Gold Top? Long-term Chart Analysis

Commodities / Gold and Silver 2011 Jun 19, 2011 - 08:01 AM GMTBy: Willem_Weytjens

Today I had a look at one of the charts I created a long long time ago (in late 2008).

I was amazed by the accuracy of the lines I drew back then.

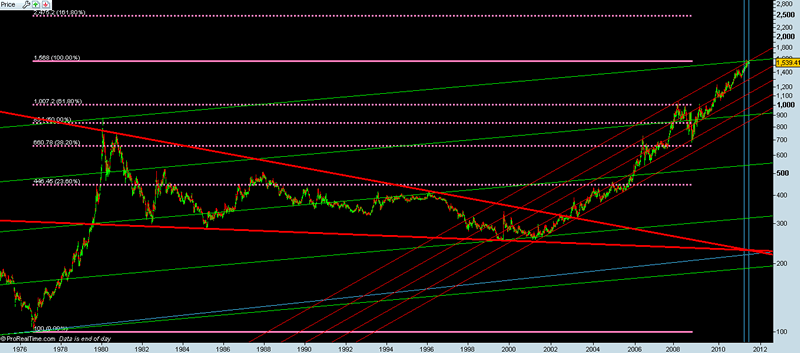

I drew Fibonacci levels from the bottom in 1976 (100$)=0.00% and assumed the highest close of 1980 (834$) would be the 50% Retracement level.

That means that there was a difference of 734$ between the 0.00% and 50.00% level, and that the 100% level would be the 50% level plus 734$, which equals 834$+734$=1568$. Please notice that the highest close ever was at 1563$ according to prorealtime software. So based on fibonacci levels, we might have reached THE top in gold for many years to come.

Now let’s have a look at the red triangle I drew over the tops from 1980 until 2002 and underneath the bottoms of 1982, 1985 and 1999.

When price broke out of this triangle in late 2002, it first retested this line in march 2003, and then never looked back.

The time target would be where the two lines eventually come together…which is roughly may 2011. I pointed this out with the two vertical blue lines.

So we now have the fibonacci levels telling us that $1568 could be a top, and that combined with an excellent timing, gives us even more reason to believe so.

I then drew parallel green trendlines underneath different support levels. What did they say? They colluded with the 100% Fibonacci retracment level AND with the time target of may 2o11.

I then drew parallel red trend lines underneath the bottoms from 2002 until 2006 and over the top of 2008. Yet again, they pointed at may 2011 with a price of $1568…

So yes, I think we have a good chance that gold is in the process of setting a top. The fact that miners are down so much while gold is only 2% below its all time high might be a sign that money was already flowing out of speculative positions such as mining stocks, while the price of gold is being kept high…

Please also notice that IF price would break out above this level, there is no resistance until 2475,2$, which would be the 161.80% retracement level. That is about 60% higher than current prices.

In short, we have very interested times ahead.

For more analyses and trading updates, please visit www.profitimes.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.