June 21-22 FOMC Meeting - Preview

Interest-Rates / US Interest Rates Jun 20, 2011 - 05:14 PM GMTBy: Asha_Bangalore

The policy statement of the April 26-27 FOMC meeting mentioned that the "economic recovery is proceeding at a moderate pace and overall conditions in the labor market are improving gradually." This assessment has changed; Chairman Bernanke noted in the June 7, 2011 speech that "U.S. economic growth so far this year looks to have been somewhat slower than expected ... A number of indicators also suggest some loss of momentum in the labor market in recent weeks." The June 22 policy statement is most likely to reflect these developments.

The policy statement of the April 26-27 FOMC meeting mentioned that the "economic recovery is proceeding at a moderate pace and overall conditions in the labor market are improving gradually." This assessment has changed; Chairman Bernanke noted in the June 7, 2011 speech that "U.S. economic growth so far this year looks to have been somewhat slower than expected ... A number of indicators also suggest some loss of momentum in the labor market in recent weeks." The June 22 policy statement is most likely to reflect these developments.

The unemployment rate at 9.1%, a meager gain of 54,000 in payroll employment, and jobless claims holding above 400,000 are aspects of the labor market pointing to not very desirable conditions. Retail sales in April and May show a marked slowing compared with the first quarter (10.5% vs. 4.4%). Auto sales declined to an annual of 11.8 million units in May from 13.2 million in April.

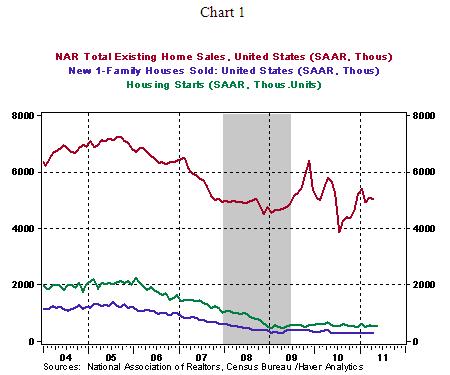

The housing sector continues to present challenges. Sales and starts of homes continue to move around recession lows, despite small gains in sales of new homes and housing starts. The Fed's earlier view that the housing sector is "depressed" is likely to be left untouched.

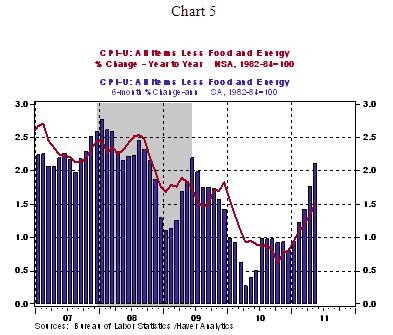

The April policy statement summed up the inflation front as follows: "Increases in the price of energy and other commodities have pushed up inflation in recent months. The Committee expects these effects to be transitory, but will pay close attention to the evolution of inflation and inflation expectations."

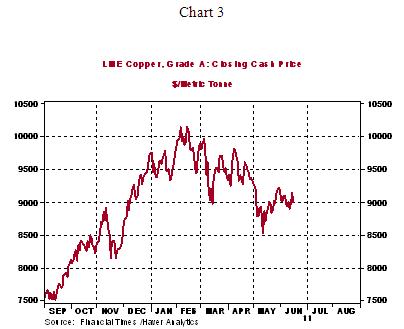

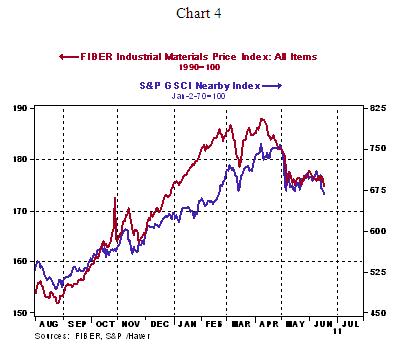

Since the April FOMC meeting, oil prices have dropped (see Chart 2), copper prices (see Chart 3) and overall commodity price indexes (see Chart 4) have trended down. This evidence is supportive of the Fed's view.

However, the core CPI, which excluded food and energy, moved up 1.5% from a year ago in May. The recent low of the year-to-year change in the core CPI is 0.6% in October 2010. This rapid increase in the core CPI is positive given that the Fed's QE2 policy action was designed to prevent a deflationary situation. There are four reasons the Fed can continue to maintain the focus on employment in the inflation/growth debate despite the increase in the core CPI allowing less head room. First, inflation is always a monetary phenomenon as Milton Friedman has stressed. In order to have persistently rising inflation, money and bank credit would have to grow at a strong pace, which is not the case at the present time. Money and bank credit are growing below historical averages and additional deceleration is likely after the termination of QE2. Second, economic reports indicate slowing conditions and projections of the quarters ahead show only moderate growth in the United States. Third, China is tightening monetary policy to contain inflation, which should setback exports of the United States to China. Fourth, the Greek crisis has the potential to adversely affect bank credit growth and economic activity in Euroland and trim the growth of U.S. exports to the region. Also, inflation expectations (Difference between 5-year Treasury note yield and 5-year TIP rate) have moved to under 2.0% as of June 17 from a recent peak of 2.45% on April 29. All of these factors indicate that inflation is not an important immediate concern.

Most importantly, markets will be looking for hints of QE3, if any in the policy statement. The Fed is likely to buy time before committing itself to anything at this juncture. It will not be surprising if the Fed indicates that it is on a watch-and-wait mode but stands ready to provide support if necessary to prevent a drop in economic activity in the near term. A press conference with Chairman Bernanke follows after the FOMC meeting.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.