Banking in Darkness FDIC System Insures $7trillion Deposits with Dwindling Insurance Fund

Interest-Rates / Credit Crisis 2011 May 12, 2011 - 04:10 AM GMTBy: Submissions

John Rolls submits : MyBudget360: Americans are offered close to zero percent interest rates to stuff their money into this banking vortex.

John Rolls submits : MyBudget360: Americans are offered close to zero percent interest rates to stuff their money into this banking vortex.

The American banking system is based on pure faith. Usually when the topic comes up in conversation I will ask someone if they know what backs the green cash in their wallet. One of the common responses is “there is gold in Fort Knox” or another typical response is that it is backed by U.S. assets. Unfortunately both of these answers are incorrect. In fact all of our money deposited in the banking system is backed by the pure faith in our U.S. government.

Now for decades this implicit belief was fine because we actually were a creditor and exporter nation. We also had a higher savings rate. Today we have a system where we continually spend more than we produce and expect this dynamic to somehow function long term as if we found an endless well of Kool-Aid. The Federal Deposit Insurance Corporation (FDIC) insures each individual account up to $250,000. Given that one in three Americans has zero dollars to their name and most others have a sum nowhere close to this amount, many go forward with an unstated faith in the system. However the FDIC Deposit Insurance Fund is largely running on fumes. This shouldn’t be such a big issue aside from the fact that the American banking system has over $7 trillion in deposits.

FDIC Fund taking hits

Source: The Tree of Liberty

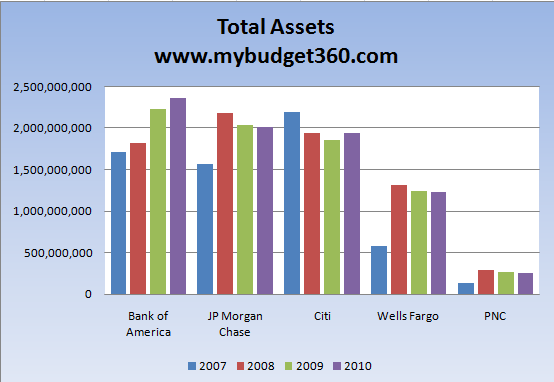

The interesting thing to note is that bank failures have slowed down yet the FDIC is actually benefitting from the Federal Reserve’s massive quantitative easing adventure. Banks have been allowed to step up to the plate and borrow from the Fed at ridiculously low rates to remedy their own appalling balance sheets. Yet little of this has helped working and middle class Americans. It is also worth mentioning that the banks with the ugliest balance sheets are the too big to fail and we have already been told that they will not fail even if we have to increase the Fed balance sheet to $2.7 trillion in a colorful trail mix of junk loans. These banks have grown over the problematic decade:

Bank of American and JP Morgan Chase each have $2 trillion worth of assets each. Most of the troubled balance sheets are situated in a handful of banks even though collectively the U.S. has over 7,500 banks. The top 10 virtually dominate the $13 trillion in total assets:

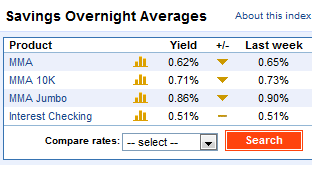

Now you have to draw your own conclusions here. The biggest banks with the worst balance sheets have a mandate that they will not fail. What this means is the cost of the bailouts is being supported by the public via low savings rates and also hidden inflation:

Keep in mind the above rate is for larger accounts. Most working and middle class Americans simply have enough in their banking account to pay the monthly bills and maybe fill up their car with low octane $4 a gallon fuel. As food and energy costs rise a larger portion of monthly income is being devoted to these items thanks to the Federal Reserve bailing out these too big to fail banks. This is ultimately the cost of not letting bad banks fail and allowing good banks to grow. The cost indirectly shows up and is spread across the mainland of America.

