Gold Targets $1,800/oz on Seasonal Strength and Deepening Eurozone and U.S. Debt Crisis

Commodities / Gold and Silver 2011 Jul 05, 2011 - 06:57 AM GMTBy: GoldCore

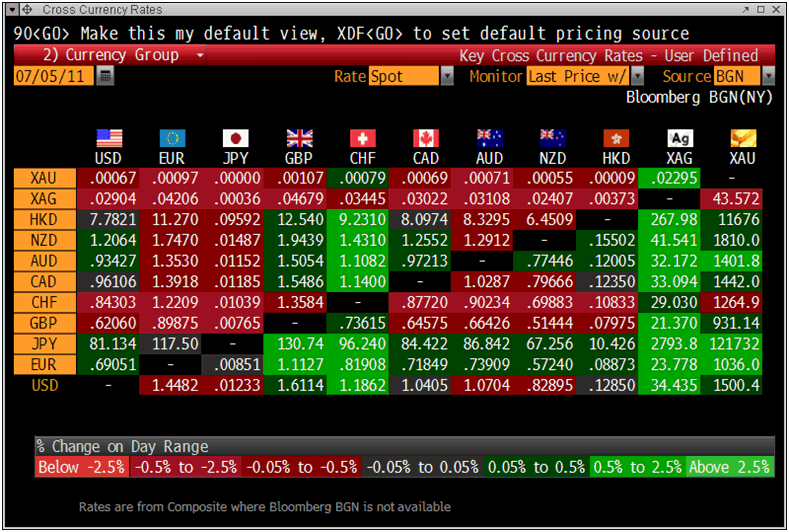

Gold is trading at $1,504.13/oz, €1,039.34/oz and £933.89/oz.

Gold is trading at $1,504.13/oz, €1,039.34/oz and £933.89/oz.

Gold is higher today and showing particular strength against the euro and the Japanese yen. The relief rally seen in equities since the latest Greek ‘bailout’ is under pressure as S&P have said the debt rollover proposal would be a “selective default”. The ECB may selectively reject the S&P Greek downgrade and arbitrarily select the best credit rating being offered.

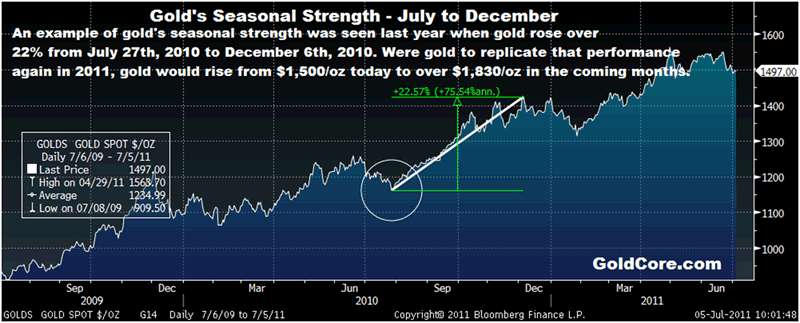

Gold in USD – 1 Year (Daily)

The risk of contagion in Eurozone debt markets and banking systems remains. Portuguese, Spanish and Italian debt has been sold this morning. Systemic risk from contagion in the credit-default swaps market also remains a threat.

In the U.S. political squabbling over raising the $14.3 trillion debt ceiling continues. However, it is likely to be resolved as the massive liabilities incurred (not including unfunded liabilities of over $60 trillion) simply cannot be paid back. It is therefore likely that more debt monetization (creating money to buy government bonds) will occur leading to further currency debasement and the risk of stagflation and severe inflation.

Cross Currency Rates

Gold's Seasonal Strength - July to December Could See $1,800/z Challenged

Gold has been supported in the traditionally weak “summer doldrums” period due to institutional demand and strong physical demand at the $1,500/oz level, particularly from Asia.

The summer months of June and July normally see seasonal weakness and it is thus a good time to buy on the seasonal dip.

Gold is now entering its period of traditional seasonal strength which is seen between July and December.

