Gold's Historic Rally Fuelled by Negative Interest Rates and Euro Disintegration

Commodities / Gold and Silver 2011 Jul 18, 2011 - 12:52 PM GMTBy: Gary_Dorsch

The Federal Reserve has just ended its $600-billion Treasury bond-buying program, known as QE-2, and already, traders are trying to figure what new tricks the Fed might have up its sleeve, in order counter a significant correction in the US-stock market in the second half of 2011. Including QE-1 and QE-2, the Fed pumped $2.35-trillion into the coffers of the Wall Street Oligarchs. Together with near-zero interest rates, and the printing of trillions of dollars the Fed fueled a speculative stampede into the commodity and stock markets, enabling traders to record bumper profits, while doing little to reduce the jobless rate.

The Federal Reserve has just ended its $600-billion Treasury bond-buying program, known as QE-2, and already, traders are trying to figure what new tricks the Fed might have up its sleeve, in order counter a significant correction in the US-stock market in the second half of 2011. Including QE-1 and QE-2, the Fed pumped $2.35-trillion into the coffers of the Wall Street Oligarchs. Together with near-zero interest rates, and the printing of trillions of dollars the Fed fueled a speculative stampede into the commodity and stock markets, enabling traders to record bumper profits, while doing little to reduce the jobless rate.

Significantly, upon launching QE-2 in Nov ‘10, the Fed said that it was deliberately seeking to raise the inflation rate in a calculated bid to encourage a further sell-off of the US-dollar’s exchange rate. One result of the Fed’s QE-2 scheme was triggering a flood of hot money into the currencies of the Emerging economies, such as Brazil, China, Chile, Russia, and Korea, (BRICK), where interest rates are much higher than in the G-7 markets. Central banks in the BRICK countries are now caught in a vicious cycle, forced to lift interest rates, to fend off the inflationary pressures that are blown their way, by QE in England, Japan, and the US.

The latest explosion in commodity prices has lifted the Continuous Commodity Index to new all-time highs. A good portion of the global surplus of cheap cash is being funneled into crude oil, copper, cotton, Gold and Silver, and food staples such as wheat, corn, rice and soybeans. The world’s most actively traded commodity, - crude oil, has risen to dangerously high levels that if sustained, could derail the global economy, and knock the European, Japanese, and US economies into recession. Despite desperate maneuvers by the US-government to cap the rise of crude oil, such as releasing 30-million barrels of crude from the strategic petroleum reserve in the month of July, the price of North Sea Brent, the world’s benchmark, is resilient, trading above $110 /barrel, and could climb to $140 /barrel, if the Fed launches QE-3.

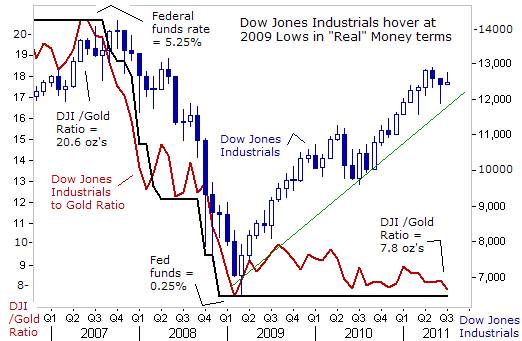

By locking the fed funds rate near zero-percent, and vastly expanding the supply of US-dollars into the banking network, the Fed was able to engineer a doubling of the value of the S&P-500’s Index from its March 2009 lows, and lifted the Dow Jones Industrials, to as high as the 12,800-level, to levels that prevailed shortly before the collapse of Lehman Brothers. Yet when seen through the prism of Gold, and measured in “hard money” terms, the US-stock market’s rally was in essence, - a monetary illusion. In fact, 1-share of the Dow Industrials can only fetch 7.8-ounces of Gold today, little changed since the lows of March 2009.

