Will Crude Oil Reach $120 by December?

Commodities / Crude Oil Jul 26, 2011 - 12:49 PM GMTBy: Eric_McWhinnie

Although there have been numerous economic reports to derail oil (NYSE:USO), the black gold continues to hold firm. Last week, investors were reminded that the employment picture remains weak, as initial claims came in at 418k. Barclays Capital (NYSE:BCS) released a report that inflows into commodity markets fell sharply as the first half of 2011 ended.

Furthermore, the IEA made it official that no more strategic reserves would be released at this time. Although these developments might cause concerns for oil prices, shares in oil companies such as Chevron (NYSE:CVX) an Exxon Mobil (NYSE:XOM) rallied last week.

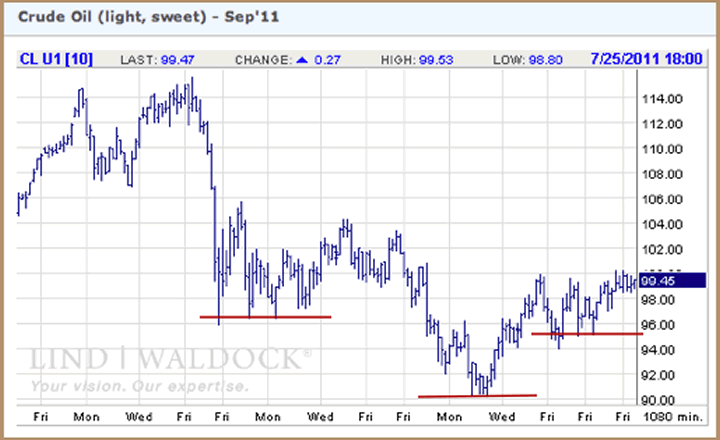

The chart below shows a possible reverse head and shoulders formation in oil, which would be bullish for the commodity. Aside from technical factors, there are hints of oil going higher according to option traders.

Oil has been holding steady near $100 per barrel, despite negative news. Although a weak U.S. Dollar (NYSE:UUP) can boost oil prices, recent activity in options hint that traders may be expecting oil prices to head much higher. According to bloomberg data, the number of contracts held by traders in options to buy West Texas Intermediate crude at $120 per barrel in December totaled 45,502 lots on the NYMEX as of July 21. This was 4,226 lots more than the second highest bet, which is oil at $125. Head of Regional Energy Research, Gordon Kwan says, ” We’re in a sweet spot. Oil prices are well supported. It’s a very profitable for the energy secotr but not high enough to kill any economic growth.”

Investors looking to also profit in oil plays should consider ConocoPhilips (NYSE:COP), Marathon Oil (NYSE:MRO), or even Diamond Offshore Drilling (NYSE:DO).

Do you want to profit from commodities and agribusiness? Get a free copy of our highly acclaimed Commodities Premium Investment Newsletter.

By Eric_McWhinnie

Wall St. Cheat Sheet : Only days after the S&P 500 crashed to the depths of hell at 666, the Hoffman brothers launched Wall St. Cheat Sheet: one of the fastest growing financial media sites on the web. Like a samurai, our mission is to cut through the bull and bear shit with extraordinary insights, a fresh voice, and razor-sharp wit. We provide the highest quality education and information for active investors, financial professionals, and entrepreneurs.

© 2011 Copyright Eric McWhinnie - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.