Stocks, Demographics, Sovereign Debt and Global Food Prices Economic Report

Economics / Global Economy Jun 21, 2011 - 01:13 PM GMTBy: John_Mauldin

This week's Outside the Box is from one of the more interesting thinkers and observers of the markets I know, Simon Hunt. When we get together in London, conversations are lively, as we don't always see eye to eye; but we can always discuss, in a very civil manner, the affairs of the world. This particular piece is wide-ranging and thought-provoking. Simon is always ready to apply actual times to his predictions, and he has held steady on them for years.

This week's Outside the Box is from one of the more interesting thinkers and observers of the markets I know, Simon Hunt. When we get together in London, conversations are lively, as we don't always see eye to eye; but we can always discuss, in a very civil manner, the affairs of the world. This particular piece is wide-ranging and thought-provoking. Simon is always ready to apply actual times to his predictions, and he has held steady on them for years.

It is late here in Geneva and I have to get up early for a speech. A big thanks to Hervig von Hove of Notz Stucki for hosting one of the more stimulating dinners with 16 people I have enjoyed in a long time, at his home out in the country, on a perfect night. I will probably make the discussion there the topic of this week's letter. Charles Gave was in rare form. The Swiss gnomes were so very fascinating, and we had such an international table. These are the nights I wish my 1 million closest friends (a few of whom were there) could listen in on. More to come on Friday!

Your living for these moments analyst,

John Mauldin, Editor

Outside the Box

Economic and Copper Advisory Services: Economic Report - June 2011

by Simon Hunt

The global economy is facing a difficult period. The US Federal Reserve's QE2 program ends at the end of the month. Europe's debt issues continue to roll on as no party wants to pull the plug on Greece. The Middle East is in turmoil and high oil prices, together with food, are a tax on global consumers. Japan's reconstruction has yet to get into full gear; and there are new concerns about the durability of China's economy. Any significant slowdown there will send ripples of fear around the world.

The Federal Reserve is likely to sit pat for some months to see how the US economy will be able to perform without the steroids provided by them. Foreign central banks have largely been absent from Treasury auctions. In quarter 1 this year, foreign central banks bought just 16% of the issuances while the Federal Reserve acquired almost 200%, according to Russell Napier. In other words, the Fed's activities have masked the exodus of foreign central banks including China from these auctions.

If foreign central banks continue to abstain from purchasing US Treasuries, the private sector will have to fund the fiscal deficit, implying quarterly remittances to the US Treasury of some $370bn. The private sector will be able to fund these auctions but at a price. They will demand a higher return on treasury paper and the funding will mean that the free-flow of funds into equity and commodities will come to an end. Many institutions are taking risk off the table.

On our associate's, WaveTrack International technical work, 10-year US Treasuries should be yielding around 4% later this summer and 6% a year or so later. The repercussions of such a change in the yield structure will have global consequences, not least on stock and commodity markets.

Debt has woven a dangerous spider's web in Europe. The basic truth is that Greece can never repay its debt; the ECB, the IMF and Euro governments are merely buying time by granting new loans, hoping that the problem goes away. Future stability, however, does not depend on what these institutions and governments do, but on how the electorates will react. In their view, austerity can be accepted only on a one or two year view, not as an ongoing way of life.

This is especially true of Greece whose national pride will find the sale of assets to foreigners wholly unacceptable. The same is true in other debt-laden Euro countries. All, apart from Italy, have seen their economies contract significantly over the past two years with little hope of any imminent improvement. The next major move could emanate from Ireland; the Irish government wants to renegotiate its ECB and other loans.

In fact, nearly all the conventional forward looking indicators (PMIs, OECD leading indicators etc.) are suggesting that global growth is slowing and rolling over. The US ISM data for May was universally awful with every component from New Orders to Imports down significantly. This is a view shared by industry mills we talk to and visit regularly.

The USA does not only have a cyclical problem, but a structural one also. The fundamental issue is that sooner rather than later government will be forced to introduce measures that will allow the country to live within its means. It will take a deep crisis before such policies can be put together and passed by the country's politicians. For instance, a run on the US dollar sometime next year or early in 2013 might do the trick.

Unemployment amongst teenagers has become a serious structural and social problem for the USA in an economy that is becoming dominated by skilled workers. The number of unemployed teenagers (16-19) now totals almost one in four. However, the number of African-American, not seasonally adjusted U-3 unemployment, including both sexes, in the same age group has risen to a stunning 41%, almost every other teenager.

Once Washington puts its act together, (it will have to or else the crisis will get so deep that US markets will become dysfunctional), America will find a large number of companies which had vacated the shores of the USA for China and other parts of Asia returning to their homeland.

There are two main reasons for this change, what we call reverse globalisation. First, manufacturers want their supply chains located close to the market, not on the other side of the world. And second just as important is the cost differential trend which is narrowing together with the increasing logistical costs. It is not only the wage profile looking 10 years forward, but the other costs, such as land, electricity, taxes together with the indirect supply chain cost increases. There is also the reluctance of the system in China to allow foreign companies to gain access to government contracts.

