When a Gold Necklace Isn't Jewelry

Commodities / Gold and Silver 2011 May 05, 2011 - 01:07 PM GMTBy: Jeff_Clark

Jeff Clark, BIG GOLD writes: When it comes to supply and demand, what you’ve been told about gold jewelry is wrong. That’s a strong statement, but I’ve got a firsthand account to back it up.

Jeff Clark, BIG GOLD writes: When it comes to supply and demand, what you’ve been told about gold jewelry is wrong. That’s a strong statement, but I’ve got a firsthand account to back it up.

Most industry organizations separate jewelry from investment when they tally the numbers on the uses for gold. This makes sense, of course, because one is a coin or bar purchased as a store of value and the other is something designed to be worn. But what if large populations around the world view them as serving the same purpose?

My friend Jayant Bhandari, who’s worked for Casey Research in the past and is now a consultant to an institutional investor, has told me for years that excluding gold jewelry from investment demand is inaccurate because there are many Asian cultures where a gold necklace is considered, in all practical uses of the word, an investment.

I’ve often wondered to what extent that’s true. Do Indians, for example, really see a gold necklace as a preserver of wealth? Gold adornments are so widespread in their society – it’s hard to find a picture of an Indian bride who’s not wearing numerous gold accessories – that it seems obvious the use is, in fact, primarily as jewelry. But is something else going on here that escapes our Western view of the precious metal?

I decided to go the source. Jayant arranged an interview with me and his mother Shanta, who has lived in India her entire life. If anyone knows, it would be her. With Jayant translating, I learned some things I think you’ll find fascinating and perhaps make you reconsider how you view gold…

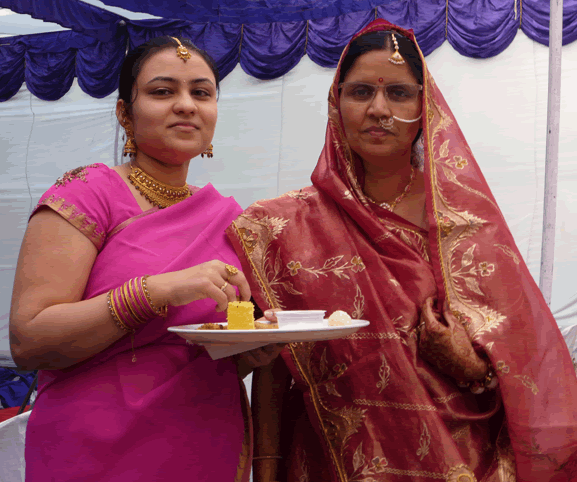

Shanta's relatives at a party. The nose piece is called a "Nath," and a "Tikka" is on the forehead. Both are worn by married women, though increasingly unmarried women wear them as well

Jeff: Shanta, why do Indians buy a lot of gold?

Shanta: Indians feel deep in their hearts that gold is the best way to preserve and invest wealth. Indians have always felt that whenever they need money, they can sell their gold to generate cash. This is the way we have always done it.

Every mother wants to give her daughter gold because the wealth can be saved on her body. And the mother is secure in knowing the gold will stay with her. Even the mother-in-law thinks this way. That’s why it's commonly given during weddings.

Jeff: I understand that gold is very important to Indian women.

Shanta: Gold is the wealth of the women and is extremely important to them. Men don't give or receive much gold. It is transferred from woman to woman, from generation to generation. Men are usually not involved. Gold is preserved by the women so that if they have a crisis, they can use it.

Women consider gold to be their biggest security. Indian women have started working in the last decade, but the young working women are still passionate about gold.

Jeff: So gold jewelry is something more than just a pretty necklace?

Shanta: I do not think of gold as a necklace or a bracelet. Indian women think in terms of how much gold is to be given to their daughter or daughter-in-law. So it is not viewed as jewelry but as a basic store of value.

Every Indian likes to have gold. This is true whether they’re Muslim or Christian.

Jeff: How much gold do Indian families like to have?

Shanta: For the middle class, I would say roughly 20% of their total wealth is in gold. In the past it was more like half. Fifty years ago, they had no other option but to keep their wealth in gold. Now they can buy other things, too.

Jeff: Are some forms of gold more desirable than others?

Shanta: In the past women preferred to have jewelry, but there is a trend to keep some of it in brick form now. Some women reach the limit of jewelry they want to hold, so they buy coins or bricks. Even if the woman doesn’t wear the jewelry, she will still keep it.

Jeff: How do Indians acquire it?

Shanta: In the past you would take your gold to the jeweler, tell him what you wanted, and he would make it for you. The modern-day woman will pick something out from the jeweler.

Old jewelry keeps getting recycled. Every family has a lot of gold – four or five generations or more. Eventually you lose the emotional connection with certain pieces and will have them made into something else.

Jeff: Where do Indians typically keep their gold?

Shanta: Historically, Indians would hide their gold or bury it. These days they use bank lockers. But no one likes to talk about their gold.

Jeff: Would you and other Indians ever sell your gold jewelry?

Shanta: Gold is given as collateral, so you would only sell it if you had no other way to raise money. We prefer to keep it and won’t sell it unless there is a crisis.

Jeff: How is gold used as collateral?

Shanta: Gold is seen as a store of value and is only used when you really need money. So we would use it as collateral for a surgery or other emergency, a wedding, or maybe in an extreme case, a house. We would not use it for a TV or car or anything like that. We might sell some for education, so only for very important things.

Jeff: Might you sell some because the price is high?

Shanta: We typically would not sell gold just because the price is high. Gold is not an investment; it is a store of value.

Jeff: Is there much interest in buying silver?

Shanta: The key is gold. The rich and middle class normally buy gold, not silver. Silver is very common among the poor class, so if you are not rich, then you will buy silver. The poor people buy silver for the same reason the middle class buy gold.

Jeff: Do other factors affect why Indians buy gold?

Shanta: The stock market has recently fallen from a lot of corruption cases, so the people are increasingly interested in gold.

Jeff: Would it bother you if the price dropped?

Shanta: It would not bother me because I still have my gold. If gold makes a new high, I am not inclined to sell it, either. Of course, I would be happy if the price goes up.

Jeff: Thank you, Shanta.

Shanta: You are most welcome.

As Shanta makes clear, gold jewelry in India is more than a fancy adornment; it’s a store of value and preserver of wealth. It’s not even an investment; it’s more important than a rising brokerage statement.

In India and many other Asian countries, the form gold comes in is less important than how many ounces you own. If you lived in India, gold would represent about 20% of your assets.

So the next time you hear a report about gold jewelry in India, remember that Shanta and others aren’t wondering how good a gold bracelet will look on their wrist, but rather are seeing it as a vehicle for storing wealth.

I think there’s a lesson in this for us North Americans. How do you view the gold you own – is it a pretty coin, an investment, or a store of value? Given the obscene abuse most fiat currencies are undergoing, I think we’d be best served viewing it as not just a potential money maker but as protection against the rabid inflation that will damage our economy and dilute our pocketbooks.

[The U.S. dollar is tanking as we speak, and gold and silver have been shooting to never-before-seen heights. And thanks to out-of-control money printing and rapid currency debasement by the Federal Reserve, more and more countries – China being the most prominent – are planning to dump the dollar. Read more here.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.