By locking the fed funds rate near zero-percent, and vastly expanding the supply of US-dollars into the banking network, the Fed was able to engineer a doubling of the value of the S&P-500’s Index from its March 2009 lows, and lifted the Dow Jones Industrials, to as high as the 12,800-level, to levels that prevailed shortly before the collapse of Lehman Brothers. Yet when seen through the prism of Gold, and measured in “hard money” terms, the US-stock market’s rally was in essence, - a monetary illusion. In fact, 1-share of the Dow Industrials can only fetch 7.8-ounces of Gold today, little changed since the lows of March 2009.

The Fed was aiming for a “wealth effect” that could lift the animal spirit of US-households, as their brokerage portfolios increased in value, and thereby encouraging them to spend more money in the economy. The Fed got a lot of bang for its buck with QE-2, lifting the S&P-500 index +35% higher. Unfortunately, the stock market gains went disproportionately to the wealthiest 10% of Americans, who own more than 80% of outstanding stock. For the remaining 90% of Americans there was little trickle down from QE-2. Last month, a CNN poll found that 48% of Americans believe another Great Depression is somewhat or very likely.

According to a recent opinion poll of 24 bond dealers that trade directly with the Fed, only 20% though the Fed would unleash QE-3 within the next 12-months. St. Louis Fed chief James Bullard said on June 30th, it could take up to a year for the Fed to correctly gauge the effects QE-2 on the US- economy. So it came as a bit of a shock, when on July 13th, Fed chief Ben “Bubbles” Bernanke telegraphed to the markets, that the Fed stands ready to launch QE-3 if the US-stock market runs out of gas, and needs more high octane fuel.

“The possibility remains that the recent economic weakness may prove more persistent than expected and deflationary risks might reemerge, implying a need for additional policy support,” Bernanke told the House of Representatives on July 13th. “Given the range of uncertainties about the strength of the recovery and prospects for inflation over the medium term, the Fed remains prepared to respond should economic developments indicate that an adjustment in the stance of monetary policy would be appropriate,” he said.

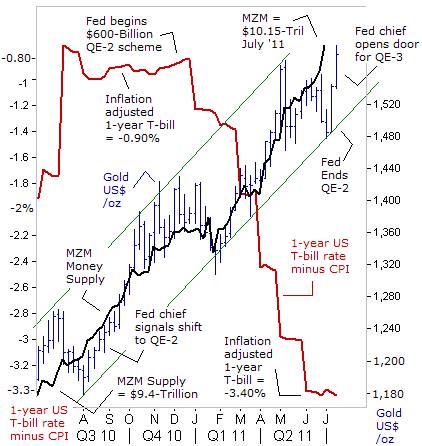

By opening the door to QE-3, as early as the fourth quarter of 2011, the Fed chief ignited a powerful surge in the precious metals markets, lifting gold towards $1,600 /oz, and snapping the silver market back to life, - surging higher above $40 /oz. Precious metal investors can hardly believe their good fortune, - the Fed chief is QE addict. Just two weeks since the end of QE-2, the Fed chief was already begun to feel the ill effects of QE withdrawal symptoms, and has an itchy finger to print more money.

By opening the door to QE-3, as early as the fourth quarter of 2011, the Fed chief ignited a powerful surge in the precious metals markets, lifting gold towards $1,600 /oz, and snapping the silver market back to life, - surging higher above $40 /oz. Precious metal investors can hardly believe their good fortune, - the Fed chief is QE addict. Just two weeks since the end of QE-2, the Fed chief was already begun to feel the ill effects of QE withdrawal symptoms, and has an itchy finger to print more money.

“Quantitative Easing” (QE), is the nuclear option of central banking. Central banks that experiment with the hallucinogenic QE-drug are in fact, monetizing debt, and attempting to keep long-term bond yields locked at artificially low interest rates, regardless if the underlying inflation rate surges sharply higher, due to the expansion of the money supply. The Bank of Japan (BoJ) for instance, has succeeded in driving the yield on Japan’s 10-year government bond (JGB) to as low as 1.05% this week, even though the supply of Japan’s debt, has mushroomed to 230% of Japan’s GDP, - and its debt rating has been cut to AA-.