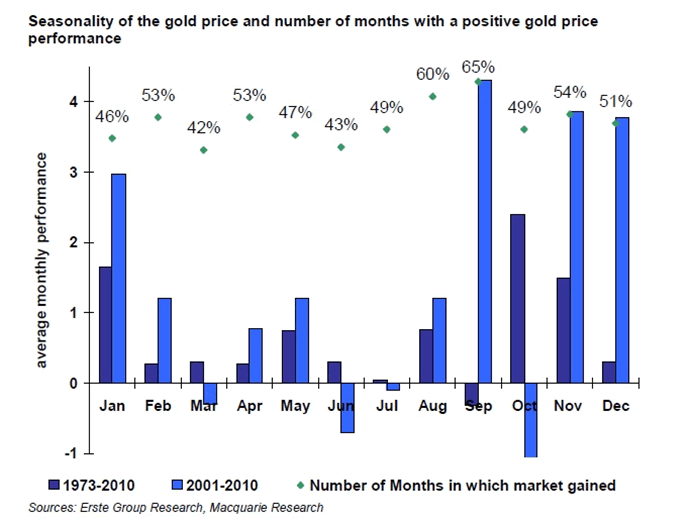

Gold tends to take a break in October and then has a second period of seasonal strength from the end of October to the end of December.

This has been primarily due to Indian religious festival, store of wealth, demand in the autumn and western jewellery demand prior to Christmas.

Since the liberalization of the gold market in China in 2003, demand for jewelry and bullion from China for Chinese New Year (mid to late January) is also becoming an increasingly important factor.

It is likely that seasonal weakness in equity markets, with both the ‘sell in May’ factor and tendency of stock markets to be weak and occasionally to crash in October may also lead to safe haven demand during this period.

As noted in the chart above, gold rose strongly (by 22%) from July 2010 to December 2010. This trend was also seen the previous year in 2009 when gold fell in June, rose marginally in July, was flat in August and then rose strongly from September into early December.

As shown in the excellent Erste Group report on gold released yesterday, the strongest months for gold are September, August and then November (see table below).

Thackray's 2011 Investor's Guide notes that the optimal period to own gold bullion is from July 12 to October 9. During the past 25 periods, gold bullion has outperformed the S&P 500 Index by 4.7 percent.

"In GOLD we TRUST" - 5th Annual Special Report by Ronald-Peter Stöferle of Erste Group

While meeting clients and industry associates in Austria last week, I had the pleasure of meeting Ronald-Peter Stöferle. We had a great conversation about gold and silver bullion, the markets and the challenges facing us today. He is very astute, knows his history and understands monetary economics.

Unfortunately we had to cut short our wide ranging conversation as he had to put the finishing touches to his excellent report.

The report is extremely comprehensive and is an important read for anyone wishing to properly understand the gold market today and why gold remains a safe haven asset and an essential diversification.

"In GOLD we TRUST" covers the following highlights:

* The foundation of a return to "sound money" has been laid

* Guilt without atonement? Excessive structural debt suggests further appreciation of gold

* Negative real interest rates continue to provide gold with perfect environment

* No reason for "AUROPHOBIA"

* Adieu "Exorbitant Privilege"

* US Treasuries: from the risk-free fixed income paper to the risky no-income paper

* Why gold is (still) no bubble

* Excursus: the creation of money from the perspective of the Austrian School of Economics

* Gold and silver as official means of payment vs. "Gresham's Law"

* The monetary system at the crossroads - on the way to a new gold standard?

* Gold as portfolio insurance

* Renaissance of investment demand - institutionals as "elephant in the room"

* Gold mining shares with historically low valuations

* Risk/return profile of gold investments remains very favorable

* Next target price at USD 2,000

* At the end of the parabolic trend phase we expect at least USD 2,300/ounce

In our commentary section today - http://www.goldcore.com/commentary , we feature an excellent interview between Lars Schall and Ronald and we also feature Fuller Money’s synopsis of "In GOLD we TRUST". The report itself was picked up by Zero Hedge yesterday and can also be read in our commentary section.

SILVER

Silver is trading at $34.71/oz,€23.98/oz and £21.55/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,723.25/oz, palladium at $764/oz and rhodium at $1,925/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.