Euro Gold Rises to EUR 1,056/oz as Portuguese Bonds Melt Down

Commodities / Gold and Silver 2011 Jul 06, 2011 - 06:47 AM GMTBy: GoldCore

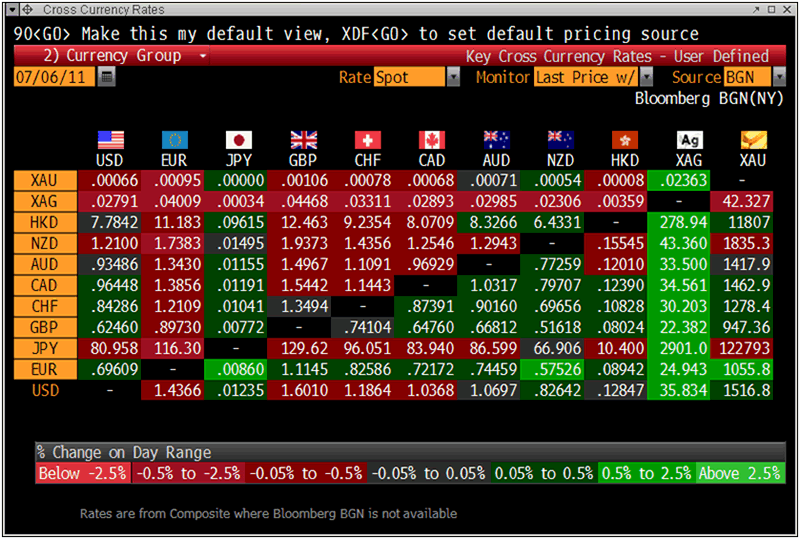

Gold is trading at $1,515.06/oz, €1,055.42/oz and £945.73/oz.

Gold is trading at $1,515.06/oz, €1,055.42/oz and £945.73/oz.

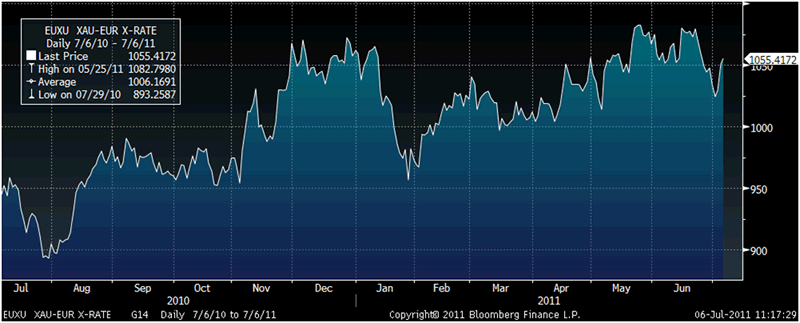

Gold is marginally higher in most currencies today and has risen a further 0.55% against the euro to EUR1,056/oz. It is just 3% from the record nominal high in euros at €1,087/oz due to the risk of contagion in the Eurozone.

Gold in Euros – 1 Year (Daily)

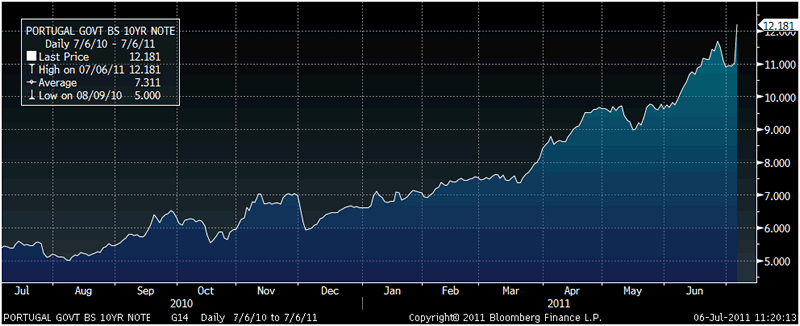

The Moody’s downgrade of Portugal has led to a brutal sell off in Portuguese debt in morning trade which has seen Portuguese 10 year bond yields surge from 11.02% to 12.23%. Yields on Portuguese two-year notes soared 212 basis points to over 15.14 percent. There is increasing speculation that another downgrading of Ireland is imminent and Ireland’s 10 year yield has surged to over 12%.

