China Becomes World’s Largest Gold Buyer

Commodities / Gold and Silver 2011 May 20, 2011 - 05:37 AM GMTBy: GoldCore

Gold and silver are higher again today with the debt laden dollar, euro and yen all being sold. News that China has become the world’s largest buyer of gold bullion and has seen investment demand double continues to reverberate in the markets and may have contributed to this morning’s strength.

Gold and silver are higher again today with the debt laden dollar, euro and yen all being sold. News that China has become the world’s largest buyer of gold bullion and has seen investment demand double continues to reverberate in the markets and may have contributed to this morning’s strength.

Both gold and silver are marginally higher for the week and after last week’s gain appear to have regained their poise and are consolidating after the recent sell off.

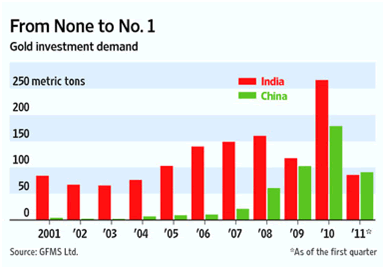

Gold Investment Demand in China - Courtesy of the Wall Street Journal

China becoming the world’s largest gold buying nation is very important. While informed analysts have been saying that this would inevitably happen much of the commentary and most of the public remain completely unaware of the huge implications that Chinese gold demand has for the gold market.

Indeed, there continues to be a huge level of ignorance regarding the scale and sustainability of China’s, but also India’s and other large and increasingly wealthy Asian countries, demand for gold and silver bullion.

Chinese investors bought 93.5 tonnes of gold coins and bars in the first quarter. China produced 340 metric tons of gold last year and consumption was about 700 tonnes, leaving a gap of nearly 360 tonnes.

Demand is forecast to increase due to the growing wealth of the Chinese middle class and deepening inflation in China.

What is most important and rarely covered is the fact that gold ownership by the Chinese public remains minuscule. Especially when compared to other Asian countries such as Vietnam and India.

Gold ownership is rising from a very, very low base which means that the investment demand and demand for an inflation hedge from 1.3 billion increasingly wealthy Chinese people is more than sustainable.

The not realized important fact that the people of China were banned from owning gold bullion from 1950 to 2003, means that the per capita consumption of over 1.3 billion people is rising from a tiny base.

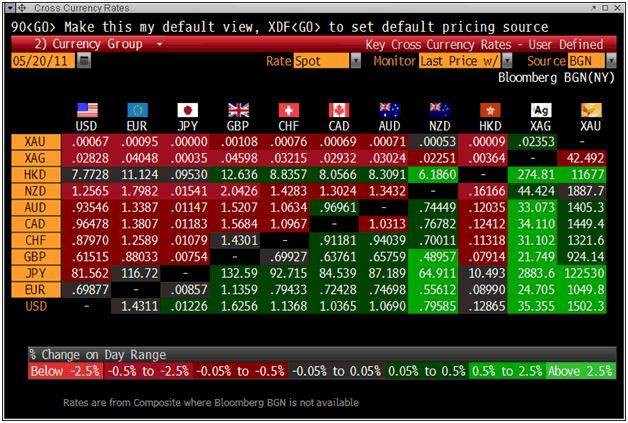

Cross Currency Rates (Including Gold and Silver)

While the recent increase in Chinese demand has been very significant, it is likely to continue and the demand is sustainable due to Chairman’s Mao’s half-century gold ownership ban.

Should the Chinese economy crash as some predict, demand could fall. However, sharp declines in Chinese equity and property markets and a depreciation of the yuan would likely lead to significant safe haven demand for gold.

Indeed, should high inflation continue in the Chinese economy or should higher inflation or even stagflation occur than Chinese demand could even increase.

Chinese demand alone likely puts a floor under the gold market at $1,450/oz.

The inflation adjusted high of $2,400/oz remains very likely given Chinese and Asian demand alone for gold bullion.

Many market participants and non gold and silver experts tend to focus on the daily fluctuations and “noise” of the market and not see the “big picture” major change in the fundamental supply and demand situation in the gold and silver bullion markets – particularly due to investment and central bank demand from China and the rest of an increasingly powerful and wealthy Asia.

It is worth noting that the People’s Bank of China’s gold reserves are very small when compared to those of the U.S. and indebted European nations. China appears to be quietly accumulating gold bullion reserves. As was the case previously, they will not announce their gold purchases in order to ensure they accumulate sizeable reserves at more competitive prices.

SILVER

The recent bear raid on silver is being challenged by silver’s very favourable supply and demand fundamentals.

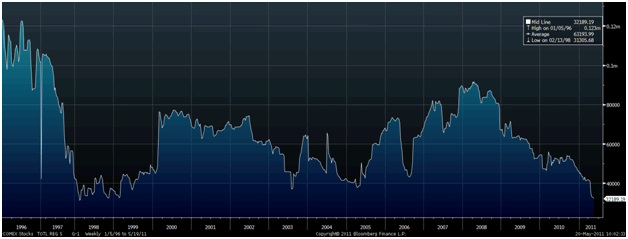

The Comex Registered Silver Bullion Inventory Data shows that silver bullion inventories are now at record lows (see chart).

Speculative paper players on the COMEX may have been successful in again manipulating prices lower but as ever the physical reality of supply and demand for the underlying commodity, asset and currency will dictate prices in the medium and long term.

Comex Silver Bullion Inventory Data/Registered

Gold

Gold is trading at $1,500.90/oz, €1,049.95/oz and £922.95oz.

Silver

Silver is trading at $35.10/oz, €24.55/oz and £21.58/oz.

Platinum Group Metals

Platinum is trading at $1,763.50oz, palladium at $728/oz and rhodium at $1875/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.