Stock Market Bottom Getting Closer

Stock-Markets / Stock Markets 2011 Jun 13, 2011 - 06:45 AM GMTBy: John_Hampson

I present 8 more bottoming indicators, or indicators that are now at further extremes:

I present 8 more bottoming indicators, or indicators that are now at further extremes:

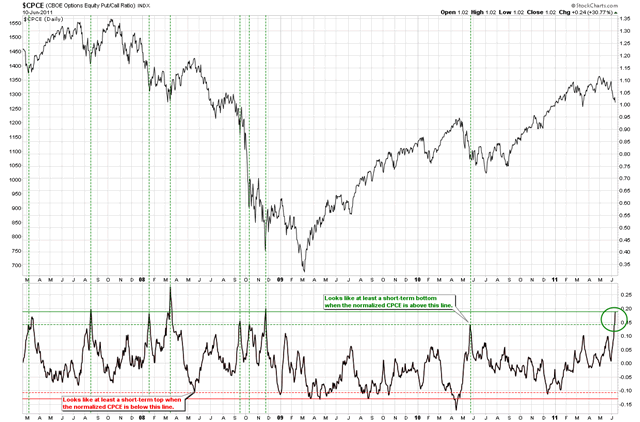

1. CPCE

Source: Cobra's Market View

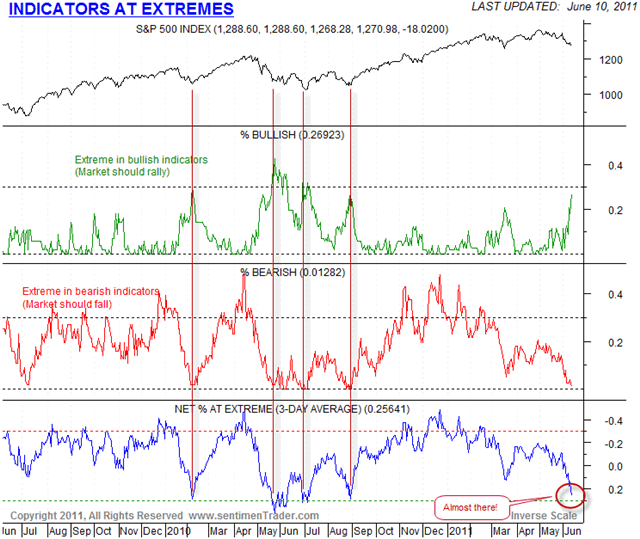

2. Collection of indicators at bearish extremes

Source: Sentimentrader

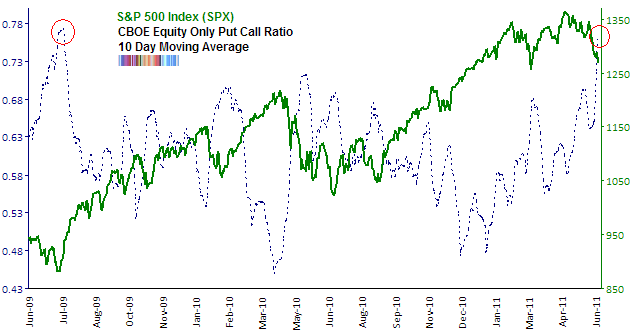

3. Put Call Ratio

Source: Traders Narrative

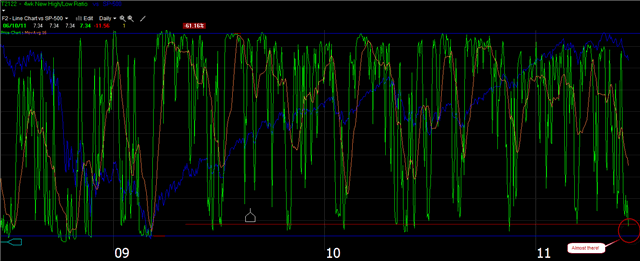

4. NYSE Stocks at 4 week low

Source: Cobra's Market View

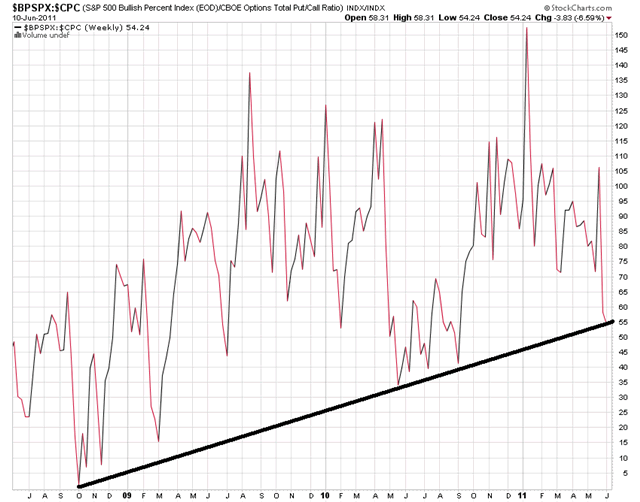

5. Bullish Percent Index

Source: Stockcharts

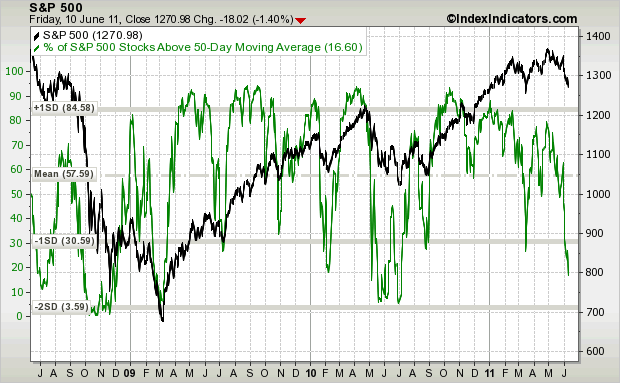

6. SP500 stocks above 50 MA

Source: Indexindicators

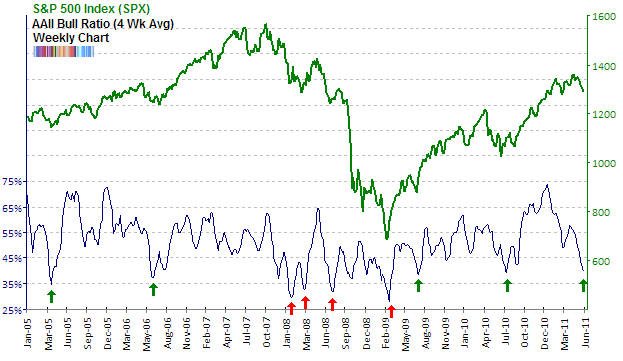

7. AAII Bullish Sentiment

Note the level reached is on a par with previous bull market lows. Only a new bear market should necessitate lower levels.

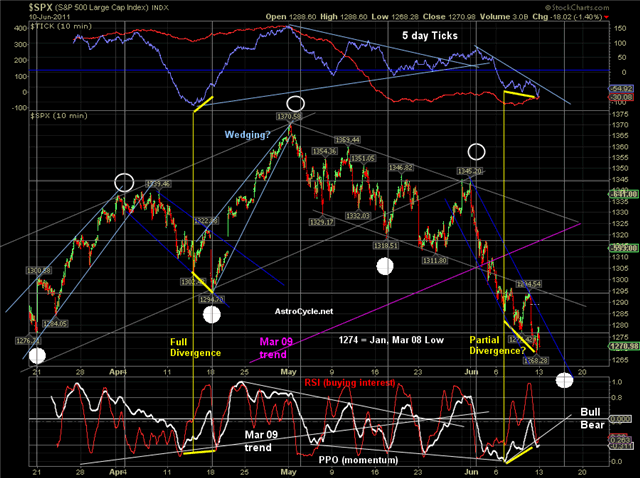

8. PPO divergence

Source: Astrocycle

Now here's what I'm looking for to finalise the bottoming deal:

