Gold and Silver Ownership and Prices Will Not be Affected by Dodd-Frank Legislation

Commodities / Gold and Silver 2011 Jun 29, 2011 - 12:18 PM GMTBy: GoldCore

Gold is trading at $1,507.70/oz, €1,044.69/oz and £941.54/oz.

Gold is trading at $1,507.70/oz, €1,044.69/oz and £941.54/oz.

Gold is higher again today as the Greek debt crisis and continuing strong demand from Asia continues to support prices.

The euro is surprisingly firm with the U.S. dollar, Japanese yen and Swiss franc under pressure. Risk appetite remains high with commodities, Asian and European equities higher and peripheral bond markets have received a bid and seen yields fall due to optimism on the Greek vote.

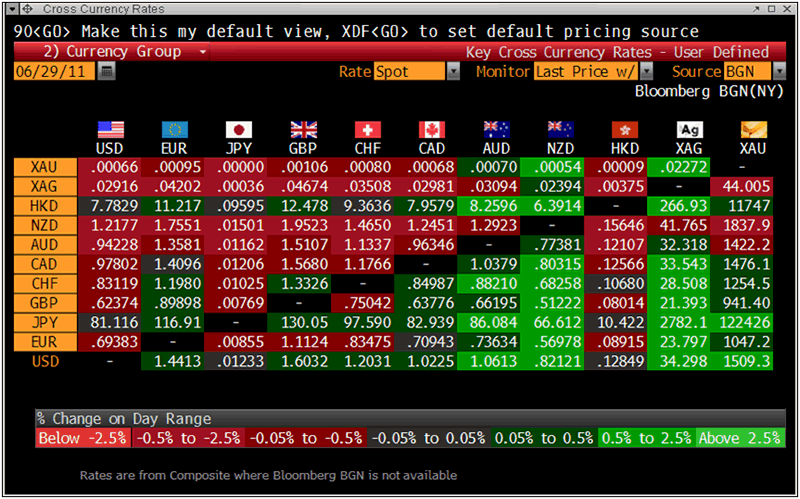

Cross Currency Rates

The governor of the Bank of Greece said overnight that Greece would be committing ‘suicide’ if the parliament does not vote for the harsh austerity and privatizations measures today (1300 GMT).

The vote is expected to be close with many Greek parliamentarians and the Greek people feeling that it is unfair to Greece and will only serve to postpone the day of reckoning.

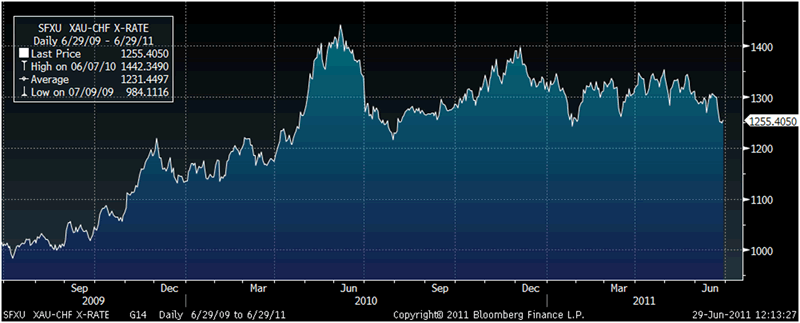

Gold in Swiss Francs – 2 Years (Daily)

Gold and Silver Ownership and Prices Will Not be Affected by Dodd-Frank Legislation on July 15

The 2010 Dodd-Frank Act, and the regulatory legislation associated with it, is due to come into law in just over two weeks on July 15.

A number of clients, particularly U.S. clients, have contacted us regarding the possibility that the new legislation could lead to price falls in the gold and silver markets. Some were even concerned that it had implications for their ownership of physical coins and bars and for bullion stored in Western Australia, Switzerland and vaults internationally.

Concerns arose due to reports that retail foreign exchange, spread betting and CFD providers are set to discontinue offering their gold and silver over the counter products. These allow speculators to take leveraged positions, short and long, in over the counter derivative products.

After July 15, U.S. residents are prohibited from trading these OTC gold and silver derivative products. All precious metal transactions that are leveraged and not delivered in 28 days, must be conducted in a “designated contract market,” a board of trade or exchange designated by the CFTC.

Those who own bullion should be reassured that their bullion ownership will not be affected as the legislation does not apply to the physical coin and bar market.

The legislation will also not apply to contracts fully paid for or delivered within 28 days, and commodity futures contracts trading on an exchange such as the CME Group CME and the many other international exchanges.

With regard to prices, some are concerned that there could be spillover from the OTC derivative market into the futures and physical market. This is because the residual risk from OTC markets is hedged on the various precious metal exchanges. Thus, some are concerned that the unwinding of OTC positions by U.S. residents could put result in falling gold and silver prices.

We believe this to be very unlikely. We acknowledge that it may lead to an increase in volatility in the coming days and in the days preceding July 15th.

However, the off exchange derivative market is very small when compared to the global physical bullion market (coins, bars and London Good Delivery Bars) and the futures market internationally (New York Mercantile Exchange (NYMEX), COMEX Division; Tokyo Commodity Exchange (TOCOM); Dubai Multi Commodities Centre (DMCC); Shanghai Gold Exchange (SGE) etc..

OTC derivatives are used primarily by retail speculators and are not important from a price discovery point of view. Also, those using these derivatives were not buyers or long exclusively and many will have been shorting the market. Thus the hedging of product providers is likely to be reasonably neutral.

In conclusion, gold and silver bullion ownership and prices should not be affected by the upcoming Dodd-Frank legislation.

Prices are far more likely to be influenced by central banks increasing favorability towards gold as a reserve asset. UBS reported that gold will be the best performing asset for the rest of the year, citing their survey of sovereign institutions. It showed that the previous intention of central banks to reduce holdings within 10 years has disappeared.

The majority of central banks internationally intend increasing allocations to gold. This is not surprising given that the Federal Reserve, the BOE and the ECB are continuing to debase the major reserve currencies. It is also very understandable given increasing concerns about the U.S. dollar remaining the reserve currency of the world.

China Gold Imports Surge - Estimated at 200 Tonnes in 2011 YTD; Compared to 250 Tonnes in All of 2010

The Financial Times today confirms surging demand from China. “Some traders estimate that the country may already have imported more than 200 tonnes of gold this year, compared to total imports last year of about 250 tonnes – itself a more than fourfold increase on 2009.”

It is safe to assume that the unnamed traders are credible sources as these figures coincide with what industry experts in China and the World Gold Council are saying about surging Chinese gold demand.

Central bank demand from China and internationally and investment demand from China, Asia and internationally will ultimately be the primary driver of the gold market in the coming months and possibly years.

Government legislation of any nature may impede in the short term but ultimately the law of supply and demand will be the ultimate arbiter of price.

SILVER

Silver is trading at $34.34oz,€23.79/oz and £21.43/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,708.50/oz, palladium at $742/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.