Gold And Silver Storm The Fed

Commodities / Gold and Silver 2011 May 05, 2011 - 05:56 AM GMTBy: Darryl_R_Schoon

All the perplexities, confusion and distress in America arise, not from defects in their Constitution or Confederation, not from want of honor or virtue, so much as from the downright ignorance of the nature of coin, credit and circulation. John Adams (1735-1826), American President

All the perplexities, confusion and distress in America arise, not from defects in their Constitution or Confederation, not from want of honor or virtue, so much as from the downright ignorance of the nature of coin, credit and circulation. John Adams (1735-1826), American President

America’s founding fathers would not be surprised at the dire state of the nation they created in1776. America was then an experiment. No similar form of government had ever been attempted; and even at its birth the founding fathers had doubts as to whether the American experiment would succeed.

Remember, democracy never lasts long. It soon wastes, exhausts, and murders itself. There never was a democracy yet that did not commit suicide. John Adams (1735-1826), American President

The once great nation of America is now a goat rodeo where the electorate is both confused and ignorant yet stubbornly believes itself otherwise. Adroitly ruled by corporate and banking elites whose deadly threat remains unrecognized, America today is bereft of leadership and options, a shadow of the nation intended by its founders.

The warnings of those who created America have long been forgotten. John Adams’ words regarding the dangers of not understanding the nature of coin, credit and circulation was clear warning to those who would later place the nation’s currency in the hands of private bankers.

The central role played by central banking in America’s problems is not understood by most Americans. However, the founding fathers clearly understood the dangers posed by the issuance of debt-based money from central banks. On my program, Dollars and Sense, .I explain the system of central banking adamantly opposed by our nation’s founders, see http://www.youtube.com/...

Of the founding fathers, Thomas Jefferson especially recognized the dangers that central banking posed to the American experiment:

The central bank is an institution of the most deadly hostility existing against the Principles and form of our Constitution. I am an Enemy to all banks discounting bills or notes for anything but Coin [gold and silver coins]. If the American People allow private banks to control the issuance of their currency, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the People of all their Property until their Children will wake up homeless on the continent their Fathers conquered.

Yet, on December 23, 1913, private bankers gained their long-awaited advantage over America when business and corporate interests successfully created the Federal Reserve Bank, a central bank which the founding fathers had fought the Revolutionary War to prevent.

After 1913, a consortium of private banks which would henceforth issue America’s currency in the form of debt, i.e. Federal Reserve notes, in opposition to the wishes of those who founded America.

The Fed’ substitution of its paper notes for gold and silver has now caused the nation irreparable harm. Since 1913, the banker’s debt-based currency has resulted in the transfer of most of America’s wealth to the moneyed elites, leaving the rest of America impoverished and in debt. Today, the very top 1 % of America receives 25 % of its income and controls 40 % of its wealth.

The bankers’ parasitic plunder of America is almost complete as America’s politicians have sold-out the country, members of both parties are now indentured to the special interests who openly buy their votes behind closed doors.

..deep down in our hearts, we have been accomplices to doing something terrible and unforgivable to this wonderful country. Deep down in our hearts, we know that we have bankrupted America and that we have given our children a legacy of bankruptcy. ... We have defrauded our country to get ourselves elected. Senator John C. Danforth (MO-R), April 22, 1992

The bankers’ triumph, however, is not complete and were it not for their insatiable greed, the bankers would already own America. But in 2008, the banker’s greed, overstepping all bounds, almost destroyed the global economy and significantly damaged the world’s banking system; and while this is bad for the Fed, it’s good for America.

Only the complete collapse of the Federal Reserve System and central banking can now free America from eternal debt enslavement; and while it’s been a long time since 1776, there are more ways than one to overthrow the few who tyrannically rule the many by credit and debt.

CENTRAL BANKING’S CONUNDRUM

The foundation of central banking was the convertibility of its debt-based paper money to gold or silver. This convertibility provided the confidence to exchange valuable goods and services for the bankers’ paper banknotes.

The ability to convert paper banknotes for gold and silver provided the requisite confidence for the bankers system to function. As long as the delicate balance between credit and debt could be maintained, this system, known as capitalism, provided England with an insurmountable advantage over the rest of the world.

England alone was able to send its army and navy to war on credit. Its navy essentially became a fleet of state-sponsored pirates, allowing England to invade other countries with impunity, plunder their wealth and become the largest empire in the world since Rome.

The British empire, however, reached its apogee in the mid-19th century and when its empire began contracting, the bankers needed another country to serve their now insatiable ambitions and need for profits. America was their country of choice.

In 1913, the creation of the Federal Reserve Bank in America afforded international bankers the very same opportunities conditional upon America fulfilling two essential prerequisites: (1) maintain the convertibility of paper money to gold or silver, and (2) maintain the critical balance between credit and debt. America failed to do either.

America maintained the convertibility of paper money until 1971 when the US had overspent its gold reserves after WWII and could no longer convert US dollars to gold; and, as a result, the balance between credit and debt after 1971 also became heavily imbalanced in favor of debt when the US discovered it could easily trade its paper dollars for the world’s wealth without a concomitant transfer of gold.