“Even with the federal funds rate close to zero, we have a number of ways in which we could act to ease financial conditions further,” Bernanke added. What’s little recognized by the unsuspecting public is that with QE-2, the Fed ventured deep into new unexplored territory, by the slashing yield on the 1-year US T-bill a stunning -250-basis points, to a record low of (negative) 3.40-percent. The “real” rate of interest fell sharply as consumer and wholesale prices turned sharply higher, fueled by booming commodity prices. At the same time the Fed was slashing the real rate of interest by 250-bps, it was also pumping $600-billion of “high powered” money into the coffers of Wall Street’s Oligarchic banks and hedge funds, that in turn, pumped the ultra-cheap money into commodities, equities, and Gold and Silver.

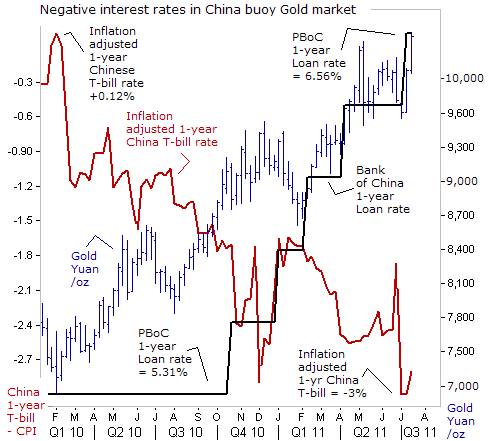

It’s not just in the US-money markets, where the “real rate of interest,” adjusted for inflation, is dropping sharply lower. In Shanghai, the inflation adjusted yield on China’s 1-year T-bill rate has plunged to (negative) 3%, from positive ×basis points, about 1-½ years ago. Five quarter-point rate hikes by the People’s Bank of China (PBoC), lifting its one year loan rate to 6.56% on July 6th, have only acted to stem the slide in the real rate of interest on Chinese T-bills, and short-term bank deposit rates, since the PBoC is lingering far behind the increase in the underlying rate of inflation in China.

It’s not just in the US-money markets, where the “real rate of interest,” adjusted for inflation, is dropping sharply lower. In Shanghai, the inflation adjusted yield on China’s 1-year T-bill rate has plunged to (negative) 3%, from positive ×basis points, about 1-½ years ago. Five quarter-point rate hikes by the People’s Bank of China (PBoC), lifting its one year loan rate to 6.56% on July 6th, have only acted to stem the slide in the real rate of interest on Chinese T-bills, and short-term bank deposit rates, since the PBoC is lingering far behind the increase in the underlying rate of inflation in China.

China’s annual inflation has accelerated to a 3-year high of +6.4% in June, leaving inflation-adjusted interest rates deep in negative territory. That encourages savers in China to funnel their money into inflation hedges such as Gold. Worryingly, there are signs that a weak US-dollar and expectations of QE-3, is still buoying key global commodity prices near record high levels. Furthermore, traders generally suspect that Beijing typically understates the true rate of inflation in the country, while overstating the strength of its economy, when reporting its statistics. So with a backdrop of deeply negative interest rates, the price of Gold has risen dramatically in Shanghai, to a record 10,400-yuan /oz, up nearly +50% from a year ago.

The State Information Centre said in a lengthy report in the official China Securities Journal on July 13th, that rising food prices are hurting consumer confidence and squeezing their spending power, thereby undermining the economy. “China’s real deposit rate has been negative for 16-months and prices are still climbing. We suggest the central bank increase interest rates further by one or two percentage points, to change the negative returns on household savings," the centre said. Yet the PBoC is expected to limit further increases in short-term T-bill rates to 50-basis point higher than today, in order to prevent the appearance of an inverted yield curve, and toppling its economy into a hard landing.

