EURO Set to Soar Over Next 5 Years, Reason 10 year Debt Schedule of Europe

Currencies / Euro Jul 06, 2011 - 12:38 PM GMTBy: Submissions

Many are going to receive this with skepticism. EURO is set to soar esp against the US dollar and UK pound.

Many are going to receive this with skepticism. EURO is set to soar esp against the US dollar and UK pound.

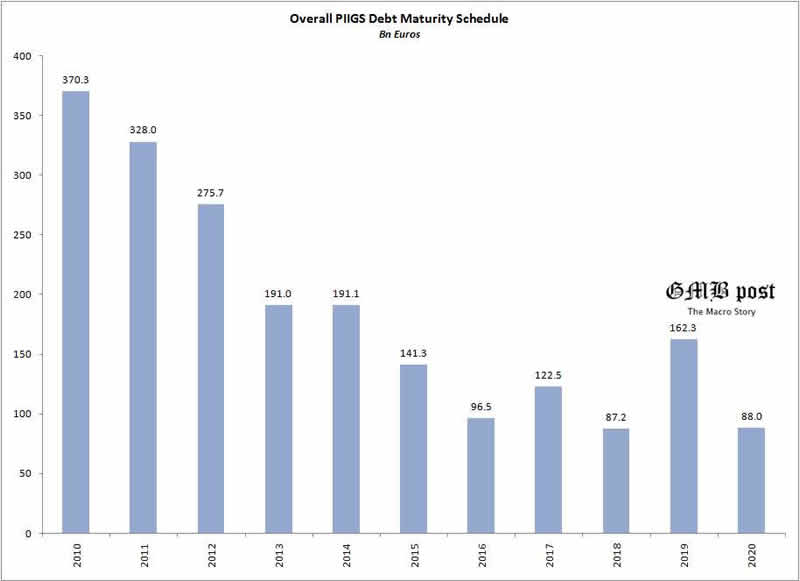

As per the EU stat released debt maturity schedule of PIIGS, a total of 370 bn euros was paid in 2010 while 328 is set to be paid in 2011. What is important to understand though is that the amount due to be retired decreases to 96.5 bn euros in 2016.

If EU can implement a debt schedule where each of the countries stick to the respective debt limits and learn from their previous mistakes, we do believe that the EU will be a powerful financial union irrespective of whether a political union exists or not. It is for the world to see that EU has till now restructured nearly 80 bn of last years 380 bn of debt maturing without any default. Yes they fought and arm twisted but ultimately they fell in line.

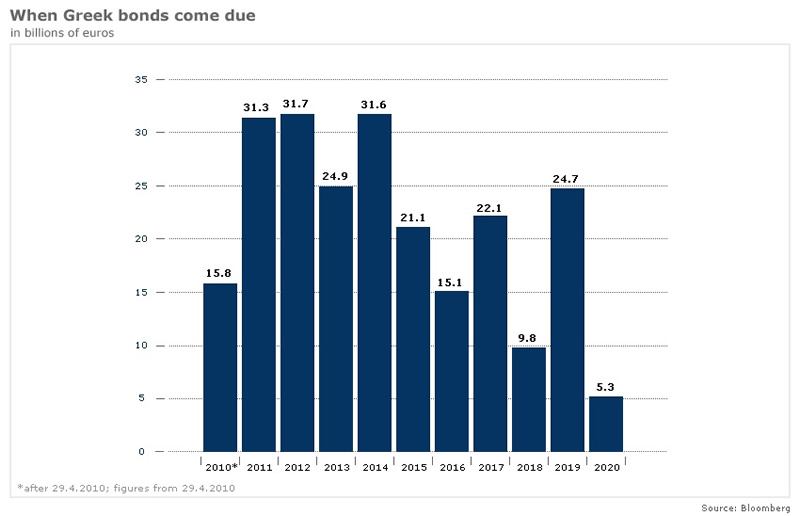

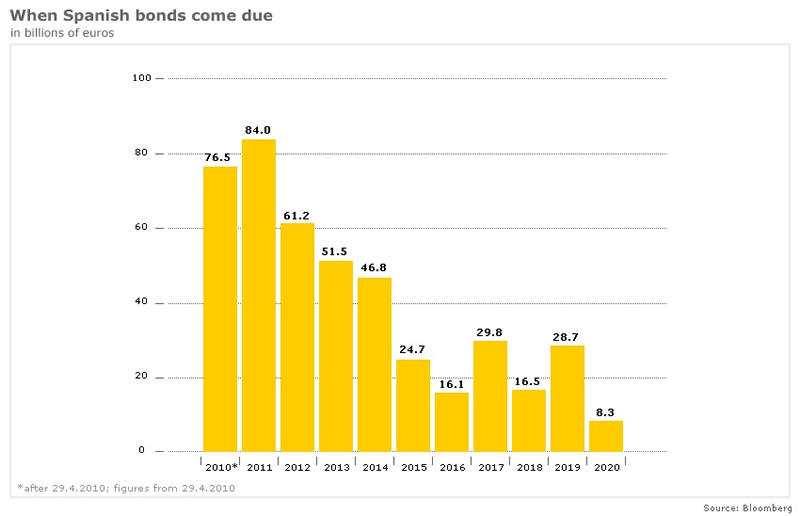

After the latest restructuring the debt schedule for each of the PIIGS countries is attached.

