US Dollar Death Spiral, Economy Hurtles Toward System Failure

Currencies / US Dollar Jun 09, 2011 - 05:55 AM GMTBy: Jim_Willie_CB

The combination of $trillion bond fraud, dependence on inflating home equity for economic development, oversized cars, oil dependence, constant market intervention, insolvent banks, insolvent homes, outsourced industry, endless war, budget deadlock amidst runaway deficits, raided US gold treasury, mammoth future benefit obligations, and handing over the keys at USDept Treasury to Goldman Sachs has left the United States to fend off systemic failure. The creeping price inflation that stems from USFed hyper monetary inflation and total ignorance on basics of capitalism like business formation have left the US vulnerable to disorder and chaos. The chaos in fact grows with the passage of time and the ruin of money, against a background of a cruel middle class squeeze. With one citizen in seven on food stamps and over 22% of the population jobless, the sunset of the American Empire is well along. The banker oligarchs are gradually killing the nation, its democracy, and its wealth engines during a sustained strangulation process.

The combination of $trillion bond fraud, dependence on inflating home equity for economic development, oversized cars, oil dependence, constant market intervention, insolvent banks, insolvent homes, outsourced industry, endless war, budget deadlock amidst runaway deficits, raided US gold treasury, mammoth future benefit obligations, and handing over the keys at USDept Treasury to Goldman Sachs has left the United States to fend off systemic failure. The creeping price inflation that stems from USFed hyper monetary inflation and total ignorance on basics of capitalism like business formation have left the US vulnerable to disorder and chaos. The chaos in fact grows with the passage of time and the ruin of money, against a background of a cruel middle class squeeze. With one citizen in seven on food stamps and over 22% of the population jobless, the sunset of the American Empire is well along. The banker oligarchs are gradually killing the nation, its democracy, and its wealth engines during a sustained strangulation process.

UNDERWATER NATION THAT CANNOT SWIM

Comments by economists continue to center on consumer spending and desired job growth, without any mention of business investment and reduced regulatory impediments. The nation has no clue among leaders to engineer a recovery. Tragically, it is not possible unless the housing market rebounds convincingly, and unless the big US banks are liquidated. The negative momentum is so grotesque. It is like a man sliding backwards on a steep icy street with no objects nearby to grab. The remarkable fact in my view is that so many trained economists and market mavens are shocked that the USEconomy is entering another recession. They must have considered Clunker Car program, New Homebuyer Tax Credit initiative, and the General Motors bailout all to be genius concepts. They seem poorly trained in capitalism, and well trained in asset inflation management laced with public indoctrination. To the sound money crowd, the degradation was obvious. The landscape is taking on the same look at mid-2008 when all hell broke loose on the financial and economic fronts. It should not be so surprising, since nothing has been fixed.

Innovation remains prevalent among technology and telecommunication firms. Too bad so much of the product output is done by US subsidiaries in Asia. The USGovt leadership thought a green revolution would make for a solid initiative until it realized that most of the purchases would come from Asia. The high speed rail projects almost all involve Chinese equipment. The US is so badly on a slippery slope, that a simple debt default might be the best of outcomes to hope for, given the nasty added ramifications that could come from chaos. The main location for innovation within the USEconomy seems to be in financial fraud and military weapons. Former USFed Chairman Volcker once accused the financial industry of having only one productive innovation in three decades, the automatic teller machine (ATM), a scurrilous accusation indeed.

The American people, having been exposed to a powerful cost surge, futile compromises to address the USGovt budget deficits, profound mortgage fraud, a series of fixes without solution that are disguised elite banker redemptions, tremendous waste of over $2.5 trillion in various policy initiatives, exemption from Wall Street prosecution, chronic housing market decline, and phony economic statistics, are awakening to the reality of a systemic failure USEconomy, punctuated by a USTreasury Bond default. The preliminary signal is full isolation by the USFed as sole buyer of USTreasurys at USGovt debt auctions. They are currently buying about 80% of USGovt debt at official auctions. Many dopey analysts have put forth the notion, even within the gold community, that a debt default is impossible given the control of the global reserve currency to cover the debt. This is shallow thinking in my view. Once the USFed and its monetary engines are exposed on the world stage to rely upon hyper monetary inflation to sustain the broken USGovt financial contraption where fraud and war and insolvency are the three passengers without a driver, the USDollar will be punished, avoided, and become the object of even more profound revolt. The leaders can swim only if they push others in the pool underwater. Most debt default starts with a nasty run on the currency.

