Rajaratnam Guilty On All 14 Counts of Insider Trading - Faces 19+ Years In Prison

Stock-Markets / Market Manipulation May 13, 2011 - 09:08 AM GMTBy: Jesse

"The tapes show he didn't believe the rules applied to him. Cheating became part of his business model."

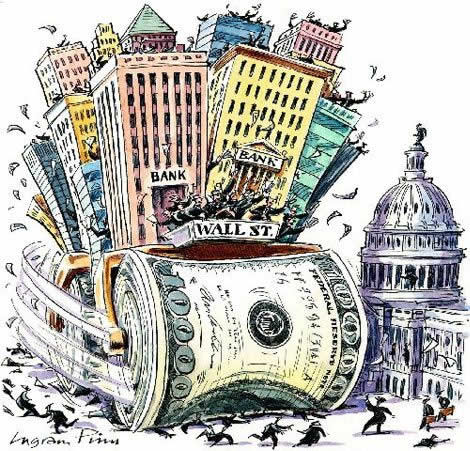

"He" is a microcosm of a financial system in which the currency of fraud drives out honest price discovery and displaces productive activity, and large institutions game the markets on a daily basis with near impunity, while the public underwrites their steady gains and occasional but spectacular losses.

Sentencing will be on July 29.

Sentencing will be on July 29.

AP

Hedge fund founder convicted in inside-trade case

May 11, 2011

NEW YORK (AP) — A former Wall Street titan was convicted Wednesday of making a fortune by coaxing a crew of corporate tipsters to give him an illegal edge on blockbuster trades in technology and other stocks — what prosecutors called the largest insider trading case ever involving hedge funds.

Raj Rajaratnam was convicted of five conspiracy counts and nine securities fraud charges at the closely watched trial in federal court in Manhattan. The jury had deliberated since April 25, and at one point was forced to start over again when one juror dropped out due to illness.

Prosecutors had alleged the 53-year-old Rajaratnam made profits and avoided losses totaling more than $60 million from illegal tips. His Galleon Group funds, they said, became a multibillion-dollar success at the expense of ordinary stock investors who didn't have advance notice of the earnings of public companies and of mergers and acquisitions.

Rajaratnam will remain free on bail, though now with electronic monitoring, at least until his July 29 sentencing.

The verdict came after seven weeks of testimony showcasing wiretaps of Rajaratnam wheeling and dealing behind the scenes with corrupt executives and consultants. Some of the people on the other end of the line pleaded guilty and agreed to take the witness stand against the Sri Lanka-born defendant.

Authorities said the 45 tapes used in the case represented the most extensive use to date of wiretaps — common in organized crimes and drug cases — in a white-collar case.

The defense had fought hard in pretrial hearings to keep the avalanche of audio evidence out of the trial by arguing the FBI obtained it with a faulty warrant. Once a judge allowed them in, prosecutors put the recordings to maximum use by repeatedly playing them for jurors.

"You heard the defendant commit his crimes time and time again in his own words," Assistant U.S. Attorney Reed Brodsky said in closing arguments.

"The tapes show he didn't believe the rules applied to him," the prosecutor added. "Cheating became part of his business model."

In one July 29, 2008, call, Rajaratnam could be heard grilling former Goldman Sachs board member Rajat Gupta...."

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.