Stock Markets Headed for a New All Time High

Stock-Markets / US Stock Markets Dec 03, 2007 - 12:25 AM GMTBy: Andre_Gratian

Current Position of the Market.

Current Position of the Market.

SPX: Long-Term Trend - The 12-yr cycle is approaching its mid-point and some of its dominant

components are topping and should soon restrain the bullish effect of the 4.5-yr. This could lead to

another period of consolidation in 2008 with an eventual bull market top in 2009-2010.

SPX: Intermediate Trend - The intermediate-term trend which had been in a correction since the index reached 1576 has now resumed its up move.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which determines the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview

The last two weeks saw the markets move a little lower and then sharply reverse their trends to the upside. Last Monday, the correction in the SPX brought it very close to its long-term trend line at 1407 where it found support and met with aggressive buying. By the end of the week it had rebounded 81 points to 1488 before closing at 1481. This was the best 4-day move in this index since 2003. The Dow Jones Industrials had an equally impressive rally of almost 750 points.

Badly beaten financial stocks staged a good rebound on the news that Federal and major bank officials were preparing a plan which would freeze interest rates on adjustable-rate mortgages that are due to reset in the near future. This would allow stretched homeowners to potentially avoid foreclosure. Another bullish trigger was the re-assurance that the Federal Reserve stood ready to cut rates at its next meeting on December 11.

From a technical standpoint, some important cycles which were due to make their lows at this time of the year bottomed out. A sharp drop in crude oil prices also provided support for the rally in stocks. Oil closed the week at $89, 10 points below its recent high of $99 a barrel.

What’s Ahead?

Momentum:

In the last Newsletter, I posted some charts that "were meant to show why it is likely that we are in the process of making a short-term low prior to resuming the uptrend." Below is a daily chart of the SPX and some of the indicators that forecast a turn in the market.

Note that as of the 19th, positive divergence was already apparent on both the momentum and advance/decline oscillators. As the SPX continued down for a few more days, that divergence increased and it led to the sharp reversal which took place when the index found support at 1407, near its long-term trend line.

Now that the longer-term cycles have ostensibly reversed, and judging by the initial price momentum which was fully supported by volume and advance/decline statistics, it is likely that we have seen a low of intermediate nature or, if your prefer, a resumption of the trend which began on 8/16 with the bottoming of the 4.5-yr cycle.

There are two short-term obstacles: 1490 is an important resistance level which has already stopped a previous rally and, when it is penetrated, the trend line and former top at about 1520 are the next challenges which will have to be overcome.

Short-term cycles in conjunction with the 1490 resistance could require a short period of consolidation before the index is ready to move higher.

Cycles

The 7th year of the decennial pattern has been discussed extensively by analysts over the past several weeks. There is a tendency for stocks to decline toward the end of that year and a low to be made in conjunction with the 12-mo seasonal cycle which can bottom at any time between September and November. This decline is usually followed by one of the best seasonal rallies of the year. Considering last week's market action, we can assume that the pattern has repeated itself and that a typical year-end rally is now taking place, but the move that has started is likely to spill over into next year.

The 9-mo cycle which normally runs about 38 weeks was due to make its low in mid-December, but it apparently came a little early. This leaves only one important cycle between now and the end of the year: the 20-week cycle whose low will be due just about Christmas time. The smaller 5-wk cycle also apparently made its low last week, exactly where it was supposed to and it gives us a good point of reference for the next 20-wk low.

There are other, short-term cycles which are due to bottom early next week and should bring about a pause in the current uptrend.

Longer term, we have to keep in mind that the 2-yr and 6-yr cycles are expected to make their tops early in 2008, and bottom in the Summer or Fall. This could lead to a deeper stock market correction after the SPX has made a final intermediate-term high.

Projections

On Friday, the SPX reached a short-term projection of 1488 before pulling-back. The index had a 17-point intra-day correction before bouncing back and during the entire correction the advance/decline remained strong, which indicates that there was very little serious selling. Because of this intra-day correction, prices may already be ready to attempt resuming their uptrend and challenge the former resistance level of 1492 but the short-term cycles that are due to make their lows next week put the odds in favor of some additional consolidation.

Once the 1492 level is overcome decisively, it will trigger a Fibonacci projection zone from 1524 to 1544. The recent decline did not create a useful Point & Figure pattern which might have given a clear upside count, but there is one which was established at the August lows and which is still valid. It gives us a projection to 1615.