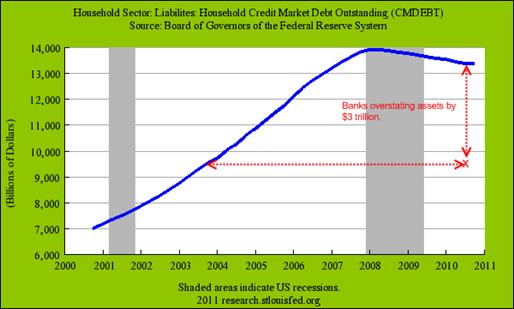

The underwater nation suffers from massive insolvency in the banking sector. Three bad jokes are played upon the US public. 1) They are told that the banks hold large Excess Reserve accounts at the USFed, earning interest income. Lie! The funds are Loan Loss Reserves moved from the banks to the USFed, where the central bank is hiding its own insolvency. The banks will need those funds to cover losses. The USFed by loose calculations is between $1.4 trillion and $1.8 trillion in the red, mainly from purchasing overpriced mortgage assets, some of whose leveraged items are totally worthless. The housing market is not coming back. The USFed itself is starging at the abyss, and might resign its commission. 2) The big US banks claim also that they have tightened their lending standards. Lie! They are insolvent and therefore must reduce their lending on a grand scale. The big US banks are in possession of far less capital than they claim, thanks to the FASB accounting rule change put into effect in April 2009. Their plight worsens. They cannot dump REO bank owned homes on a depressed market. The big US banks are trapped in an extreme and worsening condition, insolvent to the tune of $3 trillion. The FDIC pretends to have funds to support over $7 trillion in banking deposits, but their insurance fund has long been depleted. The MyBudget360 outfit does great work in analysis of the housing market and mortgage finance. See their chart below on bank balance sheet over-statement. 3) Lastly, US corporations we are told own huge cash balances. Lie! Their foreign subsidiaries command the cash, and it will not be put to work on US soil, even with handsome benefits to repatriate the funds. Business prospects look horrible in the United States, the land of fraud, insolvency, and war.

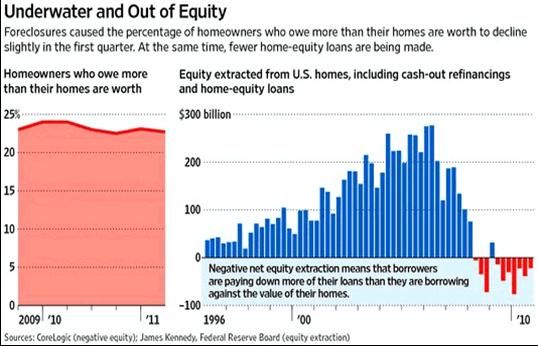

The underwater nation at the domicile level is tragic. Fully 28.4% of homeowners suffer from negative equity. They owe more on their home loans than the value of their homes. Some call it being underwater, others upside down. A second mortgage misery has taken root. Almost 40% of homeowners who took out second mortgages are underwater on their loans, more than twice the rate of owners who did not draw funds in such loans. Also 38% of borrowers who took home equity loans are underwater. By contrast, 18% of borrowers who do not have these loans are underwater. This data is according to CoreLogic. According to Federal Reserve Board data, homeowners took out a total of $2.69 trillion from their homes at the height of the housing boom between 2004 and 2006. A grand dependence was fostered, turned into a nightmare. That tally includes cash-out refinancings. Such sources of funds have vanished altogether. In fact, the trend has reversed, as homeowners are putting more money into their home equity in attempts to relieve their insolvent condition. The risks extend beyond the borrowers to banks, in a parade of insolvency and ruin for homeowners and big banks.

