Continued Sluggish U.S. Economic Growth Expected Through 2012

Economics / US Economy Jul 21, 2011 - 02:50 PM GMTBy: Paul_L_Kasriel

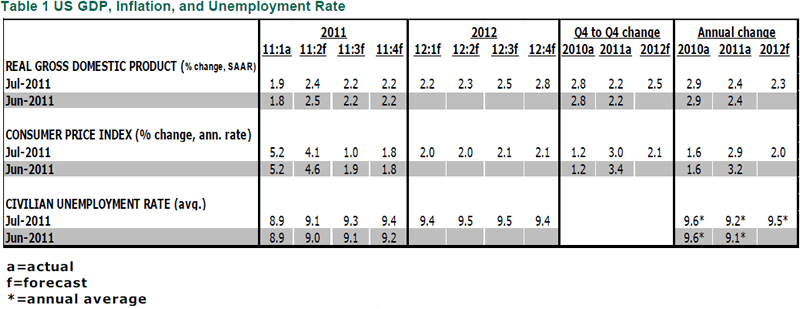

With this commentary, we unveil our first formal forecast of U.S. economic activity and interest rates for 2012. The forecast for real GDP growth is only marginally better in 2012 vs. the forecast for 2011 - on a Q4/Q4 basis, 2.45% in 2012 vs. 2.20% in 2011. We do expect some forward momentum to build in the second half of 2012 with respect to real GDP growth and for this momentum to intensify in 2013. The reason for this building momentum is an expectation of a resumption of Federal Reserve quantitative easing (QE) early in 2012 and/or a pick-up in bank credit creation. Because our forecast is for below-potential real economic growth, our view is that the unemployment rate will creep up from its Q2:2011 average of 9.1%, peaking at 9.5% in Q3:2012. It will not be until 2013, that any sustained meaningful decline in the unemployment rate sets in.

With this commentary, we unveil our first formal forecast of U.S. economic activity and interest rates for 2012. The forecast for real GDP growth is only marginally better in 2012 vs. the forecast for 2011 - on a Q4/Q4 basis, 2.45% in 2012 vs. 2.20% in 2011. We do expect some forward momentum to build in the second half of 2012 with respect to real GDP growth and for this momentum to intensify in 2013. The reason for this building momentum is an expectation of a resumption of Federal Reserve quantitative easing (QE) early in 2012 and/or a pick-up in bank credit creation. Because our forecast is for below-potential real economic growth, our view is that the unemployment rate will creep up from its Q2:2011 average of 9.1%, peaking at 9.5% in Q3:2012. It will not be until 2013, that any sustained meaningful decline in the unemployment rate sets in.

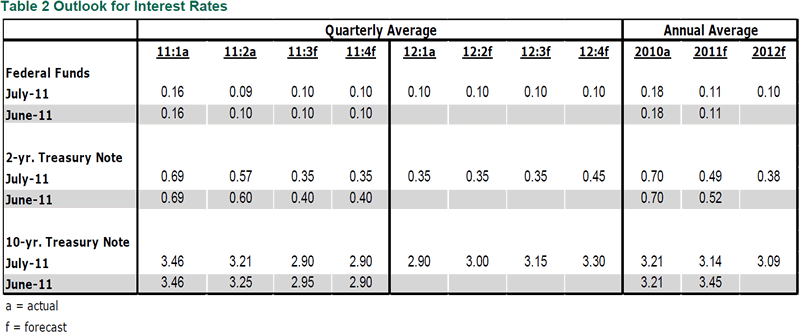

With the energy-price spike behind us and with only moderate growth in combined Fed and commercial bank credit in the past couple of years, we expect the growth in the overall CPI to slow toward 2%. Under these real GDP growth/unemployment rate/CPI growth circumstances, the Federal Reserve is unlikely to raise its policy interest rates until early 2013. If anything, the Fed will lower the interest rate it pays on bank excess reserves later in 2011. At the longer end of the yield curve, below-potential real economic growth and a moderating trend in the growth of the CPI would be expected to keep Treasury bond yields in a narrow range centered on 3%. If, however, a "grand bargain" could be reached on a 10-year plan to reduce the projected growth in federal debt, then the yield on the Treasury 10-year security could test its October 2010 low of around 2.40%. As an aside, it is our working assumption that some kind of legislation to raise the public debt ceiling will be signed into law before the Treasury has to make decisions on which bills to pay as they come due and which ones to postpone paying.