Portugal received a $112 billion loan package only two months ago. It was due to sell 1 billion euros of treasury bills today but the Portuguese government debt agency IGCP said it sold 848 million euros of bills due in October.

Portugal is a reminder that Greece is just the tip of the iceberg and Portugal, Ireland, Spain, Italy, Belgium, Hungary in Europe and the U.S. itself face similar challenges, of greater and lesser degrees.

Cross Currency Rates

The risk of contagion in the Eurozone is increasing by the day which poses obvious risks to the euro currency and the global financial and monetary system.

Investors are increasingly concerned about the risk that contagion poses to assets previously considered risk free such as U.S. Treasuries and even German bunds. Germany may ultimately have to pay towards the massive and growing costs of the deepening eurozone debt crisis.

PORTUGAL GOVT BS 10YR NOTE

Gold’s safe haven status will soon again be realized and universally accepted and constant talk of a bubble will be seen as misguided.

This is assured as we live in an era where assets previously considered risk free, such as U.S. treasuries and German bunds, are increasingly being questioned.

If risk-free notes are no longer without risk, it will reverberate throughout all markets (bonds, equities, currencies, gold etc) globally, creating an increase in relative risk levels and a consequent adjustment of investment values.

Paper assets and fiat currencies look set to continue to fall against the finite and immutable currency that is gold. Especially as the risks of a global currency war and global competitive currency devaluations remains real.

Continual short term panaceas by misguided policy makers doing the bidding of powerful banks has delayed the day of reckoning.

However, there is no such thing as a free lunch and the failure to tackle the root cause of the problem, which is insolvency through too much debt, means that the day of reckoning will be of orders of magnitude greater had more rational policies been implemented.

Gold buying remains steady but surprisingly subdued given the scale of the crisis. There remains a fundamental failure to comprehend the scale of the crisis and a blind belief that the world will return to its pre crisis state soon. This fails to appreciate that the pre crisis state of the world, with massive and unprecedented levels of debt in the U.S., the U.K. and most western economies was anything but normal.

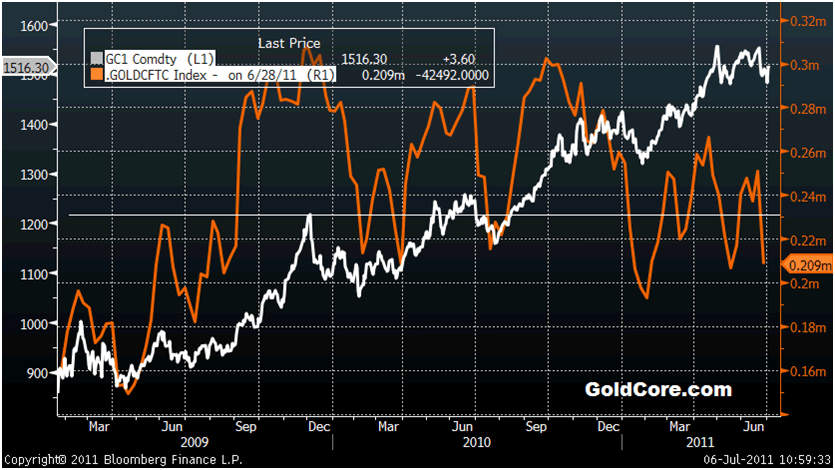

CFTC GOLD NET LONGS

Animal spirits are low and very cautious as seen in CFTC data showing that there has been a very significant liquidation by weak longs. The scale of recent liquidation is indicative of a market low and suggests we have made or are on the verge of reaching lows, basing and targeting new record nominal highs in the coming period of seasonal strength.

SILVER

Silver is trading at $35.69/oz,€24.86/oz and £22.28/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,733.65/oz, palladium at $770/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.