Don't Give Up On The Rare Earth Mining Sector Yet

Commodities / Metals & Mining May 18, 2011 - 05:09 AM GMTBy: Bob_Kirtley

The prices of rare earth oxides are blasting through the stratosphere. Manufacturers are driving prices in their haste to involve them in production of hybrid vehicles, wind turbines and the most high tech applications of which many sophisticated investors are unaware. These producers need the rare earth ore and are willing to pay for them on the world markets.

The prices of rare earth oxides are blasting through the stratosphere. Manufacturers are driving prices in their haste to involve them in production of hybrid vehicles, wind turbines and the most high tech applications of which many sophisticated investors are unaware. These producers need the rare earth ore and are willing to pay for them on the world markets.

The interest of these high tech corporations need rare earths in order to survive. China (FXI) has the right stuff, but are claiming perhaps rightfully that they need the materials for themselves. In fact they are in the forefront of venturing abroad to takeover promising heavy rare earth mines all over the world. Do not forget China's bid to control Lynas in 2009. America once commandeered this mining area, but over the years, China co-opted this area and became the world leaders supplying over 97% of the world's rare earth supply. North America and Europe need to move fast to develop their own supply as prices soar due to suppliers holding on to ore expecting higher prices. Few suppliers want to quote and their are shortages within the industry of the heavy rare earths especially dysprosium, terbium and europium.

One of the great demands for rare earths is coming out from manufacturers of hybrid cars. Toyota (TM) and Honda (HMC) in order to produce these fuel efficient vehicles requires a large amount of rare earths in each automobile. Toyota has risen the price of the Prius. This is no surprise as each Prius car uses at least 1kg of neodymium which has recently soared in value. These new hybrid models are driving sales and one can be sure that the manufacturers will make sure to gain supplies for several years to come. These companies look 3-5 years for potential supplies and heavy rare earth assets in North America and Europe are being closely studied.

Never has there been a divergence between the price of the rare earth ores and the developing rare earth miners as there is now. The current commodity correction has caused the high flying rare earth sector (REMX) to plunge to critical support levels. I believe we are currently seeing a transition of ownership from weak holders on margin to strong holders with cash. Buying these world class heavy rare assets now by end users at these cheap levels is critical as the opportunity may not last long. Many of the rare earth stocks such as Avalon (AVL), Rare Earth Elements (REE) and Molycorp (MCP) are down more than 30% from their highs. This is quite normal for highly speculative mining investments and investors in this sector should be prepared for dizzying moves to the upside and quite painful moves to the downside.

We may begin to see a race to control these heavy rare earth assets in mining friendly jurisdictions while this divergence exists between the price of rare earth ore and the rare earth mining shares. These manufacturers through the support of their governments will find available supply by strategic acquisitions and off take agreements. Personally, I am looking for the critical heavy rare earths outlined by the US Department Of Energy, such as dysprosium, terbium and europium which are seeing critical supply constraints.

The West is struggling to gain supply over the next few years and some of these undiscovered gems with the crucial heavy rare earths will not last long at these price levels. Molycorp (MCP) better move fast to gain heavy rare earth assets before investors realize that their Mountain Pass deposit does not contain the critical heavy rare earths. Just having the light rare earths will not be enough. Goldman Sachs (GS) recently revealed that there may be a surplus of the light rare earths. Investors must remember that not all rare earth mines are created equal.

Companies in the rare earth sector are advancing rapidly in developing projects all over the world and have moved rapidly to fast track key assets. Governor Parnell has supported Ucore's (UURAF.PK) Bokan Deposit and has sent a letter to President Obama on how Alaska's rare earth deposits could be a key component of developing a rare earth supply chain outside China. Another prominent miner is Lynas Corporation (LYSCF) as Australian entity in whom Japanese(EWJ) interests have taken large positions. They announced the establishment of a proposed production plant in Malaysia. They insist they are still on target for commencing production by September 2011. Malaysian environmentalists are protesting this. They remember being badly burned by Mitsubishi of Japan who left Malaysia holding a radioactive bag after producing rare earths.

The environmentalists in Malaysia are very careful this time. The Lynas management is assembling a panel of experts from all over the world to calm Malaysian fears and at the same time prevent any unfortunate reoccurrence. Lynas welcomes the one month review to ensure the project is safe and presents no danger to the workers. Lynas also hopes to have its Australia Mt. Weld project up and running. Japan (EWJ) so desperate to obtain product for their high tech industries on which their economic survival is based, has bankrolled the building of this project. Lynas is hoping to transport this ore from Australia to Malaysia for processing. This contract was signed by both sides in September 2008.

Little noticed is the acquisition by Lynas of a large rare earth deposit in Malawi, Africa. They have the approval of the Malawi Government to commence development of this major project. Interestingly, the deposit has extremely low natural radiation levels unusual for a Rare Earth Deposit.

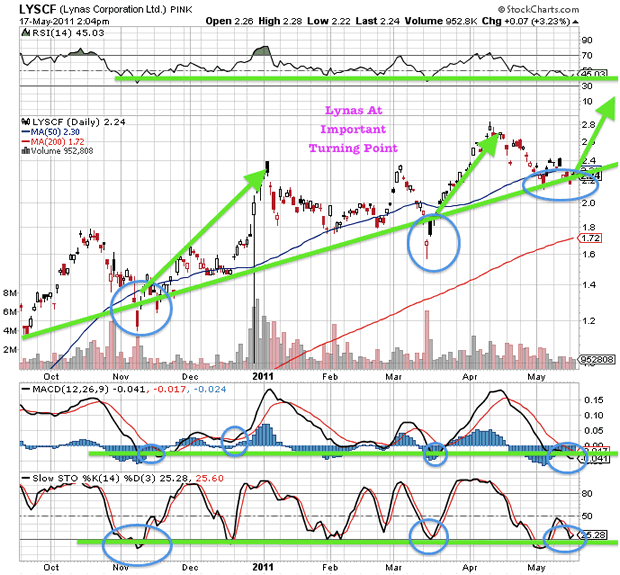

Lynas(LYSCF.PK) appears to be reaching extremely oversold levels and long term support. This is an area in which we have seen major reversals higher. I am confident about the progress of this facility in Malaysia and believe Lynas will truly be the first miner to the market outside China. Lynas is on sale and should hit our short term target.

In conclusion, the rare earth supply constraint continues to elevate Rare Earth Prices sharply both inside and outside China. Investors will not be asking for much longer why aren't rare earth mining stocks going in tandem with rare earth prices. I believe we will see major gains in the second half of 2011 in these stocks and a large amount of strategic acquisitions by end users. Investors may be looking at this pullback in rare earth miners in retrospect as an excellent buying opportunity.

Disclosure: Long Lynas and Avalon

Grab your free 30-day trial of my Members-Only Premium Stock Analysis Service NOW at:

http://goldstocktrades.com/premium-service-trial

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.