USGOVT DESPERATE GRABS

THE USGOVT IS DESPERATE FOR FUNDS. The unspoken message regarding the increase to 3% in US bank reserves requirements is that the USFed and USDept Treasury are seeking additional buyers of USTBonds when they attempt to draw QE2 to a close. This week, a controversial bank rule from Basel 3 was put into effect. US banks must put up more in reserves. They central bank has decided to eat their own banks. A banker civil war is at risk of being triggered. Stick with more basic desperation. The USGovt is making progress in raiding federal pension funds, so far snatching $79 billion. Some calling it accounting sleight of hand, but others call it confiscation much like the replacement of gold at the USTreasury with paper IOU certificates. It is worth the effort to quantify the USTreasury plunder of official retirement accounts, after the Social Security Trust Fund has been gutted. The USGovt debt limit must be raised, but compromise cannot be achieved. So the government raids public pensions with the same impunity that Wall Street commits bond fraud and deals with counterfeit. We are still looking for over $1 trillion in undelivered USTBonds, the infamous failure to deliver. The Wall Street firms found a clever method to feed their own liquidity by selling USTBonds they did not own. Of course, the regulators have a GSax pedigree. The Civil Service Retirement & Disability Fund (CSRDF), according to Stone Mountain, has been raided for $22 billion in recent weeks, with funds replaced by government IOUs. The funds have suffered a sizeable disinvestment, to be sure, to keep America strong.

The balance of securities held by the Thrift Savings Fund, aka the G-Fund, also according to Stone Mountain, has been raided for $57 billion in recent weeks, with funds replaced by government IOUs. The funds have suffered a sizeable disinvestment, to be sure, to keep America strong.

The retirement funds have seen a raid of nearly $80 billion in the past 3 weeks just to make space for further funding of bloated government, defense spending, and healthcare benefits. Under Treasury Secy Geithner, the USGovt has begun a Debt Issuance Suspension Period (DISP) for about 2-1/2 months, ending on August 2nd. The USCongress argues over small potatoes like $38 billion in spending. They argue over keeping certain spending intact, and keeping the war off limits to discussion entirely. They argue over imposing tax increases. They do not bother to pursue cuts to mindless programs of no value, like those suggested by Senator Coburn of Oklahoma. The nation of citizens is also prone to raids of pension funds, basic 401k pension fund loan grabs. Investors tap their inner bankers, even if with heavy tax penalties. In 2010, one in seven workers borrowed from a 401k plan, according to the consulting group AON Hewitt. Today, almost 30% of 401k savers have a loan outstanding against such funds, the highest in recent history.

So as Rome burns, the legislators fiddle and the generals wage war for private gain. The situation is best put into perspective by David Stockman, former Budget Director in the Reagan Admin. He said, "The real problem is the de-facto policy of both parties is default. When the Republicans say no tax increases, they are saying we want the US government to default. Because there is not enough political will in this country to solve the problem even halfway on spending cuts. When the Democrats say you cannot touch Social Security, when you have Obama sponsoring a war budget for defense that is even bigger than Bush, then I say the policy of the White House is default as well."

But the true insanity and unfixable nature are brought into proper perspective by John Williams, who heralds from the noble Shadow Government Statistics clan. He said, "[The USGovt deficit] cannot be covered by taxes. The government could take 100% of everyone's income, corporate profits, and it would still be in deficit. [Conversely] they could also cut every penny in government spending except for Medicare and Social Security, and they would be in deficit." The message by Williams is that the national government finances are not even remotely fixable, even with total income confiscation, even with almost full government shutdown!! GOLD & SILVER PRICES SHOULD ZOOM ON A BILLBOARD MESSAGE BY STOCKMAN AND WILLIAMS ALONE. My forecast made in September 2008 stands, that the USGovt debt default will occur in two to three years time. Time is up, and the threat of debt default looms large.

