Gold Price Downside Limited

Commodities / Gold and Silver 2011 Jul 05, 2011 - 01:36 AM GMTBy: Bob_Kirtley

Despite some calling for an explosive summer rally in gold, prices fell again this week on the back of easing concerns over Greek sovereign debt as the Greek parliament successfully passed the austerity legislation required to access additional bailout funds. This was due to the erosion of what we call gold's "Eurozone Debt Crisis Premium" and, as explained in our article last week; gold prices were not likely to rally in any sustainable manner. However the question is where are gold prices heading from now and how should one go about trading or investing in this environment.

Despite some calling for an explosive summer rally in gold, prices fell again this week on the back of easing concerns over Greek sovereign debt as the Greek parliament successfully passed the austerity legislation required to access additional bailout funds. This was due to the erosion of what we call gold's "Eurozone Debt Crisis Premium" and, as explained in our article last week; gold prices were not likely to rally in any sustainable manner. However the question is where are gold prices heading from now and how should one go about trading or investing in this environment.

The summer doldrums are in full flow, so seasonal weakness is to be expected. However it is during this period that the most money can be made, since it can be used to establish positions in anticipation of the next major move in gold. As the great Chinese General Sun Tzu said "Every battle is won, before it is ever fought". The big money in the last major move wasn't really made as gold hit $1425 in November or $1550 in April, it was made during the summer weakness of July and August when gold traded at less than $1200. The trades that are placed and investments that are made over this period can bring fantastic returns when the more exciting time of year comes around.

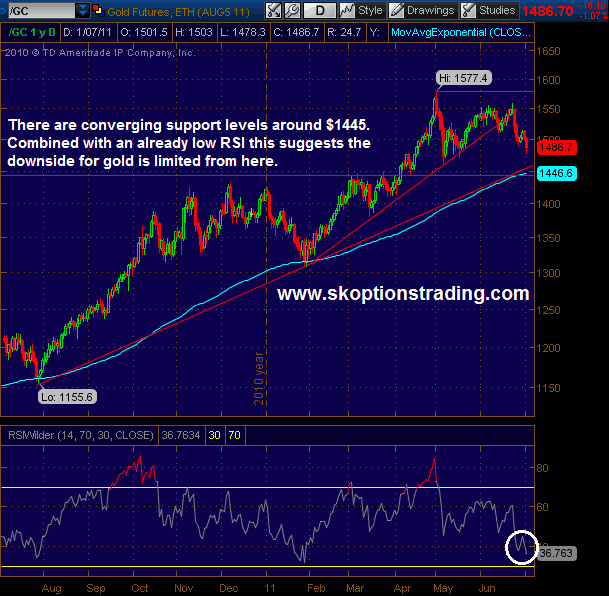

Having fallen roughly 6% from its highs around $1577, we now think that the downside for gold is limited. Technically speaking we are seeing some important support lines and the 150 day moving average converge around $1445 and we therefore think it is unlikely that gold prices will fall past this level.

In addition to this, the Relative Strength Index for gold currently stands at 36.76. Historically speaking, if the RSI falls to 30 it is a screaming buy signal. We aren't seeing that screaming buy signal just let, but it could be just around the corner.

Looking to the fundamentals that drive gold, we think fears over the Eurozone crisis will continue to subside (despite the longer term underlying problems remaining unresolved). In additional to this, money markets are now fully pricing in a hike by the ECB in July and the December Euribor interest rate futures indicates that there is roughly a 70% chance the ECB will hike again in 2011. These two factors signal to us that the Euro is likely to go higher, the US dollar lower and gold priced in dollars to increase. Keep in mind that the ECB's main objective is price stability, ie to control inflation, as opposed to the Federal Reserve's dual mandate to strive for full employment as well. Therefore the ECB can be considered more likely to hike relative to the Fed, leading to some possible interest rate differential induced strength in the Euro against the Greenback.

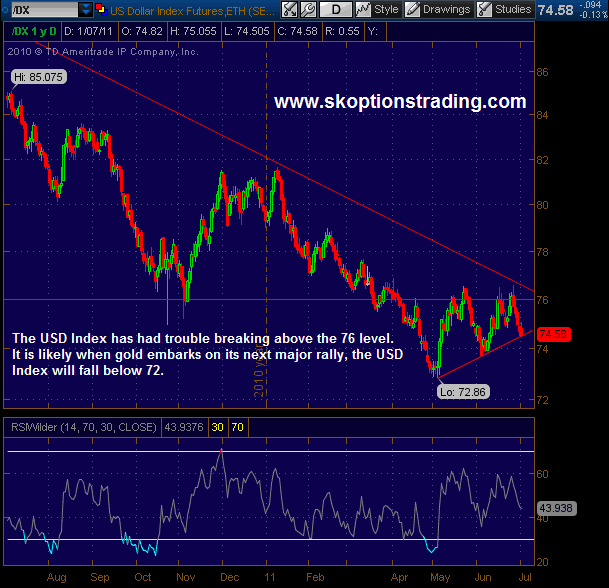

Taking a technical look at the USD Index, the 76 level appears to be offering significant resistance. This is also the same level that the USD bounced off in November 2010.

Whilst some choppy lateral motion is possible in the short term, we think the dollar will endure a serious decline in the medium to long term, coupled with the next major rally in gold prices.

Another factor being discussed that could possibly cause a large move higher in gold prices is that of a possible QE3. At present we do not see much likelihood of a QE3 program, at least not in the same nature as the previous quantitative easing programs. However we do think US monetary policy will continue to be supportive of higher gold prices, with the Fed keeping rates at zero and the TIPS yielding negative rates for multiple maturities (Please see our previous article: The Key Relationship between US Real Rates and Gold Prices).

Equally as important as devising what the move in gold will be and when it will occur is how one trades the move. This is a point that is often not given enough emphasis. As we have stated before, we think options are the best way to trade these moves. No other instrument can offer opportunities that options offer. Using options one can create a position that exactly matches one's view on the market. Suppose one agreed with the views expressed above, that gold would not fall significantly. Using options one can be rewarded for the exact scenario. Gold stocks, futures or ETFs cannot offer that flexibility or adaptability, they simply offer the investor the chance to bet up or down.

It is for these reasons that options trading offers up many attractive opportunities from a risk-reward viewpoint. We specialise in indentifying these opportunities and executing trades to take advantage of them. We have executed 81 trades since inception, with 78 closed at a profit and an average return of 40.41% per trade including losses. Our model portfolio is up 338% since inception but over the same period gold is up only 55%, the 200% leveraged gold ETN (DGP) is up 115% and the HUI gold stocks index is up 40%.

In conclusion, if one has a long term bullish view on gold then this is the summer shopping season so try not to get too tied up in the day to day market action. Keep the big picture in mind. This gold bull has a while to run yet. We are not perma-bulls and do not consider ourselves "gold bugs", we simply see market conditions as bullish for gold in the longer term.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.