Breadth

The MACD of the A/D which is shown at the bottom of the above chart makes a pattern which is very similar to the McClellan oscillator. The resistance to the price decline became apparent when the indicator failed to make a new low on 11/12 and 11/19. By the time the actual low took place on 11/26, the indicator was already in an uptrend and ready to go positive and give a buy signal. This buy signal is very similar to those given at the March and August bottom, both of which resulted in uptrends which lasted several weeks. The McClellan oscillator also gave a buy signal and went positive. This has turned up the longer-term McClellan summation index which should continue to move up as long as the McClellan oscillator remains positive. The summation index is a better gauge of the longer term trend of the stock market. It did not confirm the last market top.

Market Leaders & Sentiment

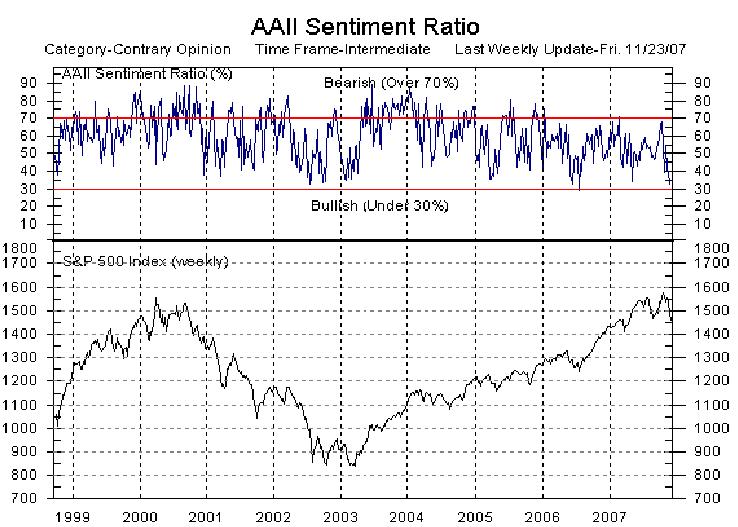

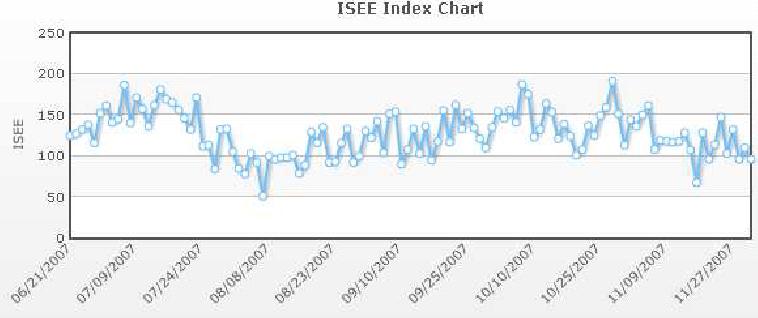

Here we have good news and bad news. The good news is that the AAII Sentiment Ratio dropped to a bullish level equivalent to that of the March 2003 and July 2006 bottoms. And the ISEE put/call index continues to make a pattern also associated with bottoms. Both indices are reproduced below.

Insider buying is also predominantly bullish.

The bad news is that the Russell 2000 Index continues to under-perform the large cap indices. At the last top, the R2K failed to make a new high by a small margin, and during the recent decline it exceeded its August low by a small margin. This could mean that the stock market is in the process of making a larger top and will be ready for a deeper correction after the SPX has made a new high. This would fit with the longer cycles which are expected to make their lows in 2008.

Both GE and the NDX made a higher high and a higher low along with the SPX on an intermediate term basis. They are currently in phase and are not providing either bullish or bearish divergence.

Summary

Last week, the decline which started after the SPX reached its all-time high of 1576 came to an end

and a strong rally ensued.

Because of the momentum generated off the low, this rally has the potential to last for a few more weeks and to take the index to another new high before a more important correction takes place.

The following are examples of unsolicited subscriber comments:

What is most impressive about your service is that you provide constant communication with your subscribers. I would highly recommend your service to traders. D.A.

Andre, You did it again! Like reading the book before watching the movie! B.F.

I would like to thank you so much for all your updates / newsletters. as i am mostly a short-term trader, your work has been so helpful to me as i know exactly when to get in and out of positions. i am so glad i decided to subscribe to turning points. that was one of the best things i did ! please rest assured i shall continue being with turning points for a long while to come. thanks once again ! D.P.

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.