Gold is Safe haven from Disintegration of the Euro

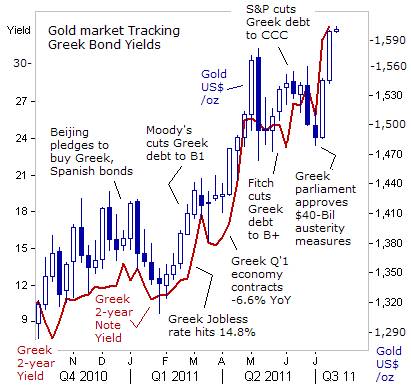

After slumping in the month of January to as low as $1,300 /oz, the price of Gold in New York has been climbing steadily higher, - and tracking the upward spiral in Greek bond yields. While Euro-zone politicians have tried to pull every magic trick out of the book to put worries over Greece’s insolvency to rest, the bond vigilantes have blow the lid off the Greek bond market. The upward spiral in Greece’s 2-year note yield to an all-time high of 33.40% in July, is all the information a gold trader needs to know, - where there’s smoke, there is fire. The Greek wildfire has already engulfed Ireland and Portugal, and is now spreading to the Spanish and Italian bond markets, putting more than $2-trillion of bond holdings at risk of devaluation.

Prospects for a disastrous, disorderly outcome to the Greek debt crisis are beginning to show up in the currency and precious metals markets, even though wildly bullish investors in the stock market do not believe it will actually happen. The result is that today’s soaring bond yields in Greece, Ireland, and Portugal, may only be a taste of what could come if Euro zone leaders fail ring-fence the weaker peripheral bond markets. Regardless of what Euro-zone central bankers and politicians have to say, the rapidly escalating yields for Greece’s bonds, is a clear signal that Athens is heading for default, and there’s little faith that the IMF can cobble a successful bailout. In the Euro zone, there’s no central government authority, and politicians have opposing interests. So more often that not, very little gets resolved without a crisis.

Prospects for a disastrous, disorderly outcome to the Greek debt crisis are beginning to show up in the currency and precious metals markets, even though wildly bullish investors in the stock market do not believe it will actually happen. The result is that today’s soaring bond yields in Greece, Ireland, and Portugal, may only be a taste of what could come if Euro zone leaders fail ring-fence the weaker peripheral bond markets. Regardless of what Euro-zone central bankers and politicians have to say, the rapidly escalating yields for Greece’s bonds, is a clear signal that Athens is heading for default, and there’s little faith that the IMF can cobble a successful bailout. In the Euro zone, there’s no central government authority, and politicians have opposing interests. So more often that not, very little gets resolved without a crisis.

A disorderly default in Greece would bring steep losses to bond holders, especially for the Euro-zone’s Oligarchic banks and the ECB itself. Over the past year, the main targets of banks and speculators have been smaller economies on the periphery of the EU, such as Portugal, Ireland and Greece. But now, Europe’s escalating debt crisis is on the verge of engulfing by far its biggest victim: Italy, the world’s seventh-largest economy, whose sheer size could thwart any scheme to bail it out. The addition of Italy to the so-called PIGS of Europe - Portugal, Ireland, Greece and Spain, marks a serious escalation of the crisis.

Italy’s total debt outstanding of nearly €1.8-trillion dwarfs that of Greece (€340-billion) and is more than two-and-a-half times bigger than the total amount (€750-billion) available in the EU bailout fund. Italy’s bond market is the third largest in the world, after the US and Japan. A large-scale withdrawal of funds from Italian bonds would have enormous repercussions for the international banking system. As a result, Italy has been described as a country that’s “too big to fail,” and at the same time “too big to save.”

An IMF staff report issued July 13th, sharply criticized leading Euro zone politicians for failing to develop unified measures to contain the debt crisis, thereby raising the possibility of a contagion wildfire spreading to other European nations. The main source of friction is Berlin’s insistence that the banks and private bondholders accept part of the pain of any new bailout for Greece. European banks may have to raise as much as €80-billion ($113-billion) of additional capital, to cover the losses in their trading books with 10-year Greek government bonds trading at about 51-cents on the Euro.

