Fed Holds Policy Rate Steady, Signals Intention to Complete Asset Purchases and Maintain Balance Sheet Size

Interest-Rates / US Interest Rates Apr 28, 2011 - 03:24 AM GMTBy: Asha_Bangalore

Yesterday's post-FOMC meeting analysis has two components: policy statement and Chairman Bernanke's press conference. Starting with the policy statement, the Fed held the federal funds rate unchanged at the narrow band of 0 to ¼ percent. There were no dissents, although in recent speeches, Fed Presidents Plosser and Fisher (both voting members) had voiced their concern about imminent inflationary pressures.

Yesterday's post-FOMC meeting analysis has two components: policy statement and Chairman Bernanke's press conference. Starting with the policy statement, the Fed held the federal funds rate unchanged at the narrow band of 0 to ¼ percent. There were no dissents, although in recent speeches, Fed Presidents Plosser and Fisher (both voting members) had voiced their concern about imminent inflationary pressures.

The Fed's views about the economy shows a minor difference from the March 15 policy statement. The first sentence of the today's policy statement describes the economic recovery as "proceeding at a moderate pace." The March statement upgraded the economic recovery to be on "firmer footing" from the January 2011 statement which simply noted that the "economic recovery is continuing."

The Fed's take on spending components of GDP was left intact, with housing sector continuing to be depicted as "depressed" and household expenditures and equipment and software outlays as expanding The Fed indicated that "inflation has picked up in recent months" but continues to view higher prices of energy and other commodities as "transitory." Rhetoric about closely tracking inflation and inflation expectations was retained in today's statement.

The policy statement settled the uncertainty about whether the Fed will complete the $600 billion purchase of Treasury securities, referred to as QE2, by noting that it "will complete" these planned purchases.

There was no change to the Fed's near term outlook for monetary policy as the phrase "low levels for federal funds rate for an extended period" continues to be part of the policy statement.

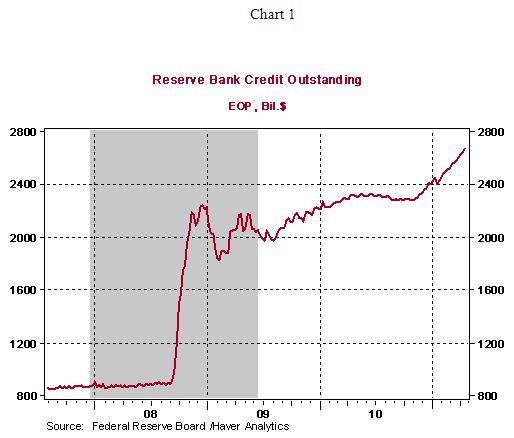

The much awaited first press conference of Chairman Bernanke after an FOMC meeting revealed that the Fed plans to reinvest maturing securities and maintain the size of the balance sheet. Effectively, the amount of monetary policy easing will be unchanged after the completion of the $600 billion purchase. The Fed's balance sheet as of April 20 stood at $2.67 trillion (see Chart 1). The Fed has purchased $548 billion of the $600 billion target so far.

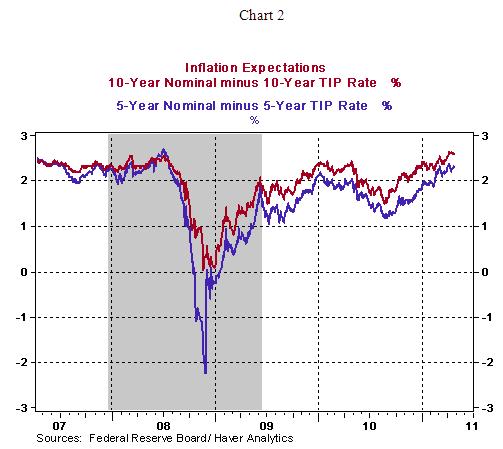

The looming question at the present time is the course of monetary policy if oil prices continue to advance. Chairman indicated that the Fed expects oil prices to stabilize and trend down. In the event that this does not occur, Chairman Bernanke noted that the evolution of inflation expectations would be the Fed's guide to monetary policy action. He went on to add that if inflation expectations fail to be stable and well anchored (which is the case at present) the Fed will have to take action. The five and 10-year break-evens obtained from Treasury inflation-protected securities are currently at levels seen prior to the onset of the financial crisis (see Chart 2). Markets will be tracking these levels closely in the days and months ahead.

Chairman Bernanke responded to a question about the meaning of the phrase "extended period" by noting that it would imply the Fed is unlikely to take any action for a "couple of meetings." June 21-22, August 9 and September 20 are dates of the next three meetings of the FOMC .

There are many unanswered questions about the Fed's exit strategy such as the actions it is likely to take to tighten monetary policy when economic conditions improve and inflation is a threat. Chairman Bernanke pointed out that the early step would be to stop reinvesting all or some part of maturing securities. In other words, if maturing securities are not replaced, the action would be akin to open market sale of securities, the action the Fed typically takes to tighten monetary policy.

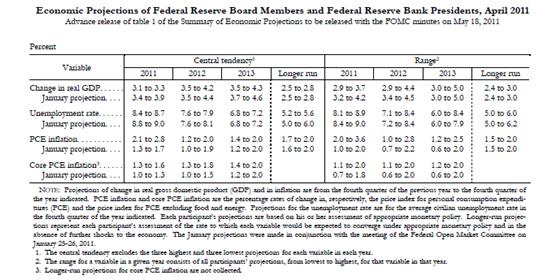

The Fed also made available its latest forecast of real GDP growth, inflation, and unemployment rate today. The Fed has lowered projections of real GDP growth for 2011and raised estimates of the unemployment rate, overall inflation, and core inflation for 2011 (see table below) compared with the predictions published in January 2011.

Source: http://www.federalreserve.gov/newsevents/press/monetary/fomcprojtabl20110427.pdf

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.