Royal Mint Silver Production Surges 100%, Sovereign Edward Supply Tight but Bullion Premiums Low

Commodities / Gold and Silver 2011 Jul 07, 2011 - 08:19 AM GMTBy: GoldCore

Gold is trading at $1,525.62/oz, €1,069.93/oz and £955.18/oz.

Gold is trading at $1,525.62/oz, €1,069.93/oz and £955.18/oz.

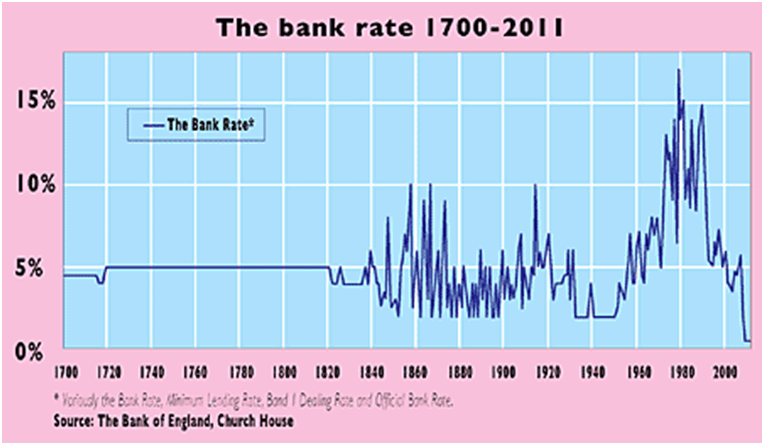

Gold is marginally lower in pounds and dollars and marginally higher in euros ahead of the key interest rate announcement from the European Central Bank (1245 GMT). The Bank of England kept interest rates at historic lows of 0.5% and the ECB is expected to increase rates by 25 basis points to 1.5% today despite the Eurozone debt crisis.

Safe haven demand for gold is continuing due to the eurozone debt crisis, the risk of financial contagion, the threat of rising inflation and the reality of negative real interest rates. Official inflation figures show inflation well above current interest rates meaning that savers and those on fixed incomes are continuing to see their savings and income eroded by the increasing cost of living.

Bank of England Interest Rates – 1700 to Today - Courtesy of Money Week

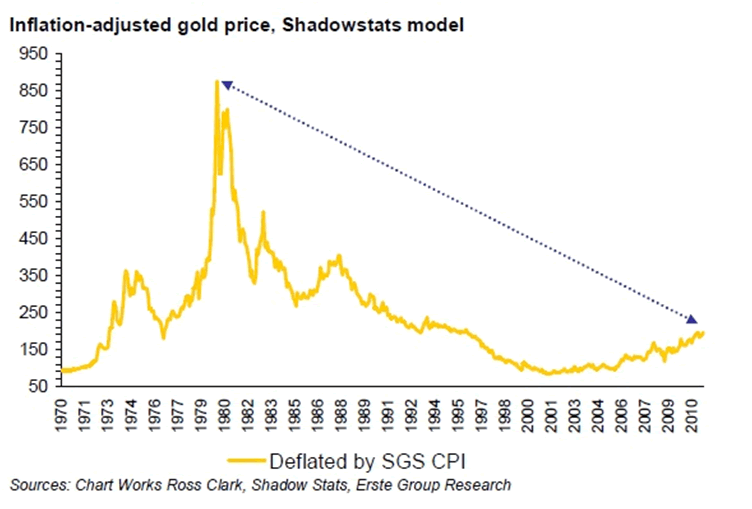

Gold and silver remain undervalued from a long term historical perspective and from the all important inflation adjusted perspective. See excellent inflation adjusted chart (from Chart Works Ross Clark, Shadow Statistics and Erste Group) which shows gold is currently some 75% below the inflation adjusted high seen 41 years ago in 1980.

The U.K.’s Royal Mint said that first-half silver production in 2011 doubled, while gold production climbed 8.9% over 2010 levels.

The Royal Mint, established in the 13th century, used 36,219 ounces of gold compared with 33,266 ounces the previous year, according to data obtained by Bloomberg News under a Freedom of Information Act request.

Silver use more than doubled to 324,421 ounces in the period. The Royal Mint makes Britannia silver bullion coins and other collector silver coins.

324,421 ounces of silver at today’s prices ($36/oz) would be worth less than $12 million dollars. Mere chump change to many wealth investors and savers concerned about their investments and savings.

This shows that interest in silver as an investment and store of wealth is increasing but it remains tiny when compared to money spent on consumer goods or when compared to allocations to cash, bonds, equities, currencies and other asset classes.

Silver bullion remains the preserve of a small but active minority of people. This is changing but owning silver, like gold, has not ‘gone mainstream’ yet. Despite the worst financial crisis in modern history and global currency debasement on a scale never seen before in modern history.

The Royal Mint moved to Llantrisant in Wales from London’s Tower Hill in 1968. It makes coins including the 22-carat 2011 U.K. Sovereign Proof, weighing 7.99 grams (0.26 ounce) and costing 400 pounds ($644). Sovereigns are 22-carat gold coins which is a purity of 91.6%.

Sovereign sales increased at the outset of the financial crisis and have remained robust in recent years. The increase in capital gains tax in the UK in June 2010 saw additional demand for sovereigns in the UK due to them being ‘coins of the realm’ or legal tender coins and therefore not subject to CGT.

British sovereigns are gaining popularity again as the increasing price of gold means that one ounce coins and bars are increasingly unaffordable to many buyers. Also, many buyers, including some high net worth buyers, like the liquidity of sovereigns but also like the divisibility whereby when one wishes to sell one can sell smaller amounts at a time (quarter ounce rather than one ounce format).

Sovereigns are also used as pure financial insurance and are very popular with those who wish to take delivery of their bullion in order to protect themselves from financial contagion and an economic collapse.

Premiums on sovereigns and bullion coins and bars remain very low.

This is typical for the summer months when premiums normally dip due to a slight drop in liquidity as holidays are taken. But the lower premiums are surprising given the scale of the continuing financial and economic crisis and the very significant buying of sovereigns from Greece. We have firsthand experience of this buying.

Interestingly, King Edward sovereigns in particular have been difficult to source in volume in recent days. Thus, these low premiums are unlikely to last for long and should be taken advantage of by those wishing to accumulate British sovereigns and other bullion coins and bars.

SILVER

Silver is trading at $35.84/oz, €25.14/oz and £22.43/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,721.00/oz, palladium at $769/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.