Why Gold and Silver Are Not in a Bubble

Commodities / Gold and Silver 2011 Jun 11, 2011 - 06:14 AM GMTBy: Jeb_Handwerger

Any thoughts of a bubble in precious metals is not pertinent at this time. As long as mining stocks are not in favor then any thoughts of a bubble are not applicable in the current situation. Mining stocks should be soaring in tandem with their brothers in bullion. Such is not the case. Miners are trading far below general market valuation. In past history during a bubble, mining stocks soared to hundreds of dollars a share at the same time as bullion.

Any thoughts of a bubble in precious metals is not pertinent at this time. As long as mining stocks are not in favor then any thoughts of a bubble are not applicable in the current situation. Mining stocks should be soaring in tandem with their brothers in bullion. Such is not the case. Miners are trading far below general market valuation. In past history during a bubble, mining stocks soared to hundreds of dollars a share at the same time as bullion.

Wealth in the ground represents an open ended warrant on mining potential. Mines can grow, new ore bodies can be found, while bullion has no such potential open ended expansibility.

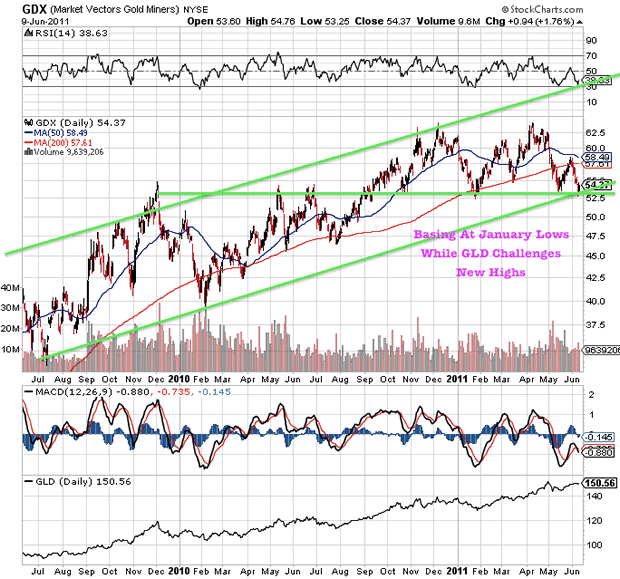

Gold mining stocks(GDX) are incredibly cheap at $1500 gold(GLD). Before the credit crisis in March of 2008 as gold hit $1000 an ounce, miners (GDX) hit its all time high of $55. Now three years later gold is 50% higher, yet the miners have barely been able to breakout of the $55 range. Yamana (AUY) and Kinross (KGC) Gold are two majors that have been significantly underperforming gold over the past three years and are not near their pre credit price levels in 2008. These stocks have not provided any leverage to the price of gold to their shareholders. Investors are sticking to the bullion etf's and are disinterested in the miners. This lack of interest in this sector signals we still have some way to go in this precious metals bull market.

The gold miners should be trading higher if they kept pace with the rise in the bullion. The standard deviation between miners and gold bullion has never been so great. It is at times such as these that investors can benefit from this apparent discrepancy.

Currently mining stocks have corrected because of apprehension regarding the possible exit from QE2 and growing difficulties for miners worldwide. Investors who were burned during the 2008 credit crisis are concerned about a repetition of such an occurrence and its effect on a potential counter trend rally in the U.S. dollar (UUP) and long term treasuries (TLT). Small mining companies (GDXJ) depend on a readily available line of credit. Investors fear if the flow of capital were to be shut off as had been their experience in the past, their ability to operate might be impaired.

This may represent a buying opportunity for investors in small miners(GDXJ). Miners represent assets in the ground whereas etf's such as GLD and SLV may have a built in weakness in the actual physical gold and silver they are holding. If called upon to produce the actual bullion, they might not be able to do so. This would favor mining stocks which represent actual wealth in the ground.

There may be an implicit weakness in the very nature of a strictly bullion etf. Simply put a large quantity of bullion may not be able to be produced on demand. Do not be surprised if the bullion etf's find themselves unable to meet the demands of the marketplace.

In such cases, the miners would once again come into favor as the investment vehicle of choice. At present there is a deviation between bullion and assets in the ground. Investors may be reluctant to hold paper in such a climate of fear and uncertainty. There are presently astute wealthy investors who have sold some of their bullion to purchase mining stocks.

Again note that many miners are presently languishing while bullion etf's struts across the financial stage. This anomaly may not last much longer. Presently mining stocks are going through a major firesale, while bullion commands center stage.

In the markets, it is prudent to expect the unexpected. That is why we should seize the opportunity to buy straw hats in winter. Such an opportunity may be upon us now as bullion etf's may stumble in the future.

The gold mining etf (GDX) may be making a critical turn in the low 50's as it has broken through trend support. The technical conditions are even more oversold than the reversal lows in January 2011, July 2010 and February of 2010. A move above the trendline and moving averages may turn out to be a very powerful buy signal and signal the current correction is over. Careful monitoring of the uptrend is required.

I invite you to partake of my members only stock analysis service for free by clicking here.

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.