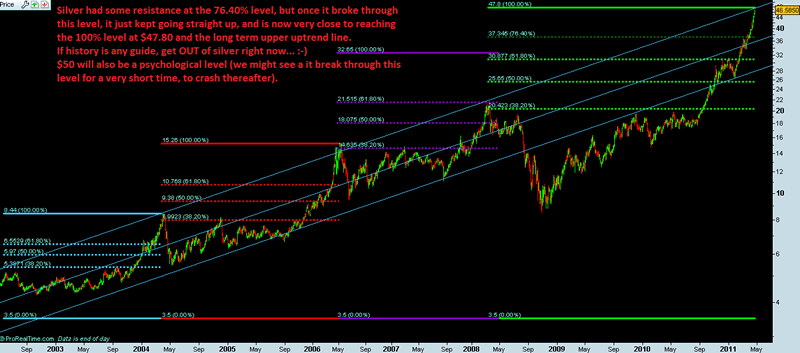

Willem Weytjens writes: First of all, here is an update of a chart I posted 3 weeks ago…

Willem Weytjens writes: First of all, here is an update of a chart I posted 3 weeks ago…

Chart created with Prorealtime

Second of all, here is a chart of the gold-to-silver ratio:

Chart courtesy stockcharts.com

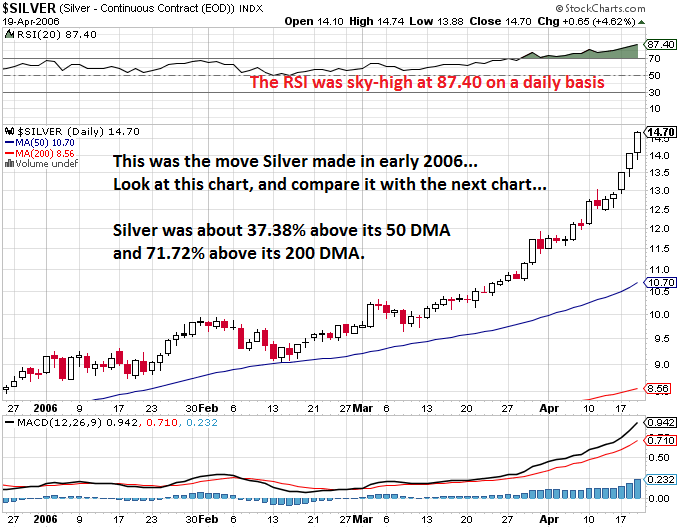

Now let’s have a look at Silver in 2006, when it also made a parabolic move:

Chart courtesy stockcharts.com

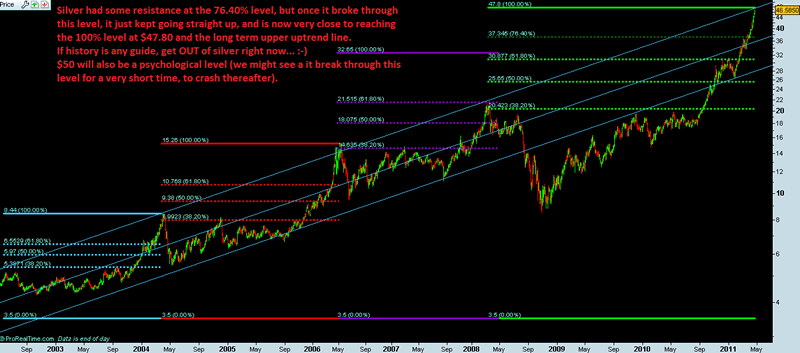

Here is the current situation:

Chart courtesy stockcharts.com

Although silver is not as stretched above its 50 days Moving Average as in 2006, it is as stretched above its 200 DMA as in 2006.

Also, the RSI is very high, but not as high as in 2006, so we MIGHT see 1 or 2 more days to the upside, but then we might get a Deja Vu of 2006.

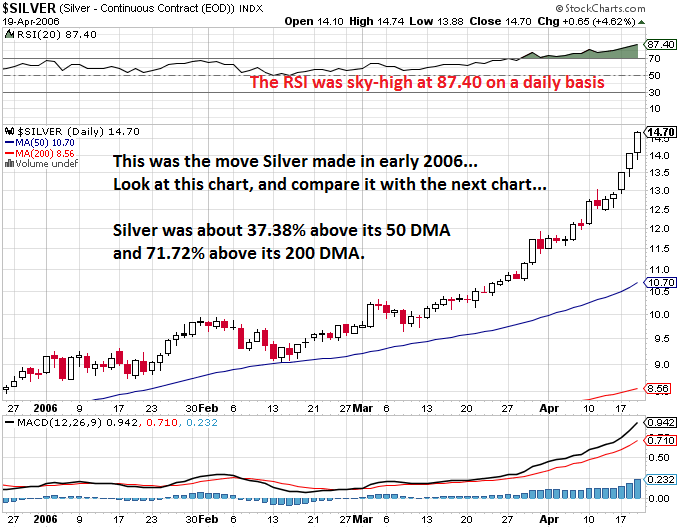

For those of you who want to know what happened on April 20th 2006, here is a chart:

Chart courtesy stockcharts.com

Short URL: http://profitimes.com/?p=1418

By Willem Weytjens

http://profitimes.com

Copyright © 2011 Willem Weytjens - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

Kevin

23 Apr 11, 13:11

|

Silver Crash 2006 vs Today

We can only hope for a drop as a better entry pricing point. I have been in since Silver was at $16 and buying in up till $44. I really think we need a pullback to go higher and I'm gathering cash to make that next long term buy. I think Bernanke's statement next week could be the catalyst for a oil and PM pullback. Cross your fingers and keep stackin

|

ron

22 Jun 11, 15:06

|

circulated american silver eagles

I can buy circulated american silver eagles for 1 dollar over spot price. I have been buying everyone I can get my hands on at that price. QUESTION: is there any monetary benefit to buying circulated silver eagles versus regular generic 1 ounce rounds? my eagles are in excellent condition just a little frosting worn a bit. I would appreciate if anyone could answer my question, thank you very much and have a good day.--ron

|

Nicholas Barrett

23 Jun 11, 18:35

|

Damaged 999 silver coins

Ron: Damaged 999 silver coins are very easy to sell where I live (a city with a big jewellery industry) and are perhaps slightly preferred to medallions of less well known provenance. 999 is preferred to sterling (925) and less pure metal. When demand for silver is high, you may get the same price for damaged 999 coins you paid 10% less for as you get for the same in good condition that you paid 10% extra for; however in general I think there is nothing easier to sell than 999 coins in mint condition. I have found that people are willing to pay a premium for mint 999 coins, for example in rolls of 20, but I also have to pay a small premium when I buy them. PLEASE NOTE: I have said price may vary according to the City you live in (and even the shop in the city you sell to) but it may also vary considerably depending on the Country: e.g in the UK in some cases you might have to negotiate V.A.T. and I don't know about tax in the U.S.A. Good luck. Nick.

|

Willem Weytjens writes: First of all, here is an update of a chart I posted 3 weeks ago…

Willem Weytjens writes: First of all, here is an update of a chart I posted 3 weeks ago…