Greece leads the pack with nearly 120 bn due over the next 4 years. But if Greece can pay back this amount, Greece is well positioned to get their economy back on track. It is an “IF” but it cannot get worse than this. The amount that defines the Greece race to economic freedom is the 120 bn euros which is roughly 10-15% of Greece GDP.

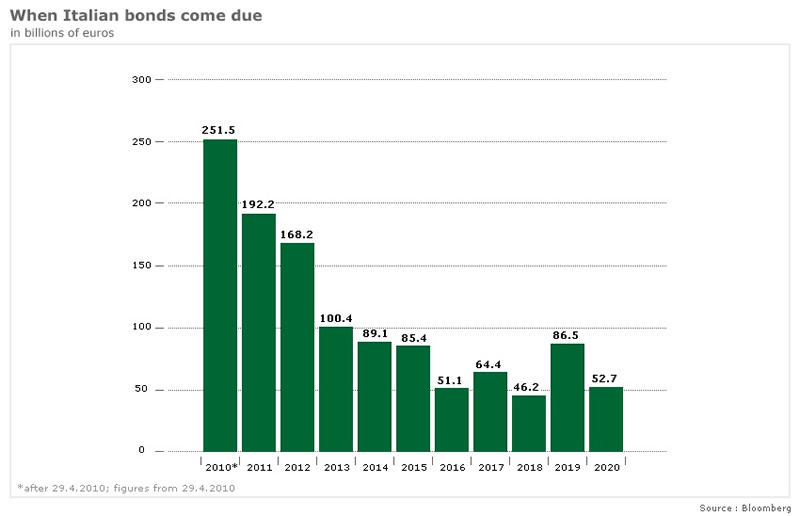

Italian have been comfortable compared to Greece. Nearly 251 bn euros due in 2010 was paid back on the back powerful auctions all through 2010.

The amount due decreases each subsequent year and hence provides tremendous comfort to the ECB. Italy is not in the league of Greece. The due amount never increases beyond 20% of the GDP (~1.6 trillion euros).

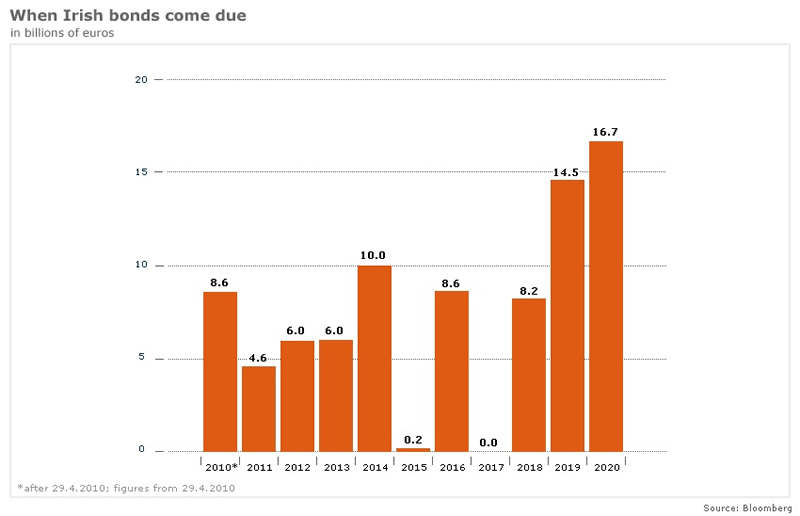

Ireland debt schedule differs from the rest in that debt maturity is back ended and hence the problems for Ireland has only begun. 38 bn euros are due in the next 4 years while 50 bn euros are due in the 4 years subsequent to 2015. But given that the rest of the pack would have already emerged out of the debt trap by then, Irish debt maturity can be a manageable matter.

What should give comfort to investors though is that payout never goes beyond the countries GDP by 12% which is a comfortable debt service ratio to manage.

