Bernanke Secretly Gives away Sixteen Trillion Dollars

Politics / Credit Crisis Bailouts Jul 26, 2011 - 01:06 PM GMTBy: Richard_Mills

The first ever GAO (Government Accountability Office) audit of the US Federal Reserve was recently carried out due to the Ron Paul/Alan Grayson Amendment to the Dodd-Frank bill passed in 2010. Jim DeMint, a Republican Senator, and Bernie Sanders, an independent Senator, while leading the charge for an audit in the Senate, watered down the original language of house bill (HR1207) so that a complete audit would not be carried out. Ben Bernanke, Alan Greenspan, and others, opposed the audit.

The first ever GAO (Government Accountability Office) audit of the US Federal Reserve was recently carried out due to the Ron Paul/Alan Grayson Amendment to the Dodd-Frank bill passed in 2010. Jim DeMint, a Republican Senator, and Bernie Sanders, an independent Senator, while leading the charge for an audit in the Senate, watered down the original language of house bill (HR1207) so that a complete audit would not be carried out. Ben Bernanke, Alan Greenspan, and others, opposed the audit.

What the audit revealed was incredible: between December 2007 and June 2010, the Federal Reserve had secretly bailed out many of the world’s banks, corporations, and governments by giving them US$16,000,000,000,000.00 – that’s 16 TRILLION dollars.

The GDP of the United States is $14.12 trillion, the entire national debt of the United States government spanning its 200 plus year history is $14.5 trillion. The budget that is being debated in Congress and the Senate is $3.5 trillion.

In the past debt ceiling votes have passed the House and the Senate without question by the majority party (remember there’s an election next year so there’s a need for political grandstanding). When Republicans controlled the chambers they passed debt ceiling hikes with the Democrats in opposition. When the Democrats are in power they up the debt ceiling while the Republican oppose it.

Obama opposed raising the debt ceiling when George W. Bush was President. The debt ceiling is simply a limit of how much a government can borrow and owe regarding public debt. By increasing the debt ceiling, a President would be able to avoid spending cuts.

A default would only occur if the US did not make payments on its debt so not raising the debt ceiling will not result in default – a default can only occur if interest payments were not made.

As the audit of the Federal Reserve has just shown whether the debt ceiling hike passes or not is a moot point. The unelected Federal Reserve will, without Congressional authority, continue to create more money.

The majority of US debt is owned by the Federal Reserve.

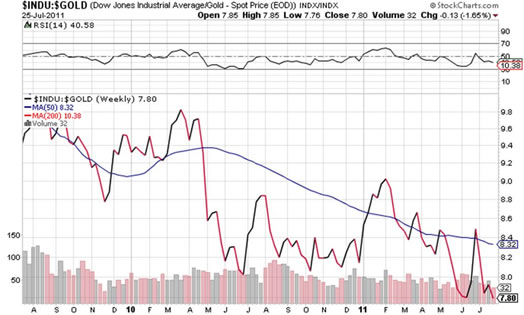

The Dow on gold’s terms is telling everybody something important is happening:

In 2000 gold made its $260 per ounce low, in January 2000 the Dow was 10,900

10,900 / $260 per ounce = 41.9 ounces to buy the Dow

Today at 12,592 DJII and $1,600 gold it’s 7.87 oz to buy the Dow.

Investors are starting to realize that gold and silver are a storehouse of value and a safe haven in times of turmoil. Gold and silvers prices have risen because of the abuse and mismanagement of our monetary and currency systems - throughout history, gold has always shone the brightest when trust breaks down, confidence falls and fear climbs.

stockcharts.com

The Dow/Gold ratio has twice before gone through corrections resulting in a transfer of wealth from one asset class to another.

In 1928 the ratio peaked at 14.5 and then dropped to 2.9 as the stock market crashed and the U.S. entered a deflationary depression. In 1965 the Dow/Gold ratio peaked at 27.6, then started a long correction to 1.57 in 1980 as Volker aggressively raised interest rates and stopped inflation.

As you can see on the above chart we began a third correction in 1999 when the Dow/gold ratio peaked at 41.

It presently would be very hard to mount an argument against gold being clearly the winning major investment of the last decade.

Latest demand statistics from the World Gold Council:

Gold Demand and Supply – First quarter 2011

- Global gold demand in the first quarter of 2011 totalled 981.3 tonnes, up 11% year-on-year from 881.0 tonnes in the first quarter of 2010.

- The quarterly average gold price hit a new record of US$1,386.27/oz (as per the London PM Fix), its eighth consecutive year-on-year increase.

- During the first quarter of the year, investment demand grew by 26% to 310.5 tonnes from 245.6 tonnes in the first quarter of 2010.

- ETFs and similar products witnessed net outflows of 56 tonnes.

- India and China, the two largest markets for gold jewellery, together accounted for 349.1 tonnes of gold jewellery demand or 63% of the total, a value of US$16bn. China’s jewellery demand reached a new quarterly record of 142.9 tonnes up 21% from 118.2 tonnes in the first quarter of 2010.

- In Q1 2011, gold supply declined by 4% year-on-year to 872.2 tonnes from 912.1 tonnes in the first quarter of 2010. This was despite an increase in mine production of 44 tonnes year-on-year, a growth rate of 7% from year earlier levels, and negligible net producer de-hedging. The decline in total supply was due to recycled gold, which was down 6% on year-earlier levels to 347.5 tonnes from 369.3 tonnes in the first quarter of 2010 and a sharp increase in net purchasing by the official sector.

- Central bank purchases jumped to 129 tonnes in the quarter, exceeding the combined total of net purchases during the first three quarters of 2010.

With the price of gold at US$1600 it’s definitely living up to its oft proven history of acting as a safe haven in times of turmoil but after being the best performing major assets of the last decade, are the price of gold and silver going to continue higher?

The settlement of the U.S. debt impasse could see a sharp correction in gold’s price - news of positive results could trigger a temporary price retreat.

Over a little longer term there exists reasonable, sound, and at least as far as I’m concerned, convincing arguments, that precious metals and their stocks are undervalued:

• Central banks are adding to their official gold holdings

• The European Union’s sovereign debt problems are worsening

• The Federal Reserve will continue to create money

• Expanding Chinese, Indian, and other Asian economies means growing wealth and rising inflation. An historic affinity to gold in the form of jewelry and as a saving and investment option means continued demand growth coming from the East

• Gold mining supply declining

Conclusion

Considering the seasonally strong period for gold and gold stocks is right around the corner:

- Jewelry manufacturers step up fabrication demand ahead of Christmas gift giving

- Indian dealers begin stocking up ahead of the autumn festivals and the Indian wedding season

- Chinese lunar new year

- Increased news flow from junior work programs

- Resource and Investment conferences

They might be even more undervalued then we think.

History proves the greatest leverage to a rising gold price is gold mining stocks.

I think gold juniors are going to be the most rewarding, the most lucrative way to garner the huge rewards from the coming freight train rush to gold. Those golden tracks are being laid today using the world’s currencies as ballast - when your cash is trash your gold is shining.

Monetary and fiscal authorities around the world are setting us up for an inflationary cycle. This will be the ultimate driver of the gold bull market going forward

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2011 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.