Within a decade, the USA could supplant China as the manufacturing hub of the world. To repeat, big changes will be needed in Washington for this historic development to occur. The changes will not just be on the fiscal side, but the need to offer businesses the right incentives to produce in the USA rather than abroad, the permitting procedures to allow the development of the country's resources, including oil (the USA could become self-contained), making government less intrusive in households and businesses and so on.

In short, it is putting back in place the principals that made America the great country it once was. Crises produce opportunities and this one is as big as they have been since the USA entered WW11. What is noteworthy is that should America grab its opportunity, it will become self-contained in energy and of course food. What other major power has those valuable twin assets?

China and the rest of Asia are no exception to this slowing economic trend. In the former, government's focus on CPI inflation and the housing market together with its concerns on the degree of speculative or hot money circulating within the economy will almost ensure that the tight monetary policy will continue for some months yet. In these circumstances, further hikes in interest rates and Reserve Requirements are likely to be seen before the end of the year.

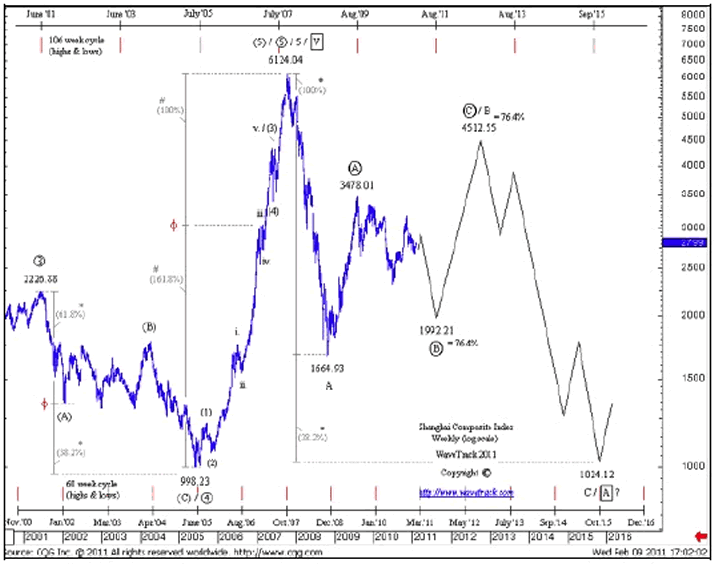

Chart 1: Shanghai Composite Index

Such a scenario fits the political cycle. Some of the country's excesses can be cleaned out by end 2011, much to the delight of the incoming leadership, whilst monetary policy remains tight. The chief economist of the State Information Centre, who is well regarded in Beijing, said at a recent conference in Shanghai that "China has a serious inflation". He concluded his speech by saying that China had to endure some short term pain for the longer term benefit of the economy. Early in 2012, monetary policy will start to be loosened and should continue to do so throughout that year. The economy should recover so allowing the outgoing leadership to depart on a high note. Post 2012, we guess that the incoming leadership will want to put the economy on a firmer long-term footing, meaning more tightening. This may well coincide with the real estate sector seeing major falls in prices and, externally, the global economy starting to suffer from the breakout of its second global credit crisis. Oil prices in the $150-200 will be a disaster for China as one senior government economist said to us. China may well go through two odd years of real recession in 2013-14 years, in our view. The impact of an effective recession in China on the rest of the world will be serious and widespread.