NOTHING FIXED, STILL INSOLVENT & FRAUD RIDDEN

The following paragraph should be read twice:

One should constantly remember that no solution to the financial crisis has been installed, nothing fixed, no big banks liquidated, no end to monetary inflation, no end to outsized USGovt deficits, no change of Goldman Sachs running the USGovt finance ministry, no discharge of big bank home inventory, no end to secretive subterranean support of stocks and bonds, no revival of the housing market, no return of US industry from Asia, no prosecution of Wall Street for multi-$trillion bond fraud, no end to money laundering of narco funds to Wall Street banks, no interruption to the endless costly wars, no end to the propaganda obediently pumped out by the US press & media networks. Nothing has changed except that some commodities are lower in price, including the queen Silver.

The steady stream of debt downgrades around the world curiously overlooks perhaps the worst offender of all, the United States. Refer to its horrendous PIIGS-like key ratios with much higher volume of debt. It seems good sport to nail Greece or Spain with a debt downgrade, when the US wrestles with a debt limit and chronic $1.5 trillion annual deficits, even costly endless wars. So Moodys is telling the USCongress that they better raise the debt ceiling or else. Or else what? Nothing!! The German debt rating agency Feri had the stones to downgrade the USGovt debt from AAA to AA. It is a significant slap in the face. They pointed to the fact that for the third consecutive year, the USGovt deficit is over 10% relative to gross domestic product (GDP). Its CEO Tobias Schmidt said, "The US government has fought the effects of the financial market crisis primarily by an increase in government debt. We do not see that here is sufficient alternative measures. Our rating system shows a deterioration, so the downgrading of the credit ratings of US is warranted. Deficits of such magnitude are not a sustainable fiscal policy. We would reconsider the rating when the US government creates a long-term sustainable budget."

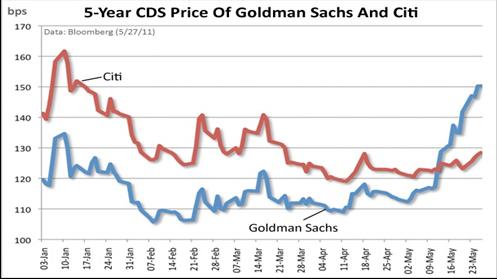

The debt rating agencies are bound by extreme political pressure, and probably secretive pressures also, maybe even outright bribery or violent threats. The agencies can shoot at the scouts like Bank of America, Citigroup, and Wells Fargo, but few if any alarm bells are actually going off. The champion of all insider trading, of investing in opposition to clients, of front running USGovt policy, of deceptive collusion with foreign governments on currency swaps to hide debt, the venerable Goldman Sachs might be in some trouble. The Goldman Sachs credit default swap could serve as a predictor for USGovt debt default. It has begun to rise and cause concern.

It is almost funny, if not tragic, that despite deferred criminal prosecution on mortgage bond fraud, despite being banned in Europe for misrepresentation and collusion to conceal sovereign debt, Goldman Sachs still has total control of the USDept Treasury. If only the people were more aware that GSax under Robert Rubin leased, sold, and leveraged a few $trillion in profit from the gold bullion that used to reside in Fort Knox. A reliable source has a friend who manages a security group in Fort Knox, which is used today to store nerve gas, nothing more, certainly no gold. The Jackass fully expects a USGovt debt default will come in the form of a forced debt forgiveness, during a grand global conference, with a hidden military threat looming. Events in Libya are extremely telling on the threat of war and wealth confiscation. A total of $95 billion in frozen (later stolen) Qaddafi wealth is a strong banker motive to conduct a good war in Libya. In all, $32 billion in Libyan funds were frozen in major US banks, and 45 billion Euros were frozen in major European banks.