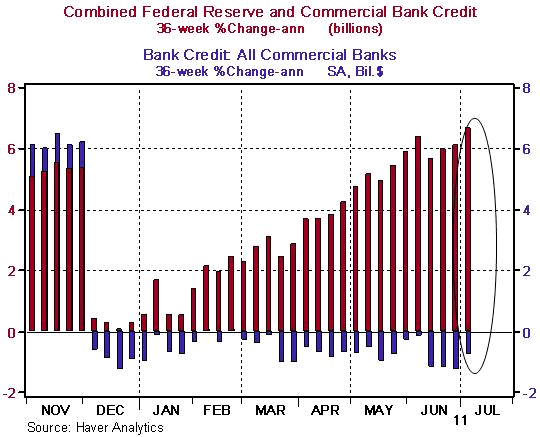

As regular readers of these commentaries know, we believe that a fundamental driver of domestic aggregate demand for goods and services is the combined growth in Federal Reserve and commercial bank credit. With the commercial banking system currently creating only minimal amounts of credit, if any at all, it has been up to the Fed via QE to be the credit creator of last resort. As the chart below shows, QE, which was re-engaged in at the start of November 2010, did result in an acceleration of combined Fed and bank credit through the first week of July 2011. Notice also that in the 38 weeks ended July 6, Fed QE was responsible for the entire 6.7% annualized growth in combined Fed and commercial bank credit, with bank credit actually contracting at an annualized rate of 0.8%.

Chart 1

With combined Fed and bank credit reaching a growth rate at beginning of July near its long-run average, why did first-half real GDP growth remain so weak, averaging 2.15% annualized by our forecast? We believe, based on historical relationships, that real GDP growth would have been even weaker had it not been for Fed QE. The spike in energy prices, which began in March because of geo-political uncertainty, reduced the growth in real combined Fed and bank credit. And the interruption in imports of motor vehicles/parts and electronic components curbed U.S. production of and purchases of motor vehicles.

As we make the turn into the second half of 2011, energy prices have receded some and Japan is gradually stepping up its exports in the aftermath of its destructive March earthquake and tsunami. U.S. motor vehicle production typically gears down in July as the assembly lines are re-tooled for the roll out of new models in September. As a result, workers in this industry are temporarily laid off. This is built into the seasonal adjustment factors for industrial production and job-related economic statistics for July. So, if U.S. motor vehicle assembly companies plan to rebuild some inventories of cars and trucks depleted by the interruption of Japanese parts exports, then we could see some seasonally-atypical industrial production and hiring reported for July.

Just as quickly as some forecasters were marking down their second-half real GDP growth projections after the weak June payrolls report, they could be marking up their second-half forecasts if we get an upside pop in July payrolls. We will not be joining them. More fundamental in our view is the Fed's termination of QE. Barring some significant increase in commercial bank credit creation, combined Fed and bank credit growth will be collapsing once again with the Fed's cessation of QE. We believe that this will represent a persistent headwind to growth in domestic aggregate demand and real GDP growth. Compounding this headwind is slowing in the growth in the world's second largest economy - the Chinese economy. Because China is such a large importer of raw materials and semi-finished goods, the slowdown in Chinese growth will reverberate around the world, which will have a negative effect on U.S. exports.

In his mid-year report to Congress on monetary policy, Fed Chairman Bernanke indicated that the FOMC would be prepared to engage in some actions to make monetary policy more accommodative if the economic environment did not improve in the second half of this year as the FOMC expects it to. He emphasized the importance of the employment situation improving. Our forecast does not call for an acceleration in real GDP growth in the second half of 2011 nor does it call for a decline in the unemployment rate. Rather, we see the unemployment inching still higher. Although we do not envision a meaningful risk of a contraction in indexes of consumer prices for goods and services in the next 12 months, we do envision continued declines in house prices. We believe that by the fourth quarter of this year, the forecasts of the Plossers and Fishers of the FOMC will once again have been demonstrated to have been errant. This will open up the FOMC discussion for some policy easing. We expect that in the fourth quarter, the Board of Governors will lower to zero the interest rate the Fed pays on bank excess reserves. Then, early in the first quarter of 2012, we expect the FOMC to commence with QE3. The resumption of growth in combined Fed and bank credit would be expected to stimulate domestic aggregate demand in the second half of 2012. We would anticipate that by 2013, banks would be stepping up their credit creation, allowing the Fed to scale back or eliminate its.

As mentioned above, we do not expect Fed policy interest rates to begin rising until the first quarter of 2013. Recall that when the Fed began lifting its policy interest in early 1994, it did so quite aggressively not long after its first rate increase. We expect similar behavior in 2013, although not quite as aggressively. The catalyst for Fed policy interest rate hikes will be a resumption of bank credit creation. Bank credit growth is capable of accelerating on a dime. Of course a lot can change between now and 2013, but as we currently look out that far, we would advise investors to begin shortening their duration bets around the fourth quarter of 2012. Stay tuned for regular "duration-forecast" updates.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.