An IMF staff report issued July 13th, sharply criticized leading Euro zone politicians for failing to develop unified measures to contain the debt crisis, thereby raising the possibility of a contagion wildfire spreading to other European nations. The main source of friction is Berlin’s insistence that the banks and private bondholders accept part of the pain of any new bailout for Greece. European banks may have to raise as much as €80-billion ($113-billion) of additional capital, to cover the losses in their trading books with 10-year Greek government bonds trading at about 51-cents on the Euro.

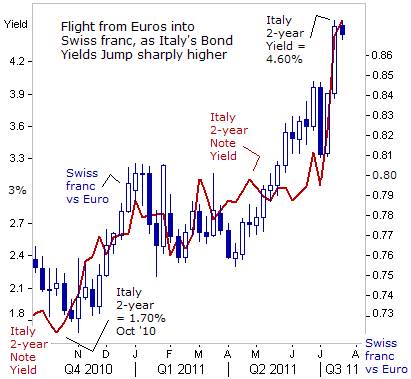

Uncertainty over the financial health of the Euro-zone’s banking system, and lingering fears that countries such as Greece, Ireland, and Portugal might eventually be forced to leave the Euro currency itself, has led many depositors in the Club-Med countries to seek safer havens in the Swiss franc and the Gold market. Foreign currency traders have bid-up the value of the Swiss franc to a record high against the Euro, while closely tracking the direction of weaker Euro-zone bond markets, including Italy’s bond yields. Since the start of 2011, the yield on Italy’s 2-year note has jumped by roughly 2% to as high as 4.78% this week. Most of that increase in yield occurred in the month of July, - lifting the Swiss franc to 0.88-Euros.

The European Banking Authority said July 15th, that only eight banks out of the 90 failed a so-called “stress test,” in the event of a severe downturn in the economy. Yet traders thought the report was seriously flawed, because the EBA didn’t include a scenario in which Greece defaulted on its debts, even though the credit default swap market is pricing in a 90% chance of a Greek default. The total loss for all banks in the test on sovereign debt in their trading books was just €10.5-billion. That compares to a total net direct sovereign exposure to Portugal, Ireland, Italy, Greece and Spain of €687-billion.

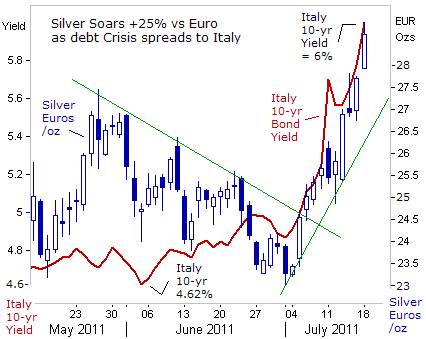

Italian banks, which easily passed the EBA’s “stress tests” and were pronounced to be in good health by the Bank of Italy, resumed their sharp downward slide on July 18th, falling more than lenders elsewhere and driving Milan’s main stock market index into bear market territory. Adding to the sense of fear was that the sharp slide of Intesa Sanpaolo SpA, Italy’s largest lender, whose shares plunged -4.2% in midday trading. Other banks, such as Unicredit, Banco Popolare and Banca Monte dei Paschi di Siena were all tumbling lower, as yields on Italy’s 2-year note jumped to 4.70%, and its 10-year yield hit 6-percent.

Italian banks, which easily passed the EBA’s “stress tests” and were pronounced to be in good health by the Bank of Italy, resumed their sharp downward slide on July 18th, falling more than lenders elsewhere and driving Milan’s main stock market index into bear market territory. Adding to the sense of fear was that the sharp slide of Intesa Sanpaolo SpA, Italy’s largest lender, whose shares plunged -4.2% in midday trading. Other banks, such as Unicredit, Banco Popolare and Banca Monte dei Paschi di Siena were all tumbling lower, as yields on Italy’s 2-year note jumped to 4.70%, and its 10-year yield hit 6-percent.