Two events occurred within 24 hours of big significance. 1) The USFed Chairman Bernanke spoke after the financial markets closed. He cited numerous singular events to blame for the rising price inflation that has plagued the USEconomy in recent months. He accepts no responsibility from the historically unprecedented release of the hyper monetary inflation spigot to cover the USGovt debts and purchase USTreasury Bonds that the world no longer wants. The USFed is currently purchasing between 75% and 80% of all USTreasury auction bonds, notes, and bills. They use a nifty quick turnaround with the obligated Primary Bond Dealers. What used to distributed to bond funds like PIMCO and pension funds across the US land are no more. The dedicated Primary Bond Dealers have resorted to shoving all the USTreasury product back to the USFed inside one month in anything but routine FOMC operations, usually in two weeks time. The US financial press reports hardly a peep. In the last few months, every time Bernanke spoke, to discuss the weak prospects of the USEconomy, the high commodity price phenomenon, the putrid banking situation, the droopy housing market, the falling USDollar, and the ongoing activity of Quantitative Easing, the USDollar fell and the Gold price rose. Nothing has changed in that respect. Waiting until 5pm to speak only caused the response to occur in the next morning.

2) The OPEC nations met at their usual pow-wow in Vienna Austria, but they accomplished nothing. They split 6 in favor and 6 against on a crude oil production increase. The dirty little secret is that the Saudis no longer have ANY spare capacity. The world always counts on the Saudis to compensate for lost output like what has been felt from Libyan disruption. The crude oil price jumped $2 quickly on Wednesday morning. My view is that the OPEC nations no longer harbor any sympathy for Western nations, have no interest in relieving their cost problems from rising energy prices. They see their own food prices rising fast, when they are more vulnerable to food prices as a people. They observe the unrest in Egypt, the war in Libya, and can see the flight of gold from those countries, while assets are confiscated in Western banks. The OPEC nations see more opportunity to gather in greater petro income at a time of great strain for their own economies and banking systems.

A geopolitical impact is on the horizon. The Saudis cannot increase output. The Petro-Dollar defacto standard is built on Saudi oil, whose volume is far less than believed. They have a dead elephant oilfield in Ghawar, details in the private reports. The Bernanke speech that cited numerous exogenous factors, plus the OPEC stalemate, seems to provide the Gold & Silver price the lit fuse for rising. The Petro-Dollar requires USMilitary protection of the Saudi royal billionaires. They are busy cutting deals for Persian Gulf security from China and Russia. It requires control of oil supply by the Saudis. It requires a US$-based purchase & sale of crude. All three requirements are slowly vanishing. The Petro-Dollar is dying a slow death. With its disappearance will come the Third World to the United States.

Paul Craig Roberts served in Reagan Treasury Dept, and also worked as editor at the Wall Street Journal. He knows about what he speaks. He described the horrendous economic situation for the USEconomy. He puts blame on Wall Street and US Corporate executives who use Asian labor in outsourcing, rendering the US nation of workers poor. Even astute analysts like Roberts all avoid the 1970 Vietnam War effect and 1973 OPEC Embargo effect that produced big deficits and serious price inflation in the US, forced the break of the Bretton Woods gold standard, and lifted the entire wage scale to where it became uncompetitive and vulnerable to globalization. Roberts discussed the secondary inflation effect, a common Jackass theme. The bankers and political leaders do not wish to see wages rise, since it would complete the systemic price inflation effect. Instead, they watch the rising cost structure, led by food & gasoline most visibly, and attempt to obstruct wage gains. My analysis has pointed out that the leaders in preventing wage gains are advocating and promoting lost income, personal ruin, and deep poverty of the middle class. Roberts instead calls it the Graveyard Effect from a desire to install lower US labor rates in order to compete with the BRIC nations, the emerging market nations. He went so far as to accuse our leaders of trying to promote debt slavery managed within a growing police state.

QE3 A CERTAINTY

Ultimately, the wretched condition of the USEconomy, the US banks, the US households, and the USGovt guarantees continuation of Quantitative Easing. The USFed and USDept Treasury are actively pursuing a Scorched Earth program to send the financial markets downward, even as the laundry list of horrendous USEconomic statistics reads endlessly. Details on the degradation of the USEconomy can be found in the June Hat Trick Letter report. The next round might be renamed Global QE. Watch the Japanese Yen, whose exchange rate is back over 125 in a sudden upward thrust, fully forecasted by the Jackass in April. They are selling USTBond assets to raise cash for reconstruction and to cover trade deficits. If another G-7 Meeting is hastily convened, they will coordinate USTBond purchases again. Call it Global QE, a far more powerful Quantitative Easing initiative with greater commodity price impact on a global scale. Expect it.

