Critical Metals Myths, Markets and Geopolitics

Commodities / Metals & Mining Jun 07, 2011 - 12:51 PM GMTBy: The_Gold_Report

William Stanley Jevons was a 19th century British economist who said, "The more efficient use you make of a scarce material, the greater the total demand will eventually be." Investors in critical metals projects all over the world hope Jevons' theory, known as Jevons Paradox, will eventually ring true. Read more in this Critical Metals Report exclusive.

William Stanley Jevons was a 19th century British economist who said, "The more efficient use you make of a scarce material, the greater the total demand will eventually be." Investors in critical metals projects all over the world hope Jevons' theory, known as Jevons Paradox, will eventually ring true. Read more in this Critical Metals Report exclusive.

But just what are critical metals? They are sometimes referred to as "strategic" or "technology" metals, but clear definitions for these terms often prove elusive and routinely depend on to whom you're talking.

Kaiser Bottom Fish Editor John Kaiser defines critical metals as "metals that are a minor input for an end product, in terms of the total value of the end product relative to the cost of that input and yet that input is critical to the overall functionality of the end product. For example, steel pipes are not made of molybdenum, but molybdenum, which makes up 0.5% of the alloy, gives it corrosion resistance and strength. That makes molybdenum critical to gas pipelines."

That seems simple enough, but separating which metals make the critical metals list from those that don't is a more complicated matter.

"It's a long and changing list," says Jon Hykawy, head of global research with Toronto-based Byron Capital Markets. "[These materials are] critical to someone, to some task at some point in time."

Hykawy explains, "A definitive list has to tell you who has tried to work out what is the critical material and why. If it's an exhaustive list produced by the U.S. Department of Energy, for instance, then it should be a list that indicates the importance of those materials to the U.S. economy. But any list has to consider those three points: For what purpose; who is doing the considering and where, because the list from a Chinese perspective would be completely different than a list from an American perspective and when, because the list has changed dramatically over the course of a couple of decades and it's likely to change very dramatically over the next couple of decades."

Kaiser's list of critical metals is a winding trip through the Periodic Table and includes, in alphabetical order, antimony, bismuth, cerium, chromium, cobalt, dysprosium, europium, gallium, germanium, indium, lanthanum, molybdenum, neodymium, niobium, palladium, platinum, praseodymium, rhodium, samarium, scandium, selenium, tantalum, tellurium, terbium, tin, titanium, tungsten, vanadium, yttrium and zirconium.

A more official, less inclusive list was published in December 2010 by the U.S. Department of Energy (DOE). The 166-page report titled Critical Materials Strategy examines the "role of rare earth metals and other materials in the clean energy economy." The report concludes, "Several clean energy technologies—including wind turbines, electric vehicles, photovoltaic cells [solar panels] and fluorescent lighting—use materials at risk of supply disruptions in the short term."

Of the materials analyzed by the DOE, five rare earth metals—dysprosium, neodymium, terbium, europium and yttrium—as well as indium, were deemed to be the most critical in the short term (up to 5 years) and medium term (5–15 years). (The agency defines critical as a combination of a metal's importance to the clean energy economy and its risk of supply disruptions.)

The "near-critical" metals in the short term included cerium, lanthanum and tellurium. The "not critical" metals were gallium, lithium, cobalt, praseodymium and samarium.

But in five years, the DOE expects that cobalt, indium, lithium and praseodymium will graduate to the "near critical" category.

Jack Lifton, an independent consultant focusing on the sourcing of nonferrous strategic metals, largely agrees with the DOE report and says the most critical rare earth metals are neodymium, europium, dysprosium, terbium, samarium and praseodymium.

These metals are used primarily in magnets and high-efficiency lighting. The magnets are employed in small electric motors to power everyday things like vacuum cleaners, lawnmowers and washing machines, as well as high-end technology applications like windmills and hybrid car engines like those in the Toyota Prius and Chevrolet Volt.

But what about more mainstream metals like nickel, iron or copper? Should they be considered critical metals?

Hykawy argues that copper ought to get some consideration, given its importance in everything from automobiles to basic infrastructure.

"I was told by a senior person at a global auto manufacturer that if he was asked to build a hybrid or electric car without rare earths, he could do it. He said [the car] might not be very good, it might be less efficient, it might be heavier but he could do it. But if someone asked him to build a car without copper, he said it would be back to the drawing board," Hykawy explains.

Kaiser says that when the metal is effectively the end product, that metal shouldn't be considered critical.

"Some people say copper is critical for all kinds of things, but a wire is a wire and a pipe is a pipe. The metal is virtually the thing in itself; whereas, if you added some neodymium to iron to create super magnetic strength in a magnet, that neodymium is critical to that [magnet's] extra functionality," he argues.

Myths

Hykawy says one of the critical metals myths is that they are both rare and expensive.

"It's not true," he says, "you can have an industry dependent on metals that are relatively common but if the downstream dependence is strong enough, you can have a significant impact on revenues in a much-larger industry with something that really isn't worth all that much. A good example of that would be dysprosium. Dysprosium is becoming more expensive per kilogram but the world market for it is still tiny. Yet without it, you can't build permanent rare earth magnets that work at high temperatures. And without being able to do that, you're not going to commit to the manufacture of those magnets and the manufacture of motorized vehicles that are dependent on motors containing those magnets. So, we put dysprosium on the critical materials list because with a lack of that you're basically impacting a large automotive sector."

