Stock Market Remarkable Bounce From Oversold Levels

Stock-Markets / Stock Markets 2011 Jul 05, 2011 - 09:14 AM GMTBy: Trader_Mark

Obviously last week was one of those you will remember for a long time, as the scope and ferocity of the bounce - light volume or not - was quite remarkable. While the front end of the week was a predictable oversold bounce on light volume heading to the end of the quarter, the action at the end of the week was more surprising.

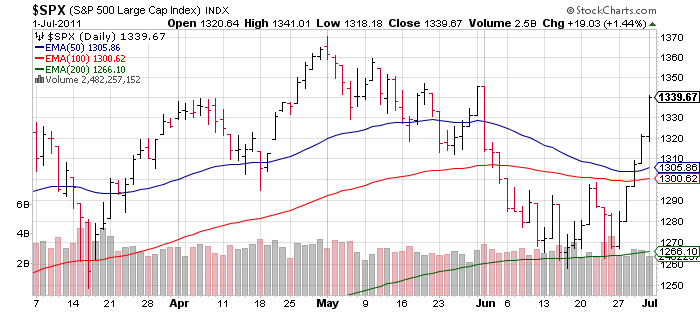

Friday struck me the most as almost all global economic data points were poor, including those in the U.S. Except for ISM Manufacturing. I had thought a better than expected data point had been built into the market by that point, especially in light of the Chicago PMI figure (heavily auto related) the previous day, but that assumption was incorrect. So with that, the huge rally pushed indexes through every major (and minor) resistance level. The high at the beginning of June is the next level to test, around 1345.

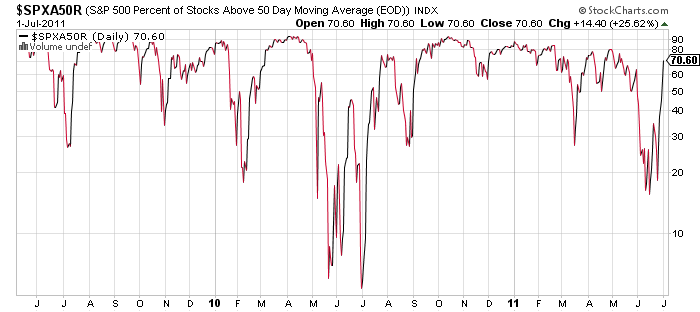

And in a snap of a finger this market went from oversold to overbought. One indicator (among many) is the % of stocks over the 50 day moving average. Aside from one episode last July, the amount of real estate this measure covered to the upside has rarely been faster. Similar violent moves can be seen in quite a few other secondary technical indicators.After such a move, even sideways action without much of a giveback would be a victory for the bulls. Bears have a ton of work ahead and may require very poor economic data to make progress, as the macro data pushes away after this week and earning reports take over. As for this week, due to the holiday we have some of the key economic reports spread over a 2 week period rather than bundled in week one of the month. Chief among them are ISM Non Manufacturing Wednesday and the monthly employment data Friday. The former has a consensus of 54.0 vs prior month's 54.6, while the latter shows a quite weak 110,000 jobs created and 9.1% unemployment rate.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2011 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.