Italian banks have €164-billion in exposure to domestic government debt on their books, but a bigger €1.26-trillion in private debts that would likely lose value in step with a sovereign default. Regardless of sovereign default prospects, the cost of borrowing for the private-sector is rising sharply at a time when Italy’s economic growth prospects are weak.

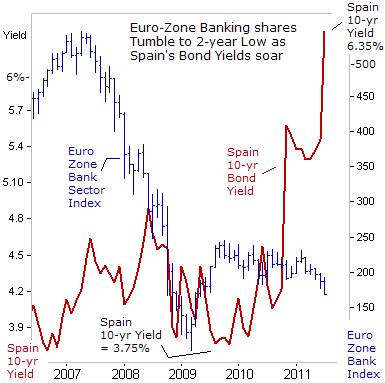

Another big worry is Spain where regional and local banks could be sitting on an explosive amount of unacknowledged losses relating to a real-estate bust. If they are, it could require a takeover of the Spanish banking sector’s bad debt by the Spanish government, a scenario that’s similar to Ireland. Official figures show that the bad loans held by Spanish banks are around €112-billion. Closer examination reveals further losses, as loans to the stricken construction and real estate sector stood at €440-billion at the end of 2010.

There is no guarantee that investors will continue to buy Spanish bonds when its economy is contracting. Spain’s jobless rate has soared to 21.3%, the highest in the industrialized world, with the jobless rate for youth under the age of 25-years reaching 43-percent. If Spanish interest rates continue to rise, it would deepen the credit crunch. Should Spain lose its ability to borrow from global lenders at affordable rates, it would need a loan package worth about €350-billion, dwarfing the €275-billion total for the Greek, Irish, and Portuguese bailouts.

Following the vicious shakeout in the Silver market in the first week of May, several bottom fishing rallies were turned back through the end of June. The EU’s short-term bailout maneuvers for Greece were successful in buying a few weeks of time, before the facade blew off. However, with the latest upward explosion in Spanish and Italian bond yields, there’s been a mad rush for safety into the “poor man’s” version of gold. Measured in Euros, the price of Silver soared +25% higher so far in the month of July, to as high as 28.95-euros /oz today, amid fears that Europe’s banking system will be badly hobbled for years to come.

Following the vicious shakeout in the Silver market in the first week of May, several bottom fishing rallies were turned back through the end of June. The EU’s short-term bailout maneuvers for Greece were successful in buying a few weeks of time, before the facade blew off. However, with the latest upward explosion in Spanish and Italian bond yields, there’s been a mad rush for safety into the “poor man’s” version of gold. Measured in Euros, the price of Silver soared +25% higher so far in the month of July, to as high as 28.95-euros /oz today, amid fears that Europe’s banking system will be badly hobbled for years to come.

The infamous bond vigilantes that used to wreck havoc on the G-7 bond markets in the 1980’s and 1990’s, appeared to have been dead and buried, for most of the past decade. But apparently, the bond vigilantes were tunneling their way under the Atlantic Ocean, far beneath the radar screens of regulators in Europe and the US. Suddenly, at the start of 2010, the bond vigilantes began to surface in the Mediterranean Sea, and launched a surprise attack on the Greek bond market, and moved quickly to the shores of Ireland, and Portugal. One and half years later, the bond vigilantes are attacking Spain and Italy.

Bond markets in England, Japan, and the US, are kept artificially afloat, by ultra-low short-term interest rates, and in fact, deeply negative interest rates when discounting for inflation. There is a sense of complacency in the G-7 government bond markets that might also be misplaced. The world of finance has changed radically since the financial crisis of 2008, but the precious metals were the big winners over the past few years, mainly because they are increasingly recognized as the only form of real money in the world’s economy.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2011 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.