Comex Silver Bullion Default on Sharp 38% Drop in Inventories

Commodities / Gold and Silver 2011 Jun 02, 2011 - 07:29 AM GMTBy: GoldCore

Spot gold and silver prices rose slightly again this morning after hitting a one-month high yesterday as equity markets internationally came under selling pressure. The Moody's downgrade of Greece and worryingly poor US economic data again pushed investors to seek the safe haven of bullion. Gold reached new record nominal highs in sterling yesterday (£945.62/oz) as the pound fell on concerns about the UK economy.

Spot gold and silver prices rose slightly again this morning after hitting a one-month high yesterday as equity markets internationally came under selling pressure. The Moody's downgrade of Greece and worryingly poor US economic data again pushed investors to seek the safe haven of bullion. Gold reached new record nominal highs in sterling yesterday (£945.62/oz) as the pound fell on concerns about the UK economy.

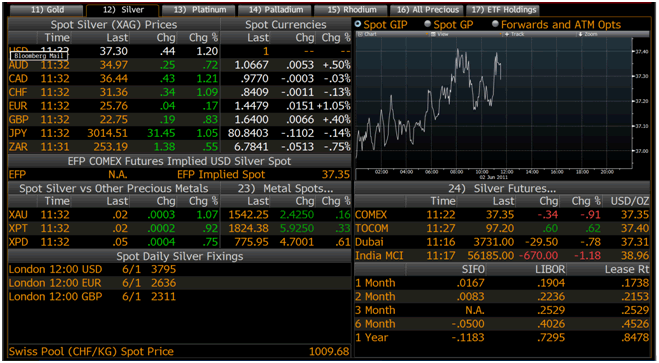

Silver Prices and Rates

Markets await key U.S. data on non-farm payrolls on Friday, while ongoing concerns over Greek sovereign debt and contagion in the Eurozone also affected market sentiment and supported the precious metals.

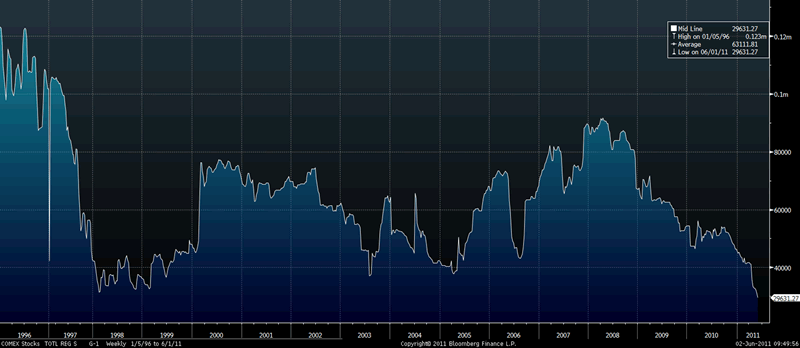

COMEX Silver Bullion Registered Inventories – January 1996 to May 31st 2011

Friday's U.S. payrolls is likely to show that the world's largest economy is weakening and may be on the verge of a double dip which will likely lead to further safe haven demand.

Seeing as the extent of the recovery was always exaggerated, this is not a surprise to us.

The supply situation in the silver market gets more interesting by the day.

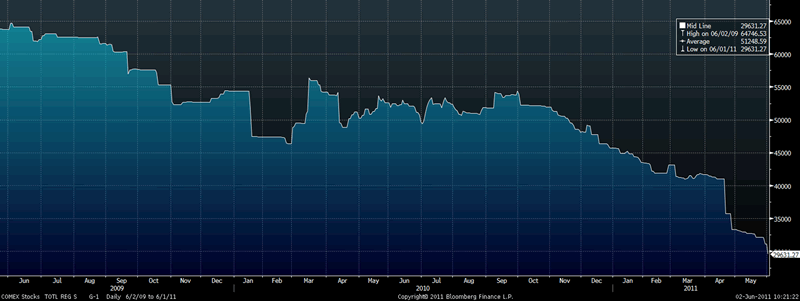

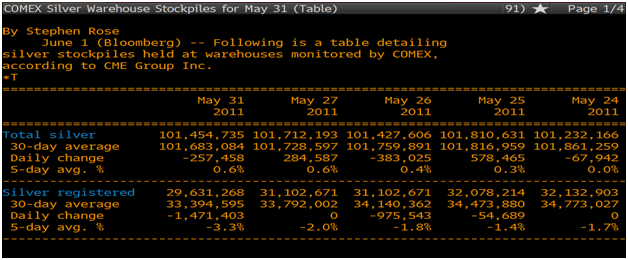

Registered COMEX silver inventories have fallen to multiyear lows at 29,631,268 ounces. In the last 5 days they fell from 32,132,903 ounces to Tuesday’s holdings of 29,631,268 ounces. As can be seen in the table below registered silver inventories fell every single day last week leading to a sharp fall of 8.4% in 5 days.

Registered metals are those metals which meet the standards for delivery under the silver futures contracts and for which a receipt from an Exchange-approved depository or warehouse has been issued. Eligible metals are those which meet the delivery standards as stated in the rules for which no receipt from an Exchange-approved warehouse has been issued.

This is a long term trend that has been seen since the early 1990s when total COMEX silver stockpiles were over 101.45 million ounces.

However, the scale of the drop in inventories since early 2008 is significant and the trend has accelerated in recent weeks.

Registered silver inventories are down a sharp 38.5% in just two weeks – from 41,044,280 to 29,631,268.

COMEX Silver Bullion Registered Inventories – June 2009 to May 31st 2011

The record nominal highs near $50/oz, seen 31 years ago and again at the end of April, are likely to be seen again sooner rather than later due to the increasingly delicate supply demand balance.

The scale of current investment demand and industrial demand, especially from China and the rest of Asia, is such that it is important to keep monitoring COMEX warehouse stocks.

The Hunt Brothers were one of a few dozen billionaires in the world in the late 1970s when they attempted to corner the market. Today there are thousands of billionaires in the world, any number of whom could again attempt to corner the silver market.

Also, today unlike in the 1970s, there are sovereign wealth funds and hundreds of hedge funds with access to billions in capital.

COMEX Silver Bullion Stockpiles – 05/31/11

The possibility of an attempted cornering of the silver market through buying and taking delivery of physical bullion remains real. However it would be very difficult to corner the silver market due to the very small nature of the silver bullion market.

A COMEX default remains a risk as does a massive short squeeze which could see silver surge as it did in the 1970s and again recently leading to silver targeting the inflation adjusted record high of $140/oz.

As ever price predictions from gurus should be take with a pinch of salt and diversification remains of paramount importance.

Gold

Gold is trading at $1,543.05/oz, €1,066.53/oz and £941.40/oz.

Silver

Silver is trading at $37.33/oz, €25.80/oz and £22.77/oz.

Platinum Group Metals

Platinum is trading at $1,821.75oz, palladium at $775/oz and rhodium at $2275/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.