Oil and Copper Prices Reflect Euro-zone Woes and Slowing Conditions in China

Commodities / Crude Oil May 24, 2011 - 01:53 AM GMTBy: Asha_Bangalore

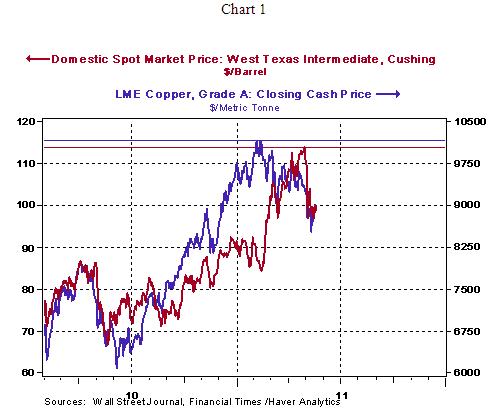

Oil prices have largely maintained a downward trend since the recent peak on April 29 ($113.93) and they are trading roughly 3.0% below the Friday close of $99.49 (Chart 1 data points end on May 20) as of this writing. Copper prices also lost ground today from the $8,982 mark seen last Friday.

Oil prices have largely maintained a downward trend since the recent peak on April 29 ($113.93) and they are trading roughly 3.0% below the Friday close of $99.49 (Chart 1 data points end on May 20) as of this writing. Copper prices also lost ground today from the $8,982 mark seen last Friday.

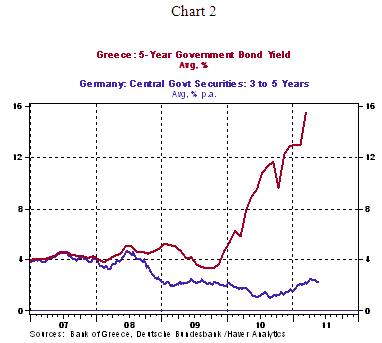

These lower commodity prices reflect the continued sovereign debt woes in Europe and the nature of economic data from China. The eurozone has to address the Greek debt problem by restructuring the debt and not engaging in temporary measures. Market assessment of the situation is visible in the growing divergence between Greek and German government bond yields (see Chart 2). Today, fears about a contagion from problems of Greece, outcome of local elections in Spain with the ruling party (Socialists) losing power, and Standard &Poor's changing the outlook for Italian debt from stable to negative pushed up yields of Spanish and Italian debt.

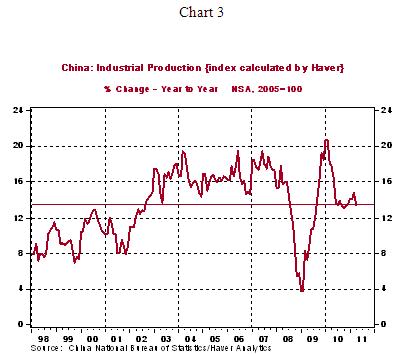

On the Asian front, the HSBC China Manufacturing Purchasing Managers Index fell to 51.1 in May from 51.8 in April, the lowest in ten months. Earlier in the month, industrial production data of China also pointed to slowing factory activity. A projected decline in demand for base metals, given the noticeable slowing in factory activity in an environment of tight monetary policy in China, is justified. Debt problems in Europe and slowing conditions in China are both headwinds that should have an adverse global impact.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.