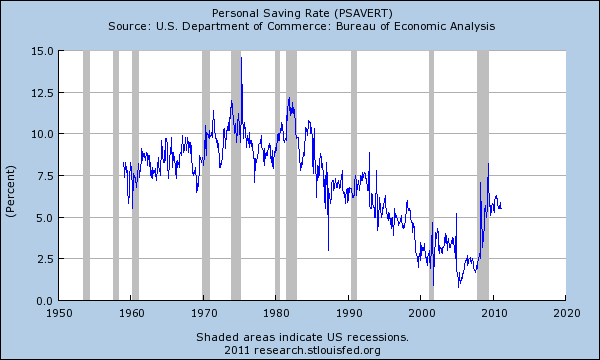

Even in light of the pathetically low savings rate, many Americans have increased their savings rate because access to debt has been slowed down:

Of course increasing your savings rate from zero makes anything look significant. Two main drivers for the above trend; first, Americans are being pushed to save because access to debt via home equity or credit cards is being shut off and second, many simply do not trust the casino that is known as Wall Street. You know things are bad when big time Vegas gamblers state publicly that they don’t trust Wall Street. This push is being reflected above and the increase has occurred at a time when many of the big banks are simply offering a place similar to your mattress to store your money and a rate of interest that is slightly above zero (also similar to your mattress).

The employment picture and banking implications

The good news is that we have added jobs in the last few months. The bad news is these jobs are reflecting the new world of low wage capitalism. In other words we have lost many good paying higher wage jobs and have replaced them with lower paying jobs. All this is happening while the cost of many items is rising. So you can do the math here; less pay and rising expenses. This calculus is not good for the American worker. If anything it is showing that our economy is adjusting to this new reality where bailed out banks can pay CEOs 800 times the median household income for actually driving our economy into the ground. I think as Americans we rally around innovative companies that produce a good and reward those that provide a service. Yet most of the large payouts are going to Wall Street investment banks that are nothing more than swindlers and snake oil salesmen trying to siphon off economic rents from the productive economy. Reward production and economic growth, not scandalous cronies that exist only because they have mastered the art of graft.

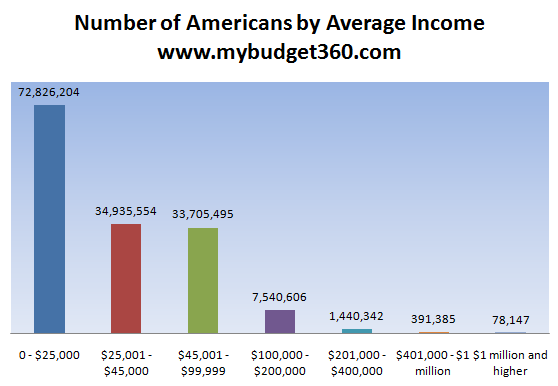

The clearest picture of this new economic divide shows up in the average per capita income:

Source: Social Security Administration

I find it amazing that few realize that half of all workers make on average $25,000 a year or less. That is, one out of two working Americans makes the equivalent of one Ford car per year (or half a year of tuition at a private university). There is something seriously awry with our banking system because it does not support the greater good of our economy. As things stand we will live in a casino like environment were massive bubbles will appear in random sectors like housing, technology, energy, commodities, and higher education simply because we allow this symbiotic relationship between Wall Street and our government to persist. The real scandal is happening there and this is what will bring the end to the middle class.

So what do we need to do? What needs to be called for is the splitting up between Wall Street investment banking and regular deposit institutions. How is it possible that we have a FDIC with nearly no money in their insurance fund backing up $7 trillion in deposits? Not only is that hard to believe but these banks have over $13 trillion in assets while massively speculating in global stock markets. If these institutions want to gamble with their own money so be it but expect them to fail. Working and middle class Americans need to rally around the nucleus of the problem and demand real substantive change. The Federal Reserve cannot balloon its balance sheet to $2.7 trillion and impact our money supply without allowing for a deep and thorough audit. If change does not occur we are going to end up with a Wal-Mart and McJob economy with people moonlighting at questionable for profit institutions that teach you a hard lesson in student loan debt all the while banks count their profits after booting out millions of Americans via foreclosure thanks to taxpayer bailouts. With this kind of system you might as well bank with the lights out.

By MyBudget360

© 2011 Copyright MyBudget360 - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.