India’s Gold, Silver Imports Surge 200%, Chinese Bullion Demand Surging Further

Commodities / Gold and Silver 2011 Jul 08, 2011 - 07:07 AM GMTBy: GoldCore

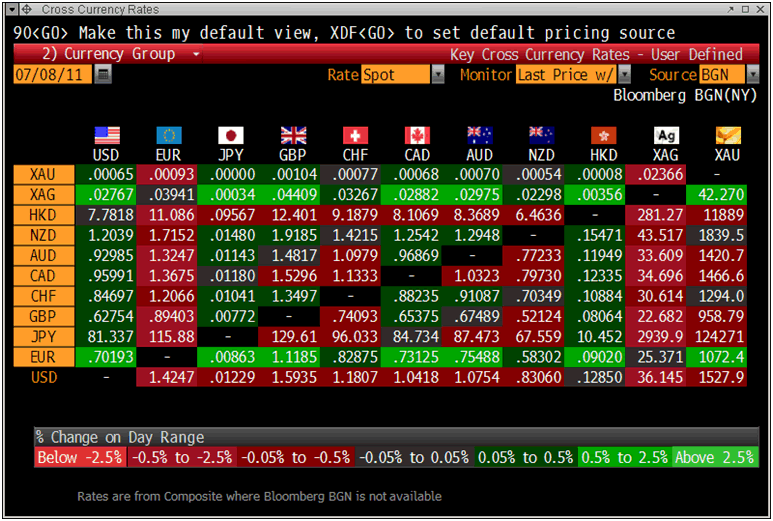

Gold is trading at $1,528.33/oz, €1,071.99/oz and £958.08/oz.

Gold is trading at $1,528.33/oz, €1,071.99/oz and £958.08/oz.

Gold was lower in most currencies except the euro this morning as euro weakness has kept gold close to record nominal highs in euros. Gold is 2.7%, 3.3% and 4% higher in dollars, pounds and euros for the week and looks set to close higher and near nominal highs in all currencies.

XAU-USD Exchange Rate

Futures markets are expected to see thin trade this morning ahead of the key U.S. employment report. It is expected to show improvement in the labor market but if the number disappoints gold should receive a safe haven bid. A good number could see gold ease in the short term but the long term fundamentals remain sound due to robust global and particularly Asian demand.

Cross Currency Rates

While all the focus will be on the US jobs market today, the more important long term factor of robust global and massive Asian demand should continue to support gold around the $1,500/oz level and silver around the $36/oz level.

Bloomberg reports this morning that gold and silver imports into India, the world’s largest importers of bullion, rose 200% to $17.7 billion in the 2nd Quarter of 2011 (April-June).

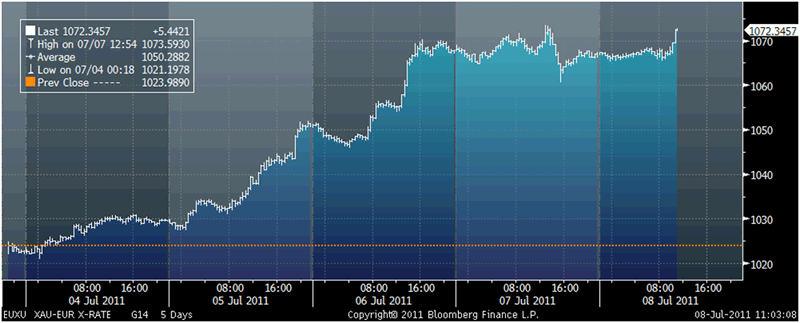

XAU-EUR Exchange Rate

Commodity Online reports that India’s state-owned trading company—Minerals and Metals Trading Corporation (MMTC)—said on Thursday that it would import 350 tons of gold and 1,200 tons of silver in 2011-12 as demand for the precious metals is rising fast. The company almost doubled its import of gold at 45 tonnes during the April-June quarter this year compared to the same period last year.

Silver prices have remained robust in India thanks to strong demand and short supply in the global market. The demand for silver is rising as buyers expect better returns and it is much cheaper than gold which has become harder for lower income Indians to buy.

China’s $70 Billion Fund Managers Protecting Wealth with Bullion

China’s increasingly important asset managers, who have been approved to raise $70 billion for allocation overseas, are seeking additional funds to invest in gold and precious metals as soaring inflation spurs interest in alternative assets as a way to protect wealth, according to Bloomberg.

Five companies have been approved this year to raise cash for investment in precious metals products overseas via the qualified domestic institutional investors programme. Twenty more applications for resources and commodity investment are pending.

China Demand

Gold demand in China is expected to continue rising as economic growth boosts wealth and inflation rising at the fastest pace in almost three years drives demand for a safe

haven.

Investment demand more than doubled in the first quarter to 90.9 metric tons as the nation overtook India to become the largest market for coins and bars, the World Gold Council said in May.

Exchange traded funds, which trade like shares, enable investors to buy precious metal derivatives without taking physical delivery. China does not have gold ETFs yet and investors and savers usually choose to buy physical gold coins and bars.

Chinese speculators, a fast growing and increasingly voracious class, buy and sell contracts traded on the Shanghai Gold Exchange and the Shanghai Futures Exchange.

Inflation Hedge

Consumer prices in China advanced 5.5 percent in May, the most since July 2008 and exceeding the government’s target of 4 percent every month this year. The People’s Bank of China yesterday said it would raise interest rates for the third time this year to curb inflation.

XAU-British Pound Exchange Rate

Massive and Continuing Demand in China & India Not Covered by Media - One Gold ATM in London Is

One of the most important continuing factors in the gold and silver markets in recent months has been the massive increase in demand seen in both India and China.

The most expensive five words in the investment lexicon are “this time it is different”. However, the huge and increasing demand from India and particularly China is a genuine “game changer”.

Chinese people could not own gold until 2003 when Chairman Mao’s gold ownership ban ended with the liberalization of the Chinese gold market.

This huge and still growing demand has been reported in the specialist financial press. But it has not been covered in the non specialist financial media and the majority of investors in the world are completely unaware of it.

As are ill informed ‘analysts’ who either are not aware of the facts and figures or choose to completely ignore them.

In recent weeks there has been a very significant increase in demand for gold and silver bullion from the more than 2 billion people In India and China. This has not been reported and covered in most of the western media.

Indeed it is curious that the opening of a gold vending machine in London is deemed to be far more newsworthy than the cultural affinity and increasing demand for gold by people ravaged by inflation in India, China and the rest of Asia - the mass of humanity.

Global Supply and Peak Gold

Meanwhile, growing global demand is being confronted with anemic supply and the real possibility of peak gold.

Kingsgate Consolidated MD Gavin Thomas, an experienced miner, believes that the peak of gold mining has been reached. He told Bloomberg that gold production had not increased in spite of the price of gold nearly tripling over the 10 years to 2011. Demand was increasing, but the grade of gold mined and the number of large discoveries was falling.

Simplistic and superficial analysis of the gold market continues despite the availability of much excellent research clearly showing why gold and silver are safe haven assets and very important diversifications in these uncertain times.

SILVER

Silver is trading at $36.18/oz, €25.38/oz and £22.68/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,747.00/oz, palladium at $780/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.