Another item few people understand is the length of time between the discovery of an economic deposit and the production of metals from that deposit.

The Halifax, Nova Scotia-based Metals Economics Group says that about 13% of the $1.17 billion spent in 2010 on exploration for commodities other than gold, base metals, platinum group metals and diamonds, was spent on lithium and rare earth exploration—that's about $152M or four times the amount spent exploring for lithium and rare earths in 2009.

Lifton says that while more companies are seeking these kinds of deposits, it still takes 10 years on average for a rare earth deposit to reach production.

"People don't realize how long it takes to get a mine into production," he says, adding, "at this point, the most [mining] friendly place in the world is [the Canadian province of] Quebec."

Markets

Large mining companies spend millions studying macroeconomic trends to determine when to bring their commodities to market in order to maximize profits. These companies have largely ignored critical metals because they lack the economies of scale for bulk-mineable metals like iron and copper.

It's not that critical metals deposits are necessarily small—far from it. If either Avalon Rare Metals Inc. (TSX:AVL; NYSE.A:AVL; OTCQX:AVARF) Nechalacho Rare Earth Element Project or Quest Rare Minerals Ltd. (TSX.V:QRM; NYSE.A:QRM) Strange Lake Rare Earth Project, both of which are in Canada's Far North, were to be brought into production, the resulting supply of heavy rare earth elements could meet global needs for the foreseeable future—even without exports from China. The problem with developing these assets is that it's expensive—sometimes into the billions—and complex, given the limited scope and nebulous nature of the markets for the individual rare earth metals.

"The problem with the critical metals is that their individual markets are quite small in the grand scheme of things," says Kaiser.

According to Kaiser, the supply chain model for mined commodities that's been in effect for about the last half century or so is now "under siege," at least as it applies to critical metals.

The old model essentially said the lowest-cost producer wins, but that approach has led to China controlling more than 95% of the world's supply of rare earth elements because the country was willing to subsidize production—and suffer the environmental effects—in order to control the market.

"One of the concepts that's starting to circulate," says Kaiser, "is that the end users need to make upstream investments that are not economic investments. In other words, investments that are not geared toward making a profit by mining the stuff and selling it in the commodity markets; but the profit is actually implicit in the avoidance of the opportunity cost that they would otherwise suffer by not having a secure supply of [these metals] that are critical to their downstream business plan."

Another approach is getting governments involved.

Price floors are one way, Kaiser believes, that governments could guarantee supply. In theory, government-backed price floors would keep critical metals-producing companies in business by creating minimum prices for any metals they produce if there is inadequate demand on the open market.

Other companies, like California-based Molycorp Inc. (NYSE:MCP), have sought loan guarantees from the U.S. government, albeit without much success to date. But the Rare Earths Industry and Technology Association (REITA), a Colorado nonprofit lobbying firm, continues to press for subsidies and advantageous legislation for its clients.

In a rare earth article entitled, Location, Location, Location. . ., Lifton looked at rare earth demand catalysts in terms of both geography and industry.

Lifton estimates that the United States uses about 10,000 tons of rare earth elements every year in manufacturing. Most of these are light rare earth elements (lanthanum, neodymium, cerium, praseodymium) used to produce fluid-cracking catalysts that "crack" petroleum hydrocarbons at oil refineries. But these catalysts account for only 5%–10% of global rare earth production.

He further explains that most of the demand for rare earths is not from manufacturing in North America or Europe. "The target market for 90% of your production is Asia," Lifton says.

In a December 2009 interview, Lifton told The Gold Report: "I don't mean to be a doomsayer, but if the Chinese government wants its own people to have the standard of living that people in Los Angeles have today, it's going to mean that China must use all of its own natural resources to improve its standard of living and its quality of life, which will mean that our standard of living will have to decline. Why? Because there are some materials—for example, the rare earths—that China controls 100% of the supply of today. And as its economy is growing, China is requiring more and more of these materials for its own domestic economy."

China has since introduced tight export quotas and a 25% export premium on rare earths and other metals deemed essential to the Chinese economy. More recently, the country brought in a tax of about $9/ton on light rare earths.

Lifton says China has vast reserves of light rare earths but that its supply of the heavies is waning.

"I'll be very surprised if it exports any dysprosium and terbium [in a few years]—the most important heavy rare earths used in the magnet industry and the lighting industry," Lifton says.

Geopolitics

In late May, the Chinese government announced that it would launch a rare metals exchange based in Shanghai. Akin to the London Metals Exchange, the Baotou Rare Earth Products Exchange will trade only spot products and serve to smooth out the supply and demand of rare earths for the Chinese economy.

The Chinese government plans ahead in five-year increments, Lifton notes, and the exchange is all about making certain that there will be an adequate supply of rare earths for the projects China plans to undertake over that period and beyond.

