The Greek/B.I.S. Currency Gold Swap

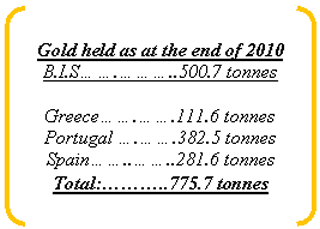

Commodities / Gold and Silver 2011 Jul 07, 2011 - 11:39 AM GMT The Bank of International Settlement holds 500.7 tonnes of gold as at the end of 2010. Why?

The Bank of International Settlement holds 500.7 tonnes of gold as at the end of 2010. Why?

In the third quarter of 2009 it held just under 120 tonnes. These were part of currency/gold swaps. There are no details of the names of the counterparties. Coincidentally, they could be nearly the total of the 'official' gold holdings of Greece, Portugal and Spain.

What of Greece's 111 tonnes of gold?

What of Greece's 111 tonnes of gold?

It is pure conjecture on our part to link the gold holdings of three of the Eurozone's financially weakest members to the B.I.S.

In the first quarter of 2010 the B.I.S. recorded the jump in gold holdings that it had acquired. Four years prior to that Portugal and Spain had sold gold through the Central Bank Gold Agreement on the open market. So we do not link sales under that agreement with these B.I.S. transactions.

The B.I.S. acquired this gold though a set of Currency / Gold arrangements the details of which have not been made public. But it was at about this time that the Eurozone debt crisis reared its ugly head. In advance of any rescue plans, when the respective central banks probably first began discussions on the matter it would have been deemed prudent to makes a collateral arrangement using the asset of last resort, gold, to secure their gold against any future bailout package being offered.

While a swap arrangement is not a sale of gold nor is it a disposal, it is sufficient for the B.I.S. to record the gold swapped as an acquisition in its books. But the central banks involved need not record its disposal, giving us a rather clandestine situation.

Hence the question, "What of Greece's 111 tonnes of gold?"

We cannot see just how the Greek bailout package can force the sale of state assets with no mention of its gold [worth $5.5 billion at present prices]. We have no doubt that Greece will cling onto the family's jewels as long as possible, but the creditors will fight to get the gold as hard as Greece fights to hold onto it. Should the news come out that the gold was handed over last year in a futile 'swap' there will be fur flying and not a few of the present government will lose their seats in Parliament. It will be a very sensitive issue. Perhaps that's why it hasn't been mentioned yet?

What price Greece's gold?

In times like today in Greece, 111 tonnes of gold is worth considerably more in international collateral to a bankrupt nation than $5.5 billion. It is the means to cover imports, when there is no other money to pay for them. These may be necessities. Money is far more valuable when you haven't got it than when you have! And gold will be fully accepted from Greece, anywhere and anytime. If it's already gone, then there'll be more than a sense of humor failure in Athens.

And for this reason alone gold as a reserve asset is undervalued. Central banks hold gold for times such as these.

When the whole world hits these types of crises [such as war], a currency price put on gold is not the basis on which gold is used. The emotional value in such times is far higher for any deal to be concluded. At such times gold can secure far more goods that its price implies, because of the dubious value national currencies will have internationally. When gold is tied to these currencies, then gold has considerably more value because of the support it gives these currencies. And this is why the issue of Greece's gold is so pertinent.

If such a crisis happens in isolation, then the dollar or euro price of gold would be used, because of the relative stability in the rest of the world. So Greece may get no more than $5.5 billion for its gold. But if the B.I.S. currency/gold swap were tied to sufficient bailout support being given, then its value would extend far beyond its price.

This is why gold's price rise is far from over. The path the developed world is following currently is headed to potentially stormy days where gold's use as selective collateral will bring far more than its market value to a nation. That's why central banks are gripping hard to the gold they have or buying more.

CONCLUSION

Are central banks tempted to confiscate debt-distressed nation's gold?

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2011 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazin![]() es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.