America took England’s golden goose, spent the gold and now the days of central banking are numbered; and whether you know it or not, this crisis presents America with a priceless opportunity to free itself from the unconstitutional abrogation of the right to live, work and prosper free of the parasitic bankers who profit from the indebting of others.

THE SURGING PRICE OF GOLD AND SILVER AND THE COMING COLLAPSE OF THE FEDERAL RESERVE

When the US could no longer convert its US dollar to gold in 1971 as required under the Bretton-Woods agreement, paper currencies everywhere became only government promises to pay. For the first time in history, all money became fiat.

Central banks rightfully became concerned that the value of their currencies, when no longer convertible to gold or silver, would loose value; and, indeed, that is what began to happen.

Governments everywhere began printing more and more money as gold no longer had to be exchanged for excess currencies held by other countries; and, of all the countries that abused the new found ability to do so, the US was the greatest transgressor.

This is why the US soon had the largest trade imbalance in the world. The US took advantage of the reserve currency status of the US dollar to begin buying more oil from the Middle East and more goods from Asia.

First Taiwan in the 1970s, then Japan in the 1980s, then China in the 1990s and 2000s found themselves with increasingly excessive amounts of US paper money. Lacking the need to exchange gold for its dollars, after 1971 the US went on a worldwide spending spree with its increasingly worthless US dollars; and, today, the rising price of gold and silver reflects the world’s growing unease with still growing US deficits in both its domestic budget and foreign trade.

Of the 21 trading days in April, the price of gold reached record highs on 15 of those days. The ascent of silver was even greater. Today’s acceleration of silver and gold is an indication that Fed’s attempts to continue central banking’s 300 year hegemony are failing.

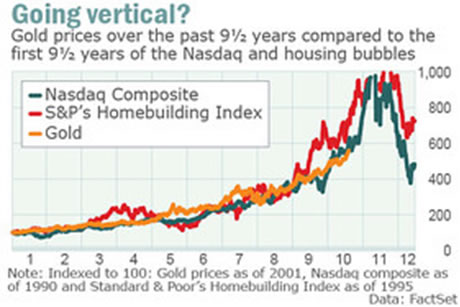

The below graph compares the price of gold to the NASDAQ and US housing bubbles; and while gold is not a bubble, to the unknowing it can appear to be so. That is because gold is moving inversely to another bubble, the now-deflating bubble of paper money, the largest bubble in history.

In April, hedge funds bet billions that the US dollar would fall and they won the bet. The price of gold is currently tracking both the demise of the US dollar and the collapse of confidence in the Fed’s global ponzi-scheme.

Instead of being afraid of the future, Americans should be rejoicing.

FRAUD AT THE FED

Is the Fed engaged in fraud?

Does a bear sh*t in the woods?

Do hemorrhoids hurt?

Eric deCarbonnel has posted a remarkable video on fraud at the Fed: In FRAUD: Federal Reserve Is Selling Put Options On Treasury Bonds To Drive Down Yields, Mr. de Carbonnel provides a clear-cut narrative as he connects the dots on a Fed scheme to distort interest rates, thereby misleading buyers regarding the risks associated with US Treasuries.

Mr. de Carbonnel’s twelve minute video goes by with remarkable speed, leaving the viewer both enlightened and repulsed, somewhat akin to watching Hannibal Lecture’s handiwork being explained in detail.

We are indebted to Mr. de Carbonnel for his revelation of what would be in a just world, the smoking gun. But this is not a just world. This is America where power determines what’s right and wrong, where the scales of justice are weighted in favor of those who rule and where the cries of the less fortunate are dismissed as undeserved.

Nonetheless, Mr. de Carbonnel’s indictment will give the viewer a clearer understanding of the smoke and mirrors deployed by the Federal Reserve. His video can be viewed at http://www.youtube.com/...

That the Fed would engage in fraud to perpetrate the ponzi-scheme of which the Fed is the principal is not to be unexpected. The Fed is engaged in a fight to the finish, although the Fed does not yet know the end is far closer than believed.

What economists perceive as a series of unexpected exogenous shocks are instead the signs of systemic instability caused by the collapse of their debt-based paradigm. Bankers will be surprised when their control over the world’s wealth and resources ends along with the paper money that made it possible.

The bankers’ self-centered concern about the future is justified as the Fed is vulnerable as never before—and while this may be bad for the Fed, it will be good for the rest of us, especially America..

Question: What will bankers do?

Answer: They will have to find gainful employment in a world where parasites no longer rule.

AMERICA THE FROG

The frog is frozen still

In water now so hot

The water’s almost boiling

But the frog knows it not

Quickly it must jump

To avoid a boiling death

The Fates themselves are watching

With collective bated breath

Will America survive?

Or will it now succumb

Its heritage abandoned

Its future now undone

By its own hand it’s threatened

Itself its great threat

The frog continues sitting still

In denial ignorant yet

The water’s getting hotter

The heat’s turned up to high

And it’s an even money bet

That the frog is gonna die

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.