Quantifiable Edge's Capitulative Breadth Indicator dropped to 5 on Friday, despite the market fall. So still awaiting decisive move to around 10.

Tied in with this, we haven't seen a high volume capitulation or bottoming hammer candle. I am looking for that kind of washout selling and reversal, likely intraday.

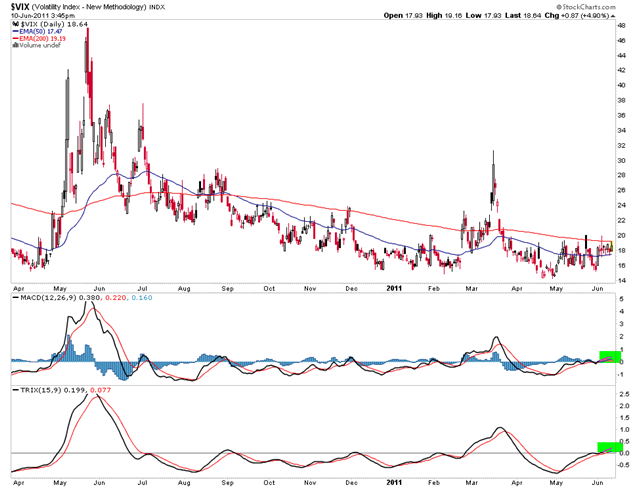

We also lack the spike in volatility that is also normally associated with a bottoming:

Source: Biiwii

Price-wise, a drop to around 1250 could mark the base, at dual support. But we should also allow for a fake-out overshoot and subsequent reversal, as the market loves to deceive:

By time, recall that we approaching the full moon on Wednesday and we are still in the Puetz crash window, both giving downward pressure. However, the geomagnetism forecast around this last weekend has been only moderate and we are now moving into a window of quiet, which should remove that negative.

Ideally therefore, the final selling washout should materialise going into this mid-week, presenting a buying opportunity thereafter. This idea is supported by copper which has potentially already bottomed ahead of the market, leading the action by several weeks:

Source: Pug SMA

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation.

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.