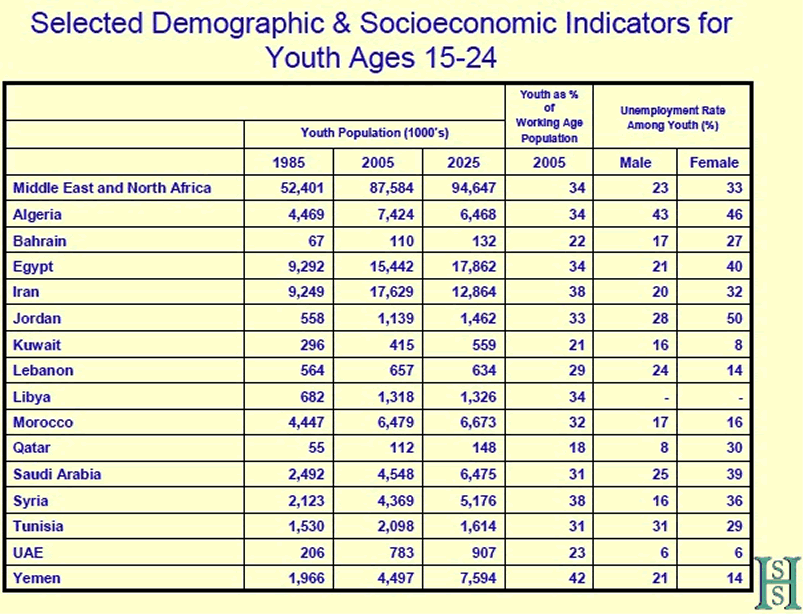

Chart 2: The Demographics of the Middle East

Some of the underlying causes for MENA countries' youth to rebel against their autocratic governments are common with China. The youth in these countries don't care about democracy or who governs: they want freedom of expression, for governments to uphold their rights and the right to work. It is why Beijing has become so sensitive to the Jasmine movement and ongoing developments in MENA. Workers' protests appear to be on the rise. The ability to communicate via computers and mobile phones (Facebook etc.) increasingly makes government powerless to control the flow of information. coherence is deeply threatening to China's Communist Party....That is the conclusion of the government itself. A report by the State Council Development Research Centre blamed protests on the marginalisation of about 150M migrant workers...

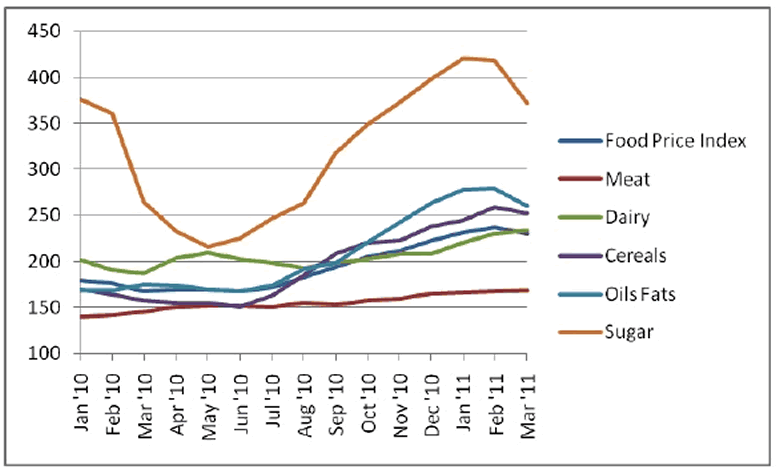

Graph 1: Global Food Prices

Global food prices have risen by 37% in the past year according to the FAO. It was higher food prices plus the high level of unemployment in MENA countries that sparked so much rioting in the region. China's government is highly sensitive to rising food prices. They may well rise further over the coming months due to the hog cycle so ensuring that pork prices increase further followed by corn and in due course even wheat. But, China's agricultural base is deteriorating. Top soil is collapsing to dangerous levels; its fertility is being destroyed by acidification; water is being consumed way beyond sustainable levels; and aquifers are being exhausted. These are structural issues, not short term cyclical ones. t productivity will decline to a rate closer to the Asian Tigers ex. China or down to the 2% a year level from its historic 5% rate. The above remarks also imply that China will be importing more foodstuffs over the coming decade. Unlike the USA, China is becoming increasingly dependent on imports of food and energy. back to the 1990s sustainable growth, but its fragility is being patched up by unsustainable fiscal and monetary excesses. In fact, as Charles Gave wrote recently in GaveKal Five Corners, these policies have had the opposite effect than those intended (the unintended consequences of policy actions!), "Capitalism cannot work without a proper cost of capital. Capitalism needs the process of creative destruction, and if real rates are negative or abnormally low, the destruction part of the process cannot happen, zombie companies are kept on perpetual life support and growth flags."

This is exactly what is happening nearly everywhere. Politicians won't bite the bullet (perhaps with the exception of the UK) without a crisis. That crisis is coming, certainly by early 2013 if not sooner, to be followed by years of recession and deflation, a period when the down years will outnumber the up ones. It will be accompanied by a serious deflation of assets, both equities and commodities, perhaps excepting food. This period of austerity is likely to last until around 2018; a generation of debt should by then have been worked off so laying the foundations for a long period of sustainable growth.

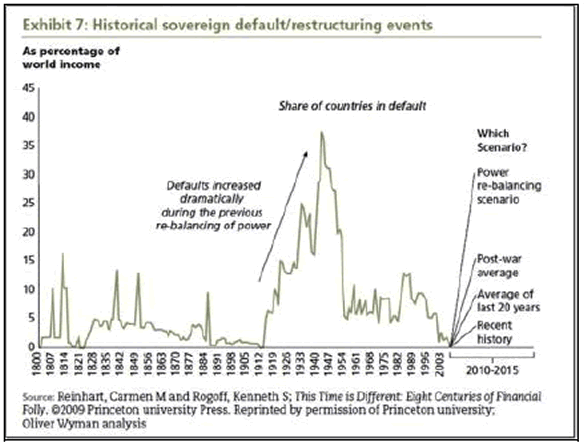

Chart 3: Historical Sovereign Default/Restructuring Events

The truth is that the lessons of history have been conveniently forgotten or ignored, as illustrated by Carmen Reinhardt and Kenneth Rogoff in their epic work "Growth in a Time of Debt". Those lessons are simple: credit crises are followed by years of sub-par growth and sovereign defaults.

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.