"China doesn't care about our quality of life or our standard of living. Everything it does in the country is for the purpose of improving the Chinese economy. It is doing everything it can to discover future prices, so it can plan future production and make sure it has enough [rare earths]," Lifton explains.

Another reason for the exchange is the underground market for rare earths.

Some estimates put the smuggled supply of Chinese rare earths at as much as 40,000 tons annually. The Chinese government believes the transparency of the Baotou Exchange will help mitigate the problem.

The government also has charged Inner Mongolia Baotou Steel Rare-Earth Hi-Tech Co. Ltd., the world's largest rare earth producer, with cleaning up its rare earth industry by eliminating some of the small-scale producers known for causing vast environmental damage in the clay deposits of southern China.

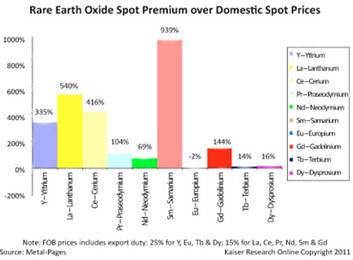

Kaiser says the environmental crackdown has resulted in higher domestic prices for heavy rare earths (see chart) versus freight on board (FOB) prices, but still there is a significant gap between what the Chinese pay for rare earths versus the rest of the world.

Hykawy says this will result in further geopolitical tension in the market for critical metals, especially between America and China. He hopes, however, that market economics ultimately win out.

"I hope the rule that everybody continues to live by into the future is to let the industries and economics decide who is going to get the materials and what they're going to be used for. And let's leave the geopolitical wrangling and the protectionism for another day," he says.

Investing

Investing in companies operating in the critical metals space has proven lucrative over the last three years or so, as the prices for critical commodities have soared. For instance, from May 29, 2008 until May 31, 2011, Avalon shares jumped from CAD$1.30 to CAD$7.56, or 482%.

Over the same period, Quest shares exploded from CAD$0.145 up to CAD$7.54, or an incredible 5,100%.

Molycorp, famous for its vertically integrated mine-to-magnet strategy at its Mountain Pass rare earth facility in southeastern California, went public at $14 in July 2010 and closed at $66.43 on May 31—an increase of roughly 375% in less than a year.

What's spawned these kinds of returns? Some think it's hype, and some of it is, but others point to critical metals prices—some of which are on unprecedented 10-year bull runs.

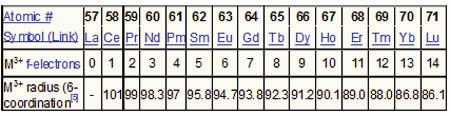

Emerging Trends Report Managing Editor Richard Karn says the price for rare earth elements—the 15 lanthanide elements, numbers 57–71 on the Periodic Table (see chart), plus yttrium—have risen a combined 1,700% over the previous decade.

Kaiser's site, Kaiser Bottom Fish, has charts for a handful of rare earth oxides. The FOB price for samarium, employed in highly strategic military applications, went from about $5 per kilogram (kg.) in January 2008 to $150/kg in January 2011. Meanwhile, the FOB price for neodymium, used to make the world's most powerful permanent magnets, went from about $30/kg in January 2008 to more $250/kg in late May.

Karn says critical metals have experienced similar gains: zirconium and magnesium were up 950% over the last 10 years; whereas tungsten was up 750%; vanadium, 300%; and germanium, 250%.

Karn posits that a basket of global demand drivers—politically motivated export restrictions, environmental crackdowns, civil conflicts, scarcity of deposits ready to be mined, and "relentless" demand for computers, cellular phones and LCD TVs—will all continue to underpin critical metals prices for the foreseeable future.

Kaiser, meanwhile, lists 20 rare earth companies on his Kaiser Rare Earth Stock Index but there are upwards of 60 critical metals trading on global bourses.

In January 2008, the total market cap of the companies on Kaiser's proprietary index was just below $500M. In March 2011, the combined market cap of the companies on his index eclipsed $1.5B before slipping to around $1.4B in late May.

The volume of shares traded in those 20 companies varies greatly. On June 1, more than 48.5 million shares of Lynas Corporation (ASX:LYC), which is developing the Mount Weld Rare Earths deposit in Western Australia, changed hands, whereas only 10,700 shares of Frontier Rare Earths (TSX:FRO) were traded.

"We're in a special window," Kaiser says. "Critical metals are tied to innovation and energy policies and things like that, which are hitting critical mass right now."

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) Brian Sylvester of The Gold Report conducted this interview. He personally and/or his family own the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Timmins.

3) Ian Gordon: I personally and/or my family own shares of the following companies mentioned in this interview:Timmins Gold, Golden Goliath, Millrock and Lincoln. My company, Long Wave Analytics is receiving payment from the following companies mentioned in this interview, for receiving mention on my website, Golden Goliath, Millrock and Lincoln Gold.

The GOLD Report is Copyright © 2011 by Streetwise Inc. All rights are reserved. Streetwise Inc. hereby grants an unrestricted license to use or disseminate this copyrighted material only in whole (and always including this disclaimer), but never in part. The GOLD Report does not render investment advice and does not endorse or recommend the business, products, services or securities of any company mentioned in this report. From time to time, Streetwise Inc. directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.