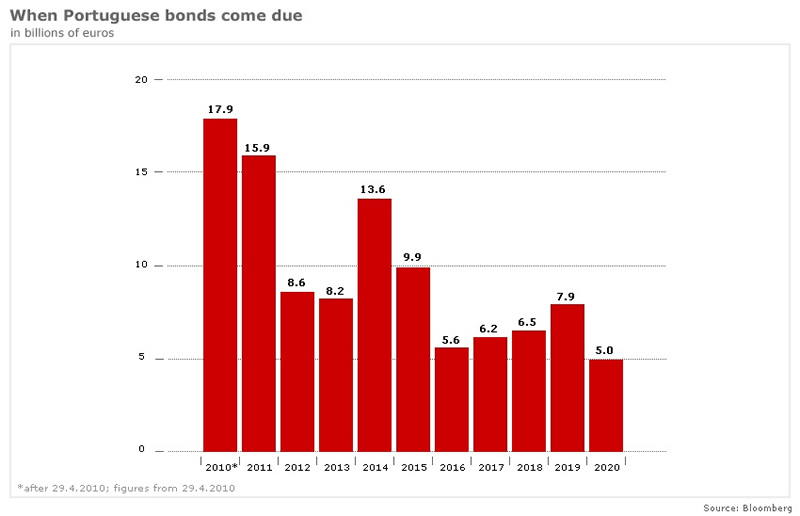

Portugal matured 17bn euros in 2010 and 15 bn in 2011 which is a decreasing amount for the next 5 years.

Portugal does not have a debt problem in our view. The overall debt maturing in the next 70 bn euros over the next 4 years which on an annual basis is not greater than 10% the countries GDP.

Total PIIGS debt maturity schedule is as follows

The total maturing debt (10 year) is roughly 370 bn and 328 bn respectively for 2010 and 2011. These are puny compared to EU GDP of nearly $14 trillion. The Debt Service ratio for EU is in the comfortable range which what gives comfort to EURO investors (esp China).

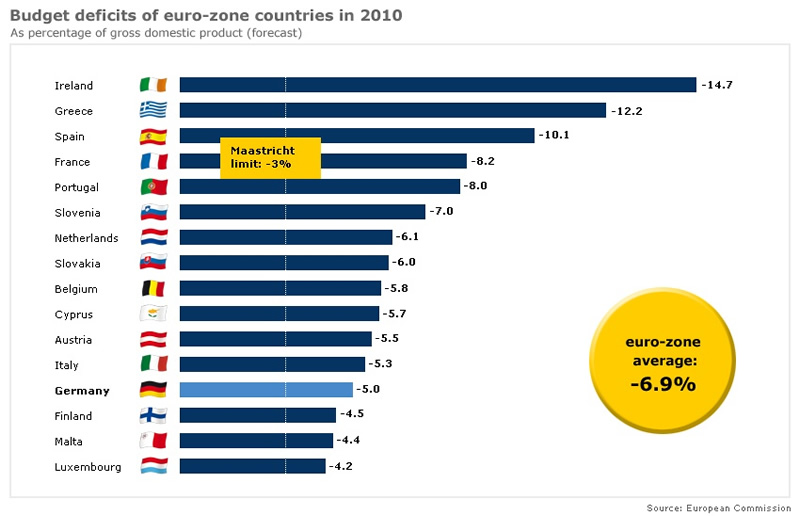

Given these debt schedules, the EU deficit is comfortable at 6.9% of GDP.

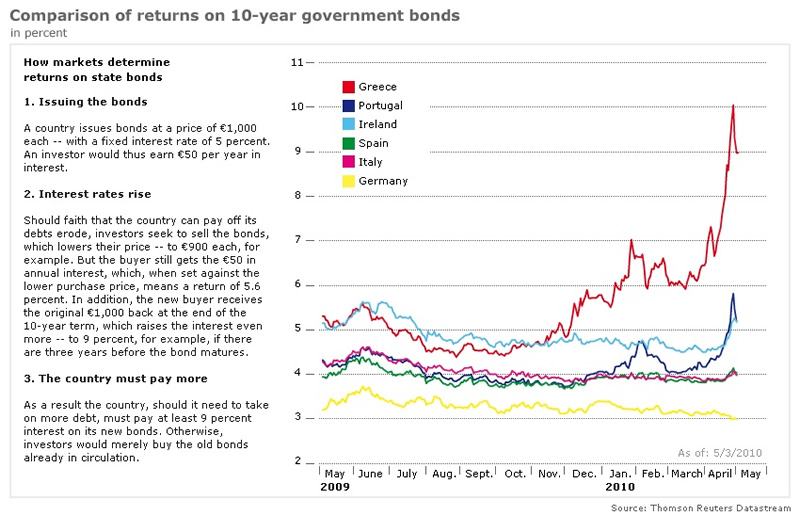

The 10 year yield has sprung for Greece and Spain but should not be a problem given that ECB is in the market to control. Even if the ECB has to step outside its mandate to purchase all PIIGS debt in 2011/12, the balance sheet hit should not be more than 600 bn euros compared to a USD 2.3 trillion for the US. And that is the worst case esp given that Italian and Spanish yields are currently comfortably placed led by strong auctions.

Given the persuasive tactics of the ECB, we believe the ECB should be able to put the house in order over the next 12 months by which point we expect the US debt maturity schedule to throw strong challenges pressurizing the dollar.

Happy investing and always keep track of the Macro story.

Source : http://gmbpost.com/investment-news/...

by Jenson

Bio: Worked with a hedge fund for 10 years as a Director and now work with the consulting firm "GMB post"

© 2011 Copyright Jenson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.