- Basically, QE2 was a failure, so it will be repeated.

- The QE2 provided demand for USTreasury auctions, when most foreign creditors went on a buyer's strike. So QE will be repeated.

- The housing market has resumed its downward path, with frightening declines to the bank balance sheets. So QE will be repeated.

- The big US banks remain insolvent, loaded down by a mountain of one million REO homes in inventory. Buyers of mortgage bonds have disappeared. So QE will be repeated.

- The USGovt deficit picture is a full blown nightmare. Rather than see market mechanisms kick into gear, with higher interest rates imposed, the leaders will continue on the hyper monetary inflation path. So QE will be repeated.

- Talk of the risk trade counter to the USDollar ending is nonsense. Weimar has met Wall Street, the syndicate handlers of the USGovt and US security agencies. The Printing Pre$$ with US nameplate cannot be stopped. So QE will be repeated.

- The Gold & Silver prices will move up hard, as soon as the light bulb goes on that QE3 is imminent without interruption. One must be a total moron not to anticipate its immediate installation. To decide not to continue QE would force failures upon major US banks.

- The USFed is all bluff with no good cards in their poker hand. They will wait for stocks to be a little cheaper and both sides of the USCongress to beg for QE3.

Inflation is all the US banking leadership knows. Left with poor or limited policy options, they will inflate more. Struggling with national insolvency, they will inflate more. Unable to load on vast stimulus packages, they will simply rely upon basic run-of-the-mill inflation. The USFed Chairman should be called the Secretary of Inflation, in a perfect world. Inflation is all they know. They will inflate until the USEconomy is a burned crisp and the US banking system is a charred ruin. The USDollar is halfway complete with a death spiral. GOLD & SILVER PRICES WILL RESPOND WITH A MOONSHOT. The FOREX market is not the domain of fools.

THE USDOLLAR DEATH SPIRAL

The big FX currency traders realize the USDollar is in a terminal decline. The big FX currency traders realize the USGovt and USFed are locked in a corner with no good policy alternatives. The rebound from May has ended. It relieved the oversold condition, and not much else. Crude oil is back over $100 per barrel. Gold is back pecking away at the $1550 level. Silver is set to challenge the $40 level again. Nothing has changed except the illusion of a tighter USFed policy, which is slowly fading away in a reality backdrop. Recall their nonsense propaganda in early 2010, about an Exit Strategy from the 0% corner. Instead, as the Jackass correctly forecasted, they went deeper with a QE card. Then amidst denials, another correct Jackass forecast, they went deeper with a QE2 card. They will go to a QE3 card next, since they are far more desperate with even more ruinous fundamentals than a year ago. It could go into a pre-emptive Global QE, thus relieving the USFed as the lone perpetrator, my forecast. The USDollar knows it. The investor community is awakening to it. The USEconomic statistics echo the QE sirens calling the corporate ships at sea to their deaths on the rocky shores. Gold & Silver will rise in the second half of the year. This time the Second Half Recovery will feature precious metals on an absolute tear!!

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"When I initially read your writings, they provoked a wide range of emotions in me from fear and anger to outright laughter. Initially some of your predictions ranged from the ridiculous to impossible. Yet time and again, over the past five years, I have watched with incredulity as they came true. Your analysis contains cogent analysis that benefits from a solid network of private contacts coupled with your scouring of the internet for information."

(PaulM in Missouri)

"Your analysis is absolutely superior to anything available out there. Like no other publication, yours places a premium on telling the truth and provides a true macro perspective with forecasts that are uncannily accurate. I eagerly await each month's issues and spend hours reading and studying them. Many times I go back and re-read the most current issue just make sure I did not miss anything the first time!"

(DevM from Virginia)

"I think that your newsletter is brilliant. It will also be an excellent chronicle of these times for future researchers."

(PeterC in England)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.